This week’s members-only investment idea is an investment grade corporate bond with an attractive yield (nearly 6%). The stock of this company also offers a high yield (the dividend yield is over 5%), but we believe the risks associated with the stock are too high, and we actually prefer the bonds instead. Specifically, the long-term viability (>10 years) of the company is uncertain which makes the stock very volatile, but we believe the company will still easily generate enough cash flow to support the bonds...

Seagate Technology (STX)

Seagate Technology (STX) is basically a provider of hard disk drives (HDDs). Bulls argue that Seagate is a free-cash-flow machine that easily covers its huge dividend (5.2% yield), and is poised to grow from the continuing proliferation of digital data and cloud customers. But Bears point to Seagate's lack of HDD competitive advantage, competitive threats from technologically improving solid state drives (SSD), and the huge short-interest (-11.6%) on Seagate's stock, all as warnings signs to stay away! In our view, Seagate is certainly not filing for bankruptcy tomorrow, but its long-term viability is questionable, at best. We believe investors would be well-served to consider the risks and rewards of the stock, the bonds, and the options in determining how best to generate big profits from Seagate.

The Stock

Seagate just completed a blowout quarter, surpassing earnings expectations, and raising 2017 guidance.

And to the chagrin of short-sellers, the stock has gained nearly 30% this year, as shown in the following chart.

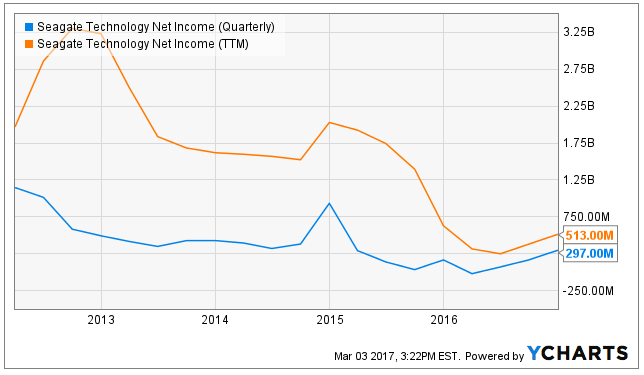

From a profitability standpoint, Seagate’s net income has improved over the last two quarters after being in a downward trend since 2012.

And following the recent “earnings beat” the Wall Street analysts came out with a typical string of reactionary price target increases.

And from a valuation standpoint, it’s easy to see how the price (currently at ~$49) could rise higher. For example, Seagate’s forward price-to-earnings ratio isn’t unattractive as shown in the following chart.

And the company’s continued strong free cash flows (cash from operations minus capital expenditures) keep income-focused investors confident that the dividend payments will keep rolling in safely.

However, uncertainty remains very high for Seagate. According to Morningstar, uncertainty is high based on…

“…risks associated with secular declines in PC sales, HDD cannibalization, and future pricing on both HDDs and SSDs. Demand for hard drives is cyclical and varies with macroeconomic factors such as personal disposable income and information technology spending at the enterprise level. Further, preference for tablets and smartphones also affects upgrades and replacement demand for hard drives in the computing market. PCs remain the greatest users of hard disk drives, and Seagate still derives the majority of its revenues from these devices. According to research firm Gartner, PC shipments in calendar 2015 fell by 8% and, more important, PC unit sales that incorporate HDDs (rather than SSDs) fell at a 22% pace. We expect that HDD-based PC sales will fall at a 19% pace in the long run.”

We agree that risks remain high, and for this reason Seagate stock is less attractive to us. We are not interested in chasing after Seagate’s big dividend yield because potential declines in the stock price could greatly overshadow any income provided by the dividend.

The Options

Selling put options is another way investors often consider to gain exposure to a stock. And in the case of Seagate, the premium is fairly attractive for selling puts (i.e. agreeing to buy the stock in the future if the shares falls to a low enough price). For example, as the following table shows, we can collect $1,040 in premium today, if we sell 1,000 put options on Seagate which entitles the buyer to put 1,000 shares to us at $43 per share (43,000) any time before May 19, 2017, as shown in the following table.

It’s like selling insurance in that we give the buyer the right to hedge their losses and sell the stock to us (at a lower price) if they’re afraid the stock price will decline. We keep the $1,040 in premium no matter what, and if the shares do get put to us then we’ll end up owning Seagate stock at a price that is more than 12% lower than the current market price. This is an attractive strategy if you like a stock (such as Seagate) and you want to “buy low.”

In our view, selling puts on Seagate is more attractive than buying the stock outright (because it provides income today and potentially allows us to own the stock at a much lower cost). And if the shares never get put to us then this is simply a way to generate extra income. As a reminder, investors have to keep extra cash in there account if they want to implement this type of bonds strategy, and extra cash can be a big drag on long-term performance. Alternatively, investors can use margin (borrowed money) if the shares get put to them, but using leverage introduces a whole new level of risk, and is generally inadvisable unless you are a well-seasoned investor (and even then it is risky).

The Bonds

However, we consider Seagate bonds to be even more attractive than the put options. For example, the following table shows outstanding Seagate bonds with a variety of coupons, yields, maturity dates, and terms.

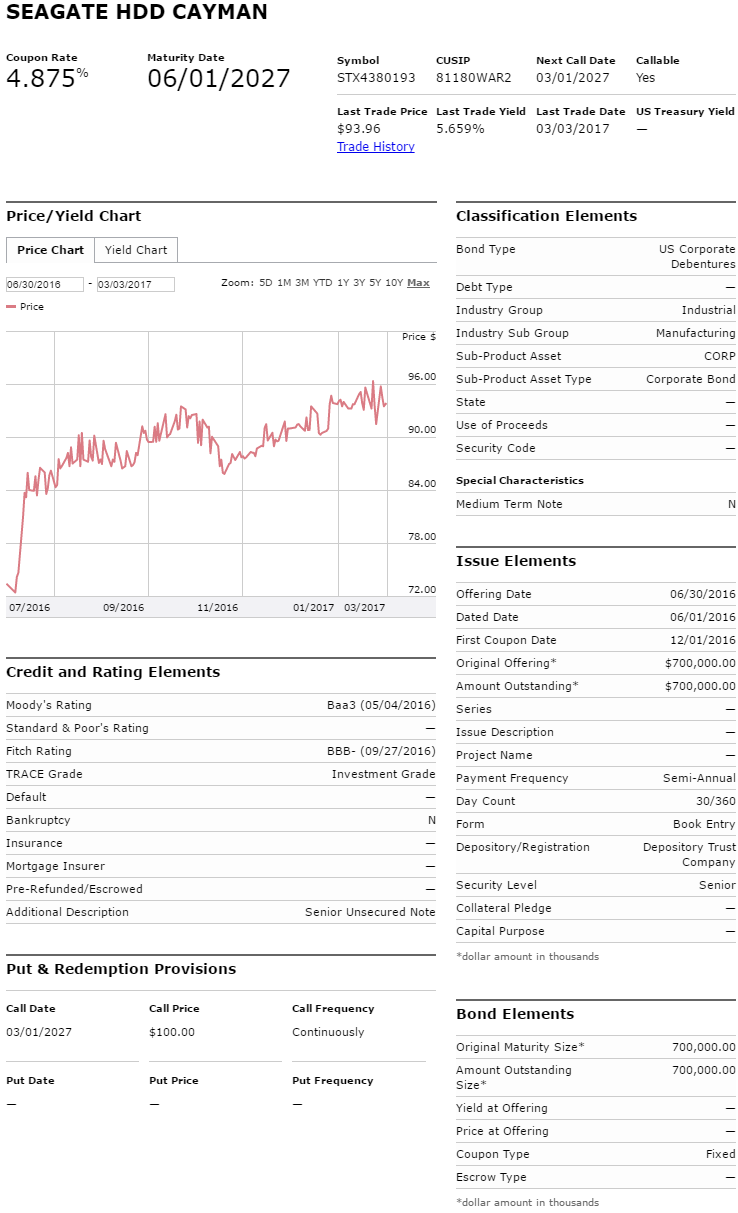

In particular, we like the 2027 bonds as shown in the following graphic.

These bonds offer a 4.875% coupon (paid semi-annually), and they trade at discount of 93.96 cents on the dollar which mean they’ll rise in value to their par value of 100 when they mature offering a total yield of 5.659%. And while an annual yield of 5.659% may not sound particularly attractive. We like it for a couple reasons.

First, we believe the bonds are “money good.” Even though Seagate’s stock price may rise or fall in the coming years, the company has plenty of business and cash to keep paying these bonds. Seagate’s business may be volatile, but they are not going out of business anytime soon. And even if they fall on hard times, they will cut their huge divided long before they stop paying these bonds (cutting the dividend frees up more cash to pay the bonds).

Second, Seagate’s business has been getting better, and these bonds may rise in value. They currently trade at a discount, but as they approach maturity and the market gains confidence in the company, the value of the bonds will increase. And as our earlier table shows, some of the earlier maturity Seagate bonds actually trade at a premium. This could happened to the 2027 bonds, and give us an opportunity to take profits sooner than their maturity date.

Conclusion

In our view, Seagate bonds are more attractive than Seagate stock and/or options because the bonds offer an attractive yield with far lower risk. And while we acknowledge that the 5.659% yield to maturity may be lower than the return on the stock market, the Seagate bonds will generate far higher income payments (the S&P 500 dividend yield is only around 2%) with far lower volatility, and this is exactly what some investors want.