This morning we highlight an attractive “style-specific” Closed-End Fund (CEF) that offers a big 7.7% yield and trades at a compelling discount to its Net Asset Value (NAV). Importantly, this particular “style exposure” is extremely powerful over the long-term (it tends to outperform, by a lot), and it’s missing from many investors portfolios.

Royce Micro-Cap Trust (RMT):

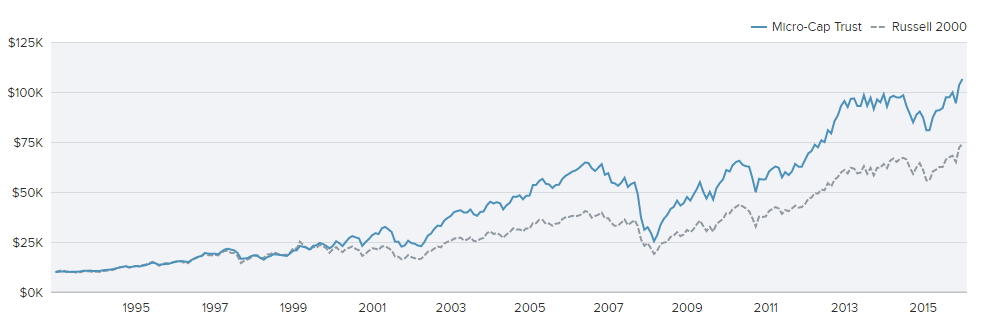

The Royce Micro-Cap Trust (RMT) is one of the only closed-end funds dedicated to investing in micro-cap stocks (generally market caps up to $1 billion), and it is worth considering. According to a style box (see below) RMT actually leans more towards value, which is important.

Over long-time horizons, small (and micro-cap) value stocks tend to be the best performers. For example, this chart show the performance of the various styles over the last +16-years.

And this next chart shows the performance since 1928.

In both charts, small cap value stocks have performed best. We could argue the reason is because small value stocks are unloved and unfollowed, but the point is that the style’s long-term returns are powerful.

(Note: RMT’s actual benchmark is 50% Small Cap Value (Russell 2000) and 50% Micro-Cap (Russell Micro-Cap)).

Management Team:

Besides providing exposure to powerful small- and micro-cap value stocks, the fund is actively managed. According to Royce, the fund management team uses a “core approach that combines multiple investment themes and offers wide exposure to micro-cap stocks by investing in companies with strong fundamentals and/or prospects selling at prices that Royce believes do not fully reflect these attributes.”

And while past performance is no guarantee of future results, this fund has put together an impressive track record of outperformance.

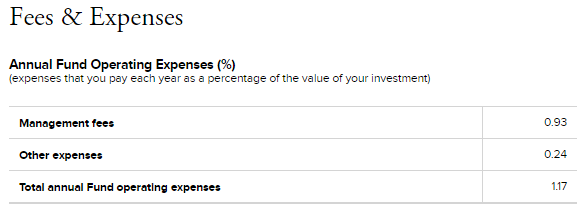

Reasonable Fees:

At Blue Harbinger, we HATE paying fees because we know it detracts from long-term performance (small annual fees can really compound and add up over time). However, in some situations it is acceptable to pay fees, and in those cases we work hard to keep them as low as possible. In the case of the Royce Micro-Cap CEF we believe the fees are acceptable for SOME investors.

Specifically, if you are a mature, income-focused investor, then it may be worth your while to own this fund because the fees are very low for a CEF, and they are incredibly low for active exposure to micro-cap stocks. Also, the fee may be worthwhile if you need the big steady 7.7% distribution payments (i.e. if you’re an income-focused investor) because the management team manages the portfolio to efficiently generate these distribution payments (the distributions are paid quarterly) so you can “sleep well at night.”

Sources of Income:

You may be wondering how this fund can generate 7.7% distribution payments when the small- and micro-cap stocks in which it invests generally pay between 0% to 2% in dividends. The answer is a combination of dividends from fund holdings, long-term capital gains (the portfolio management team carefully sells some of the “winning” stocks in order to generate income for you), short-term capital gains, and in rare cases a return of capital. The fund also uses a small conservative amount of leverage, currently 11.06% (more on leverage later). Generally speaking, if we assume small- and micro-cap stocks return around 7.5% - 8.0% per year (dividends plus price appreciation) then theoretically this fund should be able to reasonably maintain its 7.7% distribution yield over the long-term. It also helps that the fund is currently trading at an attractive discount to its Net Asset Value (NAV), and it uses a small, conservative, reasonable amount of leverage.

Discount to NAV:

For reference, this chart shows RMT’s current discount to its NAV.

For reference, NAV is the value of all the individual holdings within the fund. And the fund can trade at a discount (or premium) because of supply and demand. Specifically, this is a closed-end fund (not open-end like an ETF) so the price can fluctuate widely from the NAV.

We believe this fund currently trades at a discount for three reasons, and the discount creates an attractive entry point for long-term investors. We believe the discount exists because investors prefer CEF with higher distribution payouts and monthly payments (RMT pays quarterly). However, the payout amount (as we discussed previously) is reasonable, conservative and sustainable over the long-term, whereas other funds that pay higher distributions and riskier (in our view) and may not be able to maintain the payout over the long-term (other funds may get in trouble if the market gets volatile because of their big distributions and also their higher aggressive use of leverage).

The third reason we believe the discount exists (besides a more conservative yield and quarterly payments instead of monthly) is that many conservative-minded CEF investors believe micro-cap is inherently too risky, however we believe it is not. Specifically, micro-cap stocks may be slightly more volatile than say large cap stocks, but RMT is a diversified, well-managed portfolio that can be an important diversifier within a larger income-focused portfolio. And because the management team is able to deliver the steady distributions this makes RMT a reasonably very safe investment for investors counting on the distribution payments.

Risks:

There are a variety of risks to investing in this fund that should be considered. For example, micro-cap stocks tend to deliver bigger long-term total returns, but they also tend to be more volatile. However, the big distributions help reduce the volatility of RMT and they make the investment much more palatable for income-investors, particularly as one allocation within a broader more diversified income-focused portfolio.

Leverage: This CEF currently has an 11.06% leverage ratio. And while this leverage is generally used to help maintain exposure to micro-cap stocks (so operating expenses don’t detract from long-term performance), it’s also used to slightly magnify returns (in theory for every dollar the fund has, it invests in $1.11 worth of investments). And while leverage does add a degree of risk (it can become challenging in declining markets), the leverage level of this fund is extremely conservative. For example, many closed-end funds are only allowed a maximum of 33% leverage by regulation (to help keep them safe), and many other CEFs also lever right up to the maximum to help juice returns now but this adds risk in the future (particularly in a market decline). RMT’s leverage is much more reasonable, conservative, and in our view prudent. Additionally, it’s not like the fund is levering 15x and 20x like many of the big banks were doing before the financial crisis. The fund is only levered 1.11x, which in perspective is really very conservative and low risk in our view.

Fees: As mentioned previously, at Blue Harbinger we generally despise paying fees on our investments, but in this case they are acceptable for SOME investors. First of all, the fees on this fund are relatively low for a CEF (and especially low for micro-cap exposure). However, they may also be worthwhile if you like having a management team efficiently manage the distribution payments (so you don’t constantly have to buy and sell to generate the income you need) so you can sleep well at night. This fund, in our opinion, is NOT acceptable for a young investor still saving for retirement (because they don’t need the distribution yet, so they shouldn’t pay the fees yet, and they’d be better off investing in a low cost exchange traded fund (ETF)). However, if you are retired (or semi-retired) this fund may be worth considering.

Micro-Cap Exposure: This asset class performed particularly well at the end of 2016 which may give some investors pause before investing (because they may be contrarians and they don’t like to “chase” returns), but as we showed earlier, this is a very powerfull asset class (style) over the long-term. Further, even though micro-cap had a strong end of 2016 in terms of relative performance (they beat the S&P 500 handily), it’s still underperforming over the last 10-years, and again it’s a powerful long-term asset class/style to be exposed to.

Discount to NAV: While we consider the current discount to NAV attractive, there is no guarantee it won’t get bigger. However, we’d be much more comfortable buying this one at a discount (than at a premium), and the discount is a little larger now than it has been historically which gives us comfort from a contrarian standpoint.

Conclusion:

If you are a mature, retired (or semi-retired) investor, the Royce Micro-Cap (RMT) CEF is worth considering for an allocation within your overall diversified, income-focused, portfolio. This fund is NOT for young people still saving for retirement (they don’t yet need the income and they’d likely be better off in a lower cost ETF that pays lower distributions because the fee savings will compound and add value over a very long time horizon). In particular, we like this powerful micro-cap asset class, the strong management team, the conservative use of leverage, the relatively low fees (compared to other CEFs), and the big current discount to NAV.

The one other thing we'd add about this particular CEF is that it pairs well with the Royce Value Trust (RVT)- a small cap CEF we wrote about last week. In particular, while RVT leans slightly towards small-GROWTH stocks, this fund (RMT) leans towards small-VALUE stocks. Together, they provide more comprehensive exposure to the total small cap space.