Despite increased fear and volatility marketwide, our portfolios beat the S&P 500 (again) in May, and continue to grow their powerful long-term track records of income and appreciation. We don’t expect readers to match our portfolios exactly (even though they can come pretty close if they want); rather, the idea is to share top ideas and strategies to help you manage your own investment portfolio. This report shares our May performance, individual holdings weights & returns, and concludes with our views on how/when to rebalance your own portfolio, as well as where we’re seeing the best investment opportunities within the current market turbulence.

Strategy Performance

In May, all three of our strategies beat the S&P 500. The S&P 500 was down 6.3% in May, our Income Equity was down less (-5.27%), “Income through Growth” was down less (-2.34%), and Fixed Income Alternatives was down less (-0.23%). The Yield on AIF is 7.8% and the Yield on Income Equity is 6.3%. Here is a look at our updated strategy returns through the end of May.

Income Equity portfolio (since inception performance)

Income through Growth portfolio (since inception performance)

Current Holdings & Contenders

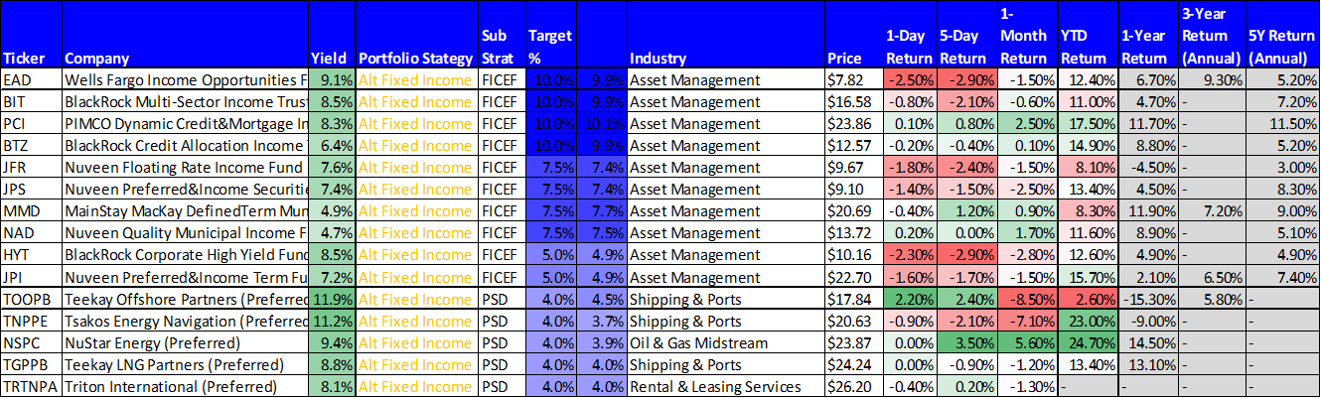

And here is a look at our current portfolio holding and “contenders” across strategies, including current weights and historical returns by position.

Data as of Friday’s close, 31-May-2019.

Note: For an Excel download of the data in the above tables, please click here.

When to Rebalance Your Portfolio

As you’ll recall, we recently completed a rare but significant portfolio rebalance. You can read more about that rebalance here. We say “rare” because we do NOT like to rebalance often because of the frictional and hidden trading costs, the risk of sitting on too much cash and missing out on returns, and the potential for costly trading mistakes (both psychological trading mistakes, as well as “fat finger” trading mistakes). It’s very important to select the right investments for you, and to construct your portfolio appropriately (don’t be over or under diversified). But it’s also really important to not run up a lot of unnecessary trading costs that can detract from your long-term returns (this is why at Blue Harbinger we hate expensive commission-and-fee-charging stock brokers!).

However, we view market volatility as one good time to rebalance. We’ve had a little volatility (not a ton, relatively speaking) over the last couple months), and that can be a good time to do some rebalancing. In particular, higher volatility names tend to sell off more than the market during times of volatility, and that can be a good time to buy some higher volatility names (i.e. “buy low” NOT high). Of course price alone is not enough to make a decision—you have to believe in the underlying business.

Similarly, and perhaps more difficult to understand conceptually, when markets are calm and volatility is low, that can be a good time to sell some of your more volatile names (theoretically they will have appreciated significantly if your bought them at a lower price when the market was more volatile and prices were lower). And this is also a good time to add more to steady lower volatility names (i.e. when market volatility is lower—not now). Of course, this should all be taken with a grain of salt because, in reality, it is challenging to do all this successfully, and also because we’re NOT suggesting over-trading your portfolio (remember, we hate trading costs, both implicit and explicit). The best thing you can do is invest for the long-term, with a diversified portfolio, that meets your personal needs and goals, and then consider rebalancing on the margin if any position gets too big or if prudent attractive opportunities present themselves. Easy. Clear as mud. Right? :)

Attractive Opportunities Now

Chipmakers: As we wrote about in last week’s Weekly, we actually like the chip stocks right now. We erroneously mentioned last week that we own Nvidia and not Skyworks, but that was wrong—we own both (hat tip to long-term reader Steven J. for bringing this to our attention). In reality, our Freudian Slip basically tipped our hand, we like Nvidia’s business more than Skyworks’ (Nvidia is a high-end innovator, Skyworks is not an new chip innovator, but rather an economy of scale play). However, make no mistake—we like them both right now. And after the continued price slide this last week—we like them both even more now—particularly Skyworks which was down big again. We own both Nvidia and Skyworks. And we own them both in client accounts too. The shares are down big because they’re cyclical, and because the US-China tariff situation/ “trade war” has investors overly scared. Long-term they are both great businesses.

Oil and Energy: The energy sector continues to show weakness, and attractive investment opportunities have gotten even more attractive based on their even lower prices. We like Adams Natural Resources Fund (PEO) and Phillips 66 (PSX).

New Residential (NRZ): This is a huge-dividend mortgage REIT name that we own and we’ve written in detail about it many times in the past. The company is impacted by interest rate volatility—so once this current batch of market volatility subsides—we expect these shares to rise in price sharply. Just know it could get worse before it gets better. We are a long-term NRZ investor.

Conclusion:

We say it all the time, and we cannot say it enough. Prudently diversified long-term investing is a proven strategy for success. Build a portfolio that is appropriate for your objectives and needs. For example, if you like/need income now, don’t put 100% of your nest egg in volatile growth stocks. Also important, don’t trade all the time because there are a ton of hidden risks and costs (as we touched up in this article). Know your goals. Stick to your strategy. And don’t get “taken” by all the crappy fear mongering investment advice you often hear from the media and big brokers that are just trying to rip you off anyway. Be smart. Thanks for reading.