If you are an income-focused value investor, some CEFs are currently offering highly attractive “double discounts” heading into 2018. CEF investors should be aware of the distribution income sources, including dividends as well as capital gains, for example. This article reviews our current CEF holdings and several top ideas for 2018.

Closed-End Funds are NOT for everyone, but for income-focused value investors some CEFs are currently offering highly attractive “double discounts” heading into 2018. This article reviews our current CEF holdings and several top ideas for the new year.

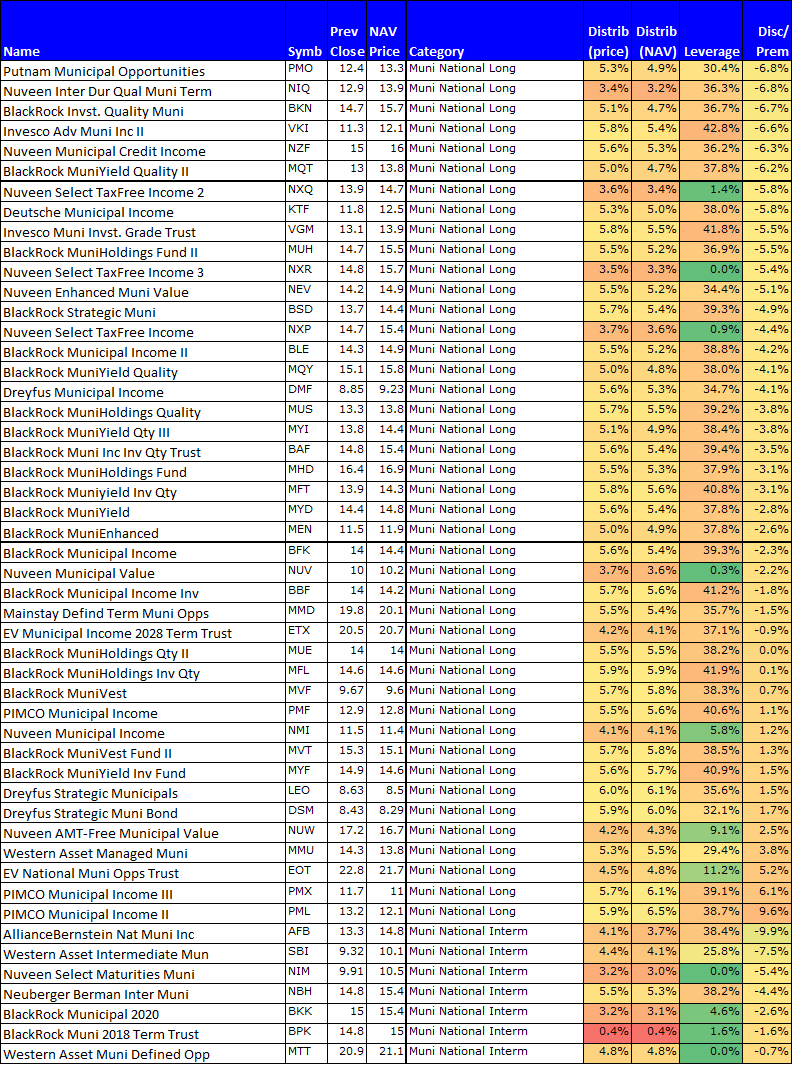

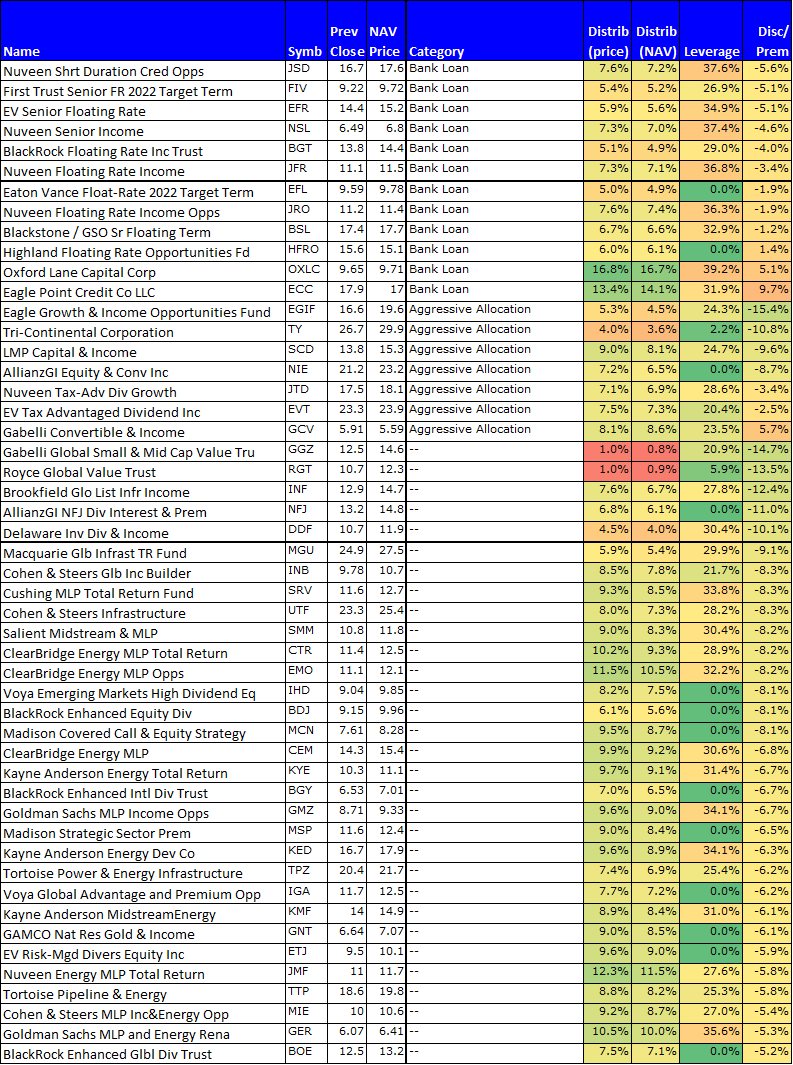

For starters, here is a color-coded list of CEFs organized by category:

Choosing the right CEF can be daunting, but when we look for attractive closed-end funds, we look for the following:

- Attractively-priced, compelling strategies

- Attractive discounts versus Net Asset Value (“NAV”)

- Healthy yields

- Conservative leverage ratios

- Prudent management

Before getting into our new ideas, here are our Current CEF holdings:

Adams Diversified Equity Fund (ADX)

Yield: 9.8%

ADP walloped the S&P 500 this year (congrats if you owned it, like us) for three main reasons. First, ADX just paid its big year-end annual dividend, and it was even larger than expected (as described in this press release) thereby bringing its annual yield to an impressive 9.8%. Second, ADX held several of the impressive growth technology companies (Facebook, Amazon, Apple, Microsoft) that lead the market higher. And third, ADX’s discount versus NAV shrunk (see chart below) thereby boosting the price return to shareholders (remember, attractive discounts versus NAV is one of the things we look for in an attractive CEF).

ADX was a big positive contributor to our performance this year.

Royce Small Cap CEFs (RMT) and (RVT)

Yields, 8.5 and 8.7%

We own these two funds too, and they were also big positive contributors to performance this year, for similar reasons to why ADX was a big positive contributor. Specifically, both funds offer big distribution yields, and both funds benefited from a shrinking discount to NAV this year. The holdings in these CEFs are also attractive from an asset allocation standpoint, as we believe small cap still has a lot more room to run. Plus the funds are relatively low-cost (low expense ratios) for a CEF, especially considering we like the management team at Royce. We’ll likely continue to own these funds for the yield and the attractive holdings. You can read more from Morningstar about these funds using the links at the end of this article.

Tekla World Healthcare Fund (THW)

Yield: 10.3%

These fund delivered positive price returns plus big income distributions in 2017, and we expect to keep holding it considering the discount versus NAV remains very attractive. We also like this fund for the relatively low management fee and the prudent use of leverage. You can read more from Morningstar about THW using this link.

New CEF Ideas:

In addition to the CEFs we currently own (as described above), here are several additional CEF’s that we consider very attractive heading into 2018 if you are an income-focused value investor.

Real Estate CEFs (RQI) (JRS) (IGR)

We like publicly traded real estate (e.g. REITs) heading into 2018 from both a contrarian value investor standpoint and a tax reform standpoint (i.e. REITs benefit under the new Tax Cuts and Jobs Act). If you’re an income-focused value investor, here are three Real Estate CEFs that we believe are worth considering because of their strategies, high income distributions, discounted prices (versus NAV) and prudent use of leverage.

- Cohen & Steers Qty Inc Realty (RQI), Yield: 7.8%: The Fund seeks high current income and capital appreciation through investment in common and preferred stock issued by REITs. Its total adjusted expense ratio (1.22%) is reasonable for a CEF, it trades at an attractively discounted price, we like the top holdings in the fund (e.g. SPG, EQIX, and PLD), and we believe the leverage ratio is prudent. More information from Morningstar on this fund is available here.

- Nuveen Real Estate Income (JRS), Yield: 9.1%: The Fund seeks high current income and capital appreciation through investment in income producing common stocks, preferred stocks and debt securities issued by real estate companies. And like RQI, JRS’s total adjusted expense ratio (1.31%) is reasonable for a CEF, it trades at an attractively discounted price, we like the top holdings in the fund (e.g. SPG, PLD and GGP), and we believe the leverage ratio is prudent. More information from Morningstar on this fund is available here.

- CBRE Clarion Global Real Est Income (IGR), 7.7%: The Fund seeks high current income with capital appreciation through investments in income producing real estate equity securities. And like RQI and JRS, IGR’s total adjusted expense ratio (1.09%) is reasonable for a CEF, it trades at an attractively discounted price, we like the top holdings in the fund (e.g. SPG, PLD and GGP), and we believe the leverage ratio is prudent. More information from Morningstar on this fund is available here.

Worth mentioning, real estate has underperformed the S&P 500 this year (2017), but it has still delivered positive returns, big income, and looks attractive going forward from a contrarian standpoint, in our view.

Gabelli Family of Funds

Mario Gabelli is a highly successful New York based investor, and from the looks of some of the CEFs offered by his firm, you may see why. We’ve highlighted (below) three attractive Gabelli Funds with compelling strategies, high income distributions, attractively discounted prices (versus NAV), reasonable CEF expense ratios, and prudent use of leverage.

- Gabelli Equity Trust (GAB), Yield 10.3%: The Fund seeks long term capital growth with current income through investment in equity securities. And like the other CEFs we like, GAB’s total adjusted expense ratio (1.10%) is reasonable for a CEF, it trades at an attractively discounted price, we like the holdings (large cap growth and value), and we believe the leverage ratio is prudent. More information from Morningstar on this fund is available here.

- Gabelli Dividend & Income (GDV), Yield: 5.7%: The Fund seeks high total return through investment in dividend paying equity and debt securities. And like the other CEFs we like, GDV’s total adjusted expense ratio (1.39%) is reasonable for a CEF, it trades at an attractively discounted price, we like the holdings (large cap value), and we believe the leverage ratio is prudent. More information from Morningstar on this fund is available here.

- GAMCO Glb Gold Natural Res & Income (GGN), Yield: 11.5% : The Fund seeks high current income with capital appreciation through investment in equity securities issued by gold and natural resources industries and through utilizing an options strategy. This strategy has delivered positive returns this year, though the returns have been lower than the S&P 500. However, the fund is attractive from a contrarian standpoint, and it also provides some unique expose to the out-of-favor natural resources industry. The yield is also attractive, and so is the discount to NAV. More information from Morningstar on this fund is available here.

Contrarian, High-Income, BDC, CEF:

- First Trust Specialty Finance (FGB), Yield: 11.2%: Business Development Companies (“BDCs”) are known for their high yields, and they are extremely out of favor this year, which makes this BDC-focused strategy more attractive from a contrarian standpoint. BDCs have recently been adjusting their strategies considering the high yielding post-financial-crisis investments they have been benefiting from are finally rolling off the books and being replaced by new lower-yielding opportunities. It makes sense that there’d be opportunities in this space considering it is strongly out of favor right now, and the management team running this fund keeps the overall expense ratio (1.54%) reasonable. Our main caveat with this fund is that even though it offers a very high yield (11.2%) it is risky considering the fund uses leverage and so do the underlying BDCs. Plus the expenses are higher than they seem because the management teams of the individual BDCs within this fund are also charging their own fees (in addition to the First Trust fee). Nontheless, if you’re looking for an actively managed, high-income, BDC-focused (because BDCs are so out-of-favor right now) CEF, this fund is worth considering. Especially considering the holdings fall into the deep-value and small (and micro) cap space, an area that has historically performed very well over the long-term and is due for a significant rebound.

Risks:

Two important risks to consider with CEF investing are leverage and return of capital. Regarding leverage, we believe it is prudent to use a small amount of leverage, and then scale up (to a reasonable level) depending on the type/riskiness of the underlying holdings and your personal risk aversion. CEFs often use a small amount of leverage just to cover their operating costs while maintaining full exposure to the market.

Regarding return of capital, investors should understand that many CEFs generate some of their income distributions via a "return of capital" instead of simply via dividends and income. For example, if the fund appreciates more in value (i.e. generates more capital gains), then it may pay a higher distribution (sourcing some of the distribution payments from capital gains) as was the case with the Adams Diversified Equity Fund (ADX), as described earlier in this report. For this reason, we believe CEFs are often more appropriate for income-focused investors. You can see the distribution source breakdown (between dividends and capital gains) using the Morningstar links provided at the end of this article.

Conclusion:

CEFs are not for everyone. However, if you’re looking for a diversified, actively-managed strategy that offers high income distributions, then CEF’s may be worth considering. We own several BDCs (as described in this article), and we’ve also highlighted a few more that we believe are currently attractive based on their discounted prices, attractive strategies, relatively reasonable expense ratios, and prudent use of leverage. In particular, we believe the CEFs we have highlighted currently offer double discounts via their attractive contrarian/value strategies and their attractive discounts versus NAV.

For reference, you can view all of our current holdings here. And you can access detailed Morningstar information for all 530 CEFs in our earlier table using the links provided below.

- Lazard Glb Total Return & Income

- Clough Global Equity

- Lazard World Dividend & Income

- Alpine Total Dynamic Dividend

- Alpine Global Dynamic Dividend

- JH Hedged Equity & Income Fund

- JH Tax Advantaged Global Shareholder Yld

- PIMCO Global StocksPLUS & Income

- LeggMason BW Global Income Opps

- First Trust/Aberdeen Global Oppos Income

- Aberdeen Asia-Pacific Income

- DoubleLine Income Solutions

- Western Asset Glb Corp Def Opp

- MFS® Intermediate Income

- Aberdeen Global Income

- Delaware Enhanced Gbl Div & Income

- Wells Fargo Global Dividend Opportunity

- EV Tax Adv Global Dividend Inc

- Virtus Total Return Fund Inc.

- Nuveen Diversified Div & Income

- Nuveen Tax-Adv Total Return

- Calamos Global Dynamic Income

- EV Tax Adv Global Div Opps

- Calamos Global Total Return

- Duff&Phelps Global Utility Income

- Reaves Utility Income

- Mac/First Glb Infra/Utility Div & Income

- Gabelli Global Utility & Inc

- BlackRock Util, Infra & Power Opp

- BlackRock Util, Infra & Power Opp

- DNP Select Income

- Gabelli Utility Trust

- BlackRock Science and Technology Trust

- Columbia Seligman Premium Tech Growth

- Dividend and Income Fund

- Franklin Universal Trust

- Special Opportunities Fund

- Clough Global Opportunities

- Clough Global Dividend and Income

- RiverNorth/DoubleLine Strategic Opp Fund

- NexPoint Credit Strategies Fund

- RiverNorth Opportunities

- RENN Glb. Entrepreneurs Fund

- RENN Glb. Entrepreneurs Fund

- Royce Micro Cap Trust

- Royce Value Trust

- RMR Real Estate Income Fund

- Principal Real Estate Income

- Cohen & Steers Qty Inc Realty

- Cohen & Steers Tot Ret Realty

- Neuberger Berman Real Est Securities Inc

- Nuveen Real Estate Income

- Cohen & Steers Limited Dur Prf & Inc

- Nuveen Preferred & Income Term

- Nuveen Pref & Income Opps Fund

- First Trust Inter Dur Pref & Income Fund

- Flah&Crum Pref Income Opps

- JH Preferred Income III

- Flah&Crum Total Return

- Nuveen Pref & Income Securities Fund

- JH Preferred Income

- Flah&Crum Pref Securities Income

- JH Preferred Income II

- Cohen & Steers Select Pref & Income

- Flah & Crum Dynamic Pref & Income Fund

- Flah&Crum Preferred Income

- JH Premium Dividend Fund

- MS Asia Pacific

- Asia Tigers Fund

- Asia Pacific Fund

- Putnam Premier Income Trust

- BlackRock Resources & Commdty

- GAMCO Glb Gold Natural Res & Income

- Nuveen CT Quality Muni Inc

- Nuveen MI Quality Muni Inc

- Nuveen MD Quality Muni Inc

- EV MI Municipal Income

- Nuveen NC Quality Muni Inc

- EV MI Municipal Bond

- BlackRock MD Muni Bond

- Nuveen VA Quality Muni Inc

- BlackRock MuniYield MI Quality

- Nuveen GA Quality Muni Inc

- Nuveen TX Quality Muni Inc

- Nuveen AZ Quality Muni Inc

- Delaware Invest CO Muni Income

- Nuveen MO Quality Muni Inc

- BlackRock MuniYield Arizona

- BlackRock VA Municipal Bond

- BlackRock FL Municipal 2020

- Invesco PA Value Muni Income Trust

- Nuveen PA Quality Muni Inc

- EV PA Municipal Bond

- EV PA Municipal Income

- BlackRock MuniYield PA Quality

- Nuveen PA Municipal Value Fund

- EV OH Municipal Income

- Nuveen OH Quality Muni Inc

- EV OH Municipal Bond

- EV NY Municipal Income

- BlackRock Muni NY Intermed. Duration

- EV NY Muni Bond II

- BlackRock NY Muni Inc Qty

- Nuveen NY AMT - Free Quality Muni Inc

- BlackRock MuniYield NY Quality

- BlackRock MuniHoldings NY Qty

- BlackRock NY Municipal Bond

- Nuveen NY Quality Muni Inc

- EV NY Municipal Bond

- Nuveen NY Municipal Value 2

- Invesco Trust NY Inv Grade Muni

- Nuveen NY Municipal Value

- BlackRock NY Municipal Income

- BlackRock NY Municipal Inc II

- Nuveen NY Select Tax Free

- PIMCO NY Municipal Income

- PIMCO NY Municipal Income II

- PIMCO NY Municipal Income III

- Neuberger Berman NY Intermediate Muni

- BlackRock NY Muni 2018 Term

- Nuveen NJ Quality Muni Inc

- EV NJ Municipal Income

- EV NJ Municipal Bond

- Nuveen NJ Municipal Value Fund

- BlackRock MuniHoldings NJ Qty

- BlackRock NJ Municipal Bond

- BlackRock NJ Municipal Income

- BlackRock MuniYield NJ

- Delaware Invest National Muni Inc

- DTF Tax-Free Income

- BlackRock Muni Inter Duration

- Managed Duration InvGrade Muni

- Nuveen AMT-Free Quality Muni Inc

- Nuveen Quality Muni Income Fund

- Dreyfus Muni Bond Infrastructure

- Invesco Value Muni Income Trust

- Invesco Quality Muni Income Trust

- EV Municipal Bond

- Invesco Muni Opps. Trust

- BlackRock Municipal 2030 Target Term

- EV Municipal Bond II

- Western Asset Municipal Partners

- MFS® Investment Grade Muni Trust

- BlackRock Muni Inc Qty Trust

- BlackRock Municipal Bond

- Invesco Municipal Trust

- EV Municipal Income

- Nuveen AMT-Free Muni Credit Inc

- Federated Premier Muni Income

- Putnam Municipal Opportunities

- Nuveen Inter Dur Qual Muni Term

- BlackRock Invst. Quality Muni

- Invesco Adv Muni Inc II

- Nuveen Municipal Credit Income

- BlackRock MuniYield Quality II

- Nuveen Select TaxFree Income 2

- Deutsche Municipal Income

- Invesco Muni Invst. Grade Trust

- BlackRock MuniHoldings Fund II

- Nuveen Select TaxFree Income 3

- Nuveen Enhanced Muni Value

- BlackRock Strategic Muni

- Nuveen Select TaxFree Income

- BlackRock Municipal Income II

- BlackRock MuniYield Quality

- Dreyfus Municipal Income

- BlackRock MuniHoldings Quality

- BlackRock MuniYield Qty III

- BlackRock Muni Inc Inv Qty Trust

- BlackRock MuniHoldings Fund

- BlackRock Muniyield Inv Qty

- BlackRock MuniYield

- BlackRock MuniEnhanced

- BlackRock Municipal Income

- Nuveen Municipal Value

- BlackRock Municipal Income Inv

- Mainstay Defind Term Muni Opps

- EV Municipal Income 2028 Term Trust

- BlackRock MuniHoldings Qty II

- BlackRock MuniHoldings Inv Qty

- BlackRock MuniVest

- PIMCO Municipal Income

- Nuveen Municipal Income

- BlackRock MuniVest Fund II

- BlackRock MuniYield Inv Fund

- Dreyfus Strategic Municipals

- Dreyfus Strategic Muni Bond

- Nuveen AMT-Free Municipal Value

- Western Asset Managed Muni

- EV National Muni Opps Trust

- PIMCO Municipal Income III

- PIMCO Municipal Income II

- AllianceBernstein Nat Muni Inc

- Western Asset Intermediate Mun

- Nuveen Select Maturities Muni

- Neuberger Berman Inter Muni

- BlackRock Municipal 2020

- BlackRock Muni 2018 Term Trust

- Western Asset Muni Defined Opp

- Delaware MN Muni Income II

- Nuveen MN Quality Muni Inc

- EV MA Municipal Income

- EV MA Municipal Bond

- Nuveen MA Quality Muni Inc

- Massachusetts Tax-Exempt Trust

- EV CA Municipal Income

- Alliance CA Municipal Income

- BlackRock CA Municipal Income

- Nuveen CA Quality Muni Income

- MFS® California Municipal Fund

- EV CA Muni Bond II

- BlackRock MuniYield CA Quality

- BlackRock MuniHoldings CA Qty

- Invesco CA Value Muni Income

- EV CA Municipal Bond

- BlackRock MuniYield CA

- Nuveen CA AMT - Free Quality Muni Inc

- Nuveen CA Select Tax-Free

- Nuveen CA Muni Value

- Nuveen CA Municipal Value 2

- PIMCO CA Municipal Income III

- PIMCO CA Municipal Income II

- PIMCO CA Municipal Income

- Neuberger Berman CA Inter Muni

- BlackRock CA Muni 2018 Term

- EV Limited Duration Income

- BlackRock Multi-Sector Income

- Wells Fargo Multi-Sec Income

- MFS Multi-Market Income

- EV Short Duration Diversified

- Putnam Master Intermediate Income

- Western Asset Variable Rate Strategic

- TCW Strategic Income

- Franklin Limited Duration Income Trust

- PIMCO Dynamic Credit and Mortgage Inc

- JH Investors Trust

- PIMCO Income Strategy Fund II

- Virtus Global Multi-Sector Income

- PIMCO Income Strategy Fund

- PIMCO Income Opportunity

- Doubleline Opportunistic Credit

- PIMCO Dynamic Income

- Guggenheim Strategic Opp Fund

- PIMCO Corporate & Income Opps

- PIMCO High Income

- PCM Fund

- PIMCO Corporate & Income Strategy

- EV Tax-Advantaged Bond & Option Strategy

- Nuveen Real Asset Income and Growth

- Source Capital Inc

- Cohen & Steers REIT & Preferred Income

- Calamos Strategic Total Return

- Cohen & Steers Closed-End Opp

- JH Tax-Advantaged Dividend Inc

- Wells Fargo Util & High Income

- Virtus Global Dividend & Income

- Mexico Fund

- New Ireland Fund

- Mexico Equity & Income

- Korea Fund

- The Central and Eastern Europe Fund

- New Germany Fund

- Swiss Helvetia Fund

- Aberdeen Israel

- Aberdeen Singapore Fund

- Aberdeen Indonesia Fund Inc

- Aberdeen Chile Fund

- Thai Fund Inc

- Aberdeen Australia Equity

- Miller/Howard High Income Equity

- Liberty All-Star Growth

- Herzfeld Caribbean Basin

- Sprott Focus Trust

- GDL Fund

- Nuveen Build America Bond Opp

- BlackRock Taxable Municipal Bond Trust

- Guggenheim Taxable Muni Managed Dur Tr

- Nuveen Build America Bond

- Latin American Discovery Fund

- Aberdeen Latin America Equity

- Boulder Growth & Income

- Gabelli Dividend & Income

- Liberty All-Star Equity

- Gabelli Multimedia

- Nuveen Core Equity Alpha

- Foxby Corp

- Central Securities Corporation

- General American Investors

- Adams Diversified Equity Fund

- Eagle Capital Growth

- Gabelli Equity Trust

- Cornerstone Strategic Value

- Cornerstone Total Return

- Aberdeen Japan Equity Fund

- Japan Smaller Capitalization

- First Trust Mortgage Income

- BlackRock Income Trust

- Nuveen Multi-Market Income

- MFS® Government Markets Income

- JH Income Securities

- PIMCO Strategic Income

- BlackRock Enhanced Gov Fund

- Western/Claymore Infl-Lnk Opps

- Western/Claymore Infl-Lnkd Securities

- India Fund Inc

- MS India Investment

- Putnam Managed Muni Income

- Pioneer Municipal High Income

- Western Asset Muni High Income

- MFS Municipal Income

- Deutsche Strategic Muni Income

- Nuveen Intermediate Duration Muni Term

- BlackRock Long-Term Muni Adv

- MFS® High Yield Municipal Trust

- Pioneer Muni High Inc Adv

- Nuveen Municipal 2021 Target Term

- MFS High Income Municipal Trust

- Nuveen Muni High Inc Opp

- BlackRock MuniAssets Fund

- Invesco Muni Income Opps Trust

- First Trust Strategic High Income II

- Prudential Global Short Duration High

- Neuberger Berman High Yield Strategies

- Western Asset High Income Opp

- BlackRock Corp High Yield

- Apollo Tactical Income

- Western Asset Global High Inc

- Prudential Sht Duration High Yield

- Western Asset High Inc Fund II

- Western Asset High Yld Def Opp

- Invesco High Income II

- Wells Fargo Inc Opp

- Pioneer Diversified High Inc

- Pioneer High Income Trust

- First Trust High Inc Long/Short

- Nuveen Global High Income

- KKR Income Opportunities

- AllianceBernstein Glb High Inc

- Credit Suisse Asset Mgmt Income

- MFS® Charter Income

- Barings Global Short Duration High Yield

- New America High Income Fund

- BlackRock Limited Duration Inc

- Brookfield Real Assets Income Fund Inc.

- Ivy High Income Opportunities

- Dreyfus High Yield Strategies

- Deutsche Multi-Market Income

- Deutsche Strategic Income

- Nuveen Emrg Mkts Debt 2022 Target Term

- Dreyfus Alcentra Gl Cred Inc 2024 Tgt Tm

- BlackRock 2022 Global Income Opportunity

- Invesco High Income 2023 Target Term

- Nuveen High Income Nov 2021 Target Term

- Nuveen Credit Opp 2022 Target Term

- XAI Octagon FR & Alt Income Term Trust

- Nuveen High Income Dec 2019 Target Term

- Eaton Vance High Income 2021 Target Term

- Nuveen High Income Dec 2018 Target Term

- Nuveen Mortgage Opp Term Fund 2

- Nuveen Mortgage Opp Term Trust

- Deutsche High Income Oppos

- Guggenheim Credit Allocation

- Nuveen High Income 2020 Target Term Fund

- Nuveen Preferred and Income 2022 Term

- Barings Participation Invs

- Barings Corporate Investors

- Invesco High Income 2024 Target Term

- Invesco High Income 2024 Target Term

- Credit Suisse High Yield Bond

- MFS® Intermediate High Income

- Western Asset Mortgage Defined Opp

- Gabelli Health & Wellness

- Tekla Healthcare Opportunities

- Tekla World Healthcare

- Tekla Healthcare Investors

- Tekla Life Sciences Investors

- BlackRock Health Sciences

- CBRE Clarion Global Real Est Income

- Alpine Global Premier Property

- First Trust Specialty Finance

- JH Financial Opportunities

- European Equity Fund

- First Trust Dynamic Europe Equity Income

- ASA Gold and Precious Metals

- Adams Natural Resources Fund

- Cushing® Energy Income

- BlackRock Energy & Resources

- Cushing® Renaissance

- Duff & Phelps Select Energy MLP

- Tortoise Energy Independence

- MS Emerging Markets Domestic

- Western Asset Emerg Mkts Debt

- Templeton Emerging Markets Income

- Templeton Global Income

- MS Emerging Markets Debt

- Stone Harbor Emg Mkts Total Income

- Stone Harbor Emerging Mkts Income

- MS Emerging Markets

- Templeton Emerging Markets

- First Trust/Aberdeen Emerging Oppos

- Aberdeen Emerging Markets Smlr Co Opps

- BlackRock Credit Allocation Inc

- Duff Phelps Utility&Corp Bond

- MS Income Securities

- Western Asset Premier Bond

- BlackRock Core Bond

- Insight Select Income Fund

- Invesco Bond Fund

- Western Asset Income

- Western Asset IG Defined Opp

- Advent Claymore Conv & Income

- Advent Claymore Cnvt Secs&Inc II

- Bancroft Fund

- Ellsworth Growth and Income

- AllianzGI Convert & Inc 2024 Target Term

- Putnam High Income Securities

- Calamos Dynamic Convertible and Income

- Calamos Convertible & High Income

- Calamos Convertible Opps & Income

- AllianzGI Convertible & Inc II

- AllianzGI Convertible & Income

- Gabelli Go Anywhere Trust

- Advent Claymore Enh Grth & Inc

- AllianzGI Diversified Income & Convert

- MFS Special Value Trust

- Sprott Physical Silver Trust

- MS China A Share

- Templeton Dragon Fund

- Taiwan Fund

- Aberdeen Greater China

- China Fund Inc

- Invesco Dynamic Credit Opps

- Invesco Senior Income Trust

- Voya Prime Rate Trust

- Ares Dynamic Credit Allocation Fund

- Apollo Senior Floating Rate

- Nuveen Credit Strategies Income

- EV Senior Income Trust

- EV Floating-Rate Income Plus

- BlackRock Debt Strategies Fund

- First Trust Senior FR Income II

- Western Asset Corporate Loan Fund

- Blackstone/GSO LS Credit Income

- THL Credit Senior Loan

- BlackRock Float Rate Strat

- EV Floating Rate Income

- Pioneer Floating Rate Trust

- Blackstone/GSO Strategic Credit

- Aberdeen Income Credit Strategies Fund

- Nuveen Shrt Duration Cred Opps

- First Trust Senior FR 2022 Target Term

- EV Senior Floating Rate

- Nuveen Senior Income

- BlackRock Floating Rate Inc Trust

- Nuveen Floating Rate Income

- Eaton Vance Float-Rate 2022 Target Term

- Nuveen Floating Rate Income Opps

- Blackstone / GSO Sr Floating Term

- Highland Floating Rate Opportunities Fd

- Oxford Lane Capital Corp

- Eagle Point Credit Co LLC

- Eagle Growth & Income Opportunities Fund

- Tri-Continental Corporation

- LMP Capital & Income

- AllianzGI Equity & Conv Inc

- Nuveen Tax-Adv Div Growth

- EV Tax Advantaged Dividend Inc

- Gabelli Convertible & Income

- Gabelli Global Small & Mid Cap Value Tru

- Royce Global Value Trust

- Brookfield Glo List Infr Income

- AllianzGI NFJ Div Interest & Prem

- Delaware Inv Div & Income

- Macquarie Glb Infrast TR Fund

- Cohen & Steers Glb Inc Builder

- Cushing MLP Total Return Fund

- Cohen & Steers Infrastructure

- Salient Midstream & MLP

- ClearBridge Energy MLP Total Return

- ClearBridge Energy MLP Opps

- Voya Emerging Markets High Dividend Eq

- BlackRock Enhanced Equity Div

- Madison Covered Call & Equity Strategy

- ClearBridge Energy MLP

- Kayne Anderson Energy Total Return

- BlackRock Enhanced Intl Div Trust

- Goldman Sachs MLP Income Opps

- Madison Strategic Sector Prem

- Kayne Anderson Energy Dev Co

- Tortoise Power & Energy Infrastructure

- Voya Global Advantage and Premium Opp

- Kayne Anderson MidstreamEnergy

- GAMCO Nat Res Gold & Income

- EV Risk-Mgd Divers Equity Inc

- Nuveen Energy MLP Total Return

- Tortoise Pipeline & Energy

- Cohen & Steers MLP Inc&Energy Opp

- Goldman Sachs MLP and Energy Rena

- BlackRock Enhanced Glbl Div Trust

- BlackRock Enhanced Cap & Inc

- Voya Global Equity Dividend&Premium Opp

- Tortoise MLP Fund

- First Trust Energy Infra. Fund

- ClearBridge American Energy MLP

- Neuberger Berman MLP Income

- EV Enhanced Equity Income

- EV Enhanced Equity Income II

- First Trust Energy Inc & Growth

- Tortoise Energy Infrastructure

- Kayne Anderson MLP

- Voya Natural Resources Equity Income

- Guggenheim Enhanced Equity Inc

- Nuveen S&P 500 Buy-Write Income

- Nuveen Dow 30 Dynamic Overwrite

- Central Fund of Canada

- First Trust Enhanced Equity Income

- Center Coast MLP & Infrastructure

- EV Tax-Managed Div Equity Income

- Voya Infrastructure Industrials & Matls

- EV Tax-Mgd Gbl Div Equity Income

- Nuveen All Cap Energy MLP Opps

- Fid/Claymore MLP Opportunity

- First Trust New Opps MLP & Energy

- EV Tax-Managed Buy-Write Opps

- First Trust MLP & Energy Inc Fund

- EV Tax-Managed Buy-Write Inc

- Nuveen S&P 500 Dynamic Overwrite

- EV Tax-Managed Glb B-W Opps

- Voya International High Dividend Eq Inc

- Nuveen NASDAQ 100 Dynamic Overwrite