Whitestone (WSR):

8.2% Yield, Avoiding the Death of Retail...

Whitestone is a retail REIT with a big monthly dividend. And the company believes it can successfully avoid the death of retail. This article explains the real reason “brick and mortar” stores are dying, and offers our views for anyone considering an investment in this big dividend REIT.

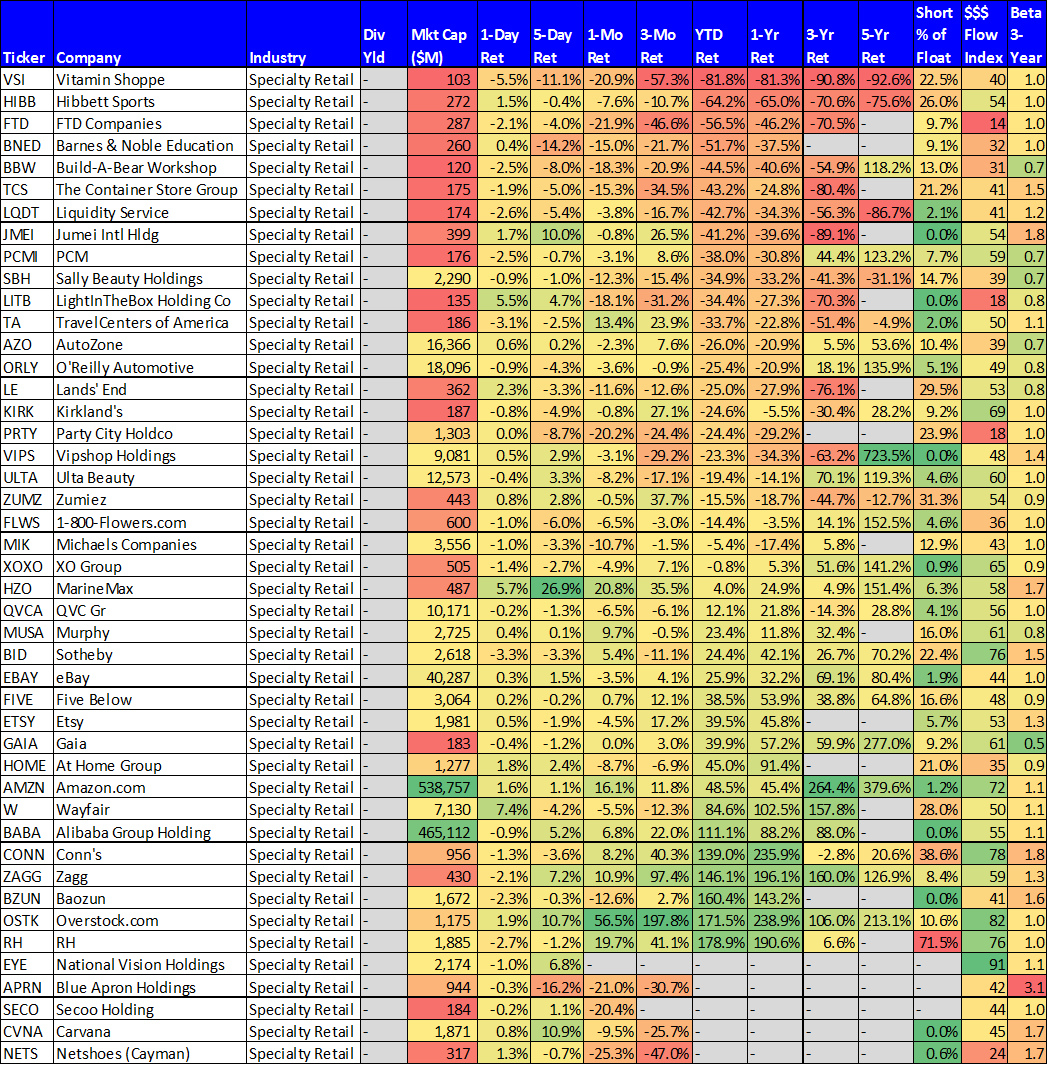

For starters, the following table shows the recent performance of retail stores as well as retail REITs. And to put it plainly, recent performance has been absolutely terrible.

For example, as the table shows, both the S&P 500 (SPY) and the Nasdaq (QQQ) have delivered strong 1-year total returns of 25.4% and 34.1%, respectively. Meanwhile, most retail-related stocks have been negative.

The general narrative is that Internet retailers are going to put all “brick and mortar” retailers out of business. And the data in the table fits this narrative, to some extent, considering online retailers such as Amazon (AMZN), Alibaba (BABA), and eBay (EBAY) have delivered incredibly strong returns over the last year. However, we argue that the real reason “brick and mortar” retailers are performing so poorly is NOT simply because of the Internet competition, but it’s something more specific.

The Real Reason Retail Is Dying:

The real reason retail is dying is because service has progressively declined to its current state at most stores… absolutely terrible! Gone are the days when the sales clerk at Sears and Macy’s knew the answer to every question you asked, and they were genuinely excited to help you. In today’s retail world… helpful, knowledgeable, courteous sales people have been replaced with ungrateful brats playing with their smartphones. Or worse, there’s no one to be found when you need assistance. On the other hand, online stores are well organized, easy to use, and much quicker and more enjoyable than working with an unknowledgeable, uninterested sales clerk.

Further, the “brick and mortar” stores that do still provide good service are doing better. For example, Apple Stores everywhere are always packed with knowledgeable sales people and technicians that are excited about the product, and those Apple stores are almost always filled with customers. Similarly, think of your favorite retail stores (or even restaurant). The places with the best service tend to do well. One the other hand, stores with terrible service often don’t last because no one wants to go anywhere near (let alone inside) those “brick and mortar” stores.

To be successful in the “brick and mortar” retail world, retailers need to give customers a reason to come into their stores. Whether it be helpful customer service, something they cannot buy online, or simply an enjoyable experience, retailers need to give customers a reason to visit. For example, Whitestone (WSR)…

Whitestone, Yield: 8.2% (paid monthly)

Whitestone is a retail REIT focused on internet-proof, experiential shopping, in attractive locations; and this (along with its big dividend and interesting valuation) is why we believe it may be worth considering if you are an income-focused investor.

About Whitestone:

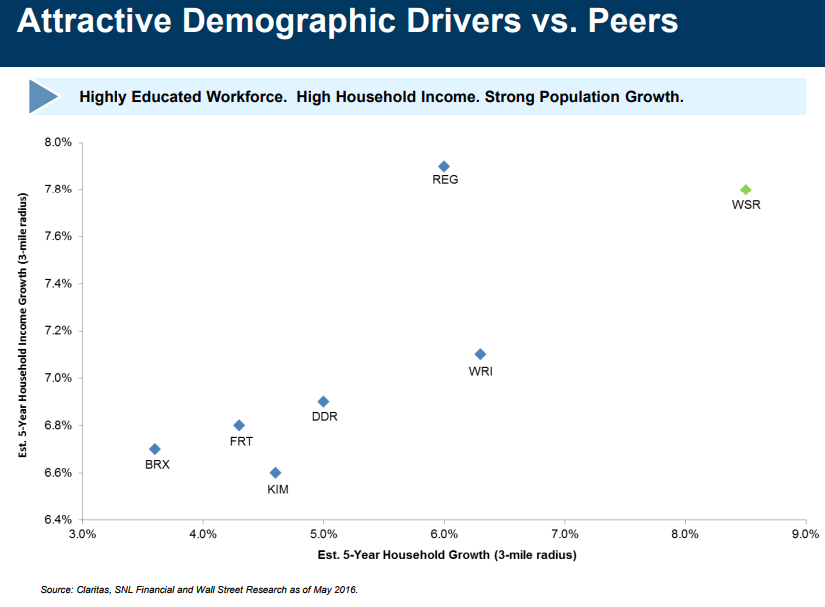

Whitestone is a pure-play community-centered retail REIT that acquires, owns, manages, develops and redevelops high quality “e-commerce resistant” neighborhood, community and lifestyle retail centers principally located in the largest, fastest-growing and most affluent markets in the Sunbelt. Whitestone’s optimal mix of national, regional and local tenants provide daily necessities, needed services and entertainment to the community which are not readily available on the internet. Whitestone’s properties are primarily located in business-friendly Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio, which are among the fastest-growing US population centers with highly educated workforces, high household incomes and strong job growth.

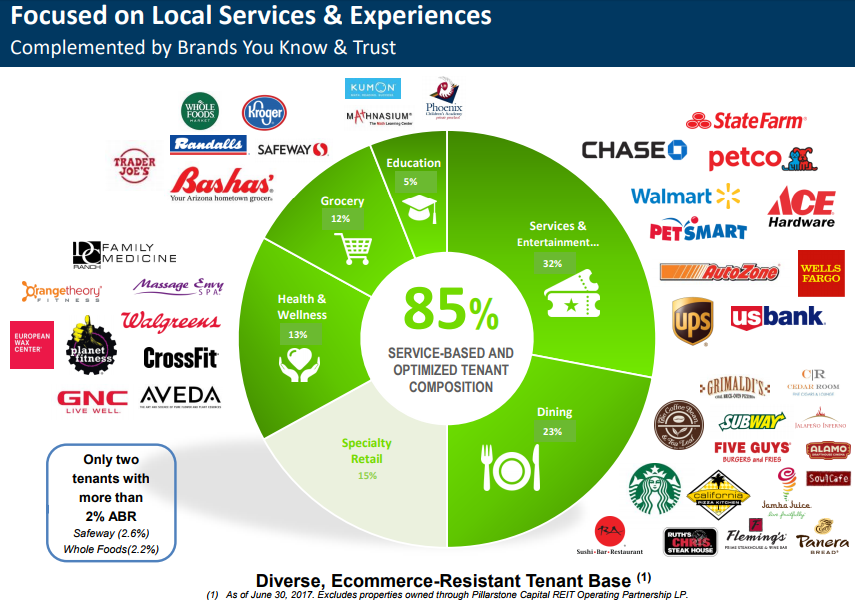

Further, Whitestone believes it has identified disruption and opportunity within the retail landscape, as described in the following graphic.

Specifically, Whitestone believes its properties are “Internet Proof.”

Also worth noting, from an operating structure standpoint, Whitestone is structured as an Umbrella Partnership REIT or UPREIT. An UPREIT is an entity that provides a selling property owner with an opportunity to convert their ownership of real estate properties into a security interest called Operating Partnership units ("OP units"). UPREIT transactions provide an attractive tax deferred exit strategy for owners of real estate who would recognize a significant taxable gain in a cash sale of a highly appreciated property with a low tax basis. In contrast, if real estate is sold or contributed directly to the REIT, it would result in a stepped-up cost basis in the property for the REIT and a taxable event for the contributing property owner.

Growth:

One of the first things that stands out about Whitestone (besides its big dividend, more on this later) is its growth. It IPO’d in 2010, and here is a look at its recent compound annual growth rate.

Further, here is a look at the strong growth in gross assets and revenues…

Not to mention strong growth in net operating income and Core Funds From Operations (FFO)

The company has also provided 2017 core FFO guidance of $1.29 to $1.34 per share.

Further, Whitestone has been growing via acquisitions, as shown in the following chart.

And importantly, these acquisitions have been strategic in nature (i.e. they’re focusing on attractive high-growth markets), as shown in the following graphic.

More specifically, Whitestone is working to meet the needs of attractive affluent communities.

To give you and overview of the types of makeup of Whitestone’s E-commerce resistant tenants, here are examples, broken down by type.

And this next graphic shows the attractive demographics of Whitestone’s locations in terms of both expected household growth and household income growth.

And also very telling, Whitestone has little exposure to “power centers” relative to peers (this is important because it creates less competition and an advantage over peers).

And in addition to the external growth (and mentioned earlier) Whitestone is also demonstrated strong internal growth metrics. For example, same store NOI is growing faster than peers, and occupancy and rents are also going up, as shown in the following graphics.

The Dividend:

Perhaps the most common reason many investors get interested in Whitestone is the big dividend. Not only is the 8.2% yield attractive, but it is paid monthly. If you’re an income-focused, receiving a check in the mailbox every single month can be very attractive. However, there are a few things we think you should know about the dividend.

First, here is a look at the dividend payout ratio…

As you can see, Core FFO currently does exceed the dividend (the payout ratio is 83%). This is attractive because it is below 100%, however there’s not as much cushion with this REIT as the most conservative REITs. However, Whitestone plans to continue growing, more so than other REITs, and high expected future growth can make a higher payout ratio more acceptable. And realistically, 83% isn’t all that bad.

Another very important consideration about the dividend is that it is not a qualified dividend (consult your tax professional, but non-qualified dividends basically mean they don’t qualify for the lower dividend tax rate). Further, the dividend has historically been comprised, in part, of a return of capital. This too can trigger unexpected capital gains taxes for you down the road. Whitestone’s dividend characteristics (i.e. non-qualified) is not a deal-breaker for many investors, but it is something to be aware of before investing.

Also, Whitestone has a history of increasing the dividend, but given the slower expected core FFO growth rate this year (management is guiding towards core FFO of $1.29 - $1.34) the rate of dividend increases may slow (or the dividend may not be increased at all in the near-term).

Debt Load:

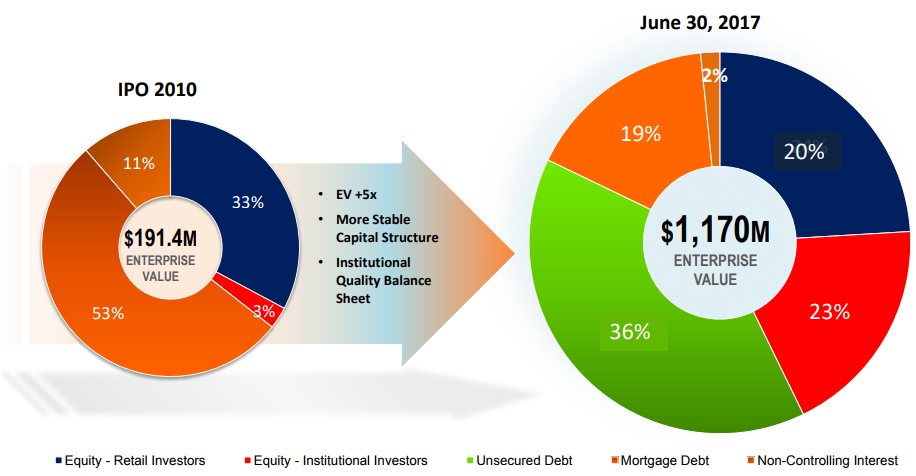

Another thing to keep on your radar is Whitestone’s current level of debt. The company has been working to better “optimize” its capital structure since its IPO, and it’s made progress. However, Whitestone does has a significant amount of debt relative to equity as shown in the following pie charts. And if the company does not achieve future growth, the debt can become a challenge.

The good news is that Whitestone is anticipating continued long-term growth, and its debt maturities are limited in the near-term, as shown in the following chart.

And the company seeks to reduce its debt level over the next 24 month, before the large maturities in 2020.

Valuation:

From a valuation standpoint, Whitestone currently trades at 10.5 times expected 2017 core FFO. This is fairly inexpensive for a REIT, but it is also an indication of risk. For example, the market is questioning if it can truly achieve the continued growth it expects to achieve. Also, the market is likely expressing some concerns with the company’s debt load.

Historically, Whitestone has had success with its selectively acquired properties, generating internal rates of return around 15%, which is attractive.

Further, Whitestone has an attractive cap rate (essentially the net operating income dividend by asset value), as shown in the following chart.

And considering the company uses leverage (i.e. the debt on its balance sheet), the return potential is magnified and attractive. However, higher cap rates can also be an indication of risk and uncertainty.

Worth mentioning, here is a look at Whitestone’s recent price action.

The difference between “price % change” and “total return price % change” is total return assumes dividends are reinvested, whereas price return assumes you’re taking the dividends as cash and not reinvesting. And as the chart shows, Whitestone has underperformed the S&P 500 this year, for those of you who like to consider “buying low.” However, the low price has a lot to do with the ongoing “death of retail” narrative, as well as the risks Whitestone faces, as described earlier.

Conclusion:

Overall, Whitestone has a lot going for it, such as a big monthly dividend, a low valuation, a stock price that has pulled back from a technicals standpoint, and a growth strategy that is designed to be “Internet proof.”

However, it also has risks such as a relatively high debt load, and a growth strategy that the market is uncertain about. In our view, we like Whitestone’s investment strategy. We do not currently own shares, but the strategy is interesting and compelling, and we’ve added Whitestone to our watch list. You can view all of our current holdings here.