Chatham Lodging Trust (CLDT) is a hotel Real Estate Investment Trust (REIT) with a big 6.1% dividend yield, and significant price appreciation potential. The market has dramatically overreacted to slowing growth among hotel REITS, and Chatham in particular offers an attractive investment opportunity for long-term income-focused investors because of its attractive valuation and potential for more dividend increases. We believe Chatham could rise 35%. Here's why...

About Chatham:

Chatham Lodging Trust is a real estate investment trust (REIT) organized to invest primarily in premium-branded upscale extended-stay and select-service hotels. It owns approximately 40 hotels with over 5,680 rooms. Its hotels include upscale extended-stay hotels that operate under the Residence Inn by Marriott brand (over 10 hotels) and Homewood Suites by Hilton brand (approximately nine hotels), as well as premium-branded select-service hotels that operate under the Courtyard by Marriott brand (over four hotels), the Hampton Inn or Hampton Inn and Suites by Hilton brand (over three hotels), the SpringHill Suites by Marriott brand (approximately two hotels), the Hilton Garden Inn by Hilton brand (over two hotels) and the Hyatt Place brand (approximately two hotels).

Income Investors and REITS:

Income-investors often flock to REITs because of their big dividends and low volatility. However, not all REITs are created equally. We ran a screen to identify big dividend REITS (we limited our search to those with yields greater than 4%, market caps over $500 million and revenues over $100 million). And as the following table shows, the one-year total returns have varied widely.

One of the first things that stands out in the chart (besides the wide range of performance) is that ALL of the Hotel/Motel REITs are clustered near the bottom in terms of performance. We believe this poor 1-year performance is the result of greatly overblown fears related to slowing growth, and Chatham Lodging is particularly attractive for a variety of reasons as described below.

The Dividend:

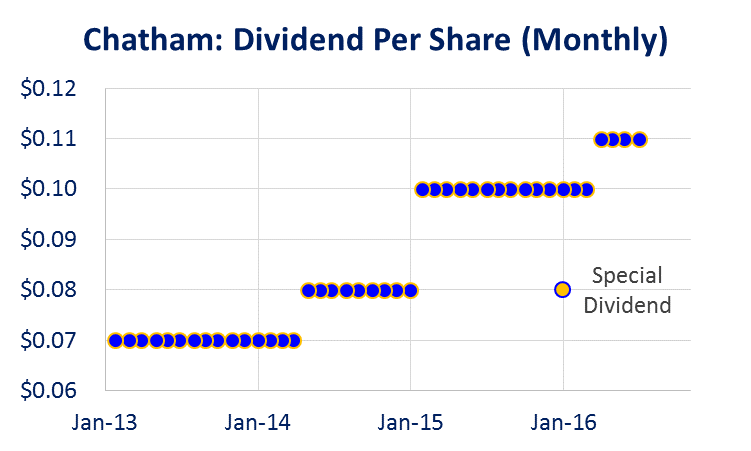

Chatham’s monthly dividend is big, safe and attractive. The dividend yield current sits at around 6% and the following chart show the recent history of dividend payment increases.

Very important to note, is that Chatham’s dividend is currently very safe because of the company’s low dividend payout ratio (currently only 54%). Specifically, Chatham only pays our 54% of its adjusted funds from operations (AFFO) as dividends, and this means the company has an additional 46% to spend on growing the company and/or increasing the dividend.

Relative to other REITS (such as Retail REITs) this payout ratio is very low (many retail REITS pay over 80% of AFFO as dividends). Chatham’s low payout ratio is a sign of strength and an indication of a changing industry. Specifically, the company has historically paid out less as more capital was used for growth, however as growth slows this cash rich company will have more wherewithal to increase the dividend.

Depressed Market Pricing and Valuation:

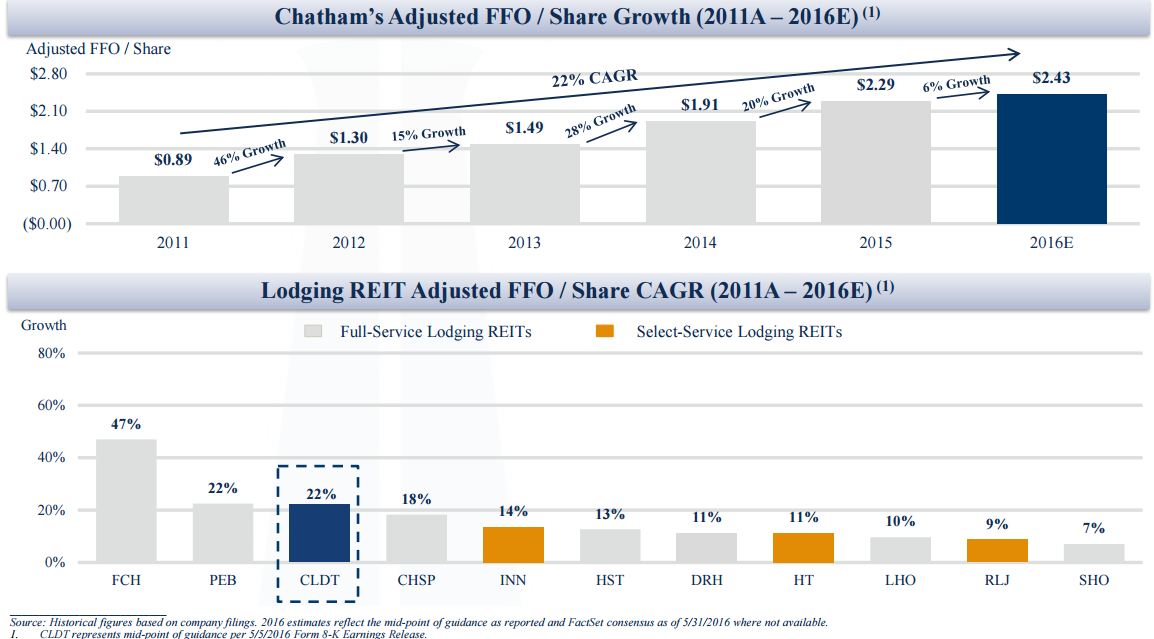

Perhaps the biggest reason for the significant 1-year decline in Hotel/Motel REITS is the slower expected future growth. For example, the following table shows Chatham’s compound annual growth rate in AFFO is expected to be only 6% in 2016 versus much higher numbers, 15%, 28% and 20%, in 2013, 2014 and 2015, respectively.

The reduced growth rate is driven by fears related to market saturation as well as increased pricing pressures driven by Internet room booking applications. However, we believe the fears are largely overblow, and a 6% growth rate is still positive growth. More specifically, we believe the market has overreacted, and Chatham is now undervalued.

Chatham management tends to agree that the market is overly negative as Chatham CEO wrote in his 2015 Letter to Shareholders:

“Most experts rated 2015 as a very successful year for the hospitality industry, creating frustration regarding a share price that did not reflect that performance.”

The same letter also says:

“Although 2015 was a challenging year for virtually all publicly traded lodging real estate trust investors, fundamentals within lodging remained favorable and Chatham achieved many significant accomplishments.”

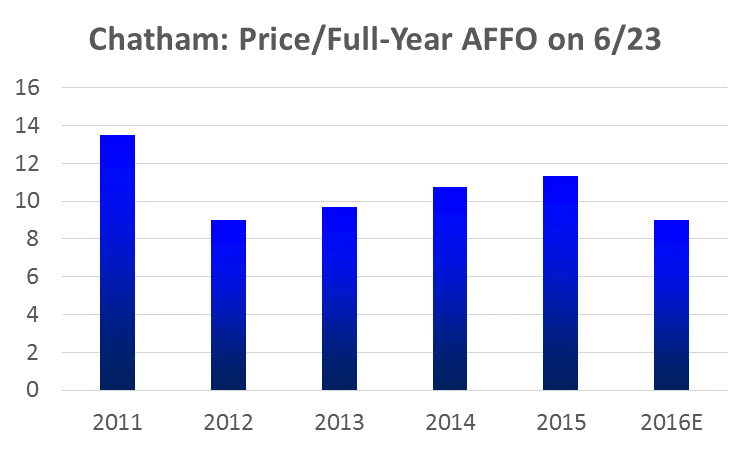

For starters, the following table shows Chatham’s Price to AFFO ratio since 2011, and the shares clearly now trade at the low end of their valuation range.

Another way to gauge Chatham’s value is with a simple dividend discount model. Specifically, if we assume an annual dividend of $1.32 ($0.11 per month x 12), an 8.32% cost of equity (per the reasonable assumptions at GuruFocus) and an extremely conservative 2.5% growth rate then Chatham is worth $22.68 per share, giving it more than 5% upside. However, recall Chatham only pays out 54% of its AFFO as dividends, and it could comfortably increase this 1.3x (to 70%) considering it won’t need as much capital for growth considering the growth rate is expected to slow. If Chatham increases its dividend payout to 70% (making the dividend $1.71 per share) and conservatively grows 2.5% per year then our same dividend discount model assumptions gives the stock a $29.39 valuation, or nearly +35% upside potential.

And for reference, Chatham is clearly expecting continued growth as evidenced by it forecast AFFO growth rate of 6% in 2016 as well as the Silicon Valley projects it currently has in progress.

Additional gauges of value for Chatham include its best in class operating margins (as shown below), its strong and growing RevPar (2.6% YTD through May, 2.0-3.5% Guidance for 2016), and its favorable debt structure (e.g. new $250 million unsecured credit facility, no maturities over next three years, weighted average cost of 4.4%, 88% fixed rate). And for reference, “RevPar” is revenue per available room; it’s a performance metric in the hotel industry that is calculated by dividing a hotel's total guestroom revenue by the room count and the number of days in the period being measured.

Risks:

Chatham faces a variety of risk factors that are important to consider. For example, the management of the hotels in Chatham’s portfolio is currently concentrated in one hotel management company. As of December 31, 2015, IHM managed the overwhelming majority of Chatham hotels. And this significant concentration of operational risk in one hotel management company makes Chatham more vulnerable economically than if the hotel management was more diversified among several hotel management companies.

The reliance upon debt is another significant risk factor. For example, debt service obligations could theoretically require Chatham to liquidate properties at unfavorable prices, and this could adversely affect the company’s ability to make distribution payments. Similarly, a rise in interest rates could have a significant negative impact on Chatham’s ability to finance future growth and/or current debt obligations when they come due. This could reduce funds available for operations.

A decline in hotel property values could have a significantly negative impact on Chatham. For example, if property values decline, it could reduce the valuation of capital used as collateral to secure debt and this could increase the cost of capital for Chatham and/or reduce the availability of capital to operate the business. The lodging industry has experienced significant declines in the past and failure of the industry to exhibit improvement may adversely affect Chatham’s ability to execute on its business strategy.

The increasing use of Internet travel intermediaries by consumers could adversely affect Chatham’s profitability. Some of the company’s hotel rooms are booked through Internet travel intermediaries, and as such this can increase competition and reduce revenues per room.

Conclusion:

We believe Chatham Lodging is undervalued as investors have overreacted to slower expected growth rates. The company is financially healthy, it continues to generate growth, and valuation metrics suggest is has significant price appreciation potential. It also offers a big monthly dividend payment, and the company has plenty of financial wherewithal (and incentive) to keep increasing the dividend payments significantly. If you are an income-focused investor, Chatham could be a very valuable addition to your diversified long-term portfolio.