Tsakos Energy Navigation (TNP) is a marine shipping company (mainly crude oil) that offers an array of high-yield equities including 5 series of preferred shares with dividend yields from 7.9% to 9.5% and common shares offering a 5.8% dividend yield. But before you start trying to decide which of Tsakos’ many high-yield securities you want to invest in, you might first want to consider whether you believe the business will actually produce the cash flows necessary to support those payments to investors. This article details the two biggest risks threatening Tsakos’ future ability to pay, and then reviews the differences between the company’s array of high yield securities. We conclude with our thoughts on how income-focused investors might want to “play” Tsakos.

Overview:

Tsakos Energy Navigation Ltd. engages in the provision of maritime transportation of crude oil and other products. Its activities include the operation of crude tankers, product tankers, and liquefied natural gas carriers, as shown in the following graphic.

The company was founded by Nikolas P. Tsakos and Michael Gordon Jolliffee in July 1993 and is headquartered in Athens, Greece.

Current Market Conditions:

The entire shipping industry has been struggling in recent years and that includes Tsakos. For example, Tsakos reduced its quarterly dividend to $0.05 per share (from $0.08) at the end of 2016. And the share price has been on the decline too, as shown in the following chart.

According to Tsako’s most recent quarterly earnings call:

“Navigating one of the weakest quarters in recent memory, TEN’s [TNP’s] operating strategy of keeping the majority of the fleet on long term contracts significantly benefited our revenues and protected us from the pressure the markets were applying on companies with heavy exposure to the spot market.”

Essentially, a big part of the reason Tsakos has been able to keep paying big dividends to investors is because it locked in long-term contracts with its customers. More specifically, as spot rates for shipping have declined dramatically in recent years, Tsakos keeps getting paid fairly well because it locked in higher rates. According to management:

“Our clear strategy to lock-in more than 70% of our fleet in long-term charters, early enough in the previous cycle, with a substantial portion of “profit sharing” agreements, has proved to be the right one. It has helped to create an invaluable buffer of healthy income in poor markets and plenty of upside going forward.”

For example, over the last quarter:

“[Tsakos’] fleet averaged $17,771 per day in time charter equivalent earnings against approximately $8,700 per day average market spot rates during the quarter. An outperformance by over 100%.”

These higher rates have made an enormous difference for Tsakos in terms of higher cash flows, and it has essentially helped the company keep paying those big dividends to investors. However, when long-term contracts roll-off Tsakos’ books, they’ll be forced to take whatever prevailing market rates are available, and those rates are currently much lower (this is essentially one of the big risks we’ll cover later).

Tsakos’ Cash Flow and Debt:

For more perspective on Tsakos’ cash situation, here is a look at cash flows from operations, capital expenditures, and free cash flow.

The good news is Tsakos keeps generating cash flow to support its debts and its big dividend payments. The bad news is, if market conditions don’t improve, cash flows from operations will decline significantly as Tsakos is forced to charter ships at whatever rates it can get when existing contracts expire, and those rates are currently considerably lower, as we described above.

Making matters more challenging, Tsakos has a significant amount of debt on its balance sheet coming due in the coming years, as shown in the following chart.

And if market charter rates don’t improve, it could become very challenging for Tsakos to keep supporting its debts and especially its dividends (debt is higher than equity in the capital structure, meaning they’ll cut the dividends just to support the debts, if need be).

One piece of good news for Tsakos is that it just completed a significant round of capital expenditures last year, and capex is expected to be lower in the years ahead; this will help increase free cash flow, and help support the dividend payments. In fact, Wall Street analysts covering Tsakos expect cash flows to be increasingly strong in the years ahead, as shown in the aggregate forecasts in the years ahead, in the following table.

Further, for what it’s worth, analysts have a positive outlook for Tsakos’ business and share price in the years ahead, as shown in the following analyst ratings chart (i.e. the average rating is a “buy,” and the average share price target is considerably higher than the current market price).

Why Are Market Conditions Expected to Improve?

Wall Street analysts and Tsakos management are both expecting market conditions to improve in the years ahead, and this is a big deal for the safety of the preferred shares and for the price (and dividend) of the common shares.

For example, according to George Saroglou, Tsakos COO, during the most recent quarterly call:

“Looking ahead with Q1 firmly behind us, the accelerated scrapping of late, the deceleration in global fleet growth, the positive global oil demand and the continuing increases in US crude oil exports, point to more favorable market fundamentals for Q2 and beyond. TEN’s [TNP’s] modern and diversified fleet with the ability to capture market upturns, puts us in a unique position to generate stronger revenues when markets turn while at the same time maintain and solidify our Company’s healthy financial position.”

As a more specific example, demand is expected to improve in the years ahead, for a variety of reasons (such as growth in China and India, as well as global GDP), as shown in the following graphic.

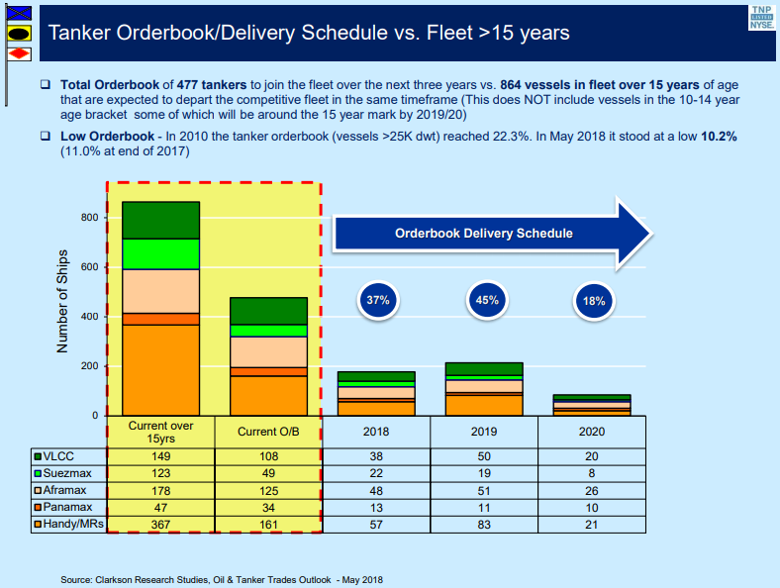

And as another example, the existing global fleet of tankers is old, which is expected to create demand for new charters going forward (i.e. this is good for Tsakos).

Further still, vessel scrapping is on the rise, which helps move supply and demand dynamics in Tsakos’ favor.

Tsakos’ Two Big Risks:

Simply put, we believe Tsakos’ two biggest risks are as follows.

1. Will spot rates rise enough...

...for Tsakos to enter new variable and fixed long-term contract rates with customers thereby enabling the company to refinance future debts before they become unbearable. As we covered earlier, charter spot rates are current less than 50% of what Tsakos is getting paid because Tsakos entered into long-term contracts when rates where higher. For some perspective, every $1,000/day increase in spot rates results in a $0.07 increase in earnings per share for Tsakos (from the fewer existing contracts that are based on spot rates, not long-term contracted rates).

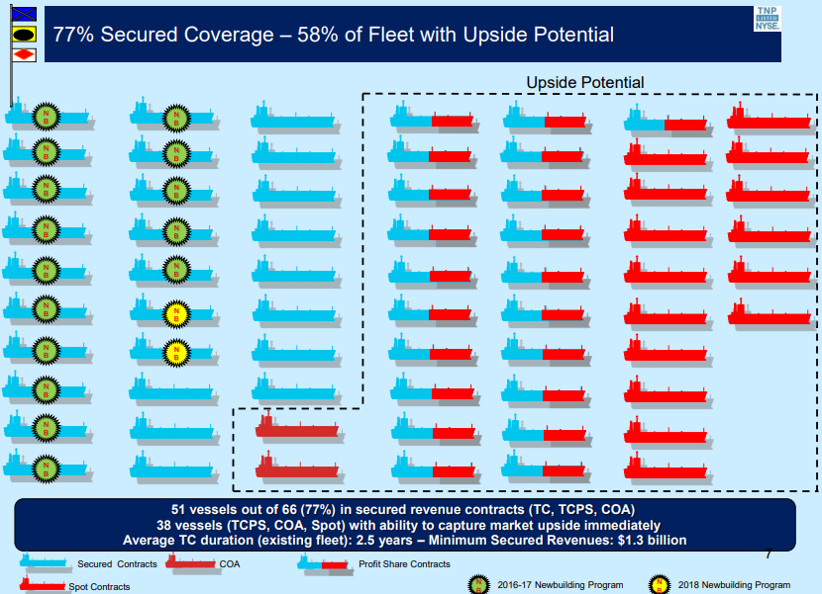

Recall that Tsakos’ existing higher rate long-term contracts will eventually expire, and if spots rates are lower at that time then Tsakos will have a tough time supporting the dividend payments. For more perspective, the following graphic shows the percent of Tsakos’ fleet under secured coverage, versus those at the mercy of spot rates.

What’s further, the above graphic points our that the average term contracts have a duration of only 2.5 years, which means if spot rates don’t rise soon then Tsakos will be dealing with big cash flow challenges at about the same time as a lot of their debt comes due for refinancing, as shown in our earlier debt maturity timeline graphic. This is the big risk for Tsakos.

2. Will supply and demand dynamics actually shift in Tsakos’ favor...

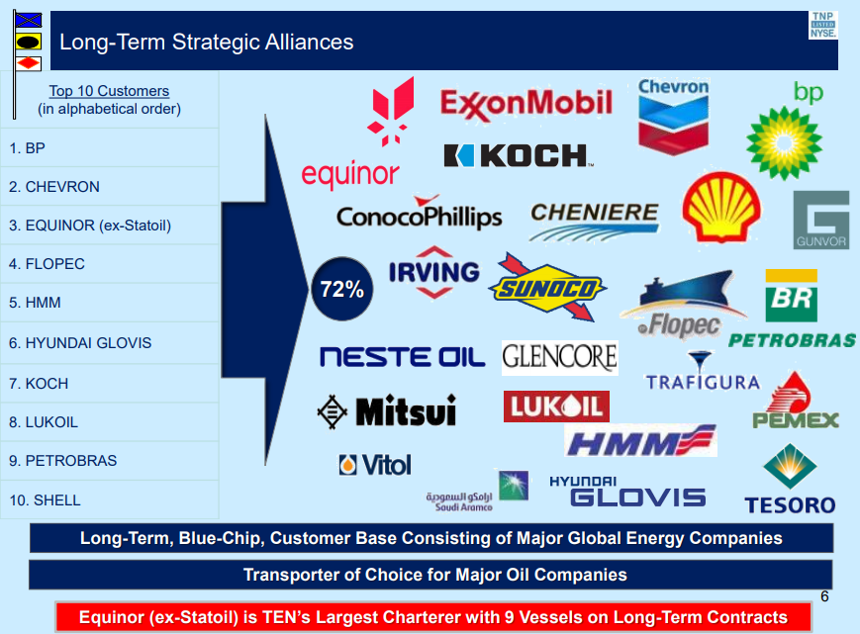

...as company and industry analysts are predicting? Said differently, even if spot rates improve, will there be enough demand to keep Tsakos increasingly healthy. Given Tsakos existing relationships with healthy blue chip customers, and considering the supply and demand dynamics described previously, we think Tsakos is likely to survive this downturn, and it may even grow its earning dramatically.

The Common Vs. The Preferred Shares:

There are a variety of differences between the common and various preferred shares that investors should be aware of before even considering an investment in any of them. For starters, the following table highlights some of the most important differences among the shares.

Regarding the five series of outstanding preferred shares, the yields are different for two main reasons. First, the series B and C have a “failure to redeem” clause (as highlighted in the table), which basically means that if they’re not redeemed by those dates, then the Tsakos must pay significantly higher dividends to investors (so it basically means Tsakos is going to redeem them prior to those dates). In fact, the two newest issues of preferred shares (series E and F) were likely issued simply to help pay off (redeem) the series B and C shares. Second, the Series E and F shares have a fixed -to-floating rate feature, as described in the table. This basically, means they have a little interest rate protection versus the non-floating-rate shares (remember, as interest rates rise, the price of preferred shares falls, all else equal). In a nutshell, if you’re going to invest in any of the preferreds for the long-term, perhaps skip series B and C because they’ll get redeemed (i.e. Tsakos will return your money) within the next 1 to 2 years, and also skip series D because it doesn’t have the fixed-to-floating rate feature, which is attractive if you think long-term interest rates are going higher.

However the far bigger difference is the one between the common shares versus the preferred shares. Specifically, the preferred shares all offer bigger dividends, but offer little opportunity for price appreciation; whereas the common shares price could increase dramatically (easily offsetting its lower dividend payments, many times over), and the common could actually increase its dividend payment too (in fact, if you look at dividend per share forecast from Wall Street analysts in our earlier table, they’re actually expecting the quarterly dividend to rise back to its previous $0.08 level from its current $0.05 level starting in the 4th quarter of 2019). Worth mentioning, the preferred shares dividends are cumulative and less likely to be lowered because the company would just have to make them up later assuming they don’t file bankruptcy, whereas its easier for Tsakos to reduce (or even eliminate) the common dividend, if need be, which they have already done in the recent past. Also worth mentioning, in a bankruptcy situation, both the common and preferred would likely get wiped out entirely, whereas the bondholders (not publicly traded, unfortunately) would likely get a significant portion of their money back (or at least they’d end up owing Tsakos’ ships because most of the debt is secured by assets).

Conclusion:

From an income-focused value-investor standpoint, Tsakos is a bet we’re willing to make, especially considering the market wide industry improvements that are increasingly expected by management and analysts. We currently own Tsakos common shares within our Blue Harbinger Income Equity portfolio because we like the hearty dividend plus the potential for very significant price appreciation in the years ahead. However, we’re not opposed to the idea of owning the preferred shares (we like series E and F), especially if your biggest focus is income, not price appreciation. Keep in mind that Tsakos is still very risky (as described in this article) and if you are going to invest, we recommend holding it as only one position within a more broadly diversified income-focused investment portfolio. For reference, you can view all of our current holdings here.