Welcome Members!

Ideas are organized below.

View the Latest:

From rising defaults to low credit spreads, new regulation and competition (on two fronts), mainstream income-focused investors have grown a bit too comfortable (complacent) investing in the previously-niche BDC industry (which now faces bigger challenges, as the market cycle is coming full circle). This report will walk you through the challenges, with a special focus on industry stalwart Ares Capital (ARCC) (now trading at roughly book value and offering a big 9.4% dividend yield.

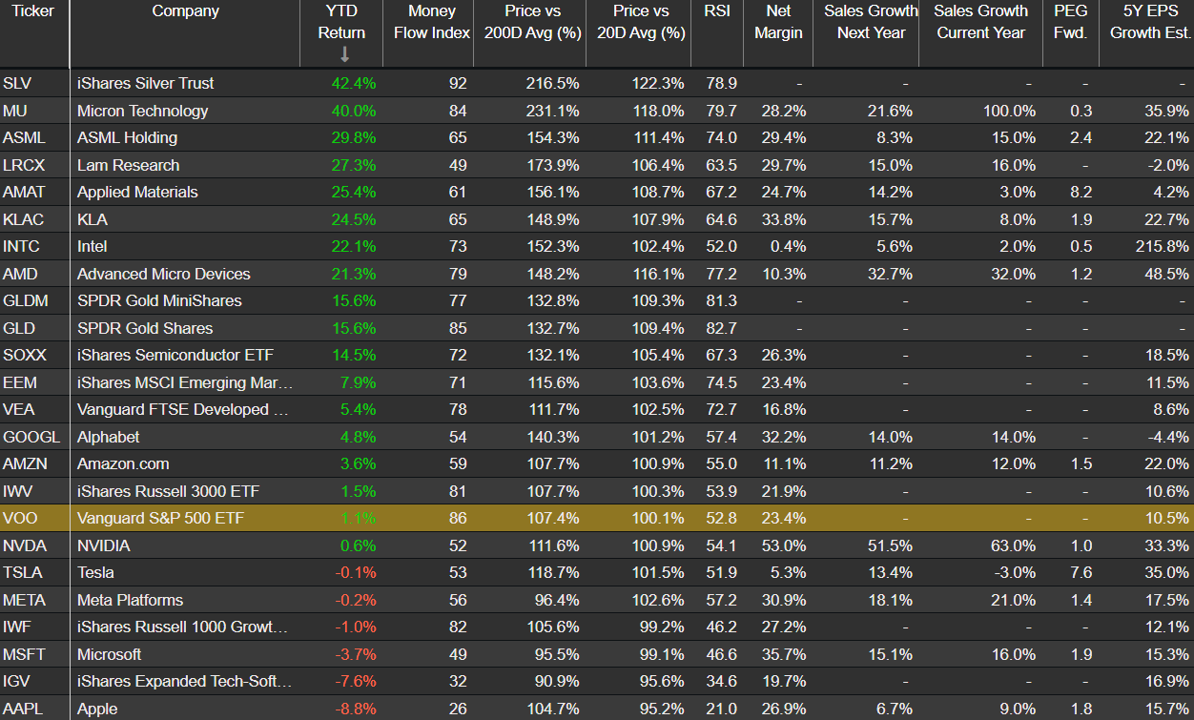

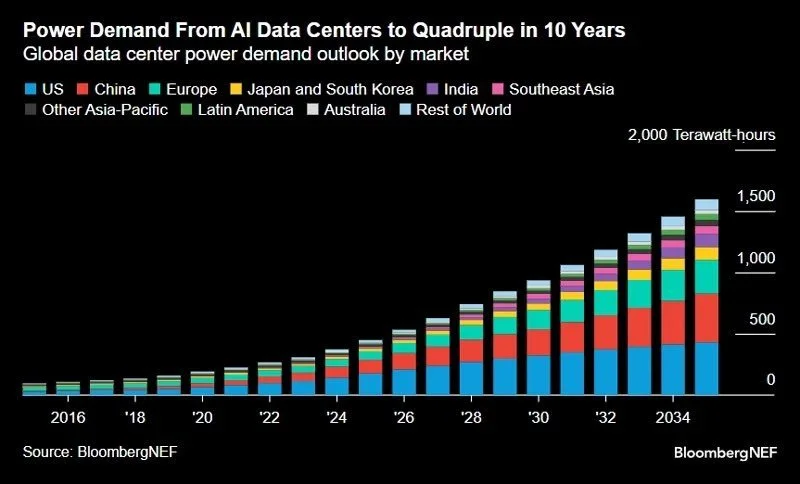

The 3 Biggest Megatrend Trades in the World are reflected in this table: (1) The Debasement Trade, (2) The AI Megatrend, (3) US Uncertainty.

The 3 Biggest Megatrend Trades in the World are reflected in this table: (1) The Debasement Trade, (2) The AI Megatrend, (3) US Uncertainty.

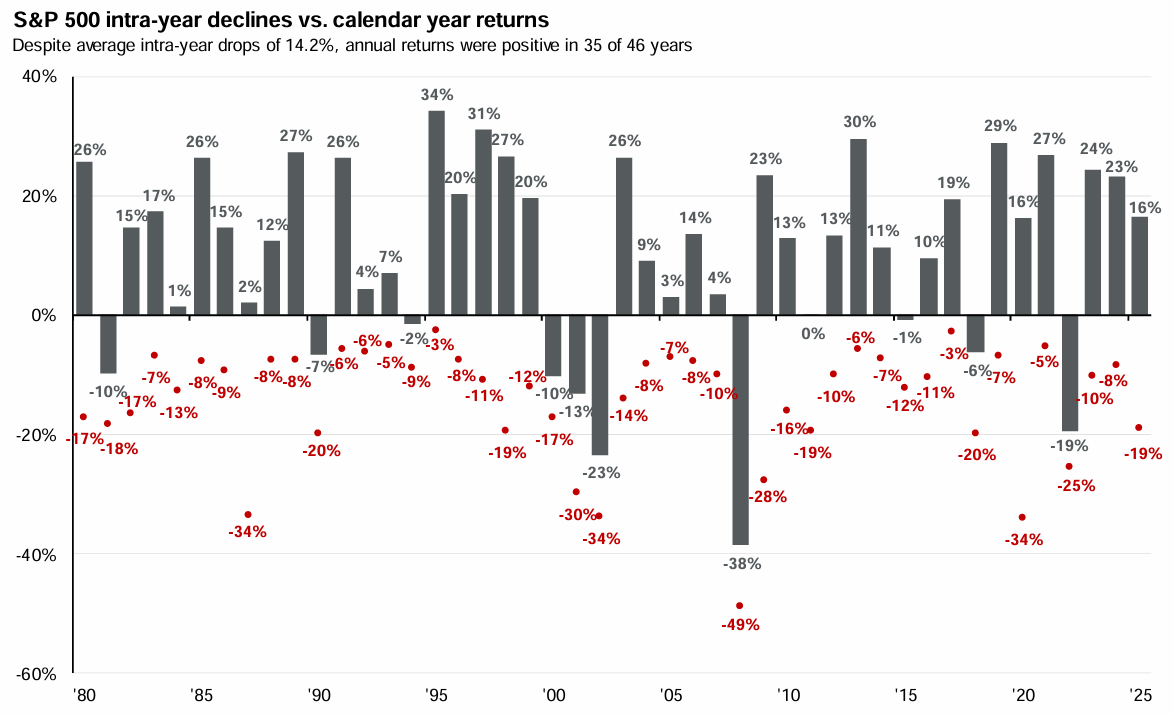

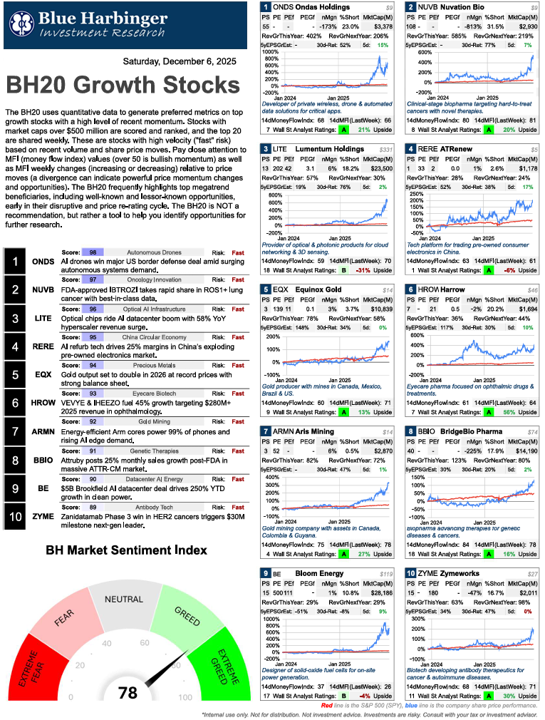

After 3 consecutive strongly-positive years for US stocks (see graph), 2026 is off to a healthy start, despite geopolitical risks (Maduro removed from Venezuela) macroeconomic political risks (the Trump administration continues to pressure Fed Chair Jerome Powell), as the BH Market Sentiment Index sits at 70 (Greed).

The BH Fear Index sits firmly in “neutral” (at 53) heading into the holiday week as stocks staged a late week rebound driven by a tech rally and cooling inflation data.

Despite the selloff on Friday (the S&P 500 declined 1.1% and AI-megacap Broadcom was particularly weak (-11%) after releasing lower margin expectations) the market remains in an uptrend and the AI trend is likely firmly intact (with more upside from industry leaders…

Almost like clockwork, when the BH Sentiment Index touched on "Extreme Fear" just 2 weeks ago, the market has come screaming higher as "they" bought the dip.

In yet another whipsaw move for the market, investors "bought the dip" driving the BH Sentiment Index from only 20 ("Fear") to now 55 in just one week. It's been a wild and unusual ride over the last 4 weeks as the market "Fear Index" (The VIX) spiked and is now falling, credit spreads widened a bit (and are now shrinking) and growth stocks have come roaring back after the market sold off following Nvidia earnings (which were very good) and now news that Google TCU chips are finding massive inroads with AI.

"Market Fear" is currently strong, as the BH Market Sentiment Index has fallen from 83 ("extreme greed") just 3 weeks ago to now 20 (teetering on "extreme fear"). The reason is multifaceted, but the market has posted significant gains in recent months (since "Liberation Day") and investors are increasingly concerned about an "AI Bubble," as well as an increasingly hawkish fed (creeping inflation fears) and unsettled trade agreements with South Korea (we import a lot of steel, semiconductors and cars (Kia, Genesis, Hyundai)).

Market "Greed" is tumbling, with the BH Sentiment Index falling from 83 two weeks ago, to 50 last week, and now only 38 (Fear). This is an increasingly attractive time to buy quality stocks that have sold off (be contrarian), however speculative growth stocks (e.g. the "AI/Growth Bubble") is at risk of falling further…

Market "Greed" is tumbling, with the BH Index falling from 83 a week ago ("Extreme Greed") to now only 50, placing sentiment firmly in the "Neutral" range as market participants try to make sense of tariff court cases, the ongoing government shutdown, and constant cries of a growth/AI stock bubble.

BH Fear & Greed Index: Markets regained momentum, confidence and "greed" over the last week as stocks remained near flat but regained their footing as money flowed in (MFI over 50 again for SPY), the VIX (market fear index) calmed down, credit spreads came down/ remain low, and treasury yields remained mostly neutral. Nvidia…

BH Fear & Greed Index: The market remains a bit jittery with the VIX slightly elevated and gold prices hitting record highs (gold feels a bit like a "meme stock" at this point). Sharing the updated BH Market Sentiment Index. From a high level, this market remains neutral to slightly greedy.

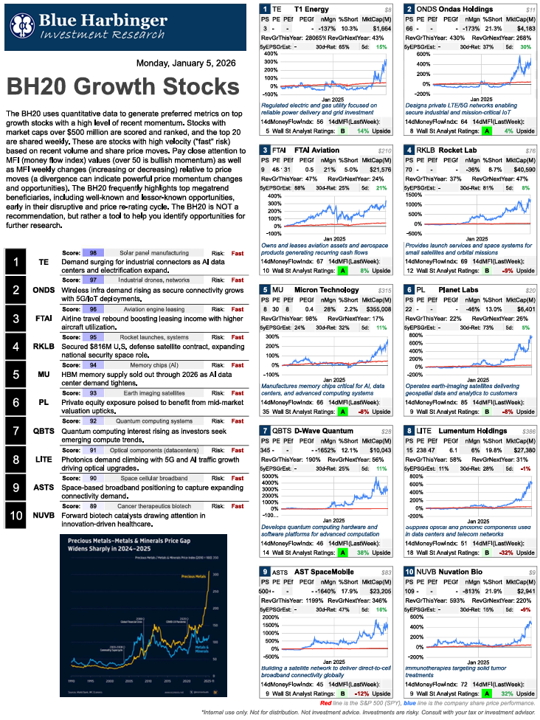

Sharing data on the latest holding in the extremely popular Dan Ives AI Revolution ETF (IVES). Considering the extraordinary popularity of AI combined with the non-stop public appearances of Ives (he is everywhere!) these stocks will continue to receive a lot of attention, especially from retail investors, and some of them rightfully so. Enjoy!

This post will fall on deaf ears, because, quite frankly, it is too sophisticated for most non-professional investors to understand. But it needs to be said. Long-term stock market investing is driven by the market more than your stock picks, and when you don’t know which stocks to buy (with some of your money), do NOT sit in cash, instead sit in a low-cost S&P 500 ETF. Your future bank account will thank you. Here is why…

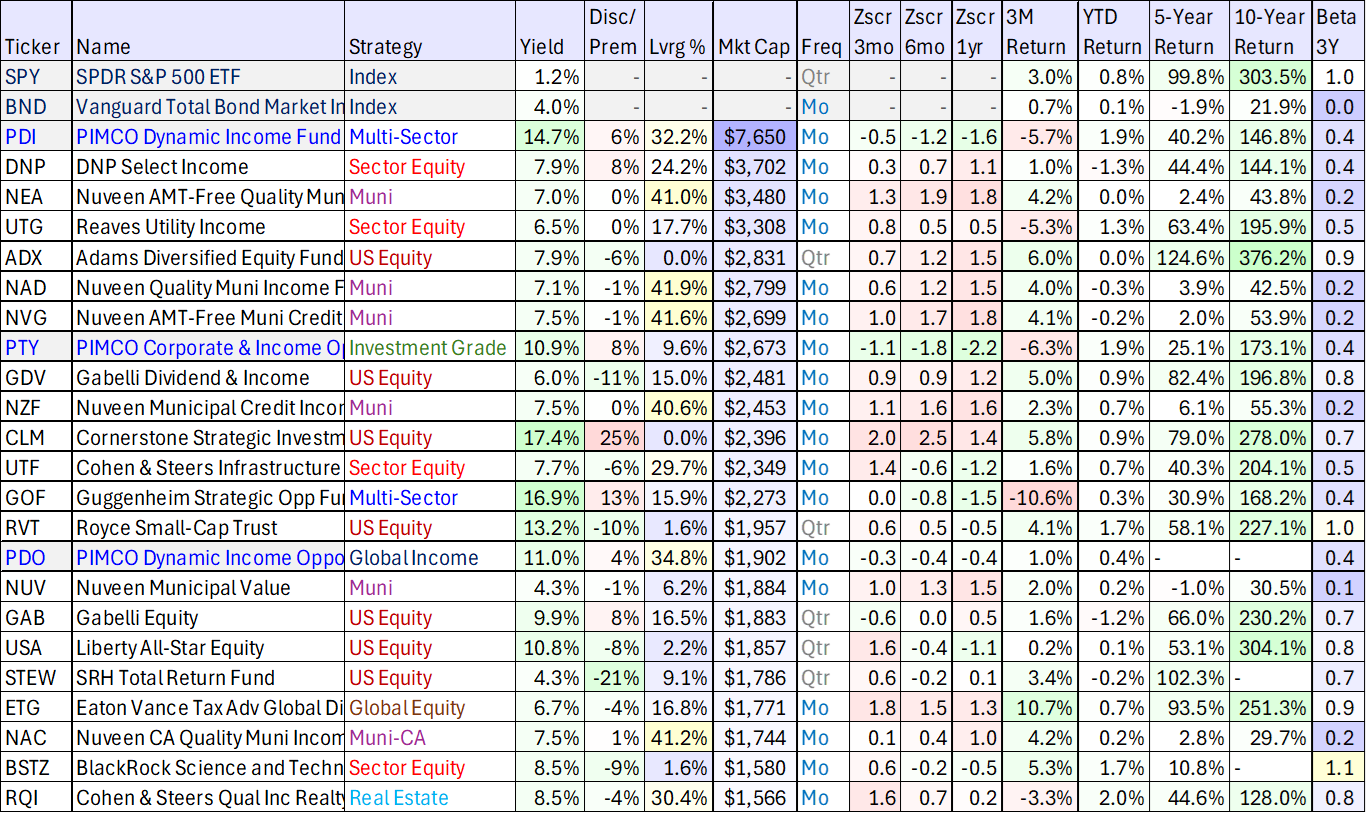

Quick Note: Cash Savings → High Income and Safety. Maybe it’s your emergency fund. Maybe it’s your savings for near-term expenses. The stock market is WAY too risky in the short-term, so where can you safely park your cash that also earns a decent yield? This report reviews two compelling options (Vanguard bond ETFs) for you to consider. I use them both regularly.

QUICK NOTE: Microsoft earnings are basically a “home run” for the AI megatrend, and they say a lot about the company. In particular...

Updates and Reports:

Members Mailbag: