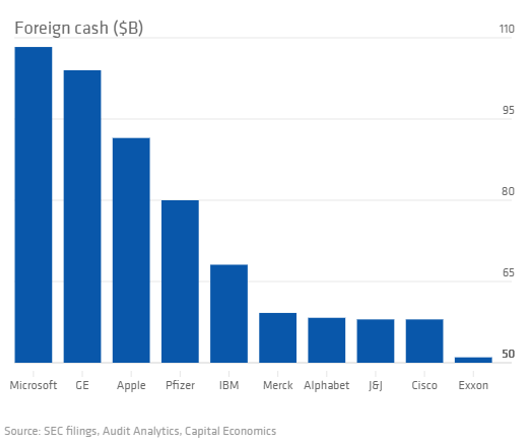

Apple has a lot of overseas cash as shown in the following chart. And we think it’s likely, that during Wednesday’s “Tech Summit,” President-Elect Trump will extend an olive branch whereby he’ll offer a tax-break so companies (like Apple) can bring the money back to the US. However, of course there will be strings attached (for example, Trump wants iPhones manufactured in the US, despite daunting economics). This article reviews Apple’s current valuation, its healthy dividend, some of the possible results of the Tech Summit, and whether we believe now is a good time to buy Apple or jump ship!

The Tech Summit:

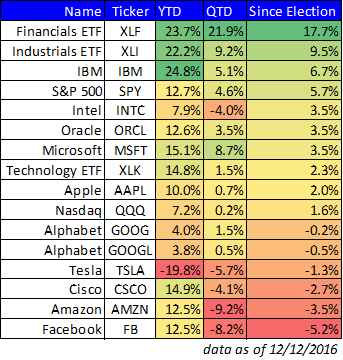

The so-called “Tech Summit” will take place on Wednesday whereby President-Elect Trump has summoned the big-wigs from Apple, Amazon, Alphabet, Facebook, Microsoft, and a few others to meet at his Trump Tower in New York for a pow-wow. It’s no secret Trump has been hostile to liberal West-Coast tech companies, and their stock prices show it (they’re underperforming since the election as show in the following chart).

data source: Yahoo Finance

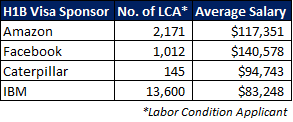

The meeting is supposed to focus on creating jobs, but it seems likely it may be another firing squad (a la what happened when Trump met with the News/Media execs last month). It also seems likely Trump with cover hot-topics from his campaign including overseas cash (see above chart), H1B visas (see chart below), Government subsidies (for example, Tesla lives off tax breaks from Obama) and tax rates (e.g. Amazon pays very little taxes because they hide earnings with R&D).

The Tech Summit will impact Apple because it employs a large number of people overseas, and it has a large amount of cash overseas. Regarding, overseas employees, Trump wants to create more jobs in the US by, for example, manufacturing iPhones in the US. In reality, the economics are stacked strongly against Trump because the cost of the iPhone would increase dramatically if the company could not utilize cheap labor in China. However, Trump did write The Art of The Deal, and we expect him to try to structure a deal with Apple. Specifically, he’ll likely offer a tax break to bring Apple’s large overseas cash back to the US, and he’ll expect something in return like more jobs in the US. We don’t expect a deal to happen overnight (he’s not even President yet), but we do expect an eventual deal whereby Trump will create some tax deal whereby Apple brings the money back to the US but only pays some (not all) taxes on it, and the taxes received will be used to create some specific new US Apple manufacturing jobs that Trump can brag about.

Apple’s Dividend History:

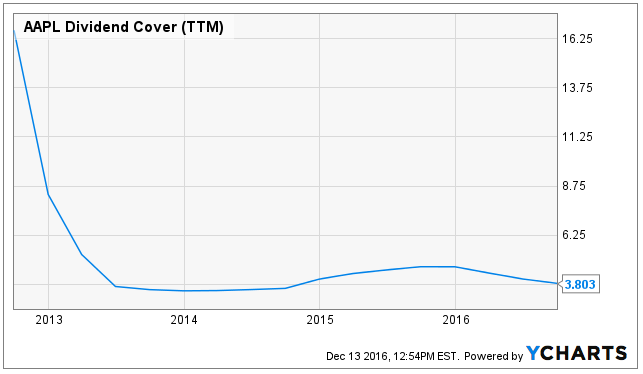

Steve Jobs was the visionary of Apple’s incredible historical growth, but since his passing, the company has been evolving from a growth company to a value company. For example, Apple finally started paying a dividend in 2012 (instead of using that cash to fund more growth). And the dividend is actually now quite healthy at 2%, and it’s competitive with other S&P 500 companies, for example. Additionally, some big name value investors have been taking positions in the stock. For example, Warren Buffett’s Berkshire Hathaway built its stake in Apple during the second quarter of this year as the stock price fell. Apple is now Berkshire’s 14th largest holding by market value at nearly $1.8 billion. For added perspective, Apple’s dividend coverage ratio (as shown in the following chart) sits at 3.8 times- a very health coverage ratio that indicates a high degree of safety.

Apple’s Valuation:

Apple’s current valuation is relatively attractive. For example, Apple’s price-to-earnings ratio (as shown in the following chart) has risen somewhat since earlier this year, but it remains low by historical standards, and low relative to peers.

A simple discounted cash flow model is another way to gauge Apple’s current valuation. Starting with free cash flow for the 52-weeks ended September 24th (i.e. cash from operations minus capital expenditures = $52.3 million), and then discounting it by Apple’s weighted average cost of capital (~12.5%) minus an assumed conservative growth rate of 5% (the 33 professional analyst forecast provided by Yahoo Finance expect growth of 8.5% of the next five years) gives Apple an enterprise value of $497.9 billion. Adjusting for the $75.4 billion of long-term debt and dividing by the 5.33 billion shares outstanding gives a per share valuation of ~$117 (its current stock price is approximately $116 per share). In our view, Apple was much more attractively priced a few days after the election when it traded down to $105 per share (and even more attractive in June/July when it traded in the low $90’s per share). Worth noting, if we adjust our growth assumptions (above) to 8.5% for the next five years (per the Yahoo analysts' forecast), and a conservative 3% per year thereafter, Apple is worth around $125 per share, giving it a little upside with a nice dividend to boot.

Conclusion:

In our view, Apple is no longer the impressive growth company it was under Steve Jobs. However, it has evolved into a very steadfast, solid, blue-chip-company, with a little upside, and a healthy dividend. Importantly, the results of this week’s Tech Summit could put Apple on a totally different trajectory (good or bad!). In addition to watching the price of Apple for a more attractive entry point, we’ll also be watching the results of Wednesday’s meeting for any clues on big changes that could change our thesis. We do NOT currently own shares of Apple but it is on our watch list, and we may add shares if/when market conditions are right.