If you’re going to manage some/all of your own investments, you ought to have some idea of your portfolio’s beta risk (so you can make sure it is appropriate for your goals). This week’s Weekly shares the updated performance data for each of our current holdings (as well as our “Contenders List”), and we’ve also included each position’s “beta” risk to help you gauge your risk exposure relative to your long-term investment goals. We’ve also highlighted a couple attractive investment opportunities.

As usual, the media punditry bombarded us with headlines of new risks, bubbles and “can’t miss” opportunities over the last week. In reality, it’s almost 100% click bait designed to use fear to (1) drive page views and ultimately advertising dollars, (2) frighten you into placing trades so Wall Street can get more of your money via implicit and explicit trading costs, and (3) frighten you into paying someone else totally inappropriate high fees to manage 100% of your investments for you.

Long-term goal-oriented investing has proven itself the best investment strategy time and time again throughout history. Our Blue Harbinger investment ideas and portfolios are long-term goal-oriented investments designed to help you succeed in managing some/all of your own investments.

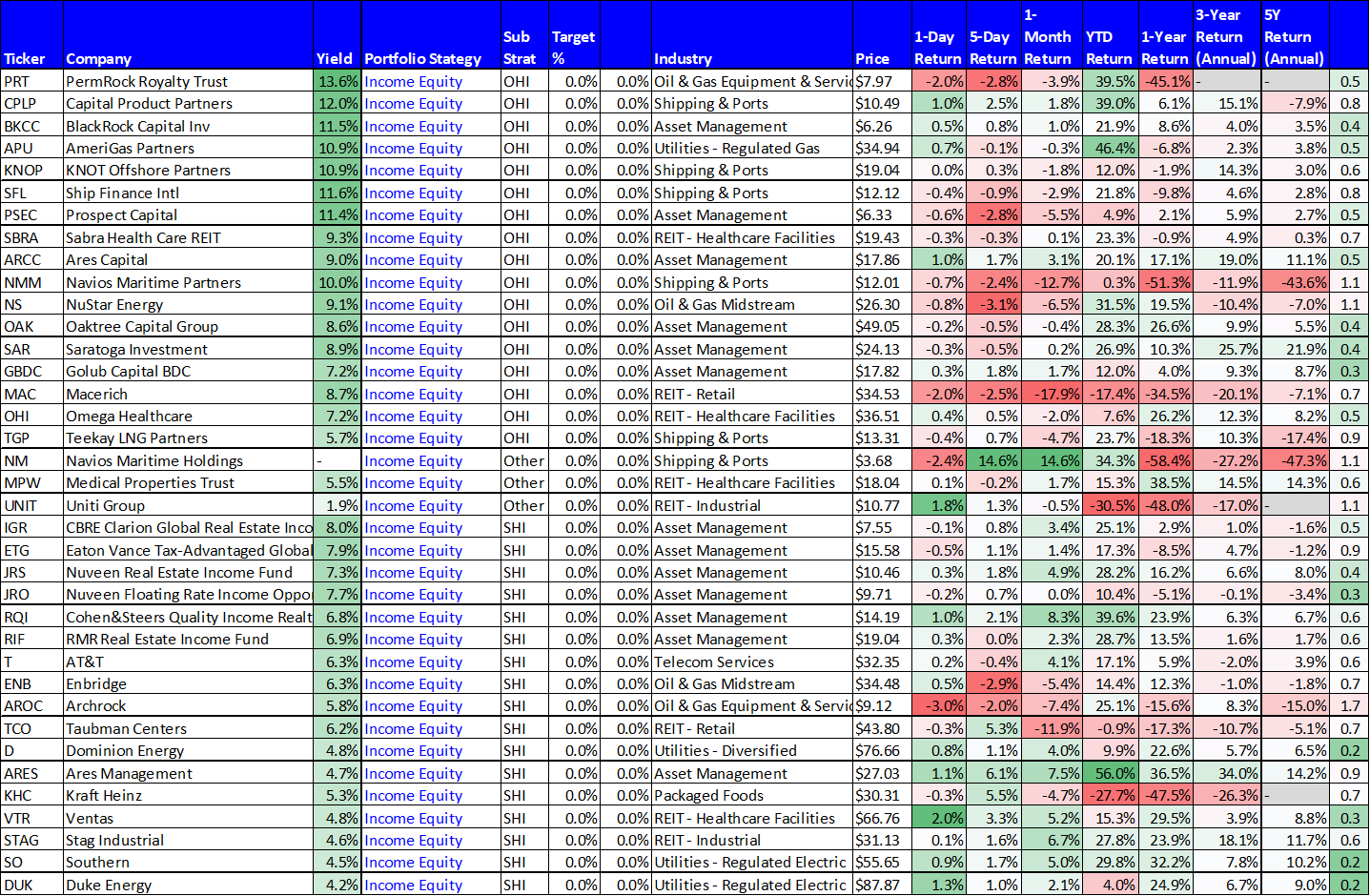

Here is a look at the holdings and performance across all of our investment portfolios as of Friday’s close, and this week we have included a new column… Beta.

(Data as of Friday’s close (14-June-2019). Download this data in Excel spreadsheet format HERE.)

Academically speaking, “the beta of an investment [or portfolio] is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1.” In plain English, it’s a measure of how dramatically your investment valuations move when the market moves. If you’re young, general knowledge suggests it’s okay to have higher beta risk because your investment horizon is long so you can handle the volatility. But if you’re already retired and counting on your nest egg for income then you probably don’t want nearly as much beta risk.

As you can see in the beta column of our portfolio holdings (above) Our current income producing investments generally have less beta risk, and our “Income via Growth” investments generally have more beta risk. Keep this is mind as you cater your own personal investment portfolios to meet your own personal goals and needs. How much volatility and/or beta risk can you handle?

Attractive Investment Opportunities:

For your consideration, here (below) are two investment ideas that we believe are worth considering. We own them both, and you can check out their recent returns in the table provided earlier in this report.

Simon Property Group (SPG), Yield: 5.0%

Simply put, Simon is being significantly undervalued by the market. It’s big 5.0% dividend yield is extremely safe (Simon has the highest credit rating of all REITs), and the business and the dividend will both continue to grow. Two potential arguments (bad ones, in our view) for why the shares are trading so cheaply relative to Simon’s value are as follows. One, SPG operates shopping malls, and people are afraid shopping malls are going to be put out of business due to the rise of online shopping. While it is true some B-class shopping malls have been under tremendous pressure, Simon has A-class location malls and the business continues to set records in terms of growth and profitability. Secondly, if we are late in the economic expansion cycle, some investors fear Simon could start making bad/expensive acquisitions of struggling REITs when the market starts to turn south. In our experience, Simon management is hated in the industry because they’re ruthlessly disciplined. Simon’s management is extremely unlikely to make bad/expensive acquisitions. The fears are overblown, and Simon’s dividend and shares are extremely undervalued. We own shares of Simon Property Group, and for more information, here is one of our recent write-ups on SPG.

Realty Income (O), Yield: 3.7%

Realty Income is a monthly dividend payer, and it’s very popular among REIT investors thanks to its steadily growing dividends and price. In our view, Realty Income is one of those steady blue chip REITs with a very safe dividend over the long-term. In the near-term the shares could experience some volatility, but that volatility will be less than the overall market’s volatility thanks to the big steady dividend payments (and it’s lower beta). And over the long-term, the dividend and the share price are eventually both going higher. You can read our recent full write-up on Realty Income here.