Image: Scott Pollack

The S&P 500 is now up over 20% this year, which is a big number. But to keep that in perspective, it’s up only 11.4% over the last year, and it’s averaging 10.7% over the last 5 years. Keep those more moderate numbers in mind the next time someone tries to frighten you into ditching your long-term strategy and selling everything because “the sky is falling.” This week’s Weekly reviews the performance of every position we own over recent time periods, and highlights a few ideas that are particularly attractive right now.

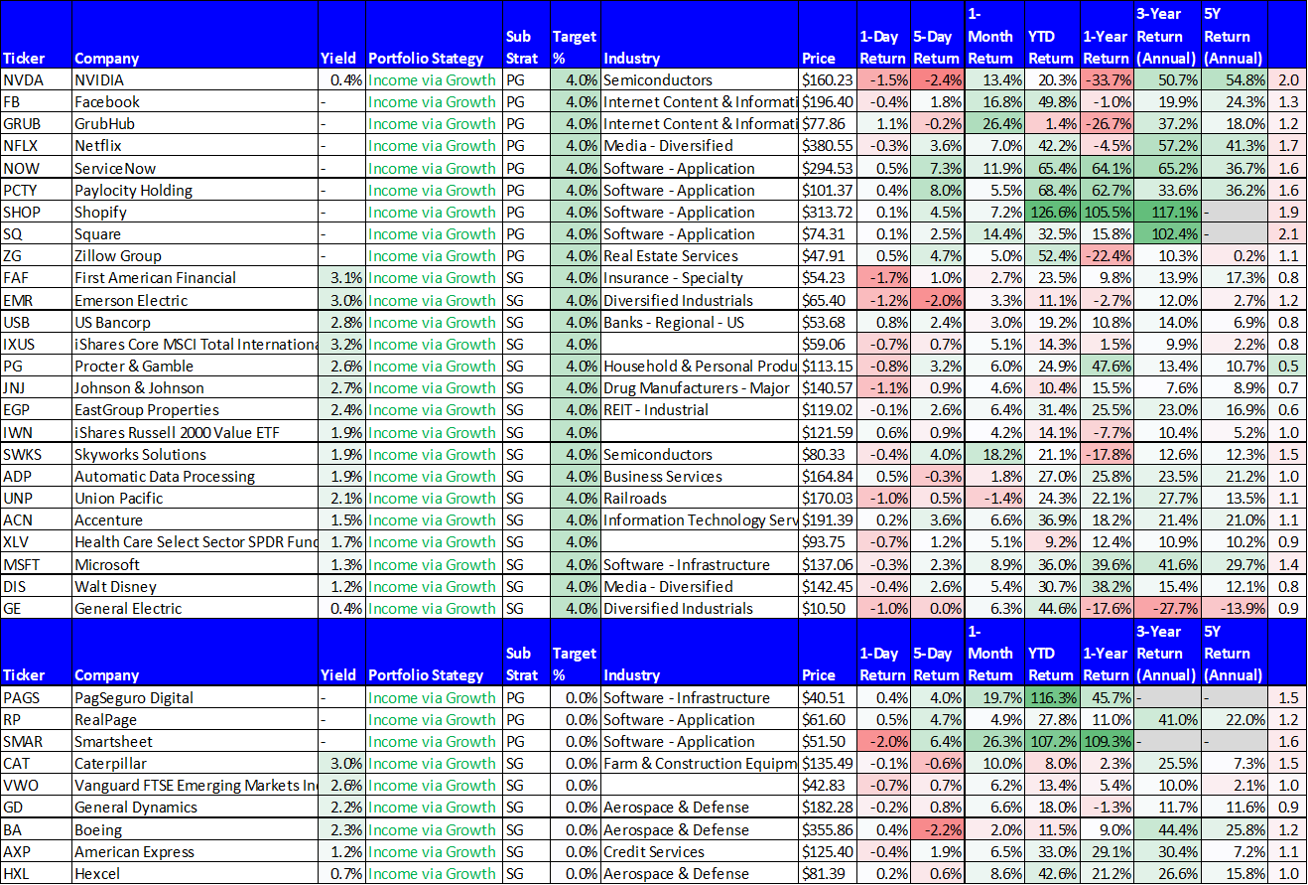

To cut right to the chase, here is a look at each of our current holdings across each of our strategies, including 1-day, 5-day, 1-month, year-to-date, and more performance data.

To download a spreadsheet of this data, click here.

Our Income Equity portfolio kept paying high income (it yields 6.3%), our Income Via Growth portfolio put up another week of attractive gains (on average, the holdings were up 1.9% over the last 5 trading days, which is still way to short of a time period to judge a strategy), and the media pundits finished another week of fear mongering designed to make you screw up by ditching your long-term investment strategy.

And worth noting, here are a few names on the list from above that we believe are particularly attractive investment opportunities right now, assuming you have a little extra cash to put to use (but be sure to stick to your long-term objective-focused investment strategy).

Simon Property Group (SPG): You’ll notice this big 5.0% dividend yield shopping mall REIT is lagging the rest of the market this year. However it shouldn’t be, and that’s part of what makes it so attractive right now. SPG has very strong fundamentals, it has an attractive valuation, and if/when the market shifts from growth to value it will be absolutely revered and sought after. Plus, that big 5.0% dividend yield is attractive and very safe.

Tekla Healthcare Opportunities (THQ): We wrote about this healthcare focused closed end fund with the big 7.6% dividend just a few days ago. And if you like to generate large stable income, it’s worth considering. Here is a link to our full write-up explain the reasons it is attractive now (e.g. discount to NAV, large yield).

Netflix (NFLX): No dividend yield on this one, just lots of attractive long-term price appreciation potential. Netflix can still likely increase subscribers by a factor of 3 to 4, and they can increase the price too (and subscribers won’t even blink). Plus, as an example of what we noted earlier, Netflix may be up big this year, but it’s still down over the last full year, and this makes it even more attractive in our view.

Nuveen Floating Rate Income Fund (JFR): This is a low-beta high-income investment. And it’s important to note, we’ve got it in our Alternative Fixed Income portfolio because it’s an income play not a long-term growth play. And with the strong jobs report last week, some fear the market has gotten too aggressive with its interest rate cut expectations. Rising rates (and/or less interest rate cuts as the market is now expecting following the strong jobs report) can be good for floating rate funds such as this one. Just recall, this is an income play, not a growth play. It’s total returns (income plus capital appreciation) have not been fantastic in recent years because floating rate securities haven’t done well considering rates have not risen nearly as much as many investors had expected Sthem too, but this can change quickly, and the income is attractive while you wait.

The Bottom Line

You can slice and dice data to say whatever you want. For example, pundits are trying to scare investors into believing the market is overheating because the S&P is up over 20% year to date. But if you consider a different timeframe—1-year for example—the gains have been much more reasonable (people seem to already forget the big sell off in Q4 of 2018). The best thing you can do is select investments that meet your personal objectives and then stick to that strategy. Prudently diversified, objective-oriented, long-term investing has proven to be a winning strategy over and over again throughout history.