As a follow up to our free article titled “10 Attractive High-Yield Blue Chips, For Contrarians,” this members-only article highlights five more attractive opportunities. And in this case, we currently own all five of these investments.

Dogs of the Dow

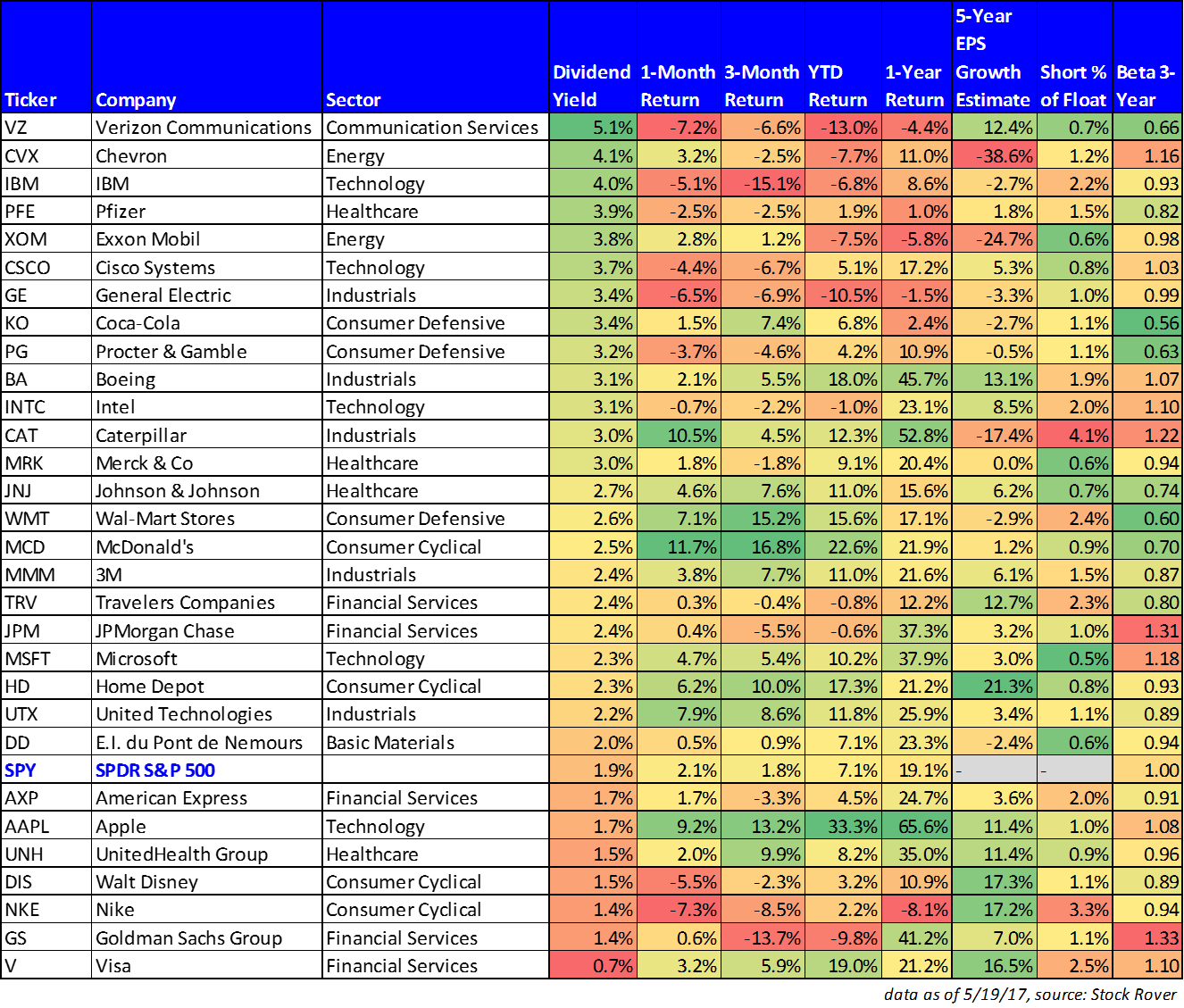

As a reminder, the Dogs of the Dow strategy is a contrarian income-focused method for identifying attractive blue chip opportunities. Specifically, the strategy advocates investing annually in the ten members of the bellwether Dow Jones Industrials Average with the highest dividend yield (these are the dogs). The argument is that blue chip companies don’t alter their dividends based on market conditions therefore the ones with the highest yield represent companies at a lower point in their market cycle and are therefore the best value opportunities. For your reference, the following table ranks the 30 Dow Jones stocks by dividend yield (the ten highest are the “dogs”), and it also includes a variety of other financial metrics for your consideration.

5. Procter & Gamble (PG), Yield: 3.2%

We currently own shares of Procter & Gamble in our Blue Harbinger Income Equity portfolio. We like the stock now that is has shed scores of brands, keeping only the most profitable ones, and we think this sets the company up for more profitability ahead.

We also believe PG's significant non-US exposure (emerging markets in particular) position the company well for future gains. Specifically, as the US stock market has continued to rally since the financial crisis, and particularly since the Trump election, we believe the rest of the world will follow. It may sound cliché, but a rising tide raises all ships, and the US will lead the rest of the word higher (and this will benefit companies like PG that have a lot of non-US exposure).

As contrarians, we believe there is some truth to the “Dogs of the Dow” strategy, and we like Procter & Gamble (and its big 3.2% dividend yield) right now.

Master Limited Partnerships (“MLPs”)

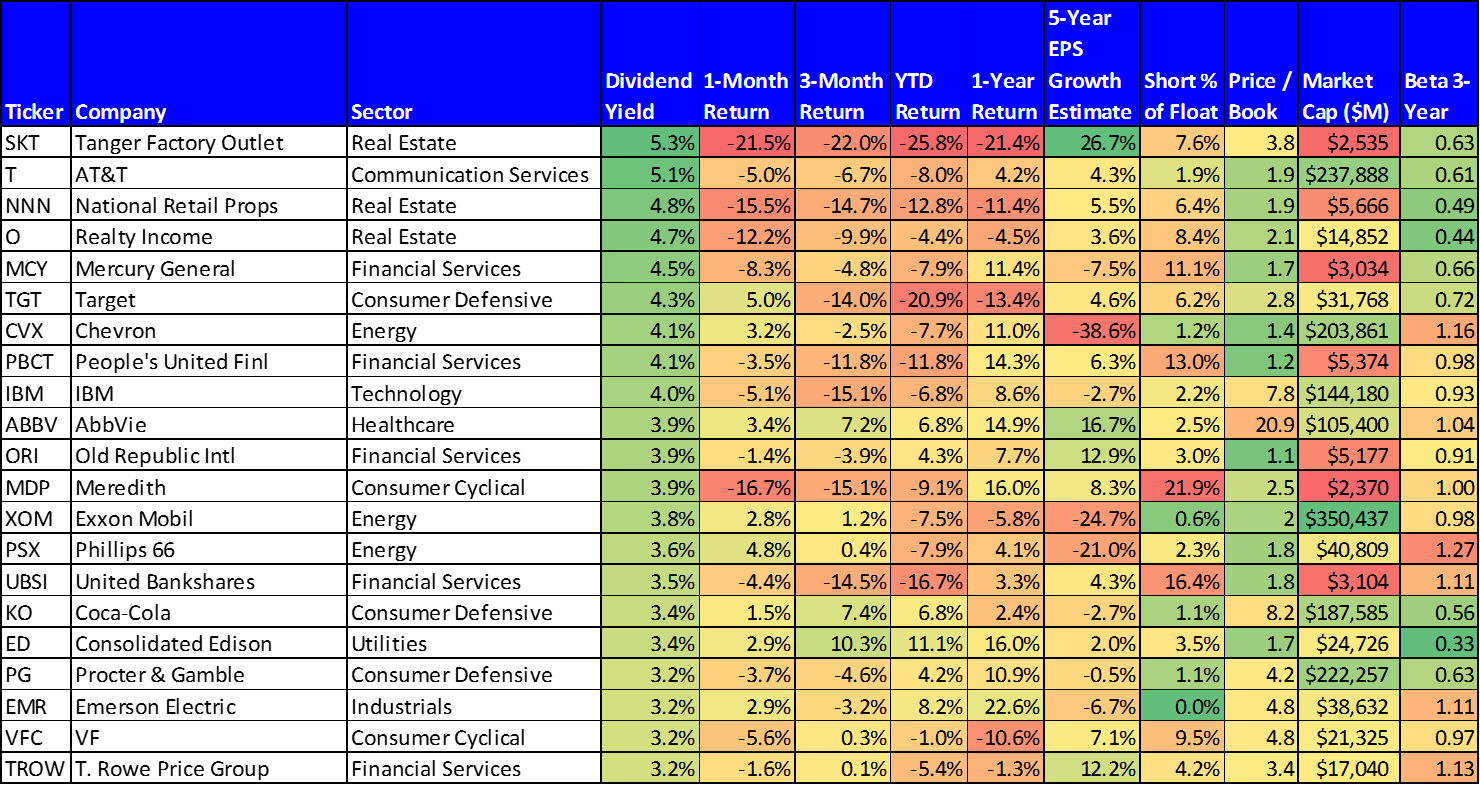

As a reminder, MLPs currently offer a variety of attractive, contrarian, blue-chip opportunities for income-focused investors. If you are not aware, MLPs are publicly-traded limited partnerships that must generate at least 90% of their income from qualifying sources of depletable natural resources and minerals. And considering the challenging market conditions in recent years for many natural resource commodities (e.g. lower oil prices, lower natural gas prices) many MLPs are still on sale. For your reference, the following table includes a variety of data on publicly traded MLPs, including distribution yields, recent price performance, and current market capitalization, to name a few.

4. Phillips 66 (PSX), Yield: 3.6%

Though technically NOT an MLP, Phillips 66 owns 50% of DCP Midstream (a natural gas MLP), and it is also investing in new midstream assets outside of DCP that will likely be moved to MLP “Phillips 66 Partners” eventually (Phillips 66 owns roughly 70% of Phillips 66 Partners).

Aside from the big healthy dividend yield, we like PSX because the market is still valuing it more like a refiner than like an MLP (the market generally assigns MLPs higher valuation multiples because of the big safe distributions). And considering PSX continues to grow its midstream business, we believe it has a lot of room for price increases via multiple expansion (i.e. it should trade at a higher price given it’s big steady earnings and cash flow generation).

We own PSX in our Blue Harbinger Income Equity portfolio, we believe now is an attractive time to consider investing because of its recent pullback in price (i.e. it’s an attractive contrarian opportunity). Also, not that it makes any difference to our thesis, however famous value investor, Warren Buffett, is a large PSX shareholder.

Dividend Aristocrats

As a reminder, to be included in the S&P High-Yield Dividend Aristocrat index, a company must have increased its dividend payout every year for at least 20 years in a row (it must also be included in the S&P 1500). Income-focused investors are often attracted to Dividend Aristocrats because of the perceived safety of the growing income payments. We believe many of the Dividend Aristocrats currently offer attractive contrarian opportunities. For example, the following table includes a list of Dividend Aristocrats along with a variety of additional metrics.

3. Emerson Electric (EMR), Yield: 3.2%

Emerson Electric is a diversified global manufacturing company that is attractive for a variety of reasons. For starters, it is a dividend aristocrat meaning it has increased its dividend every year for more than 25 years in a row (the total dividend payments of $1.2 billion are also well-covered by free cash flow of $2.4 billion).

Emerson is also a very efficient operator considering its Return on Invested Capital (19.2%) greatly exceeds its cost of capital (8.5%) which allows it to grow profitably, a feat many other companies cannot accomplish.

Economic moats help Emerson maintain its exceptionally high return on invested capital, and they are another reason the company is an attractive long-term investment. For example, high switching costs on products with multiple year/decade lifetimes help Emerson retain its customers. Also, Emerson's service infrastructure spans the globe and includes 352 process management centers, 277 network power centers, and 22 climate technology centers.

Further, long-term growth opportunities, particularly in emerging markets, also help make Emerson an attractive investment opportunity. Specifically, Emerson's commitment to and experience in emerging markets develops strong roots and brand recognition in fast-growing regions of the world.

Also, Emerson is a "Made in the USA" company (something the current White House supports). Additionally, EMR's price has recently declined over the last month thereby providing a more attractive valuation and entry-point for investors. Overall, if you are an income-focused, contrarian, value investor, Emerson is worth considering. We own it in our Blue Harbinger Disciplined Growth portfolio.

Healthcare REITs

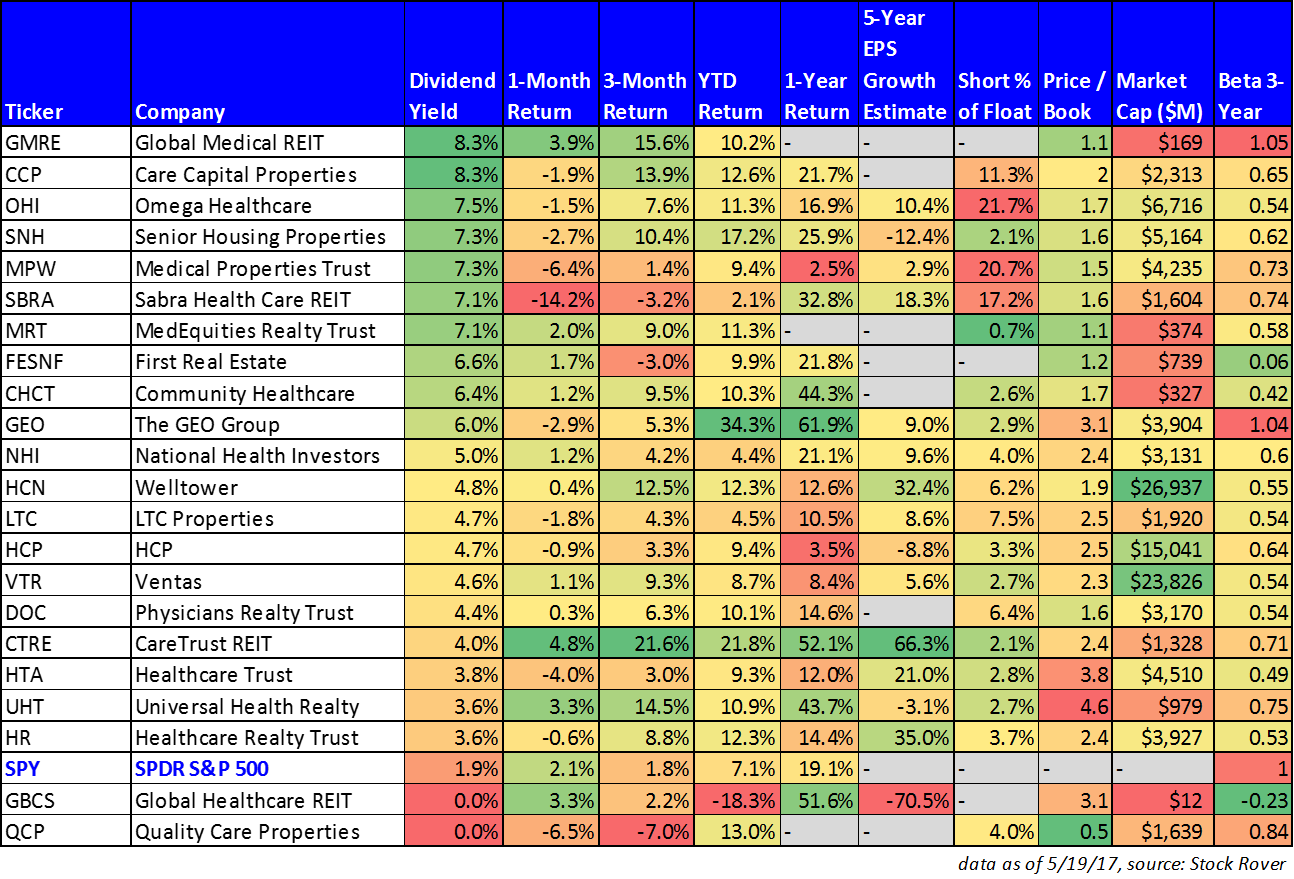

As we mentioned previously, many healthcare REITs offer big steady dividend yields, and they’ve also underperformed the broader market lately for a variety of reasons such as investor fear related to rising interest rates and potential changes to the Affordable Care Act. For your consideration, the following table shows the performance (and a variety of other metrics) for big-dividend healthcare REITs.

2. Omega Healthcare Investors (NYSE:OHI), Yield: 7.5%

In our view, Omega is an exceptionally attractive, undervalued, big-dividend healthcare REIT. And its price has become decidedly more attractive since last summer. Specifically, Omega has been on sale due to uncertainty surrounding Congressional efforts to repeal/replace the Affordable Care Act (i.e. investors are afraid). Also, Omega's price has been dragged lower as the entire REIT sector is down due to rising interest rates fears. In our view, both of these fears are baked in and overblown, and Omega currently represents an exceptional contrarian opportunity to invest in a big safe dividend.

As we’ve mentioned before, here is what Omega had to say in its most recent investor presentation regarding healthcare reform:

Specifically, Omega believes the healthcare reform fears are overblown because alternative payment models will expand under Medicare. And regarding Medicaid, the phase-in process will be long, thereby allowing states to offset the burden. And Omega's geographic diversification will help minimize the impact of rate changes in any one state.

On a comparative basis, skilled-nursing facilities REITs (like Omega) have lagged the overall healthcare REIT space because of the regulatory reform uncertainty. Also, these REITs still have some of the highest short interest as fearful investors continue to place their bets. Worth noting, despite the high short interest, Omega has a relatively high expected annual earnings growth rate of 15.8% over the next five years (largely because the demographics of a growing aging population with increasing healthcare needs are strongly on Omega's side).

Also, as we mentioned previously, the entire REIT group has sold off because investors are afraid that rising rates will negatively impact these highly levered companies (i.e. they use a healthy amount of debt to run their businesses). However, this fear is already significantly baked in (the prices are down), and Omega has the strong ability to continue to generate FFO to cover and grow its dividend. In fact, Omega recently raised its dividend (again) and announced that earnings expectations continue to rise.

Overall, we recognize Omega faces unique regulatory reform risks, but we believe it is a risk worth taking. If you are an income-focused value investor, Omega is absolutely worth considering. We own shares in our Blue Harbinger Income Equity portfolio.

Closed End Funds (“CEFs”)

Closed End Funds are often another income-investor favorite because of their big yields (often in excess of 7%), and they’re also often a contrarian investor favorite because they can trade at significant discounts to their net asset values. However, before jumping in head first, investors need to be aware of a few things. First, the yields offered by CEFs are usually not all generated from dividends of the underlying securities they hold. After all, how do you think a CEF generates a 7% yield when the stocks it holds all generally pay only 2-4%? The answer is capital gains (sometimes a return of capital) and leverage. Regarding capital gains, CEFs often share short and long-term capital gains via their distributions (it’s not all dividends) and this helps keep the yields so high. Also, many funds use as much as 30% borrowed money (and sometimes slightly more) to help magnify the returns and the yields (and for operational expenses too). Distributing capital gains and using some leverage is not necessarily a bad thing, but it does introduce risks to CEFs that investors should be aware of. And if you’re comfortable with them, then closed end funds can be an excellent source of high income.

1. Adams Diversified Equity Fund (ADX), Yield: 7.8%

The Adams Diversified Equity Fund is an internally managed, closed-end fund that is focused on generating long-term capital appreciation and committed to paying at least 6% in annual distributions (paid quarterly). It also provides exposure to a diversified portfolio of large cap equities, and pays close attention to risk management. It trades at a very attractive discount to its net asset value (NYSE:NAV). We are also very comfortable with its holdings, particularly its sector exposures, and believe it's poised to deliver very strong future returns. Oh, and its successful, long-term, track record dates back to 1929! You can read our full write-up on ADX here: 7.8% Yield, Superior Management, Big Discount To NAV. We currently own shares of ADX in our Blue Harbinger Income Equity portfolio. And if you’re going to verify the yield, be sure to go to the company’s website because sites like Google and Yahoo Finance get it wrong.

And as a reminder, all of our current Blue Harbinger holdings are available here.