Energy Transfer is an attractive, big-distribution midstream energy company, and the price is significantly too low (in our view) because it has been incorrectly lumped in with other energy stocks whose near and intermediate term prices are more dependent on energy prices (ET has stable long-term contracts based on volume, not energy prices). Further, the recent volatility has created an attractive high-income-generating opportunity in the options market. This write-up shares the specific details on this attractive income-generating trade.

The Trade:

Sell PUT Options on Energy Transfer (ET) with a strike price of $12.50 (4.7% out of the money), and expiration date of October 18, 2019, and for a premium of $0.13. That’s an extra 12.5% income for us on an annualized basis (0.13 / 12.50) x 12 months). If the shares get put to us before the options contract expires then we're happy to buy the shares of this big yield (9.3%) midstream energy company at the lower price of $12.50. And if the shares don't get put to us, we still get to keep the extra income we generated no matter what.

Your Opportunity:

We believe this is an attractive trade to place today and potentially tomorrow as long as the price of Energy Transfer doesn't move too dramatically before then, and as long as you’re able to generate annualized premium (income for selling, divided by strike price, annualized) of approximately 10-15%, or greater.

Our Thesis:

As we concluded our recent full report on Energy Transfer:

“Energy Transfer offers investors an attractive, stable income vehicle in the energy sector. As a midstream MLP, the majority of the company’s cash flows are based on fee and tariffs tied to volumes rather than prices which leads to cash flow stability despite swings in oil and gas prices. The company is set to improve its balance sheet and cash flows which will help reduce the company’s valuation gap relative to its peers. ET’s 8.8% dividend yield is highly appealing given improving fundamentals and defensive nature of its cash flows.”

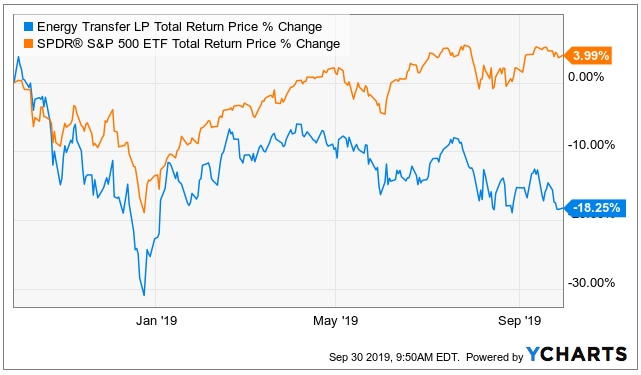

Nonetheless, continuing volatility in the energy sector has caused these shares to sell off again (as you can see in the chart below), and this makes for an attractive income-generating opportunity because the premium income available in the market generally goes up when volatility goes up.

In particular, the premium income available on this trade is bigger than normal (thanks to recent volatility) and especially attractive for a high yielding midstream company, like Energy Transfer.

Important Trade Considerations:

Two important considerations when placing options trades are upcoming earnings announcements and dividend dates because they can increase volatility and dramatically impact the value of your options contract in unexpected ways. And in the case of Energy Transfer, both are largely non-issues. Specifically, ET isn’t expected to go ex-dividend again until the beginning of November (after this contract expires), and it isn’t expected to announce earnings again until early November (also after this options contract expires).

Cash Secured Or Margin:

If you're going to place this trade, you'll need to keep enough cash in your account to cover the cost of the shares if they do get put to you. Options trade in lots of 100, so you'll need too keep at least $1,250+ of cash on hand for each contract ($12.50 strike price times 100 shares). The other alternative, if your account is approved for margin, you don't need to keep the cash on hand, but if the shares do get put to you then you'll buy them with borrowed money (on margin), and there is a cost to that (currently around 2.7% annual interest charge at Interactive Brokers, for example).

Conclusion:

Energy is an attractive steady income producer and big distribution payer. If you’d like to buy the shares straight up—that’s probably not a bad idea (we currently own some shares). However, if you’re nervous about a potential market pullback, and you’d prefer to pick up shares at an even lower price, then selling these income-generating put options is currently attractive. Specifically, selling the puts allows you to generate big attractive upfront income now (that you get to keep no matter what), and the big risk is that the shares will be put to you (you’ll have to buy them) at $12.50, which is lower than the current market price. And we’d be happy to own shares of this attractive big distribution payer, as a long-term investment, especially at a lower price of $12.50 per share.