If you are an income-focused investor, you may want to diversify away from 100% common stocks and consider diversifying into some bonds and preferred stocks. This can reduce your risk, reduced volatility, and still pay you very attractive dividend and interest payments. This article highlights a variety of attractive high-income bonds and preferred stocks for you to consider. However, please keep in mind that because these investments offer higher income payments they may also involve higher risks. Investors should always consider their own personal situation before investing.

Without further ado, here is the list…

Frontier Bonds 2023 Bonds, Yield: 13.5%

A lot can be (and has been) said about Frontier Communications (FTR). The stock price has been one of the absolute worst in the market, the dividend has been cut, and the yield remains enormous thereby prompting some to say it is attractive while others believe it is an obvious value trap. Investing in Frontier’s common stock is simply too risky for us, but we do like some of the bonds.

We’ve written in detail above Frontier’s bonds on multiple occasions, as follows:

- Frontier: How To Play The Dividend Cut Fear

- Frontier: High-Yield Bonds, Big-Dividend Stock, Or Leveraged Options?

- Despite the Fear, We Like this High-Yield Investment

However, our basic thesis on Frontier bonds is that the company still has a lot of income-generating business, and they’ll be able to keep operating and supporting their debt load for multiple years to come. Further, they’ll cut that big common stock dividend again so they have more cash to support the bonds if they need to (debt is higher than equity in the capital structure). Further still, if Frontier files for bankruptcy, it’s likely not happening right away, and even in a bankruptcy, their cash generating businesses will likely be picked up by another telecom company, and so too might Frontier’s debt obligation. We encourage you to read more about our views on Frontier using the links we provided earlier, but in a nutshell, we like these bonds.

STAG Preferred (STAG-C), Yield: 5.3%

Stag Industrial (STAG) is a REIT, and a lot of investors love the common shares because the price performance has been terrific over the last two years, and the dividend is still big considering the dividend yield is 5.1%. We wrote about the attractiveness of STAG’s common shares back in 2016 when their price was much lower, in this article: Stag's Big Dividend: A Unique Risk Worth Considering.

But a lot of investors don’t realize STAG also offers attractive preferred shares for investors that still want a big dividend yield (the preferred shares currently yield 5.3%). Plus the shares have pulled back more than $1 from the 52-week high of $27.74), thereby making for a more attractive entry point, in our view. Remember, most preferred stocks have a face value of $25 (including STAG-C), so you won’t necessarily get the huge price appreciation on this one, but you will also avoid a lot of volatility considering the common shares always run the risk of pulling back significantly, in which case the big dividend would be more than offset by the price decline. If you’re looking for an attractive yield preferred stock, STAG-C is worth considering.

Prospect Capital Baby Bonds (PBB), Yield: 6.1%

We sold our common stock shares of Prospect Capital (for a very big gain) earlier this year, and we warned investors of the dangers before that stock (PSEC) crashed.

However, Prospect baby bonds (PBB) are still very attractive, in our view (if you don't know what we mean by "baby bonds" you can check out all the details here). Not only does Prospect have the financial wherewithal to keep paying its bonds, but if it runs into future challenges it will cut its huge dividend (to free up extra cash) long-before it ever defaults on its bonds. Further, the bond price has pulled back recently thereby making for a more attractive entry point, in our view (they trade at $25.83). You can read more about the terms of these bonds using the link above (or here). And if you are an income-focused investor, Prospect baby bonds are very attractive and worth considering.

Sabra Healthcare Preferred (SBRA-P), Yield: 6.7%

Sabra Health Care REIT (SBRA) owns and invests in healthcare real estate, and we believe the company's preferred shares are attractive.

Back in August, Sabra merged with Care Capital Properties (CCP) in an all stock deal. The transaction resulted in a credit rating upgrade to investment grade for Sabra. Here is a look at how the two companies' combined business looks...

One of the biggest risks for Sabra is its exposure to skilled nursing facilities because Congress keeps threatening to reduce the amount of Medicare reimbursement payments (among other things) it makes as part of the effort to "repeal and replace" the Affordable Care Act, and this could have a significant negative impact on Sabra. However, in reality, we believe this risk is overblown because Congress can't realistically reduce healthcare spending, they can only feasibly slow its rate of growth, in our view.

Now, if you like high income investments, but you're not comfortable with the uncertainty and volatility of Sabra's common shares, you might consider investing in Sabra's Series-A Preferred shares. For your consideration, here are the preferred share details from Quantum Online:

Sabra Health Care REIT, Inc., 7.125% Series A Cumulative Redeemable Preferred Stock, liquidation preference $25 per share, redeemable at the issuer's option on or after 3/21/2018 at $25 per share plus accrued and unpaid dividends, and with no stated maturity. Cumulative distributions of 7.125% per annum ($1.78125 per annum or $0.4453125 per quarter) will be paid quarterly on 2/28, 5/31, 8/31 & 11/30 to holders of record on the record date fixed by the board, not more than 35 days or less than 10 days prior to the payment date (NOTE: the ex-dividend date is at least 2 business days prior to the record date). Upon the occurrence of a change of control the company will have the option within 120 days to redeem the preferred shares at $25 per share plus accrued and unpaid dividends… Dividends paid by preferreds issued by REITs are NOT eligible for the preferential 15% to 20% tax rate on dividends.

Two important things to consider with regard to these preferred shares is that 1) they only trade at a small premium to the redemption price of $25 (the current price is $25.65), and 2) they are redeemable at the company's option in 5 months (on 3/21/2018). It's not yet clear if Sabra will redeem them on the earliest date, but if they do then you'll only receive two more dividend payment of about $0.445 each, minus the $0.65 cent premium the shares currently trade at. However, if Sabra does not redeem the shares, you'll just keep receiving the attractive 6.7% annual dividend in the form of quarterly dividend payments until they do redeem them (however there is no stated maturity date). If you are an income-focused investors that is averse to common equity volatility, then Sabra's preferred shares might be worth considering.

Variable Rate Preferred Stock ETF (VRP), Yield:4.6%

If you like the higher-yields and lower-volatility of preferred stocks, but you’re not comfortable with individual stock-specific risks, and you’re afraid that rising interest rates may depress the value of your preferred stock holdings, then you may want to consider the PowerShares Variable Rate Preferred Portfolio (VRP).

This particular ETF solves the stock-specific risk by giving you a diversified portfolio of preferred stocks. Specifically, it holds 124 different securities. Important to note, the majority of the preferred stocks in this portfolio are in the Financial Sector. This creates some sector specific risk for investors, but it still diversifies away most of the stock-specific risks. Also, the Financials sector is strong and healthy. For example, all of the US big banks are now passing the Federal Reserve’s stringent stress tests, and all of the big banks had their capital distribution plans (dividend increases and share buyback plans) approved by the Fed as well. Banks use dramatically less leverage than before the financial crisis, and they are dramatically safer than they were before the financial crisis. Plus, the overall economy is strong, and interest rates are expected to rise which will help banks be more profitable (i.e. the net interest margin will increase).

This portfolio also greatly reduces the risks associate with rising interest rates. For example, if you own fixed rate securities, and interest rates rise, then the value of your holdings will fall to mathematically increase the yield to market rates. This is the risk of owning bonds right now, and it poses a risk for preferred stocks too. However, this particular portfolio of preferred stocks have variable interest rates that rise when interest rates rise, and (to a very large extent) this solves the fear of the rising interest rate problem.

Other things to consider about this fund is that it has a decent market value (there is $1.9 billion of investments in this fund, up from $658 million of investments last June) which helps it achieve economies of scale and makes it safely viable. Also, the management fee on the fund is 0.50%. This is a reasonable fee for such a fund, but keep in mind you don’t pay any fee when you own individual preferred shares outright (instead of in a fund). Overall, if you’re looking for big, safe, diversified (across financials) yield that will rise when interest rates rise, this PowerShares Preferred Share ETF is worth considering.

Teekay Preferred Stock (TOO-B), Yield: 8.5%

We highlighted these preferred shares back in June when the yield was even higher than it is now: 10 High-Income Investments Worth Considering (see #7). However, Teekay’s preferred shares continue to offer very attractive yield, in our view. Here is what we wrote about them back in June, and it is still relevant today:

“If you are an income-focused investor, we believe Teekay’s Series-B preferred shares (TOO-B) are worth considering. The market dramatically overreacted to recent bad news (e.g. a cancelled contract by Petrobas, and a Morgan Stanley downgrade), and now the shares are cheap. The company is profitable, has significant cash flow, and can easily support the preferred share dividend payments (and can free up more than enough cash by cutting the common share dividend, if need be). Certainly there are risks (the market could turn south again), but the industry will eventually recover (demand continues to grow, and competition is lower as many firms have already filed bankruptcy). Teekay has plenty of financial wherewithal to keep supporting the preferred share dividends, and we expect the share price will rebound sharply, as well.”

If you don't know, Teekay Offshore Partners (TOO) is a provider of marine transportation, oil production, storage, and long-distance towing. We continue to believe the company's preferred shares (TOO-B) are attractive and worth considering if you are an income-focused investor.

Ferrellgas Partners 2020 Bonds, Yield: 12.6%

As we recently wrote in this article, Ferrellgas (FGP) is mainly involved in the retail distribution of propane. However, in recent years, it has been making efforts to diversify its business (into midstream energy) in order to support and grow its distribution. Unfortunately, this transformation got the company in trouble. Specifically, the company took on a lot of new debt in 2014 and 2015, just as energy prices started to nosedive. And not only did energy prices dive, but the US experienced unusually mild winters which meant propane demand also declined sharply. The combination of these two declines proved too much, and the company was forced to cut its distribution (thereby causing the stock price to tank).

However, we believe Ferrellgas' common shares are going to experience a powerful rebound as soon as we have a very cold winter. And more importantly, these 2020 Ferrellgas bonds are safe either way. Specifically, the company will cut the big dividend on the stock to free up cash to support the bonds, if they need to, and it is that large cash safety net that gives us even more confidence in the bonds.

Ferrellgas doesn’t announce earnings until December 7th, and expectations are very low because they announced disappointing earnings in each of the last two quarters (any positive news could send the stock and bond prices much higher). Ferrellgas is hoping for indications of a colder winter and higher propane prices, but either way we believe these bonds are safe, and worth considering if you are an income-focused investor.

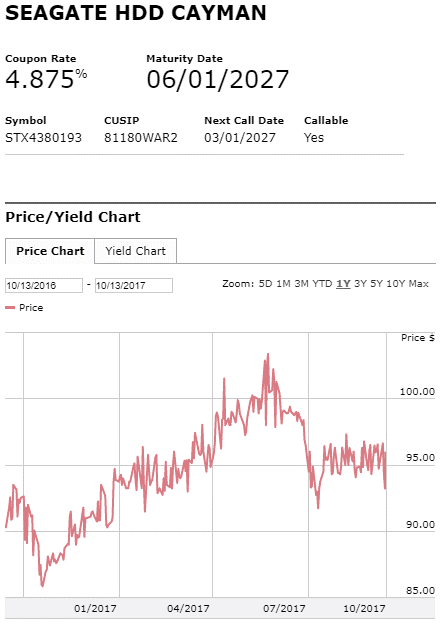

Seagate 2027 Bonds, Yield: 5.8%

These Seagate bonds are among the least risky on our list. And considering the price of these bonds has pulled back over the last quarter, they're offering a much more attractive entry point, in our view. The coupon is only 4.875%, but they trade at at discount to par (around 93 cents on the dollar) thereby bringing the yield up to nearly 6%.

Importantly, these bonds are very safe, in our view, and we expect the price to move back much closer to par (and even above par) well before they mature. earlier this year the price was slightly lower than it is now, but the price rose to well over par over the summer, before pulling back recently thereby making for a more attractive entry point for new investors (the bond price declined after the market overreacted to a couple disappointing earnings announcements).

If you don’t know, Seagate Technology (STX) is a provider of hard disk drives (“HDDs”). Bulls argue that Seagate is a free-cash-flow machine that easily covers its huge dividend (7.3% yield), and is poised to grow from the continuing proliferation of digital data and cloud customers. But Bears point to Seagate's lack of HDD competitive advantage, competitive threats from technologically improving solid state drives (“SSD”), and the large short-interest on Seagate's stock, all as warnings signs to stay away!

In our view, Seagate's business won’t grow in the future as rapidly as it did in the past, but the business certainly isn’t going to disappear over night. We believe this business will continue to generated powerful cash flows for many years, and it will easily support these bonds. And if the company does ever need more cash flow, they’ll simply cut the big dividend on the stock to free up cash flow to support the bonds (bonds take priority over stocks in the capital structure).

We continue to believe these bonds current price makes for an attractive entry point for new investors. You can read our earlier report about Seagate bonds here:

Navios Maritime 2019 Bonds, Yield: 12.1%

As we recently wrote in this article, this company’s stock (NM) and bonds have been steadily rising, and we expect that to continue right up to the maturity date in February of 2019, unless they get called before then (the earliest call date is 2/15/18, and the call price is $100). Considering the coupon on the bonds is 8.125%, and they trade at a discounted price of $95.20. the yield to maturity and the yield to call are both in the double digits.

One thing we like about these bonds is that maritime shipping industry is improving as the herd has been thinned and the business outlook improves. Plus, as we explained in our earlier report, Navios (NM) will use its sister entities to support its debt payments, something many investors don’t seem to appreciate fully enough.

Navios hasn’t yet released a specific earnings announcement date, but last quarter it was announced on 8/22, so three months after that puts them around 11/22. We’re expecting continued good news, and we believe these bonds continue to be attractive for new income-focused investors.

Tsakos Preferred (TNP-E), Yield: 9.0%

Tsakos Energy Navigation (TNP) is a provider of international seaborne crude oil and petroleum product transportation services. And Tsakos offers a variety of attractive preferred shares. In our view, the risks associated with this shipping company are decreasing, but the shares don’t yet reflect its improving prospects. Depending on your preference for dividends versus price appreciation, both the common and preferred shares are worth considering. We’ve owned the common shares within our Blue Harbinger Income Equity strategy since early 2016, and we believe significant price appreciation lies ahead. Further, we believe the preferred shares continue to become less risky and the high-yield is very attractive. You can review our full write-up on Tsakos’ Series-E Preferred shares from several months ago, in this article (the details are still relevant, and the current price of TNP-E remains attractive):

Conclusion:

We believe all of the bonds and preferred stocks highlighted in this article are attractive. They're not the typical big-dividend stocks you hear about, and of course there are risks (as there are with any higher-yielding investment opportunity). However, if you are an income-focused investor, you may want to consider some of these attractive opportunities for your diversified investment portfolio.

As a reminder, you can view all of our current holdings here.