The market has been strong this year, but dividend yields on popular blue-chip stalwarts have been in decline. They’re NOT cutting their dividends, but mathematically as price increases, current yield declines. You probably have multiple specific examples in your own investment portfolios, and this article is the first in a series describing several very popular blue chips stocks that have steady businesses, but their valuations are getting frothy rich, and their dividend yields are becoming unattractively low. This article focuses on an attractive income-generating Procter & Gamble (PG) trade.

The idea is that if you like the business for the long-term, but feel the stock price is currently ahead of itself, then why not add more income to your account by collecting premium for this low risk options trading strategy.

To get directly to the point, we’ll give you the options trade details first, and then get into our detailed review of this blue-chip consumer staples stock, second.

The Trade:

Sell Covered CALL Options on Procter & Gamble (PG) with a strike price of $130.00 (~3.3% out of the money), and expiration date of December 20, 2019, and for a premium of $0.66. That’s an extra 6.3% income for us on an annualized basis (0.66 / 130.00) x 12 months). If the shares get called away from us before the options contract expires then we're happy to sell the shares at the higher price of $130.00 (another 3.3% gain in less than 1 month). And if the shares don't get called away, we’re happy to hang on to them for the long-term, plus we still get to keep the extra premium income we generated no matter what.

We believe this is an attractive trade to place this week, so long as the shares don’t move too dramatically, and you’re able to generate at least 5% to 8% extra income (on an annualized basis), and if you’re comfortable with the possibility of also using discipline to sell your P&G shares if the price rises even further than it already has.

Important Trade Considerations:

Two important considerations when placing options trades are upcoming earnings announcements and dividend dates because they can increase volatility and can impact the value of your options contract in unexpected ways. And in the case of PG, they are both largely non-issues because the company just announced earnings two weeks ago (and therefore won’t announce again until after this options contract expires), and PG isn’t expected to go ex-dividend again until the end of December 17th (also after this options contract expires).

The “Covered” Part of this Covered Call Sale

Because we currently own shares of PG, that makes this trade dramatically less risky. Specifically, if we did NOT own shares, and we were forced to deliver the shares if the options contract got executed, then we’d be forced to first buy them in the open market at the prevailing price. Theoretically, if the shares rise dramatically in price, we don’t have to go out and buy them in the open market because we already own the shares, and that dramatically reduces the risk of this trade. Covered Calls (and cash secured puts) are generally the simplest and least risky types of income-generating options trades.

Our Thesis:

Procter & Gamble (PG) is one of the largest consumer products goods companies in the world with product offerings in multiple categories and geographies. The company’s stock has staged an impressive recovery since we first recommended it several years ago (specifically, P&G is experiencing multi-year highs in organic as well as earnings growth due to successful turnaround). As such, despite the strength of the business, the valuation is rich, and the dividend yield has fallen (mathematically, because the price has risen) to near multi year lows. We continue to like P&G as a safe, low beta, “forever stock,” but the price has gotten ahead of itself in the near-term, and this income-generating options strategy (covered call selling) is attractive.

Overview:

The company generated $67.7 billion in sales and $13.8 billion in operating income in 2018 from a diverse group of consumer product categories and brands.

Why P&G underperformed from 2012-17

P&G’s stock underperformed the consumer staples industry as the company failed to innovate its product portfolio and lack of newness led to the company losing share to competitors. At the same time, the company’s brands such as Tide and Gillette were premium priced and that further provided opportunity to competitors to take share from P&G using sharper pricing. Finally, millennials and online-shopping led dramatic changes in the competitive landscape with smaller brands becoming a force to reckon with even for an 800-pound gorilla such as P&G.

Source: Yahoo Finance

What changes did the company put in place to turnaround the performance?

The company’s turnaround has taken time and involved a fair share of controversy as Nelson Peltz, a famous activist fought a contentious proxy battle with the management. The company realized that in order to innovate it needs to shed parts of its bloated organization. The rightsizing resulted in a 60% reduction in categories and a 70% reduction in the number of brands. Category and country combinations declined from 140 to just 50. Additionally, the company consolidated its manufacturing, supply chain and marketing infrastructure. The process not only generated savings but also provided ammunition for the company to reinvest in its core brands that accounted for majority of its earnings. P&G raised the level of innovation and new product introductions after many years of stagnation in product portfolio.

What were the results of this turnaround?

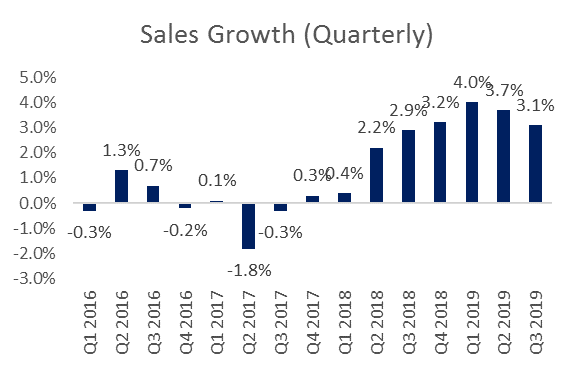

Company’s efforts to reinvigorate sales growth finally started showing up on the P&L from Q2 2018. After hovering around -1% to +1% for several quarters, the company’s growth rate decisively moved into 2%+ category. At the beginning of the fiscal 2019, the company guided to 2-3% organic growth and 3-8% EPS growth. The company’s actual performance was 5% organic sales growth and 7% EPS growth. Excluding negative currency impact, EPS growth was a strong 15%. The recovery in performance has been broad based however Healthcare, Fabric and Home care have been outperformers while grooming continues to be weak due to changes in shaving behavior of male consumers.

P&G’s Fiscal 2020 has started on a good note with Q1 FY20 organic sales growth at 7% and EPS growth at 22%.

Trajectory going forward

The company’s annual guidance calls for 3-5% organic sales growth and 5-10% EPS growth. Given the performance in Q1 FY 20 and despite tougher comparisons for rest of the year, the company is well positioned to beat and raise its guidance over the next few quarters. Having said that, longer term it still remains a low single digit revenue and high single digit EPS grower as the company holds large share in its categories and there is only limited amount of share it can take.

Valuation at multi-year highs and dividend yield at multi year lows

Given the turnaround in company’s growth, not surprisingly the stock has seen an impressive rally since mid-2018 with the stock returning over 70% even excluding any dividends. As a result of the share price appreciation, the company’s valuation multiples have reached multi year highs. The company’s forward dividend yield is at 2.39% as compared to historical range of 3-4%. Additionally, the company’s EV/EBITDA is 18.02 vs sector median of 12.65 and its own average of around 13 times.

Risks

Sustainability of trends

It is important to note that the company clocks over $67 billion in sales and it is very difficult for a company of that size to grow earnings by over 20% for a prolonged period. Longer term, it is a high single digit earnings growth story and the reason for the premium valuation currently is due to investors expecting company to deliver more than the typical growth estimate. As trends normalize, the stock could take a back seat.

Changing consumer habits

Before the proliferation of online retail, consumer brands possessed considerable competitive moat as a result of domination over shelf space at retail and access to expensive ad inventory on mainstream media channels. That has changed now as small brands based on consumer reviews and social media marketing can scale up much faster than before. The new competitive landscape could impede P&G’s future results.

International economic and currency risks

Procter and Gamble’s products are sold in 180 countries including many emerging markets with lack of political and economic stability. International markets account for 58% of the company’s sales and as such the company’s earnings are susceptible to volatility in currencies and GDP growth abroad.

Conclusion:

While the company has clearly seen an improvement in trends and is firing on all cylinders at the moment, the P&G’s valuation and dividend yield are not appealing relative to the sector and its own trading history. As a long-term investor, it is important to be disciplined both when you buy and sell a security (we bought PG several years ago at a much lower price and a much higher dividend yield). If you’d like to generate additional upfront income now, and you’re comfortable selling your P&G shares if the price continues to rise (over the strike price) over the next month, then this conservative income-generating options trade is worth considering.