If you are a contrarian, income-focused investor, Tsakos Energy Navigation (TNP) may be worth considering. Not only does this international searborne crude oil transportation company offer a big 5.1% dividend yield that we expect will be increased soon, but there are also company-specific and macroeconomic-cycle factors that may drive its share price significantly higher. This article provides an overview of the company, its price, its dividend (including the preferred shares), considers important risks, and concludes with our views on how to play it.

About Tsakos:

Tsakos Energy Navigation (TNP) is a provider of international seaborne crude oil and petroleum product transportation services for national and other independent oil companies and refiners. As shown in the following graphic, the company’s fleet consists of 65 double-hull vessels totaling 7.2 million deadweight tonnage.

And worth mentioning, Tsakos’ fleet is younger than its worldwide peers, especially after considering its recent large capex spend on ships (more on capex later) as shown in the next graphic (note: Tsakos refers to itself as “TEN”).

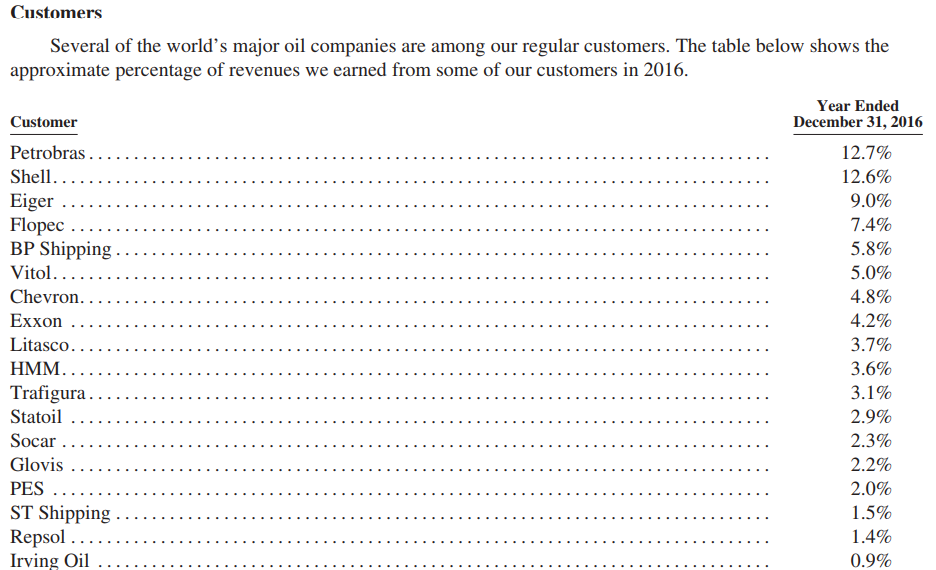

And for color, the following graphic shows some of Tsakos valuable blue chip company relationships.

About The Share Price:

As the following chart shows, Tsakos (TNP), the shipping industry (SEA) and the entire energy sector (XLE) have underperformed the rest of the market (SPY) recently.

Tsakos recent poor performance has been driven by macroeconomic and company-specific factors, but both are likely about to get significantly better.

For starters, from a macroeconomic standpoint, low oil prices, and supply and demand disruptions (in both energy markets and the shipping industry) have wreaked havoc across the shipping industry with multiple companies dramatically cutting their dividends (e.g Nordic American Tanker) and some shippers filing for bankruptcy altogether, such as Hanjin (despite differing cargos, shipping company prices can trade with a high degree of correlation). However, the cycle may be about to turn upwards considering worldwide oil demand continues to grow, and supply/demand challenges have thinned the herd, with many of those remaining (such as Tsakos) now more operationally efficient (according to management: “we are proud that our G&A expenses must be one of the lowest in our peer group just starting a $1,000 or a little bit above for everything that has to do with running TEN). For perspective, here is a look at the continuing strength in global oil demand.

For added perspective, here are a several Tsakos management quotes (from the quarterly call) that are worth considering:

“Global oil demand continues to grow above historical growth levels…. [and] we expect the remaining of 2017 and 2018 to be a much better year or a much better quarter than the third quarter.”

Further, management believes their operational expertise in weathering the challenging market conditions in recent years is now…

“providing stability and positioning TEN to fully reap the benefits of the next market recovery, which we expect to start shortly.”

Further still, on the supply side, management explains:

“The tanker order book is coming down, the bulk of the orders placed in past years have been delivered, and despite the short term headwinds which we have experienced in the second half of this year, longer term supply is managed. We should note that the big part of the existing tanker fleet is over 16 years. Implementation of new environmental regulations with high compliance cost and charter discrimination against older tonnage could lead to an increase in scrapping. We have already witnessed increased scrapping in the larger vessel categories.”

For more perspective, here is a look at some of the positive demand considerations from Tsakos latest investor presentation.

All of these conditions are positioning Tsakos to benefit from the next upturn in the market cycle, which is expected to begin soon. However, despite the improving outlook, the market continues to extrapolate Tsakos’ previous bad performance into the future.

Tsakos’s Recent Performance Looks Worse Than It Really Is:

We believe there are three reasons why Tsakos future prospects are better than they look. First, even though Tsakos missed expectations by two cents when it announced earnings at the end of November, it did beat on revenues (a good thing). It missed earnings because they included $2.5 million of special survey costs that would normally have been incurred at a later stage and have been spread over a longer period (according to management: “we took advantage of the very weak market of the third quarter to bring forward three of our surveys.”). But on a go-forward basis, it’s good they’ve gotten this out of the way. Also earnings suffered from refinery outages, and high inventories and OPEC cuts. These negative events are exceptions, not the norm (Tsakos will benefit from not having them every quarter).

Secondly, Tsakos just completed a large capital expenditure cycle that positions it for more growth and higher free cash flow in the future. Per the following graphic, the newbuilding vessels are expected to increase revenues by 30%.

With this newbuilding capex largely behind them, a large amount of free cash flow will be generated from increased revenues and simply from not spending so much on capex. This will be helpful to the dividend (more on this later).

Thirdly, many investors are ignoring the expected turn upward in the market cycle (as described in the previous section) and instead they’re incorrectly extrapolating recent weak performance into the future.

About the Dividend:

Tsakos offers a big dividend on its common stock and on its preferred shares, as well. Regarding the common shares, there are multiple reasons to believe there is both safety and upside potential. For starters, here is a look at the company’s historical dividend yield (5.25%) (its current dividend yield is 5.1%).

We believe Tsakos’ dividend is safe because the company will have more free cash flow (due to more revenue, less capex, and less unusual expenses, as described previously). Additionally, Tsakos’ CFO had this to say during the last quarterly call when asked about a dividend increase:

“And our intention, as you know, we are very large shareholders manage, I mean very large shareholders close to 40% together with the Board. So dividend, we are, it’s very important for us. And as long as we can logically increase it, we will logically increase it and I will leave it to that.”

As long as conditions continue to improve, Tsakos should have plenty of financial wherewithal to increase the dividend, and they have the desire to increase it as well. Further, as the share price rises from its current low levels, there will be more incentive to increase it just to keep the yield somewhat consistent with historical averages, as described previously.

Preferred Dividends

Also important to note, Tsakos offers several series of preferred shares that offer attractive dividend yields. For example, the series B, C, D and E preferred shares offer 8%, 8.875%, 8.75% and 9.25% dividends, respectively, and they trade at $25.16, $25.50, $24.83, and $25.15, respectively (relative to their face values of $25). Considering the preferred shares are higher in the capital structure than the common shares, income focused investors may want to consider them (especially since their prices have fallen recently thereby making their prices more attractive relative to their $25 face values). However, keep in mind these shares become redeemable, by Tsakos, on 7/30/2018, 10/30/2018, 4/29/2020, and 5/28/2017, respectively. And Tsakos has incentive to redeem them as soon as possible so they don’t have to continue making the high payments. For perspective, consider the following preferred share Q&A from the last quarterly call:

Ben Nolan: And then secondly for me and this will do. But something that I don’t know that I never heard you address, but few of the -- a few of prefers that you done in past years become callable next year. They’re not too terribly big, but as you do begin to have free cash flow certainly depending on what the spot market allows. Is that something that you would consider doing as well perhaps calling back some of those prefers to reduce the cash flow component of those?

Paul Durham: We have taken into consideration the refinancing or redemption of those preferred stocks over the next few years. As we see that we can comfortably redeem them. In any account, at the moment, we are on a ready to be small scale buying back where possible. We have been doing that and we can always revert back to buying back and gradually lowering the amount, total amount has been redeemed. But that's fairly comfortable given our full year’s forecast that we can manage to redeem and quite successfully.

Considering those comments from the call, and considering the additional free cash flow Tsakos will likely soon have, it also seems likely the preferred shares will get redeemed by Tsakos on or near the earliest redemption dates, and investors will have to find a new place to deploy that capital when it happens.

Risks:

In addition to the positive outlook factors for Tsakos, there are also risk factors that are worth considering.

1. Management Conflicts of Interest: For starters, there are some conflicts on interest in the management structure. For example, Tsakos is managed by Tsakos Energy Limited, and according to Tsakos’ annual report:

The Holding Company and the Management Company have certain officers and directors in common. The President, who is also the Chief executive Officer and a Director of the Holding Company, is also the sole stockholder of the Management Company.

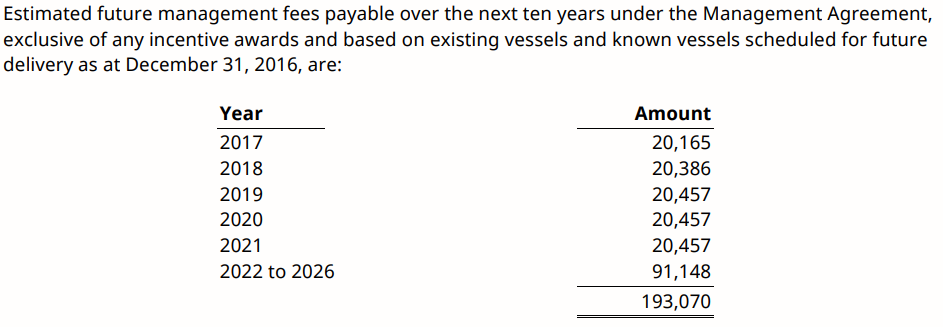

And considering Tsakos pays management over $20 million per year (as shown in the followning graphic) there is naturally some incentivee for management to act in the management company’s best interest not necessarily Tsakos shareholders best interest.

2. Shareholder Dilution:

Shareholder dilution is another risk factor for Tsakos. For example, here is a look at the historical amount of shares outstanding.

Tsakos has issued new shares on multiple occasions which can be dilutive to existing share holders. Also, the company has issued new preferred shares (such as the latest series E preferred shares) which are higher in the capital structure and can be dilutive to the common shares).

3. Supply and Demand Disruptions:

Supply and demand disruptions, such as production increases and decreases from OPEC, can impact the shipping industry. Further economic condition, and competion can impact supply and demand, thereby impacting Tsakos as well. For example, the reason the industry has struggled in recent years is due largely to supply and demand dynamics.

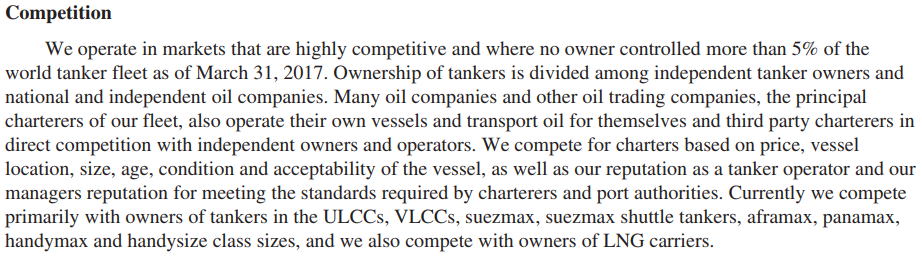

4. Competition:

Competition is another risk factor for Tsakos. Tsakos describes the risk of competion in its annual report as follows:

5. Environmental Risks:

Finally, there are environmental risks that should be considering. For perspective, here is an excerpt on environmental risks from Tsakos’ most recent quarterly call:

I think this is something that I think very few of owners, but much, much fewer of the shareholders have understood that we are growing into a head-on collision that will have very, very positive effects for rates. As soon as at the middle of 2019 and 2020, I think for those we’re not familiar, will shipping were tired because we have to deal with everyday is what we have to reduce our emissions from 3.5% on New Year day in 2020 down to 0.5%. So this is a Herculean task in Greek as we say, but there are solutions.

So the oil companies are pushing owners to put scrappers on the ships. Owners have not reacted positively at all. They were hoping that by to-date 40% of the world fleet will have scrappers, less than 3% have scrappers today, and we’re talking about a couple of years that this has to happen. And we are in the tanker, with the happen to acquisition is that the 6 are not going to become refineries, because it’s not good for the environment and it’s not good for recommend factor. Refineries have to be on line.

So we believe that there will be enough of fuel at the time. And if there is not, we can cover our obligation by slow steaming and I think this is the key, because as you know by slow steaming, there will be much more demand of utilizations will grow and will be much more demand and we hope this will help the rates. So we have calculated by reducing our speed by 25%, we can need our obligation of burning 0.5% of emissions. So I’m not a very technical person, but where we’re going and we expect this situation to create a lot of positive for the market.

Tsakos believes its ships are well-positioned for future environmental factors, especially relative to peers, but it is still a risk factor that should be considered.

Conclusion:

Tsakos has performed poorly because of market-cycle and company-specific challenges. However, we believe investors are incorrectly extrapolating poor past performance, and there are multiple reasons to believe Tsakos will experience significant gains in the future, such as its improved operational efficiency, the completion of a large capex spend (which will increase future free cash flow), and indications the company is about to benefit from an upturn in the market cycle. We’re staying away from the preferred shares for now (especially the ones that become redeemable soon), however we do currently own shares of Tsakos’ common stock in our Blue Harbinger Income Equity portfolio because we believe both the dividend and the share price have significant upside. If you are a contrarian income-focused investor, we believe Tsakos is worth considering.

For reference, you can view all of our current holdings here.