Triangle Capital (TCAP) is a Business Development Company (BDC) with an enormous 9.3% dividend yield. The share price has barely budged this year starting out at $19.11 and currently sitting at $19.32. However, the company cut its regular quarterly dividend by $0.09 per share back in May (and it hasn't been paying supplemental dividends either). The big question for income-focused investors: Is this amazing 9.3% dividend yield safe, or is it a dangerous trap to avoid?

In our view, Triangle Capital remains a very attractive opportunity for income investors, and we continue to own it in our Blue Harbinger Income Equity portfolio (we purchased it in May two days after the dividend cut was announced). Specifically, we like Triangle because of its conservative management team, it is an often overlooked opportunity, it is well-diversified, its valuation remains attractive, and because its big dividend is very rare and very attractive.

Conservative management team...

One of the reasons we like Triangle Capital is because of its conservative internal management team. For example, we believe management’s decision to cut the dividend earlier this year was prudent. The following quote from management earnings announcement explains the rationale well:

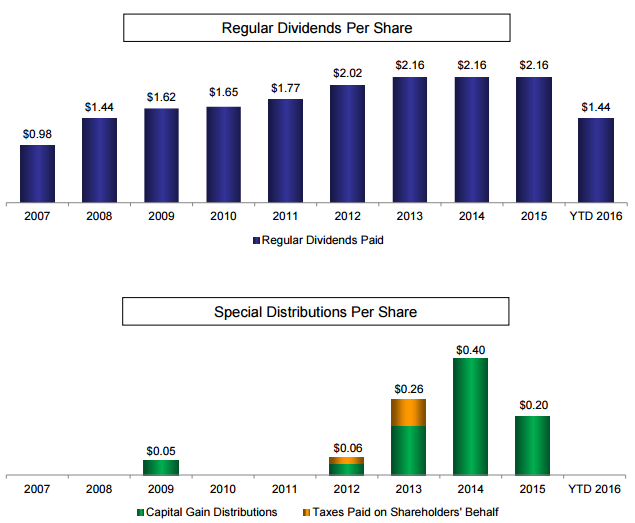

With respect to the Company's announced adjustment of its quarterly dividend, Mr. Poole (CEO) stated, "One of the hallmarks of Triangle has been the Company's long-standing policy of generating net investment income in excess of its dividends. Since 2013, the market pricing for our type of investments has changed from 14%-15% to 11%-13%. As a result, given that our quarterly earnings power is lower in today's market environment, we believe it is appropriate to adjust our dividend to a foundational level from which we can grow in the future. In making this adjustment, we feel it is important to recognize that since its IPO Triangle has generated cumulative base dividends for shareholders that are 58% higher than the BDC industry average for those BDCs that have been public over the same period of time. In addition, Triangle has paid shareholders supplemental distributions of capital gains totaling approximately $18 million, or $0.60 per share, since January 2014. By taking this pro-active step to adjust our dividend we can continue to operate from a position of strength as we grow our investment portfolio."

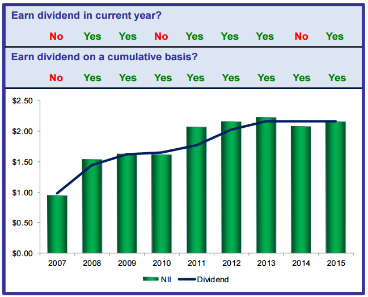

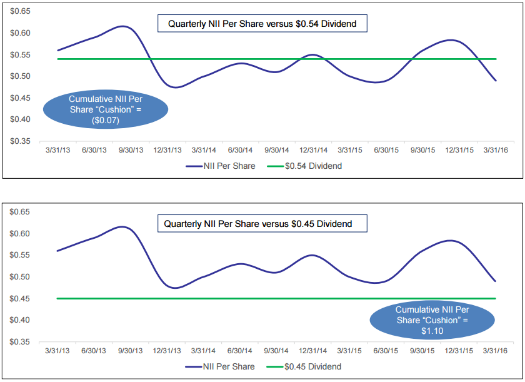

In our view, this was the exact right action for management to take. And as the following chart shows, the dividend payment is still enormous, and it is in line with the company’s Net Investment Income (NII).

And the next several graphics provide additional color on the improved prudency of the dividend payment adjustment.

Overall, we believe the dividend cut was prudent, and importantly the dividend payments are still enormous and sustainable.

Another way to think about the conservativeness of Traingle’s business is the cumulative average non-accrual rates as shown in the following chart.

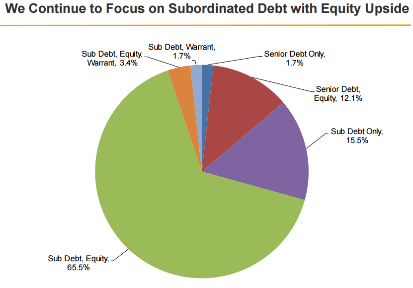

As the chart shows, Triangle is similar to just below investment grade (below BBB) but not in a situation where default is imminent. Additionally, Triangle reduces the risk with diversification (more on this later), and has equity upside on its investment as shown in the following chart.

Another example of Triangle’s conservative management is the conservative amount of debt as shown in the following table.

Triangle’s debt-to-assets ratio is not unreasonable compared to another top BDC that we like, Main Street Capital (we've written about Main Street previously here).

Opportunity is often overlooked...

Another big reason why we like Triangle is because it is an opportunity that is often overlooked. As the following chart shows, relative to loan and bond mutual funds (other financing/debt investments), the BDC market size is very small resulting in it often being overlooked.

Another important point is that BDC’s don’t have to deal with inflows and outflows (like loan and bond funds do), thus making it more truly possible for Triangle to take a long-term investment approach- a good thing in our view.

It’s well-diversified...

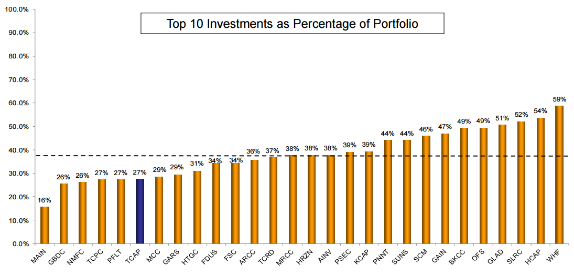

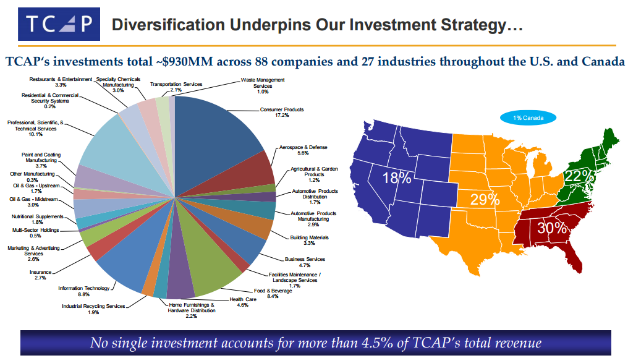

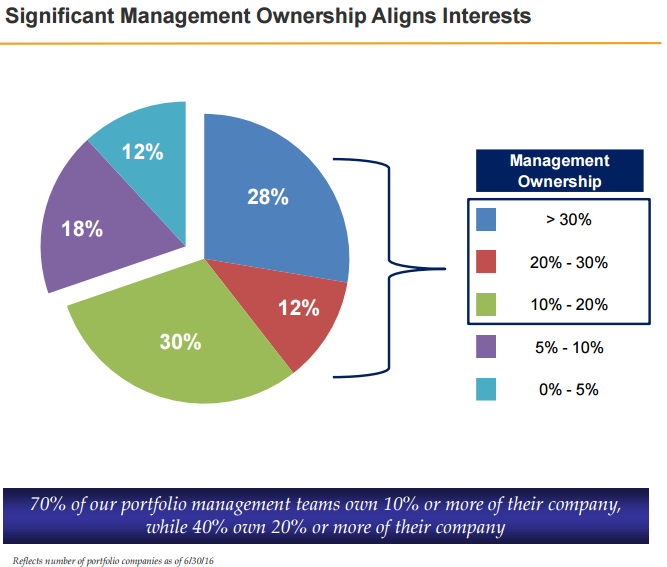

Diversification is another reason we like Triangle. Even though it operates in a smaller market place, it still has plenty of room for opportunities and diversification. The following two charts give some flavor for this in terms of investment concentration, industry and geography.

Also worth noting, Triangle’s interests are further aligned as many of the management teams of Triangle’s investments have “skin in the game” as shown in the following chart (this is a good thing).

Industry outlook looks good...

Worth considering, Triangle believes they are in the sweet spot of valuations. The following graph shows how Triangle’s typical transaction size (lower middle market) is not overheating the way larger transaction sizes may be. This is important as Triangle makes deals which include equity valuation considerations, and lower valuations now mean more upside later.

Valuation remains attractive...

From a valuation standpoint, Triangle remains relatively attractive. Even though capital appreciation may be a secondary objective for Triangle’s investors (income is often the primary objective), it's good to know the investment’s price is still attractive. For example, the following price to book chart demonstrates that Triangle remains relatively attractive by its own historical standards.

And this next chart demonstrates the reasonableness of Triangle versus another attractive BDC (Main Street Capital) as well as relative to a few bellwether banks (Wells Fargo, Bank of America and JP Morgan).

And as we mentioned earlier, the dividend to Net Investment Income remains sustainable. In fact, this next chart shows how Triangle has been able to increase its value over time.

Its big dividend is very rare, and very attractive...

Another reason we consider Triangle attractive is because where else are you going to find such a high yield in today's market? To put that in perspective, this next chart shows how investors have been forced to go further out on the risk spectrum to generate the same 7.5% return as in the past.

Also important, Triangle still offers one of the best dividends in the BDC industry, and it is sustainable.

And as we’ve mentioned earlier, Triangle has a track record of sometimes paying additional (supplemental) dividends from its capital gains. This can be extremely attractive for income investors.

Risks...

Of course Triangle Capital is not without risks. For example, if the return opportunities available decrease again (remember management explained that the reason the dividend was cut was because “the market pricing for our type of investments has changed from 14%-15% to 11%-13%.”), the dividend would likely have to be cut again. However, if you are a dividend investor this is not the end of the world. Specifically, even if Triangle reduces its dividend again, it will still be a huge dividend because it's already so big to begin with. Further, as we mentioned earlier, a great buying opportunity was created last time the dividend was cut, and there would likely be another great buying opportunity if they had to cut the dividend again (which they likely will not need to cut in the near future based on the current dividend to NII ratio).

Another risk is the possibility of multiple contraction. Even though Triangle’s price to book value is very reasonable relative to peers and history, it could still fall due to a price decline. However, as an income investor, the primary objective is income, and the income distribution would likely still remain intact. Plus, the price wouldn’t likely stay low for long considering the yield is so high relative to everything else that investors would likely just bid the price back up again.

Perhaps the biggest risk for Triangle is the overall economy. If the market crashes, Triangle’s debtors may not be able to make debt payments, and Triangle’s equity holdings will decline in value. Granted Triangle is well-diversified as we’ve described previously, and this protects them somewhat from sub-market challenges such as declining oil prices.

The overall market cycle poses another significant risk for Triangle. For example, much of Triangle’s equity and debt-related capital gains over the last five to seven years occurred because the market was rebounding off the lows of the financial crisis. This is true even though Triangle explains they don’t invest in distress situations. And considering the markets won’t likely continue to climb as quickly as they did following the financial crisis, Triangle may not experience the same types of gains. In fact, this is part of the reason why Triangle cut its dividend. As we quoted earlier Triangle’s CEO explained “Since 2013, the market pricing for our type of investments has changed from 14%-15% to 11%-13%.”

The burdens of being an RIC and BDC create regulatory risks for Triangle. For example, according to Triangle’s annual report: “If we were unable to obtain tax treatment as a RIC, we would be subject to tax on all of our taxable income at regular corporate rates. We would not be able to deduct distributions to stockholders, nor would they be required to be made. Distributions would generally be taxable to our stockholders as dividend income to the extent of our current and accumulated earnings and profits.” Additionally, Triangle notes “Prospective investors should recognize that the present U.S. federal income tax treatment of an investment in our stock may be modified by legislative, judicial or administrative action at any time.”

Conclusion:

We believe an investment in Triangle is worth the risks because of the big sustainable dividend payments. As mentioned above, we like the conservative management team of this often overlooked opportunity. We also like that it is well-diversified, and its valuation remains relatively attractive. Most importantly, as an income investor, Triangle’s dividend is very attractive and very hard to beat. We continue to own Triangle in our Blue Harbinger Income Equity portfolio.