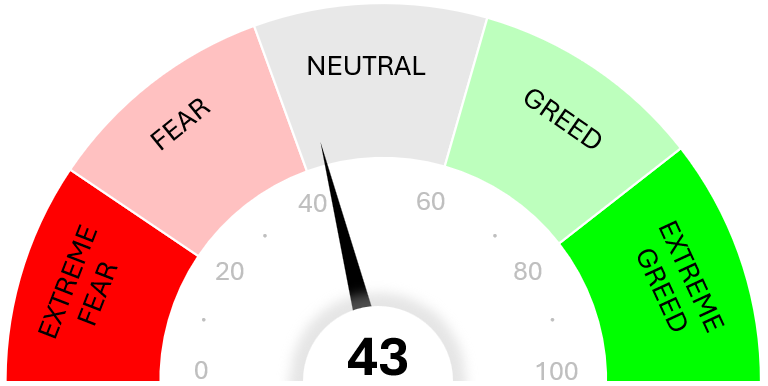

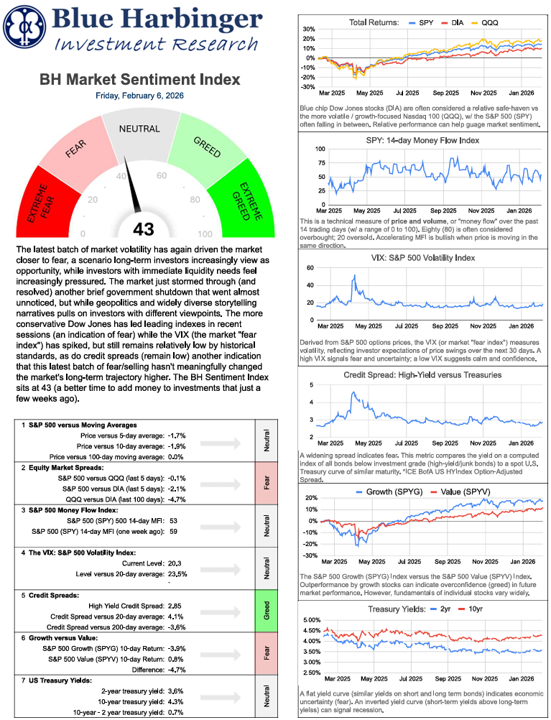

The latest batch of market volatility has again driven the market closer to fear, a scenario long-term investors increasingly view as opportunity, while investors with immediate liquidity needs feel increasingly pressured.

For starters, the market just stormed through (and resolved) another brief government shutdown that went almost unnoticed. Yet geopolitics and widely-diverse storytelling narratives pull on investors with different viewpoints.

The more conservative Dow Jones has led leading indexes in recent sessions (an indication of fear) while the VIX (the market "fear index") has spiked, but still remains relatively low by historical standards, as do credit spreads (remain low) another indication that this latest batch of fear/selling hasn't meaningfully changed the market's long-term trajectory higher.