Year after year, since the depths of the great financial crisis, growth stocks have outperformed their value counterparts. But something has changed over the last 6 months. The script has completely flipped. Once shunned value stocks (as well as small cap stocks and non-US stocks) are now leading the way (see charts below). And there is reason to believe this trend may continue—according to the same script academics have written about for many decades. Let’s dig in—to help you reflect on your own growth-versus-value allocations right now and well into the future. Your future net worth may thank you.

15 Years of Growth Dominating Value

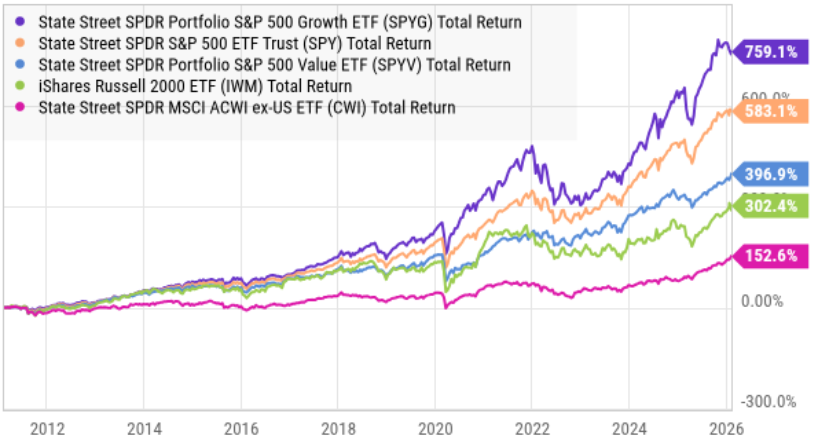

As you can see in the chart below, growth stocks (as measured by the S&P 500 Growth ETF) have posted dramatically superior performance as compared to value stocks. And for all practical purposes, value stocks also include small cap stocks (e.g. the Russell 2000) and non-US stocks (e.g. the MSCI All-Country-World-Index ex-US ETF).

Before reviewing “why,” it’s first worth briefly considering the difference between growth and value. In simplest terms, growth stocks are the ones with higher earnings growth expectations (often as measured by Wall Street analyst forecasts) and with higher valuation multiples (as measured by price-to-book value metrics, as per the index creators).

So in some sense it makes complete sense that growth stocks have dominated in recent years because of the extraordinarily loose (and stimulative) monetary policies in the US since the 2008-2009 Great Financial Crisis (“GFC”), as we will get into in a later section of this report.

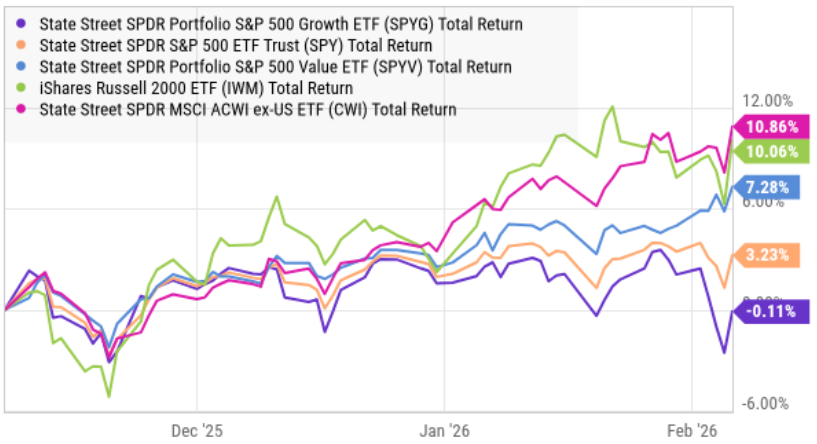

But first, let’ also consider what has happened to growth-versus-value dynamics over the last six months. As you can see in the following chart, the script has completely flipped with VALUE stocks (not growth) now completely dominating performance.

The big questions, of course, are “why” has performance reverted in recent months, and “is this a short-term anomaly or a long-term (or even permanent) reversal?”.

Why?

According to academics, such as Nobel-prize winning Eugene Fama (and his 3-factor model), value stocks DO outperform growth stocks over the long-term. But before anyone starts accepting academic research as market gospel (which it is not), it’s easy also to argue that Fama and the academic research was created during a historical time period where value did outperform growth for a reason, and those reasons are dynamic and not the same now as they were then.

Why has Growth outperformed?

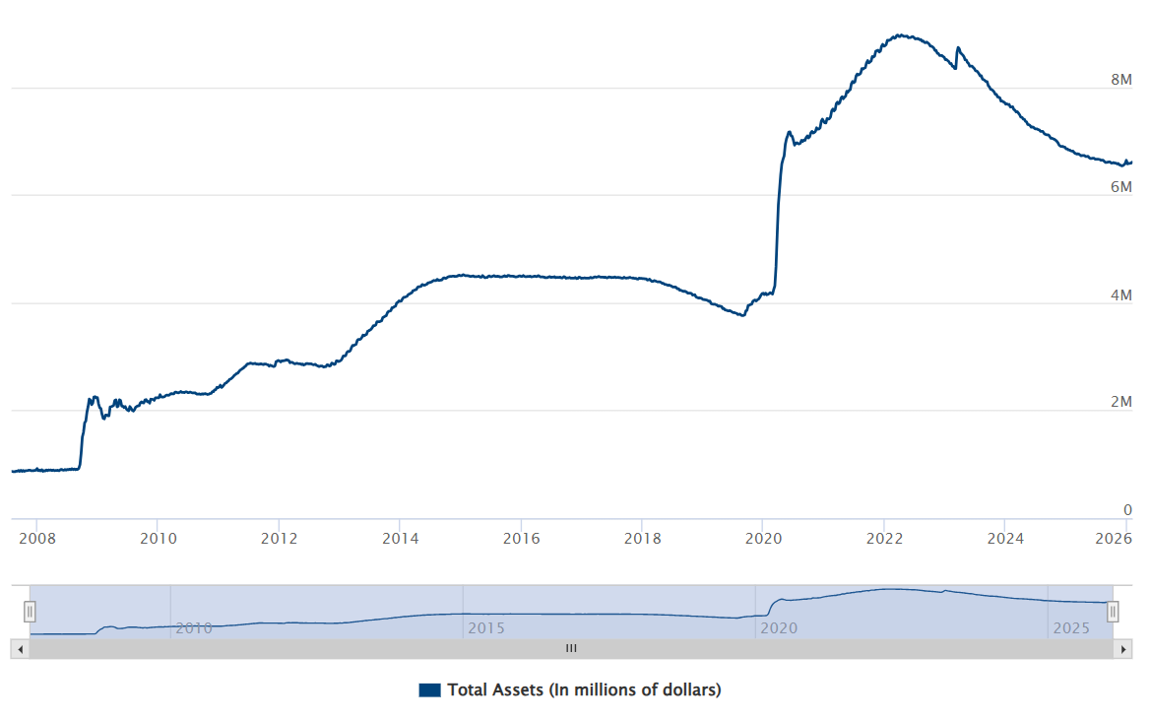

As mentioned earlier, growth stocks have arguably obviously outperformed value because of ultra loose and stimulative monetary and fiscal policies post the 08-09 GFC (and post-Covid too). Specifically, to get the economy out of its “near-death” funk, interest rates were cut to near zero and all kinds of quantitative easing and twisting occurred (as the Fed expanded its balance sheet) all designed to stimulate economic growth.

The government and central banks have basically tipped the scales to favor growth stocks by making it easier to fund growth through borrowing at low interest rates. And not surprisingly, disruptive growth stocks have dominated.

For example, you may recall the ridiculously strong performance of Cathie Wood’s now infamous ARK ETF (ARKK) which soared to absurd heights when the fed cut rates to zero after covid hit the economy. That result is not surprising considering the types of businesses/stocks in that fund are all about future growth/innovation, and that type of growth and innovation is spurred by being able to borrow money and raise capital for growth at basically zero cost (again, interest rates were near zero—that’s a pretty cheap borrowing rate—and it also inflates valuations to make it easier to borrow against higher valuations as collateral).

Low rates and quantitative easing created a powerful tailwind for growth stocks to dominate over value.

The Fed’s Balance Sheet

Over the last 24 months, as you can see in the chart below, the Fed’s balance sheet (which ballooned post-GFC and post-Covid, as they worked frantically to boost the economy) is now shrinking (and the chickens may be coming home to roost).

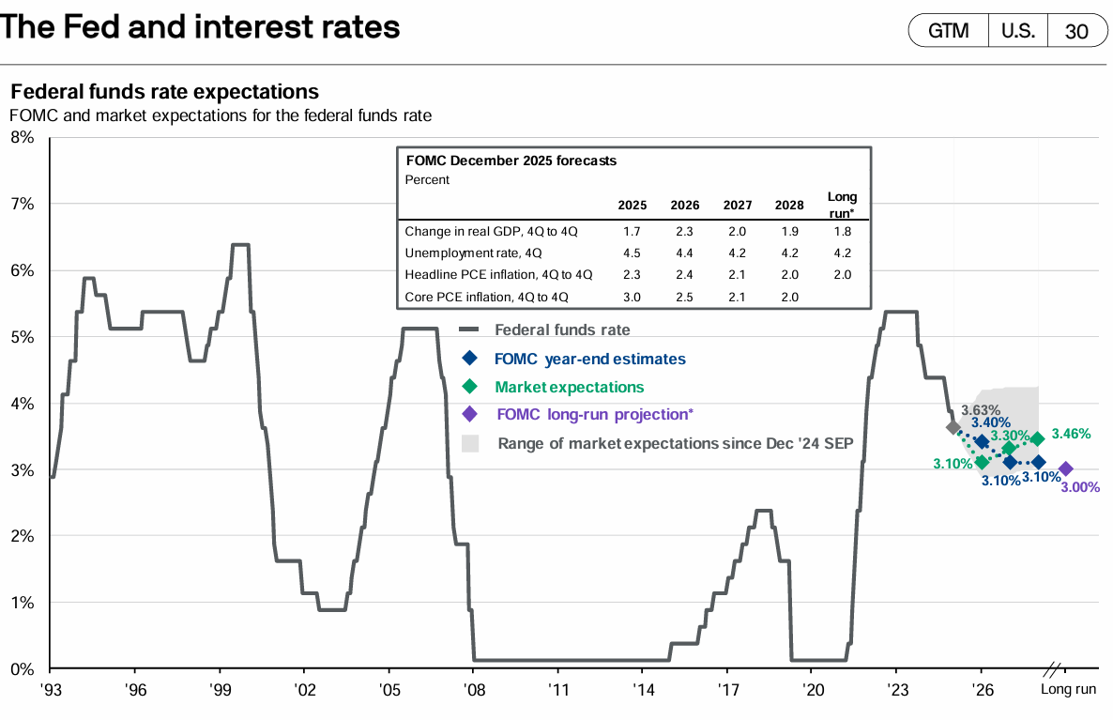

Also worth noting, interest rates are NOT as low as they were (as you can see in this next chart).

Basically, the monetary-policy stimulus is going away as the Fed’s balance sheet reverses course and as interest rates have risen (basically to combat the absurdly high inflation that easy monetary and fiscal policies created in the first place—yuck!).

The Good News for Growth Stocks

Despite the underperformance of growth stocks versus value stocks in recent months, it’s not all bad news for growth.

For example, interest rates have actually been trending lower in recent months—a good thing for economic growth and growth stocks.

Additionally, certain growth stocks have built such incredible competitive advantages and moats (over the last decade) to protect themselves from competition—they are still in really good shape—from a business standpoint, as I recently wrote about in detail here:

Further still, valuation is never going to be overly cheap for growth stocks, considering they have higher expected growth rates—as a lot of growth stocks are very attractively priced from a valuation standpoint as I wrote about in the link above.

Further, the market has pulled back recently, and is acutally starting to get a bit fearful—traditionally a GOOD time to buy (i.e. “buy low, sell high”).

The Bottom Line

At the end of the day, you need to do what is right for you and your personal situation. Not everyone needs to chase S&P500-beating performance every year—sometimes a lower volatility mix of diversified stocks and bonds is the best strategy (instead of going all in on volatile and speculative stock market “bets”).

And along those lines, now may be a very good time to doublecheck your own mix of growth-versus-value stocks in your own personal portfolio. If you have been dramatically overweight growth stocks over the last decade—that has likely paid off handsomely for you. And if you are jealous of growth stock performance over the last decade, now may not necessarily be the best time to go “all in” on growth (despite the fact that interest rates are trending lower, the fed’s balance sheet is shrinking and fiscal-and-monetary stimulus “ain’t” what it used to be).

For me, I know prudently diversified, goal-focused, long-term investing continues to be a winning strategy. And if your performance is different than the S&P 500 in recent months—you might want to doublecheck your growth-versus-value allocations and make sure they are right for you.

I am still very long the stock market—and looking forward to continuing powerful long-term gains and compound growth ahead.