Triangle Capital Management (TCAP)

Current Price: $17.30 / share

Price Target: +$22.45 / share

Rating: BUY

Triangle Capital cut its big dividend this week, and we bought shares shortly thereafter.

Following the dividend cut, the stock declined roughly 15%, the yield is now around 10.5%, and we believe the company is significantly undervalued. Specifically, we bought Triangle because of its attractive cash flows, its big dividend yield, its strong internal management team, and its multiple layers of diversification benefits within the Blue Harbinger Income Equity portfolio.

About Triangle’s Big Dividend

For starters, Triangle’s dividend is large because it has elected to be treated as a Regulated Investment Company (RIC) and a Business Development Company (BDC). This means Triangle generally pays no federal income tax on any ordinary income (or capital gains) as long as it pays out at least 90% of its investment income as dividends. Many other companies retain a significant portion or their earnings for future growth, whereas Triangle has structured its entire business to distribute earnings to shareholders in the form of big dividends.

Triangle’s business is focused on generating current income (for dividend payments) by providing customized financing to lower middle market companies located in the United States. Specifically, the company's investment objective is to seek returns by generating current income from its debt investments and capital appreciation from its equity related investments. For reference, the following pie chart provides a breakdown of the types of investments Triangle makes.

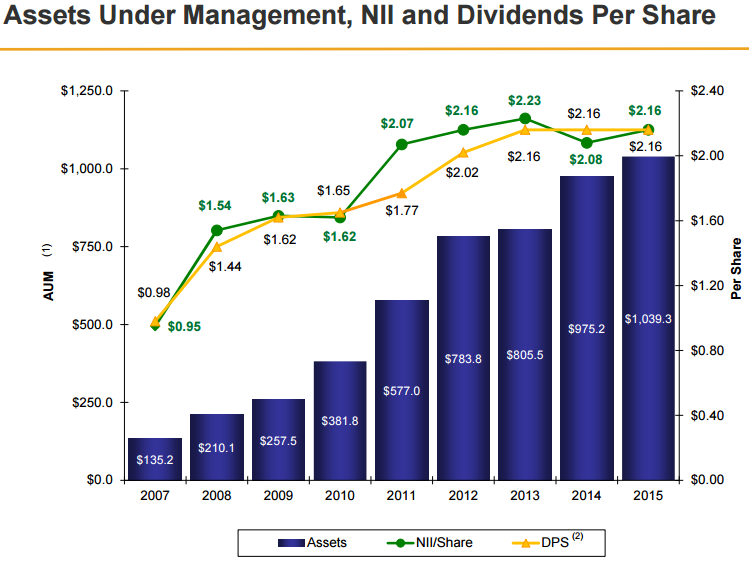

Triangle has historically had no trouble maintaining and growing its dividend payments (prior to this week’s dividend cut) as show in the following chart.

However, in an extremely conservative step, Triangle cut its quarterly dividend this week and did not pay a supplemental dividend. We believe the company easily had the financial wherewithal to pay both of these, but elected not to because it strengthens the financial position of Triangle as well as its ability to have a healthy future. With regards to the dividend cut, Triangle CEO, E. Ashton Poole, said the following.

"One of the hallmarks of Triangle has been the Company's long-standing policy of generating net investment income in excess of its dividends. Since 2013, the market pricing for our type of investments has changed from 14%-15% to 11%-13%. As a result, given that our quarterly earnings power is lower in today's market environment, we believe it is appropriate to adjust our dividend to a foundational level from which we can grow in the future. In making this adjustment, we feel it is important to recognize that since its IPO Triangle has generated cumulative base dividends for shareholders that are 58% higher than the BDC industry average for those BDCs that have been public over the same period of time. In addition, Triangle has paid shareholders supplemental distributions of capital gains totaling approximately $18 million, or $0.60 per share, since January 2014. By taking this pro-active step to adjust our dividend we can continue to operate from a position of strength as we grow our investment portfolio."

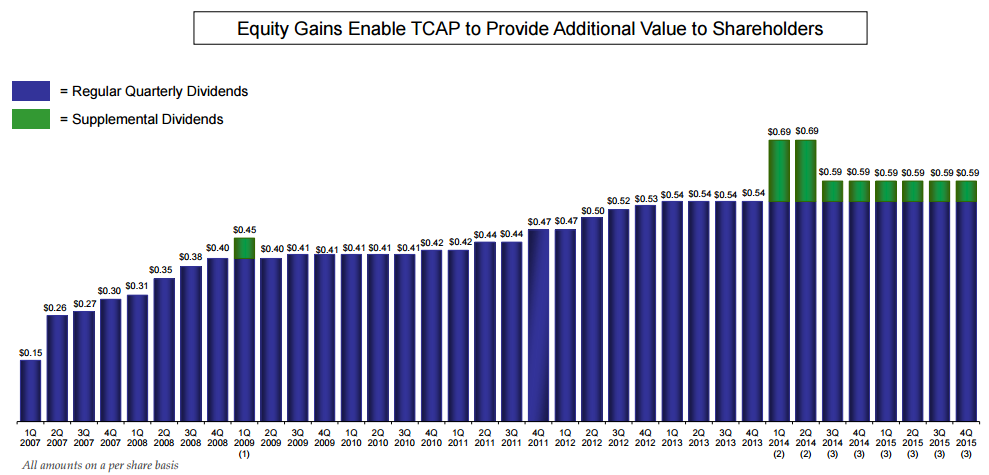

For reference, here is the company’s track record of regular and supplemental dividend payments (prior to this week’s dividend cut).

And regardless of this week’s dividend cut (they cut it t0 $0.45 from $0.54), we believe Triangle continues to have an excellent business, and the recent price decline has provided an excellent entry point for long-term investors.

What is Triangle Worth?

Using a basic dividend discount model, with some very conservative assumptions, Triangle is worth $22.45 nearly 30% more than its current stock price. For reference, our model assumes $0.45 quarterly dividends (with no future supplemental dividends), and 8.02% cost of equity (using the conservative assumptions at GuruFocus), and a zero percent growth rate. Realistically, the company will likely pay some supplemental dividends again in the future (i.e. they’ll have more capital gains) and the growth rate will likely be more than 0%. Both of these assumption differences give Triangle even more significant upside price appreciation potential.

Also worth noting, Triangle’s weighted average cost of capital (WACC) is lower than its return on capital (per the same GuruFoucs assumptions) which suggests it actually has the ability to grow profitably. This is the opposite of Main Capital (we recently did a public write-up on Main) where the WACC is greater than the return on capital.

Triangle’s Attractive Internal Management

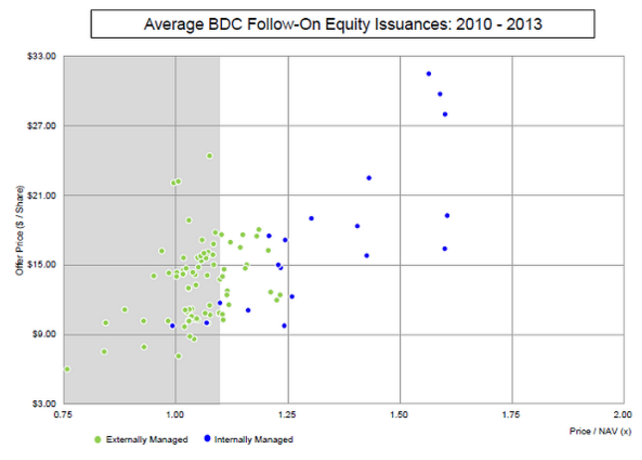

Another reason we like Triangle is because of its internal management team structure. The fact that Triangle is internally managed is important. Conflicts of interest may exist when BDCs are run by external management teams, and data suggest internally managed BDCs are better. For example, external managers are often compensated as a percent of assets under management, so they are incentivized to take on new business (whether or not it is profitable business) because it increases the amount they get paid. Whereas internally managed BDCs (such as Triangle) are (if incentivized properly) driven to create profitable growth. The following chart shows new equity issuance for internally managed (blue dots) versus externally managed (green dots) BDCs.

The noticeable observation is that internally managed BDCs have a track record of issuing new shares at a premium to their net asset values (suggesting investors expect a strong return on assets) whereas externally managed BDCs have a track record of issuing new shares at a discount to their net asset values (suggesting they’re more interested in growing assets under management instead of profitability).

Another reason why internally managed BDCs are often more profitable is simply because their expenses are lower. For example, the following chart show the operating expenses of Triangle (an internally managed BDC) versus other externally managed BDCs. Triangle has a clear advantage.

Diversification Benefits

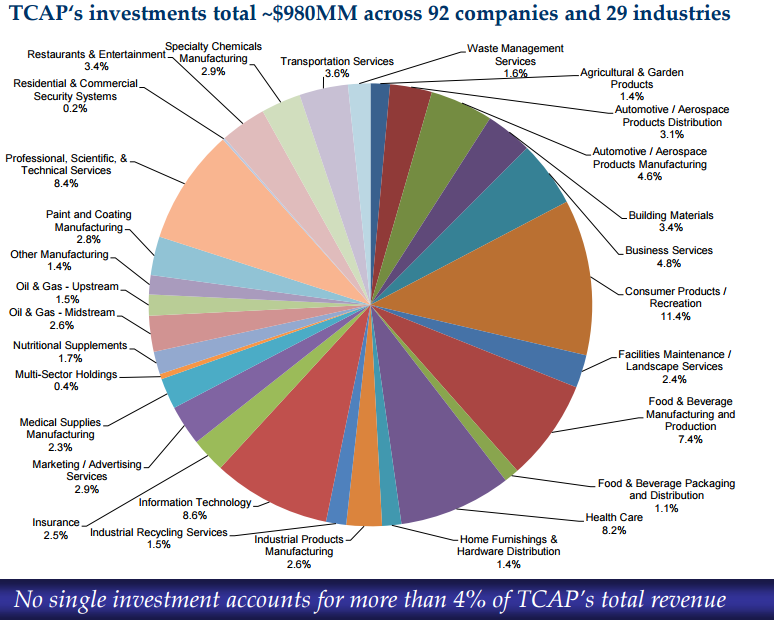

Two fronts on which Triangle enjoys diversification benefits are the way its business is diversified across industries, clients and geographies, and secondly the risk-management diversification benefits Main Street can add to an income-focused investment portfolio such as the Blue Harbinger Income Equity portfolio. The following charts gives an idea of Triange’s industry, client and geographic diversification.

Additionally, Triangle provides important diversification versus other income investment categories as shown in the following charts.

Risks

Perhaps the biggest risk for Triangle is the overall economy. If the market crashes, Triangle’s debtors may not be able to make debt payments, and Triangle’s equity holdings will decline in value. Granted Triangle is well-diversified as we’ve described previously, and this protects them somewhat from sub-market challenges such as declining oil prices.

The market cycle poses another significant risk for Triangle. For example, much of Traingle’s equity and debt-related capital gains over the last five to seven years occurred because the market was rebounding off the lows of the financial crisis. This is true even though Triangle explains they don’t invest in distress situations. And considering the markets won’t likely continue to climb as quickly as they did following the financial crisis, Triangle may not experience the same types of gains. In fact, this is part of the reason why Triangle cut its dividend. As we quoted earlier Triangle’s CEO explained “Since 2013, the market pricing for our type of investments has changed from 14%-15% to 11%-13%.”

The burdens of being an RIC and BDC create regulatory risks for Triangle. For example, according to Triangle’s annual report: “If we were unable to obtain tax treatment as a RIC, we would be subject to tax on all of our taxable income at regular corporate rates. We would not be able to deduct distributions to stockholders, nor would they be required to be made. Distributions would generally be taxable to our stockholders as dividend income to the extent of our current and accumulated earnings and profits.” Additionally, Triangle notes “Prospective investors should recognize that the present U.S. federal income tax treatment of an investment in our stock may be modified by legislative, judicial or administrative action at any time.”

Conclusion

We believe the market has overreacted to Triangle’s dividend cut this week, and the company is now significantly undervalued. The dividend cut was a proactive effort by a strong management team to keep dividend payments in line with distributable net investment income. However, the company could have easily maintained the higher dividend payment if it chose to do so. Regardless, we believe the market is not giving Triangle enough credit for its future income generating power, and its current price makes an attractive entry point for diversified, long-term, income-focused investors.