Facebook shares are down more than 10% since late October while the Nasdaq and S&P 500 have both posted gains (+2.5% and +5.4%, respectively). Arguably, Facebook is down because of slowing growth fears, the incoming administration’s hostility to West Coast tech companies, and renewed concerns (and lawsuits) over unfriendly shareholder voting rights. However, this one-trick-pony (online advertising) may still have a lot of room to run. So do the negatives justify the lower share price, or is now a great time to “buy low” just in time for Christmas!?

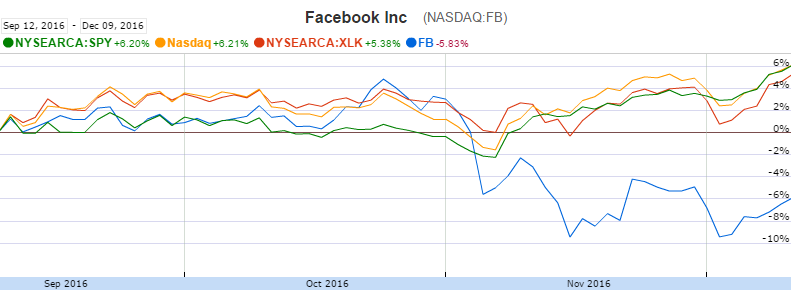

For starters, here is the 3-month performance chart for Facebook, and it’s not pretty.

Specifically, Facebook is significantly underperforming the S&P 500 (SPY), the Nasdaq, and the Technology Sector ETF (XLK). The obvious question is why has Facebook’s price fallen sharply? Here are some of the negative contributors…

Fear of Slower Growth:

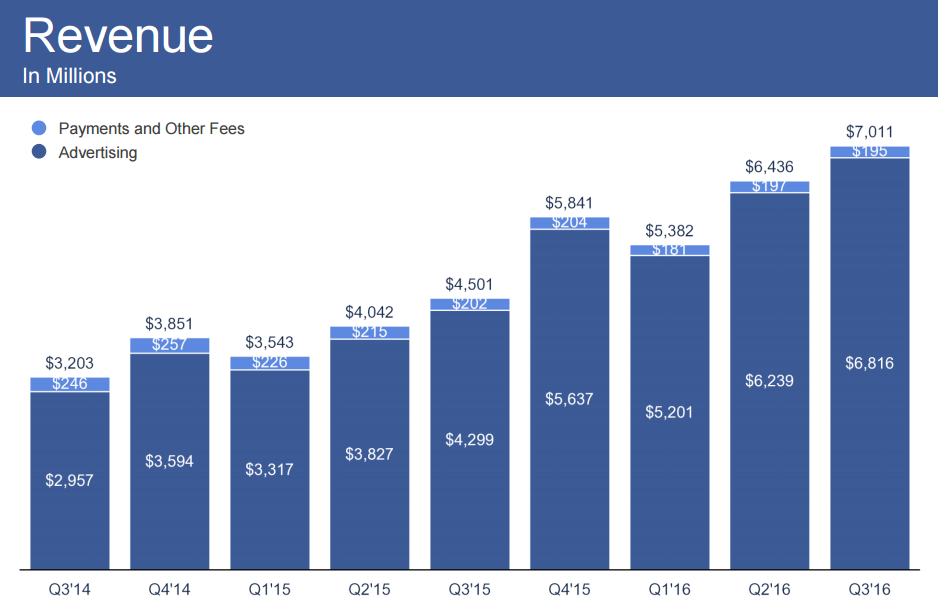

The number one negative contributor is simply the fear of slowing growth. Facebook has grown so big, so fast, that many investors run (sell) at the slightest sign of slowing growth. For perspective, the following chart from Facebook’s Q3 earnings release shows the obvious uptrend in revenues (there is some quarterly seasonality, but the trend is clearly up).

And this chart shows the growth in active users (which is now coming more from outside the US and Canada as that market becomes increasingly saturated).

And worth noting, Facebook has a clear history of surprising to the upside on earnings announcement as shown in the following table.

However, it’s actually the rapid growth and continued surprises that has many investors scared. Specifically, Facebook is a one-trick-pony (online advertising sales) and there is a perceived limit to that space. There are only so many billions of people in the world, and so much advertising dollars for Facebook to capture (especially in light of the competition). And considering Facebook keeps further saturating markets and surprising to the upside on earnings, investors are growing increasingly nervous. Especially considering Facebook’s stock price has had such an amazing run over the last four years, it’s not surprising that nervous shareholders are taking profits and putting downward pressure on the stock price.

President-Elect Trump:

It’s no secret that President-elect Donald Trump is hostile towards West Coast tech companies (e.g. Facebook, Amazon). These types of companies have been very vocal in their support of Clinton and aversion to Donald Trump. And Facebook (as well as Amazon and Tech companies in general) took a bit of a nosedive after the election. We saw Facebook’s chart post-election above, but check out this chart of Technology (XLK) and Financials (XLF) versus the S&P 500 (SPY) following the election (there were clear winners and losers).

Additionally, Trump has expressed hostility towards Facebook’s use of H1-B visas claiming the company is using the program to take jobs away from American’s and give them to foreign workers for less money. In reality, Facebook does use foreign workers under the H1-B program, but Facebook also pays them very well and does not appear to be abusing the program as shown in the following table:

FB’s Unfriendly Treatment of Shareholders:

Another reason Facebook’s stock price has been beat up is the company's biased share class structure which basically gives CEO Mark Zuckerberg unchecked power. As we’ve written previously:

Facebook’s corporate governance structure introduces a variety of risks for shareholders. For some background, Facebook founder and CEO, Mark Zuckerberg, is the largest shareholder, he has virtually complete control over the company via voting rights (there are multiple share classes, and Zuckerberg own the class with the real voting rights), and Facebook’s board is comprised of insiders and friends. This allows Zuckerberg to take actions that are not necessarily in the best interest of shareholders, and he has already demonstrated a penchant for taking questionable actions.

For example, Zuckerberg has made some very big acquisitions (WhatsApp, Instagram); these types of acquisitions are often a symptom of a company with more cash than it needs, and rather that returning it to shareholders it is spent on the types of acquisitions which have historically destroyed value for shareholders. Facebook may be young enough with enough growth opportunity that these acquisitions may bunk the norm and actually add value in the long-term, but they may also be the beginning of a bad habit for Zuckerberg; additional acquisitions could prove quite destructive to shareholders as often is the case.

As another example, Facebook’s board could inappropriately increase the number of shares outstanding which would be dilutive to existing shareholders. Facebook has historically used shares to pay for acquisitions (e.g. Oculus) and to reward executives with stock options. These types of share issuances are often not in the best interest of existing shareholders.

Additionally, the Wall Street Journal recently reported on lawsuits concerning Facebook management’s conflicts of interest:

“Facebook Inc.’s move to change its capital structure was tainted by secret text messages and meddling from financial advisers that pointed to a process rife with conflicts of interest, according to investor lawsuits filed in Delaware.”

Growth and Valuation:

Despite the negatives dragging Facebook down, the company really does have a lot of continued long-term growth opportunities. For example, Facebook has information on its users that is unprecedented in the advertising industry that can be used to tailor ads and dramatically increase their effectiveness. And the current trajectory of growth likely won’t disappear overnight. For example, the 45 professional analysts survey on Yahoo Finance expect average growth of 34.84% per year for the next five years. That is enormous!

We gauge Facebook’s valuation with a discounted free cash flow model assuming a 20% 5-year growth rate followed by 2% growth into perpetuity with a 5.85% weighted average cost of capital to arrive at a valuation of $197 per share. This gives Facebook very significant growth potential in the coming years versus its current deflated price of $119 per share.

Mean Reversion:

Given Facebook’s tremendous growth, attractive valuation, and recent stock price declines, now may be an excellent time to buy from simply a mean reversion standpoint. Also, worth considering, one of our favorite aggressive growth managers, Zevenbergen Capital Investments based in Seattle, has a very large overweight stake in Facebook in its Growth Fund (see that fund’s top 10 holdings in the following chart).

We admire Zevenbergen for its concentrated approach and long-term track record. However, Zevenbergen’s fund has been recently underperforming (see chart below, they launched this mutual fund in 2015, but we’ve been following their separately managed account growth strategies for many years prior to 2015).

In the case of Zevenbergen, we’ve watched their highly volatile strategy come screaming back multiple times in the past, and we expect it to do so again in the future. And from a mean reversion standpoint, we believe now may be an exceptional time for long-term investors to own shares of Facebook (i.e. buy low!).

Conclusion:

We own Facebook in our Blue Harbinger Disciplined Growth strategy. We bought the shares back in 2013 for around $27 per share. They currently trade at $119 per share, and we believe they have continued significant upside potential ahead. Specifically, thanks to nervous investors, the November election, and headlines about biased share classes, the price has fallen, thus creating an attractive entry point for long-term investors.