If you’re an income-focused contrarian investor, big-dividend REITs may have caught your attention this year considering they’re underperformed the market (SPY) significantly. This week’s Blue Harbinger Weekly shares our brief views on ten big-dividend REITs, and without sharing which ones are attractive “value plays” and which ones are dangerous “value traps,” here are the ten: CBL & Associates (CBL), Taubman Centers (TCO), Realty Income (O), Uniti Group (UNIT), Washington Prime (WPG), Tanger Factory Outlet (SKT), Sabra Health (SBRA), Pennsylvania REIT (PEI), and Ventas Healthcare (VTR), and General Growth Properties (GGP).

Dangerous Value Traps:

A “value trap” is a stock that looks attractive because it’s price is down and it trades at a low valuation. However, in reality, value traps have too much risk and potential downside, and should be avoided. Without further ado, here are the five big-dividend REITs that we consider value traps.

1. Washington Prime (WPG)

Washington Prime is a shopping mall REIT, and it is a dangerous value trap, in our view. Shopping malls have sold off hard this year as more people shop online, and Washington Prime will struggle to recover because of its less desirable property locations (lower rent and sales per square foot). While we do believe some retail REITs are oversold, Washington Prime is Not one of them. With short interest at more than 23%, this is a dangerous value trap. Long-term investors should stay away from Washington Prime Group.

2. CBL & Associates Properties (CBL):

CBL & Associates Properties is a retail REIT, and its shares often grab the attention of income-focused investors because of their huge 14% yield. However, this is a REIT we have no interest in owning because the recent dividend cut is an indication to us that management sees more pain ahead as its portfolio of lower quality retail locations (see rent and sales per square foot in our earlier table) will continue to face challenges. CBL has a very low price to FFO multiple of only 2.9 times ($5.65/$2.10) which we view as a danger, not an opportunity. And short interest of around 33% is another clear red flag, in our view.

On the other hand some of CBL’s debt may be worth considering. Specifically, we don’t expect CBL to go out of business over night, but rather we suspect it could just shrink dramatically, over time. For example, CBL could have more dividend cuts ahead as its less valuable properties continue to decline in value. Another dividend cut would be bad for income-focused equity owners, but it could be a good thing for the debt (bonds). For example, the most recent dividend cut freed up more cash to support the debt, which is ahead of the equity in the capital structure. Given the slow pace that we expect CBL to decline, and the additional cash flow that may become available via more dividend cuts, we think the CBL bonds may actually be worth considering. We wrote about the bonds in more detail here. (members-only).

3. Tanger Factory Outlet (SKT)

Tanger has performed absolutely terribly this year, and we believe there is more pain to come. These off-the-beaten-path outlet malls are not desirable considering more and more people go online for discounts now. Short interest is nearly 40% (this is huge), and we agree with the negative sentiment. Unless you like investing in opportunities where the risks greatly exceed the potential rewards, stay away from Tanger. Don’t be misled by its track record of raising the dividend—this will end.

4. Sabra Health Care (SBRA)

Sabra owns and invests in real estate serving the healthcare industry. This particular REIT has outsized exposure to skilled nursing facilities, perhaps the riskiest of health care properties. Constant government pressure to reduce reimbursement has put many healthcare operators (including Sabra tenants) in a world of hurt. Short interest is about 25%, and why risk your money when there are so many better opportunities elsewhere. Sabra Healthcare? No thank you.

5. Pennsylvania REIT (PEI)

A different depressed retail REIT with the same ugly challenges. Pennsylvania REIT owns and operates retail shopping malls, and unfortunately for investors, PEI invests in the type of retail properties that will continue to face serious challenges. People aren’t simply going to these malls for something to do like they used to, especially considering they spend so much time (and there are so many shopping opportunities) online. This is another retail REIT with high short interest (currently 33.8%). Don’t fool yourself into believing the internet is not going to grow. Stay away from this value trap.

Attractive Value Plays:

Despite the challenges, it’s not all gloom and doom for big dividend REITs. Some of them are actually attractive “value plays,” in our view. And by value play we mean stocks that have sold off too far and have more value than their stock price suggests. The following attractive value plays have big dividends and attractive price appreciation potential, in our view.

1. Taubman Centers (TCO), Yield: 4.0%

In our view, well-located retail assets can coexist very profitably with internet retailers, and Taubman’s portfolio of properties is among the most desirable.

This REIT's locations provide value and convenient experiences that shoppers will continue to seek out. And considering it currently trades at around 17.1 times the midpoint of 2017 adjusted FFO guidance, we think it’s worth considering if you are a contrarian income focused investor.

2. Uniti Group (UNIT)

Uniti Group is basically a telecom REIT that pays a huge dividend (+13%). Your first thought may be that the telecom industry is ugly, and your second thought may be that anything that pays a dividend this high cannot be safe. It’s true this is a higher risk investment opportunity, but there are reasons to believe Uniti may have some very significant upside price appreciation ahead.

For starters, Uniti was created when telecom company Windstream (WIN) spun off some of its assets to a REIT in an attempt to unlock some value that the market was not giving it enough credit for. However, since the spin-off in 2015, Uniti has been working to diversify its business away from only Windstream assets.

True the “old-school” wireline telecom business is struggling big time. Companies like Frontier (FTR), CenturyLink (CTL) and Windstream (WIN) have been performing absolutely horribly, while the big boys (AT&T and Verizon) have been doing better (though not great) because of their wireless/mobile assets (and because they have more attractive wireline assets anyway).

Uniti has a low credit rating that was recently downgraded because Windstream’s credit rating was downgraded (remember, more than half of Uniti’s business is based on lease income from Windstream). However, Windstream has been taking significant steps to firm up its business (they eliminated the dividend to free up cash flow), and Uniti has been growing business with other non-Windstream telecoms.

3. Ventas (VTR)

Ventas is a big-dividend healthcare REIT, and it has sold off in sympathy with other healthcare REITs such as Sabra (as described above). However, Ventas has essentially zero exposure to the risky skilled nursing facilities that are creating challenges for other companies. Ventas is an attractive blue chip value play, and you can read our write-up on Ventas here:

4. General Growth Properties (GGP)

GGP isn’t the risky shopping mall operator that will continue to be plagued by changing shopper preferences (i.e. more online shopping). GGP is a prime location retail property owner.

And as a sign of value, Brookfield Property Partners (BPY) recently made a bid to acquire GGP at $23 per share, and GGP has reportedly rejected the offer (an indication that GGP also believes they are worth more). This bid is consistent with our belief that the retail REITs with better locations have a much better chance of succeeding (and ultimately thriving in the long-term) despite the current internet-driven carnage. As shown in our earlier chart (in the Taubman section, above), GGP achieves higher sales and higher rents per square foot than many other less desirable retail REITs. And consistent with our views, GGP’s properties are located in more attractive, convenient, experiential locations than many of its peer’s properties.

Whether or not GGP's rejection of the $23 bid was a good idea is yet to be known. For example, market conditions (both real and perceived) could still get worse before they get better, and GGP may end up regretting its decision to reject the bid. Also, there are some twisted management conflicts of interest in the whole Brookfield Property Partners—Brookfield Asset Management (BAM) relationship that could make GGP and BPY shareholders relatively worse off relative to BAM. For example, we wrote about this in detail in our recent members-only article.

However, assuming Brookfield’s belief is correct that we are closer to a bottom (not a top) in retail REITs (that’s why they’re interested in buying), GGP could have a lot of long-term upside, regardless. Plus, the proposed deal (which may be sweetened) involves what amounts to an immediate dividend increase to GGP shareholders if the deal goes through.

5. Realty Income (O):

Realty Income owns roughly 5,000 retail properties across the US (as well as a handful of industrial and office properties), and the company continues to grow. It has also raised its divided 77 quarterly in a row (the dividend is paid monthly, by the way), and it expects to pay out only ~83% of its adjusted FFO as dividends in 2017, which is a healthy margin of safety for this low-beta company.

As of December 31, 2016, 99.5% of Realty Income's properties were single-tenant properties leased with a weighted average remaining lease term of approximately 9.8 years. We believe these high quality, attractive location, single tenant properties can co-exist and thrive regardless of the growth in online retail.

Conclusion

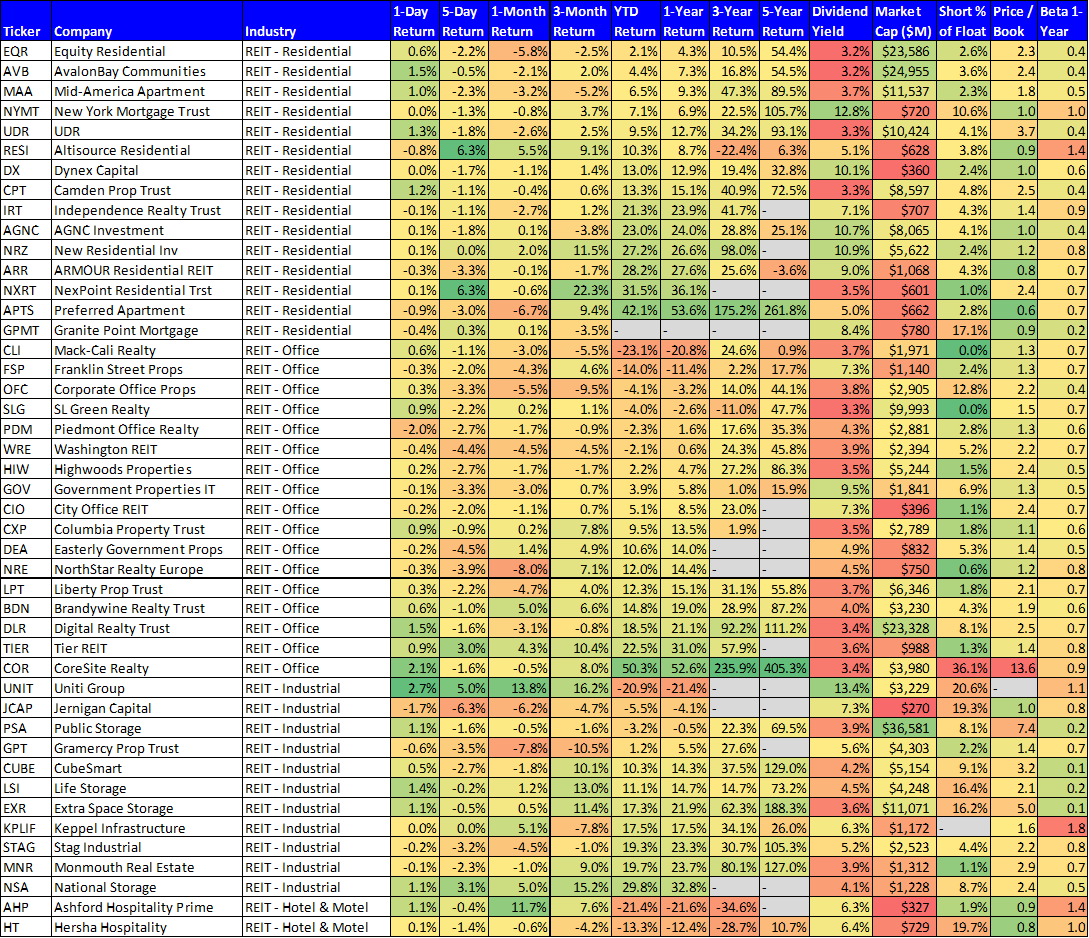

There are some attractive contrarian opportunities is the REIT space right now, especially in retail REITs, but don't go chasing after every big dividend where the share price has recently sold off. We prefer quality companies with a business model that can thrive, such as the five value plays highlighted in this article. For your reference, here is a comprehensive list of big-dividend (>3%) REITs with a market cap of at least $250 million. You may be able to find some additional attractive opportunities on this list. Please let us know if you'd like more information on any of them. And for reference, you can view all of our current holdings here.