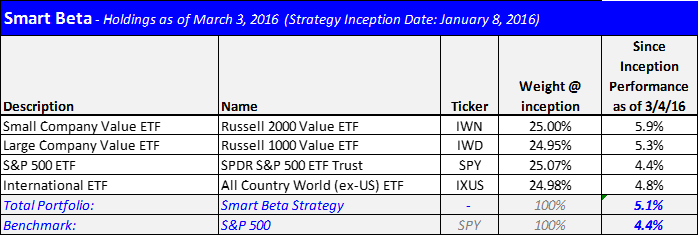

Strong jobs data and a rebound in oil prices fueled the S&P 500 2.6% higher last week. Our Income Equity strategy outperformed, and it’s now up 7.1% since its launch in early January versus only 4.4% for the S&P 500. Additionally, our Smart Beta and Disciplined Growth strategies also added to their S&P-500-beating performance. And on a completely separate note, our Tsakos options trade is now up 98% since we initiated it on February 8th. Next week’s biggest scheduled data release will be crude oil inventories on Wednesday (3/9), and we strongly believe the stocks in all three of our strategies (mentioned above) are set to climb considerably higher. Here are the holdings in each strategy along with recent performance:

And regarding our Tsakos call options, we continue to own them with no intention of selling anytime soon. The strike price is $5.00 and they don’t expire until June. They were out of the money when we bought them, but they’re now considerably profitable considering Tsakos (TNP) has risen to $6.42 per share. We believe these call options still have considerably more upside prior to their expiration. You can read more about why we own Tsakos calls here.