We made a new purchase in our Blue Harbinger Disciplined Growth strategy on Friday, and this week’s Weekly provides more details on the purchase. We also provide an updated holdings list with all of the details for the Disciplined Growth strategy. This week’s members-only new investment idea is the stock we purchased. We reported on this stock last week too, so this week’s “part 2” includes more details on why we believe it’s an exceptional investment opportunity right now.

As we reported on Friday afternoon, the new stock we purchased is Emerson Electric (EMR). To some, this may seem like a boring company that has not performed well over the last two years. However, in our contrarian view, this is a tremendous time to buy. The stock is cheap for two reasons. One, it’s at a lower point in its market cycle (it’s better to buy low, than high), and this is causing many investors to overlook it. And two, it has been repositioning its strategy this year to evolve with changing market conditions, and this has other investors nervous and/or scared. However, Emerson’s big dividend is very safe (they have plenty of cash to cover it, and they’ve actually increased it for more than 25 years in a row), plus they really do have significant growth opportunities ahead. You can read our latest write up on Emerson here…

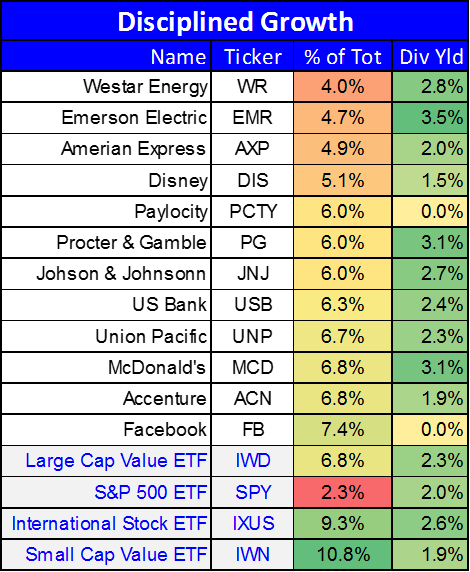

For your reference, here is the latest holdings list for the Blue Harbinger Disciplined Growth strategy:

You’ll notice that in addition to the new Emerson Electric purchase, we’ve also reduced our exposure to passive exchange traded funds (ETFs) and reallocated some of that money to our existing individual stock holdings. We're very happy with our individual stock holdings and the way the portfolio is positioned. Passive ETFs now comprise 29.3% of the total holdings in this strategy.

Why we Own passive ETFs:

We own passive ETFs in this strategy for two main reasons. First, they are a low cost way to gain diversified market exposure. Specifically, each ETF holds hundreds of individual stocks we reduces the risk of having one single stock “blow up” and pull down the returns in the rest of your portfolio. Secondly, we use the ETFs to “tilt” the portfolio towards the type of investments that we believe will outperform the rest of the market. Specifically, you’ll notice that two of the ETFs are “Value” ETFs. This means that the ETF does not invest in the most expensive “growth” stocks, and instead buys only the stocks that are relatively less expensive. Value stocks have outperformed growth stocks consistently over many decades (although certainly not every single year—but definitely over the long-term.). Value stocks are continuing to rebound from relative underperformance that resulted from the fed’s favoring growth stocks with their expansive monetary policies since the financial crisis. But with the Fed getting more “hawkish” Value stocks should continue their recent trend of outperformance this year which we believe is just barely the start of more outperformance ahead.

Additionally, all of the EFTs are very low cost (25 basis points or less, preferably). Keeping cost low is extremely important over the long-term, but little costs add up over time. And little costs can cause you to miss out on large compounding investment growth over the long-term.

Regarding the S&P 500 ETF, this is mainly a placeholder. It’s a small position that gives us low cost passive market exposure. This is an ETF that consistently outperforms many active stock pickers simply because its costs are low and its diversification reduces its risk exposures.

Lastly, the International Stock ETF is a way for us to get exposure to non-US stocks (both developed and emerging markets). This allocation is important because it adds diversification, and because international markets continue to be inexpensive relative to the US. This ETF is also very low cost.