All Blue Harbinger strategies delivered healthy gains in March, thereby extending their long-term outperformance. The strategies are positioned prudently to achieve their long-term goals, ranging from attractive income to powerful long-term growth. This report reviews performance (including specific holdings) and where we’re seeing the best opportunities going forward. Most importantly, keep perspective. Foolish investors panicked and sold out of fear in Q4 thereby missing out on Q1’s fantastic returns. Don’t get greedy and make the opposite mistake now. Stay disciplined.

Holdings and Performance:

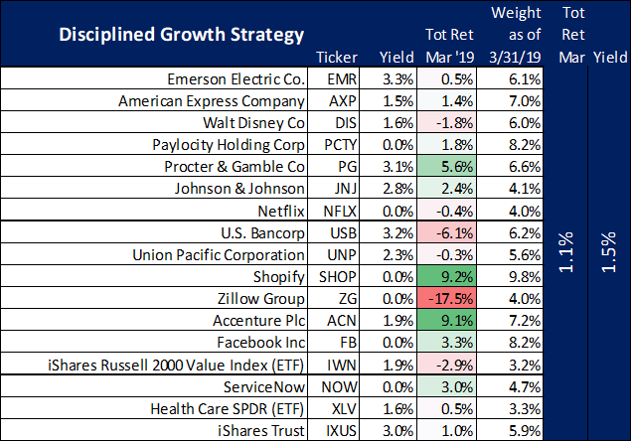

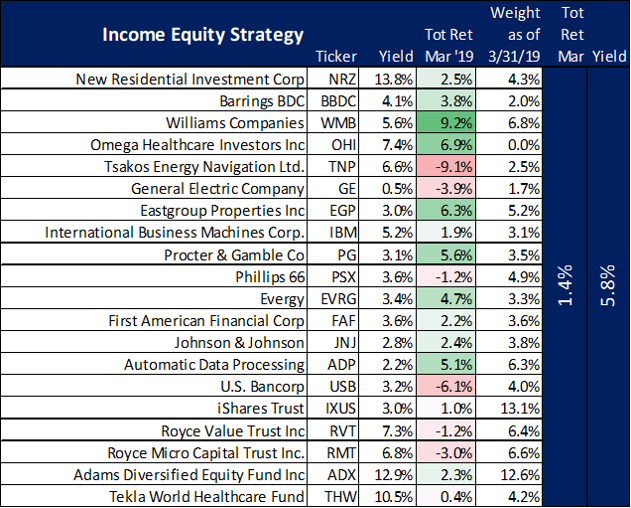

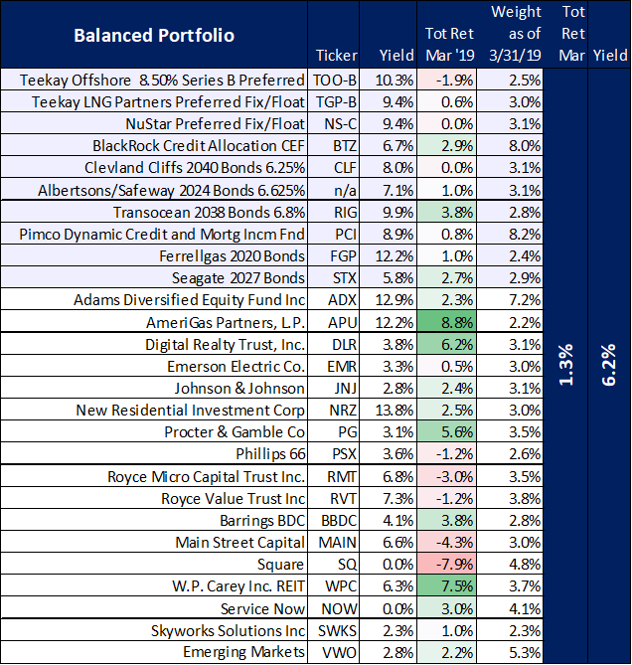

For starters, here is a look at the performance and holding of each of our Blue Harbinger strategies, which continue to deliver market beating performance.

Portfolio Winners and Losers:

And here is a look at the biggest gainers and decliners in March. Keep in mind, 1-month is a short time period when it comes to long-term investing, and we’ll gladly take some volatility in our individual holdings in exchange for powerful long-term results (portfolio growth and income).

Procter & Gamble (PG) had a surprisingly good month for a “boring” dividend-paying blue chip. The shares delivered a total return of 5.6% thereby outpacing the 1.8% return of the S&P 500. From a valuation standpoint, the shares are still reasonably valued, especially considering organic sales growth has accelerated to 4% in the last 2 quarters. The dividend has been increasing for over 60 years. This consumer staples stock a portfolio staple, as well.

US Bancorp (USB) delivered a negative 6.1% total return in March. Banks sold-off in general as the Fed’s increasingly dovish interest rate tone is bad for the net interest margins of banks. However, the 27 Street analysts covering the stock believe it has 11.7% upside, and that goes well with its healthy dividend yield (the yield has been increasing for nine years straight). We appreciated USB’s mostly main street approach (non Wall Street, non big investment banking deal), and we continue to like the shares as a way to play the sector.

Shopify (SHOP) continues to be on fire as the shares gained 9.2% during the month of March. Revenue is climbing very quickly, the total addressable market is large and the competition is basically non-existent. We understand the shares of this company can get very volatile, and we expect to enjoy the ride considering they have a lot more long-term upside.

Zillow Group (ZG) was our worst performer in March as the shares declined 17.5%. Wall Street continues to be uncertain about its new strategy to facilitate “instant offers” in the housing market. We are more bullish, and the Fed’s new “lower for longer” view on interest rates will be good for the housing market in general. We suspect 2 years from now the share price will be dramatically higher, and the analysts that are bearish now will become late-to-the-party bulls then.

Accenture (ACN) gained 9.1% during March and it continues to be an underappreciated high “Sharpe Ratio” stock. This company delivers consulting work at the forefront of innovation at large enterprise organizations. The workforce and business model allow the firm to adapt the innovation and profit. We are long-term owners.

Williams Companies (WMB) posted a strong 9.2% total return in March thanks in large part to rising oil prices. Ironically, despite short-term energy price volatility, WMB’s long-term revenues are relatively steady thanks to the long-term contract nature of much of their business. Wall Street price targets didn’t move much during the sell-off in Q4, and they believe the shares continue to have 10% upside from here to go along with attractive 4.9% dividend yield.

Tsakos Energy Navigation (TNP) declined 9.1% during March as much of the shipping industry continues to be under pressure. Tsakos’ 6.5% yield has continued to hold strong, and management remained upbeat on the most recent earnings call, explaining:

Coming out of the longest bad market ever with positive operating performance, being able to pay obligations and a steady dividend, it's quite an achievement, confirming our operating model and our supreme industrial platform. It's important to note that we have managed to repay debt equivalent to $2 per share and to maintain a cash position of $2.50 wallet per share equivalent. And now with a stronger market in the fourth quarter, continuing at an admittedly lower pace in 2019, we're benefiting from profit-sharing arrangements and look forward to a stronger year, positioning for growth and for renewing our fleet and further growing our platform. Once again, I'd like to congratulate, on behalf of the board, Nikolas Tsakos and his colleagues, his team and wish him an equally successful 2019.

The seven Wall Street analysts covering Tsakos assign an average target price of $4.25, thereby giving the shares 35% upside. This is a high risk, high reward investments, and the business (and the shares) are due for a rebound.

AmeriGas (APU) shares gained 8.8% in March. These are welcome gains after a challenging Q4 for the share price, which was down on warmer weather. After the dividend yield was in high single digits for most of 2017 and 2018, it spiked in Q4, and still sits at 12% after Q1, which is concerningly high. However, news that there may be simplification roll-up transaction between APU and UGI could soon add significant strength to APU’s balance and share price. This is one of our riskier high-yielder, but we continue to hold it with our diversified Income Equity portfolio because we suspect the shares have more upside from here. The nine Wall Street analysts covering the stock believe, in aggregate, the shares have 10.3% upside with a price target of $34.33.

Conclusion:

At the end of the fourth quarter many investors believed the sky was falling, and they ditched their long-term investment goals due to fear and panic. In the first quarter of 2019 the market has been very strong (up nearly 15%), and some investors may be starting to get a little too confident. Fear and Greed drive the market and cause investors to make silly mistakes. Don’t. Instead, stick to your long-term investment goals. Disciplined, long-term goal-oriented investing is a proven strategy for success.