If you’re brave, you might want to consider investing in Omega Healthcare Investors (OHI), currently yielding 10%. However before you do, consider these five big risks:

- Macroeconomic headwinds (e.g. interest rates, recent tax law changes, and increasing alternative yield opportunities).

- Omega operators (particularly Orianna, Signature, Daybreak, Preferred Care, and arguably Genesis and others) are increasingly unable to pay their rent thereby forcing Omega to consider draconian rent concessions.

- The regulatory environment is simply not good.

- Omega is pinning its hopes on a widely hyped demographic wave and market cycle that may not turn soon enough.

- Omega’s dividend coverage (as compared to FAD, AFFO and shrinking cap rates) is a red flag.

We conclude this article with a few things that could actually go right for Omega, as well as some ideas on who might want to consider investing, and who might want to avoid this big-dividend healthcare REIT altogether.

About Omega:

Omega Healthcare is a big dividend (+10% yield) real estate investment trust (“REIT”) that maintains a portfolio of long-term healthcare facilities in the United States and the United Kingdom. As of 12/31/17, 83% of its investments were in Skilled Nursing Facilities (“SNF”) and 17% in Senior Housing.

Omega has an impressive track record of raising its dividend every quarter, however the company recently announced that future dividend increases have essentially been put on hold.

According to CEO Taylor Pickett during the latest earnings call:

“We're proud of our unprecedented streak of 22 straight quarterly dividend increases, wherein we increased the dividend from $0.43 per share to $0.66 per share, 53% over five and a half years. Our quarterly dividend growth was predicated on and driven by our consistent FFO and FAD growth. As a result of our strategic repositioning activities, 2018 will not be a growth year and therefore we do not expect to increase the dividend during 2018.”

In addition to dividend increases being essentially put on hold, Omega’s share price has not been performing well, as shown in the following chart.

5 Big Risks Facing Omega

1. Macroeconomic Headwinds

Before reviewing the Omega-specific reasons the dividend and price are being challenged, it’s important to understand that there are a variety of industry wide REIT headwinds including interest rates, recent tax law changes, increasing alternative yield opportunities, and “risk on” market conditions, as described in our recent article: 100+ Big-Dividend REITs, The Mass Exodus Continues. Also worth mentioning, a lot of investors are betting against Omega as short-interest was recently more than 18%.

2. Operator Risks

Struggling property operators are a huge risk that Omega is dealing with. For example, in the quarterly call, Omega described multiple large operators that are facing significant challenges (Orianna, Signature, Daybreak, Preferred Care and arguably Genesis), and three of them are among the company’s top 5 biggest operators, as shown in the following table.

Here’s what Omega had to say about (1) Orianna during the quarterly call:

“We are in active confidential negotiations with Orianna and remain confident that our post transition restructuring rent or rent equivalent in the event of asset sales, will be in our previously stated range of between $32 million and $38 million.”

And comparing those figures ($32 million to $38 million) that’s a very significant reduction compared to the contractual rent amount as listed in the above table.

Similarly, (2) Daybreak is another challenged operator. Both Orianna and Daybreak were put on a cash basis in the third quarter and therefore Omega recorded no Orianna or Daybreak revenue in the fourth quarter. Per the quarterly call:

“for Daybreak… as Dan mentioned they maintained their payment plan. So, once they're caught up on the passed to AR, which is going to happen at or around at the end of this quarter. We'll begin to book Daybreak on a - it's contractual basis which is $7 million quarter run rate.”

If Omega has to renegotiate (i.e. lower) Daybreak’s contractual payments, that could be another big hit to Omega’s cash flow and ultimately its ability to raise and support the dividend.

Next, (3) Signature, Omega’s third biggest operator. Here’s what management had to say:

“Moving on to Signature Healthcare, since our last earnings call, considerable progress has been made toward finalizing a comprehensive agreement among Signature and Signature's three primary landlords, which will effectively bifurcate each of the three portfolios into three distinct legal silos and separate virtually all legal obligations.

As part of those agreements, Omega has agreed to defer certain rent payment obligations and provide for a working capital loan. While we remain cautiously optimistic that a satisfactory global restructuring with all constituents will be finalized in the near future, such restructuring remains contingent upon Signature's successful resolution of its material PL/GL claims.”

Depending on the outcome to the Signature restructuring, that could be another big hit to Omega’s cash flow, and ultimately its ability to raise and support the dividend.

Another potential big hit to Omega’s cash flows are related to operator (4) Preferred Care. Here’s what management had to say:

“In addition to the three operators just mentioned, another one of our top ten operators, Preferred Care, a Texas based operator and certain of its affiliated operators in the states of Kentucky and New Mexico filed for Chapter 11 bankruptcy as a result of the $28 million jury award in the state of Kentucky and the overwhelming number of personal injury suits initiated against such operators in those states. While Omega has no exposure to Preferred Care in Kentucky, we currently lease 16 facilities to Preferred Care in New Mexico, Texas, Arizona and Oklahoma.”

Preferred Care is another big threat against Omega’s future revenues.

Finally, (5) Genesis, Omega’s second biggest operator, continues to perform (according to management anyway), but investors are worried. Here’s what management had to say about Genesis during the quarterly call:

“Yeah, the Genesis - our portfolio performances continue to do well, it has been and continued to be about the mean. I can't really comment on why it does better than other portfolio's, other than obviously there's different assets in different states. A lot of our assets are legacy fund facilities. We continue to support the management team, we think they are doing a good job, they have done a good job and we will remain supported. But, on our portfolio once again it's been consistent and it continues to perform.”

Management seems somewhat optimistic about Genesis, but here’s what the Genesis CEO had to say during his last quarterly call:

“Clearly, this has been the most protracted and complex down cycle in our history. More recently, as these pressures had continued to mount, we have begun to see operators of all sizes forced into receivership or other formal restructuring proceedings.”

And if Omega management is being overly optimistic about Genesis, it begs the question: what else are they being overly optimistic about? (for example, how many more operators are in trouble).

3. Regulatory Challenges:

Omega’s operators are facing extreme challenges largely because of continued regulatory pressures on Skilled Nursing Facilities, in particular. For example, according to the Genesis CEO:

“Government-sponsored reimbursement rate growth is not keeping pace with inflation and cost, particularly nursing labor costs amid a strengthening labor market. And unfortunately, unlike other industries, with the majority of our revenue coming from government-sponsored payment plans, skilled nursing operators have no ability to pass these incremental costs along to our customers.”

Additionally, according to Omega’s quarterly call:

“Medicare Part B therapy caps were permanently repealed, [but] partially paid for with a small reduction in the Medicare per day annual market basket rate increase.”

Further, the industry is under constant threat of regulatory changes. For example, according to Omega, in 2017…

“The industry elevated further threats to federal Medicaid funding, as tax reform took the focus of Medicaid reform in congress.”

and

“Looking ahead to 2018, the concern for SNFs is the potential that a cut to Medicaid provider tax funding could be used as an offset to any ACA modification legislation.”

It has clearly been a challenging regulatory environment for skilled nursing facilities.

4. Demographic and Market Cycle Uncertainty

Another huge risk for Omega is the current market cycle and the anticipated demographic wave that may not arrive soon enough. For starters, management believes the SNF industry is at the lower end of the market cycle, and there simply are not a lot of attractive merger and acquisition opportunities that Omega needs for growth. Here’s what CEO Taylor Pickett had to say when asked about M&A activities:

“The assets that are out in the market place for us generally aren't that attractive, but I think as this cycle begins to end, what we typically see is an uptick in real estate sale activity and I would expect that to occur again backend of '18 into'19.”

It seems he is corroborating the idea that the market environment is terrible and he is hoping things will improve within the next year or two.

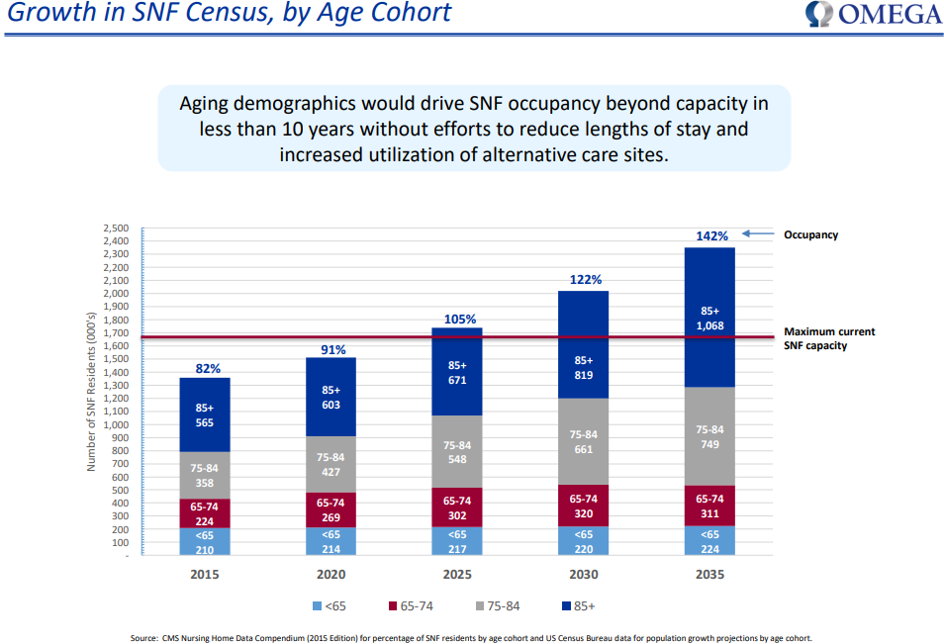

Next, here is a look at the demographic wave Omega is hoping for.

This graphic suggests that there will eventually be an undersupply of skilled nursing facilities, but that’s not coming until 2025. Also, the graphic is based on assumptions that there will be no efforts to reduce the lengths of stay and increased utilization of alternative care sites. Yet, the government regulators continue to put pressure on operators to do exactly that (i.e. reduce lengths of stay and increase use of alternative care sites). It seems Omega management may be again overly optimistic about the current environment.

Another example of Omega pinning their hopes on market cycle improvements is this quote from CEO Taylor Pickett:

“The labor market has been difficult and direct care wages within the Omega portfolio have increased 2.9% year-over-year. Fortunately, although wage growth puts pressure on tenant coverage's, the level of wage growth is generally manageable and other related MediCare and MediCaid rate increases generally lag behind, eventually reimbursement rates catch up for labor inflation.”

Omega is basically waiting/hoping for highly uncertain market conditions to improve.

5. Rapidly Shrinking Dividend Coverage

For starters, here is a look at Omega’s historical quarterly Funds Available for Distribution (“FAD”), Adjusted Funds from Operation (“AFFO”) and dividends, and the trend is going in the wrong direction (i.e. FAD and AFFO are shrinking, and dividend increases have been put on hold).

Specifically, the dividend payout ratios have been trending higher (this is not good for dividend safety), and things are projected to get worse in 2018. For example, AFFO was $3.30 per share in 2017, but management has provided 2018 guidance of only $2.96-$3.06.

Another way to think about Omega’s earnings power is “cap rate” (cap rate is basically the income of an asset divided by the cost of the asset). All else equal, higher cap rates are better. However, Omega’s investment cap rates are shrinking thereby making it increasingly challenging to continue raising and supporting the dividend. For example, CFO Robert Stephenson noted cap rate slippage, although slight, on the last quarterly call when asked about sales. He said recent property sales result in “very little slippage in terms of run rate,” but slippage nonetheless.

Here is a look at Omega’s investment assets and revenues in 2017.

This amounts to a cap rate of around 10.5%. However, recall Omega is evaluating over $300 million of asset sales in 2018, and combining those sales with the fact that they’re having trouble finding assets to buy (remember CEO Taylor Pikckett claims “the assets that are out in the market place for us generally aren't that attractive”), Omega is going to end up with a smaller pie with lower cap rates… Not exactly what dividend investors want to hear, especially considering all the unfavorable operator renegotiations currently underway, and the fact that there is very little cushion between the dividend Omega is currently paying. These challenging headwinds are a big part of the reason short interest on Omega is currently high.

What Could Actually Go Right for Omega:

2019 Acquisitions: Omega is faced with an unattractive acquisition market right now, but it may improve by 2019. According to Omega’s earnings call:

“The acquisition market remains choppy and to date is not particularly robust. However, as we've seen through several cycles in the SNF industry, there tends to be a significant uptick in mergers and acquisitions as down cycles come to an end. I would expect to see meaningful growth opportunities later in 2018 and moving into 2019.”

If Omega does start seeing attractive acquisition opportunities, that could help support the dividend, and eventually help the company return to dividend growth.

Demographic Wave: As we mentioned previously, Omega is counting of a huge demographic wave that will support its business in the future. And according to the company:

“We have partnered with two leading consulting firms to gather an extremely comprehensive and detailed analysis of the demographics that will drive demand for skilled nursing facilities throughout the next decade. With literally thousands of hours dedicated to this analysis, we believe we'll begin to feel the demographic demand wave going into 2019. And finally we have unique business attributes that set us apart from our competitors. We had the most SNF operator relationships.”

If the SNF demographic wave does come, Omega’s business will be well-positioned for it.

Improving Regulatory Environment: Despite the challenging regulatory environment as described earlier, Omega believes the environment is actually “neutral to favorable.” To support this more positive outlook, Omega explains:

“Fortunately, although wage growth puts pressure on tenant coverage's, the level of wage growth is generally manageable and other related MediCare and MediCaid rate increases generally lag behind, eventually reimbursement rates catch up for labor inflation. On the reimbursement and regulatory front, the environment is generally neutral to favorable.”

Further, Omega believes the Trump administration has more friendly regulatory policies. For example:

“On January 24, the senate confirmed the appointment of Alex Azar to lead the Health and Human Services Department with oversight of CMS. Azar's confirmation provides assurance that the SNF friendly regulatory policies to date under the Trump administration are likely to continue, especially with the continued leadership of CMS by Seema Verma.”

Also:

“In congress the risk to SNF fundings through Medicaid reform has lessened with the reduction in the Republican senate majority from the Alabama election.”

Subsiding Dividend Headwinds:

According to CEO Taylor Pickett:

“However, I want to be very clear that we are very confident in the payout percentage coverage and the sustainability of our current dividend of $0.66 per share per quarter. With the current yield of 10% and our strong beliefs with the headwinds we've been battling are beginning to subside. We believe we're well positioned to deliver substantial shareholder returns over the next five years.”

“We expect that our quarterly AFFO results will trend upwards throughout 2018, providing us with a solid baseline run rate as we head into 2019.”

Conclusion:

Do not confuse Omega’s sell-off as just another REIT facing macroeconomic headwinds—there is a lot more going on here. The big question is whether Omega can get through this SNF mess without cutting the dividend and ultimately return to dividend growth. Management believes they can, but the market is not so confident considering the recent sell-off and the high level of short-interest. If you have a higher tolerance for risk and a longer horizon, you might want to consider owning Omega. However, if you’re looking for only the safest dividends, then you might want to consider other opportunities such as those we’ve highlighted in this recent members-only article: Top 10 Big-Dividend REITs (note: Omega is included as one of the higher risk opportunities on this list).