From rising defaults to low credit spreads, new regulation and competition (on two fronts), mainstream income-focused investors have grown a bit too comfortable (complacent) investing in the previously-niche BDC industry (which now faces bigger challenges, as the market cycle is coming full circle). This report will walk you through the challenges, with a special focus on industry stalwart Ares Capital (ARCC) (now trading at roughly book value and offering a big 9.4% dividend yield.

What is A BDC?

A BDC (Business Development Company) is a type of publicly-traded (or non-traded) closed-end investment company created under the Investment Company Act of 1940 to provide financing (primarily senior secured loans and equity) to small and mid-sized private companies (that are typically underserved by traditional banks).

To avoid corporate taxation, BDCs are required to distribute at least 90% of their income as dividends—which makes them an income-investor favorite (often yielding 7% to 10%, or more). In exchange for this favorable tax treatment, BDCs must also follow strict regulatory leverage limits and portfolio diversification requirements.

Why is Ares Capital (ARCC) Special?

Ares Capital Corporation (ARCC) is the largest publicly-traded BDC (by market cap) and one of the most well-established (with over $20 billion in assets and a track record of strong performance since its 2004 IPO). It benefits from Ares Management's massive origination platform, which allows ARCC to access high-quality middle-market deals, maintain strong portfolio diversification, and keep non-accrual rates relatively low compared to peers. ARCC trades at or near book value (P/B ~1.0x), delivers a healthy 9–10% forward dividend yield (with minimal cuts historically), and has delivered strong long-term total returns (280% over 10 years), making it a top choice for many income investors.

What are the BDC Industry Risks?

However, Ares is currently facing many of the same risks and challenges confronting the entire BDC space, such as:

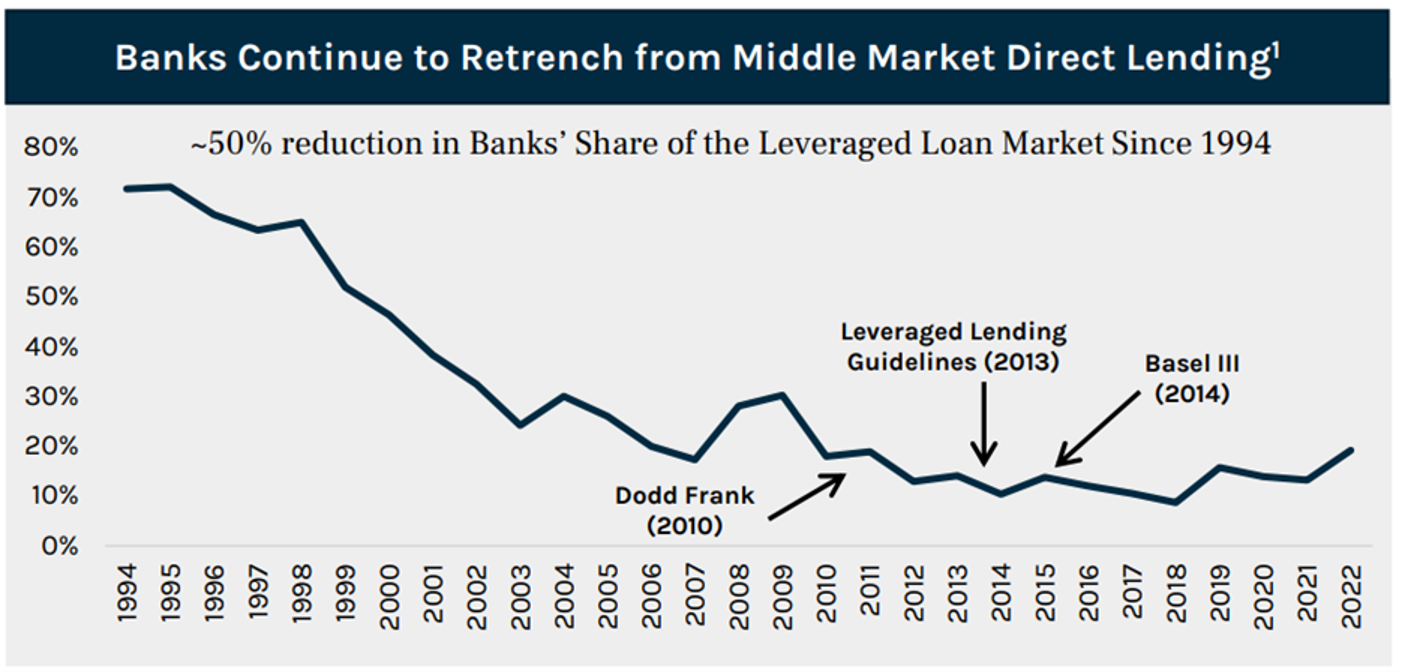

Competition has Grown: Following the Great Financial Crisis (“GFC”) in 2008-2009, BDCs were a niche industry and many individual BDCs were in the right place at the right time. Competition was low in this industry, but opportunities were high as new GFC bank regulations and reserve requirements forced many big banks to exit the space and thereby leaving lots of opportunities for BDCs to prosper. Not to mention, BDCs were providing exactly what a lot of investors were looking for (big steady income) at a time when income was uncommon (as the fed had cut rates to near zero) and steadiness was also uncommon (the market was going through a period of extraordinary volatility).

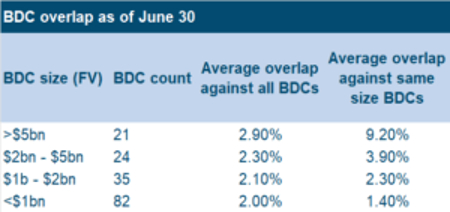

However, in the years since the GFC, BDC competition has grown as the BDCs themselves have become larger and there are more of them competing for the same opportunities (which can pressure yields lower and risk higher—yuck!). In what was once a niche industry, a lot of income-focused investors may be a little too comfortable (complacent) with the risks involved in the industry.

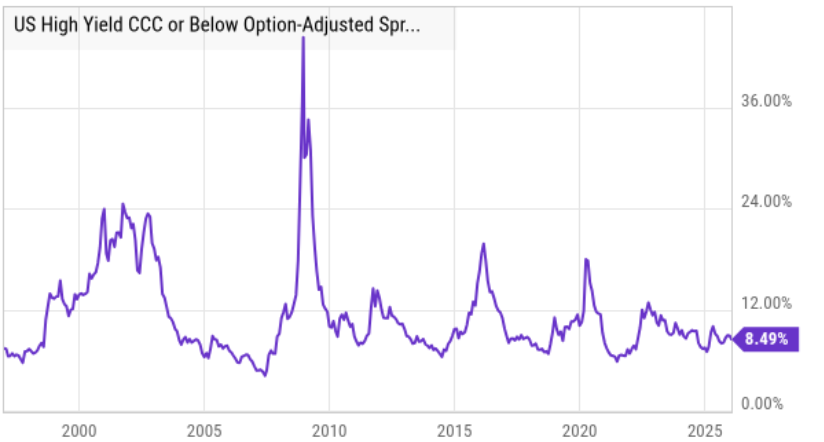

Credit Spreads are Low: Continuing with the complacency theme, credit spreads are also low, an indication that many investors are comfortable with higher risk loans (such as the ones BDCs make). When credit spreads are low, investors aren’t being compensated as much for the risks they are taking, relative to history (as you can see in the credit spread chart below).

And for a little more color, direct lending yields fell below 10% for the first time in three years (according to CreditSights) an indication that the industry is shifting. What’s more, with the fed on a rate cutting cycle, some BDCs will face even more pressure than others on a fixed-versus-floating rate relative comparative basis.

Negative Regulatory Shifts: Adding to the list of challenges BDCs currently face, in December 2025, the OCC and FDIC rescinded the 2013 Interagency Guidance on Leveraged Lending (and 2014 FAQs), deeming it overly restrictive. The guidance had scrutinized high-leverage loans (e.g., >6x debt/EBITDA), limiting banks' participation and shifting market share to nonbanks/private credit (e.g. BDCs).

However, banks must now manage leveraged lending under general safe-and-sound principles. This allows more aggressive competition at higher leverage levels, potentially eroding private credit's pricing/volume advantage in middle-market and sponsor-backed deals. This does NOT bode well for BDCs as the market cycle is coming full circle (back toward the pre-GFC landscape that made BDCs less attractive as compared to some big deep-pocketed banks). The Fed has not necessarily joined yet, but broader deregulation aims to bring activity back into regulated banking (again, not good for BDCs, already facing heightened competition just among themselves).

Rising Defaults: Despite low credit spreads, we are seeing some rises in default rates (some view this as idiosyncratic, others view it as systemic). For example, BlackRock TCP Capital (TCPC), a publicly traded middle-market lending fund, recently announced a roughly 19% decline in its net asset value per share, primarily due to write downs on troubled loans. Some investors view this significant markdown as indicative of mounting pressures in the private credit space (amid rising non-accruals and portfolio stress).

Dangerous Private Fund Redemptions: Further compounding stress, we have seen a recent wave of redemptions in the private credit fund space, which does have spillover repercussions on publicly traded BDCs (some more than others).

For example, redemptions in non-traded private credit vehicles spiked in late 2025, with quarterly requests reaching 4–6% for most large platforms and spiking to 14–15% at Blue Owl Technology Income (OTIC).

This creates challenges in multiple ways, ranging from forced asset sales (at unattractive prices) to meet liquidity needs. And this is especially problematic as many private funds and public BDCs invest in the same loans.

This can be especially problematic when an investor (such as Blue Owl) owns a lot of the same loans in its private funds and publicly traded BDCs because it creates volatility from potential arbitrage opportunities (as public BDC prices update daily whereas private funds may not update valuations as frequently as they honor redemption requests).

Current BDC Valuations

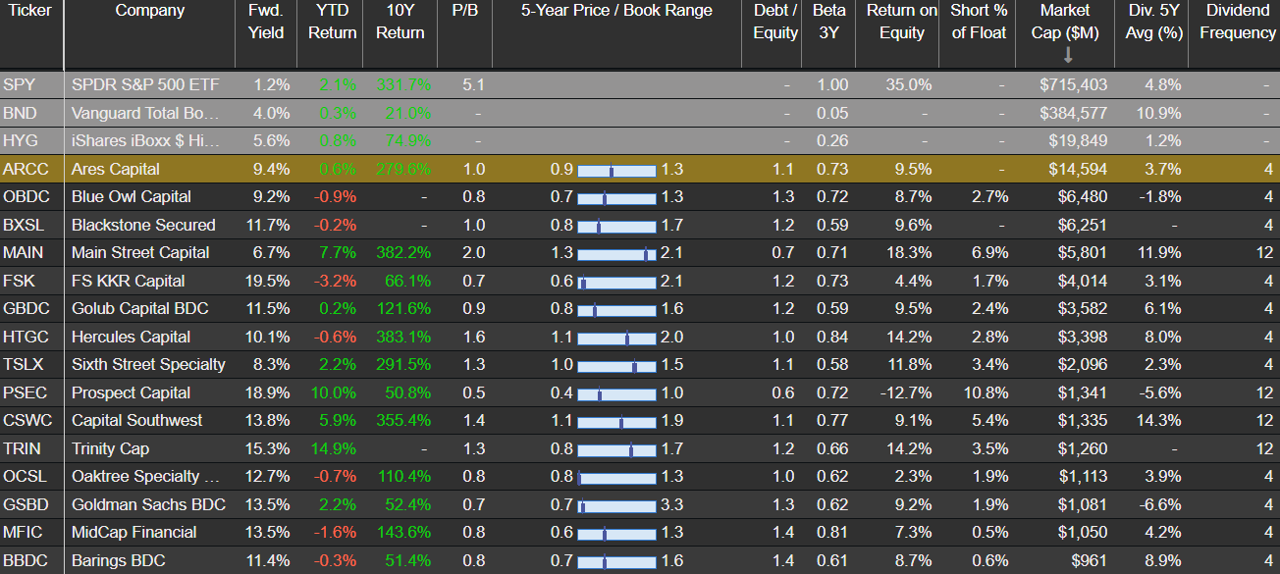

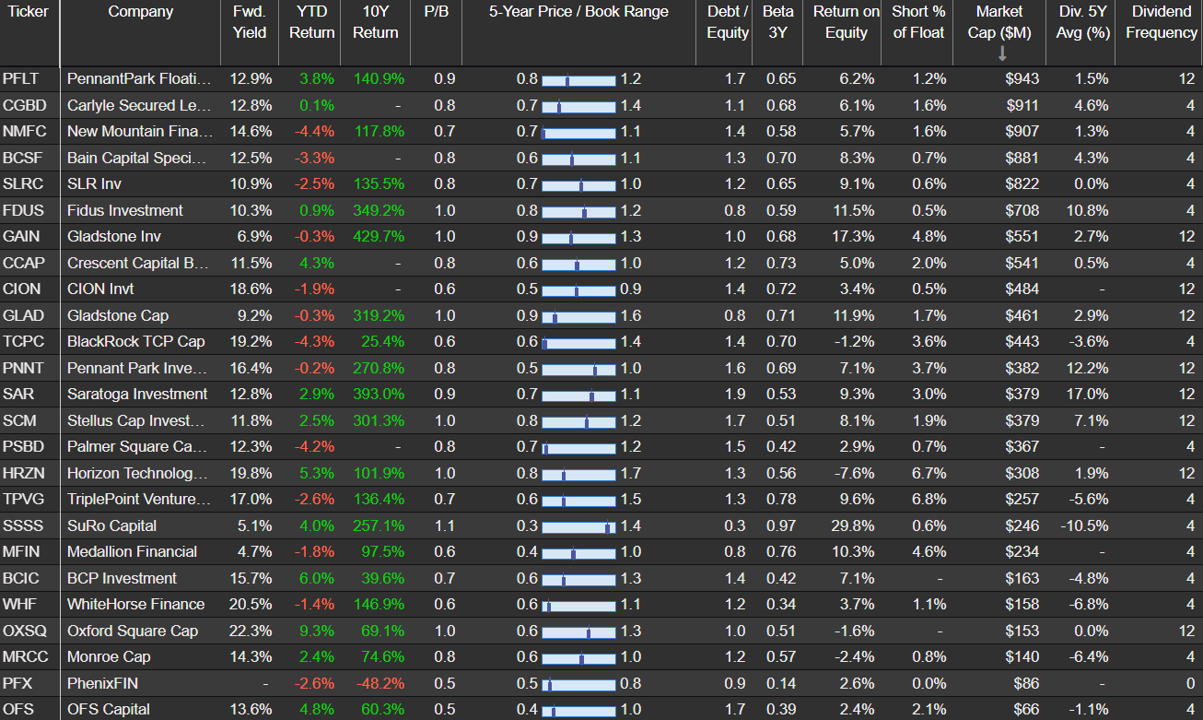

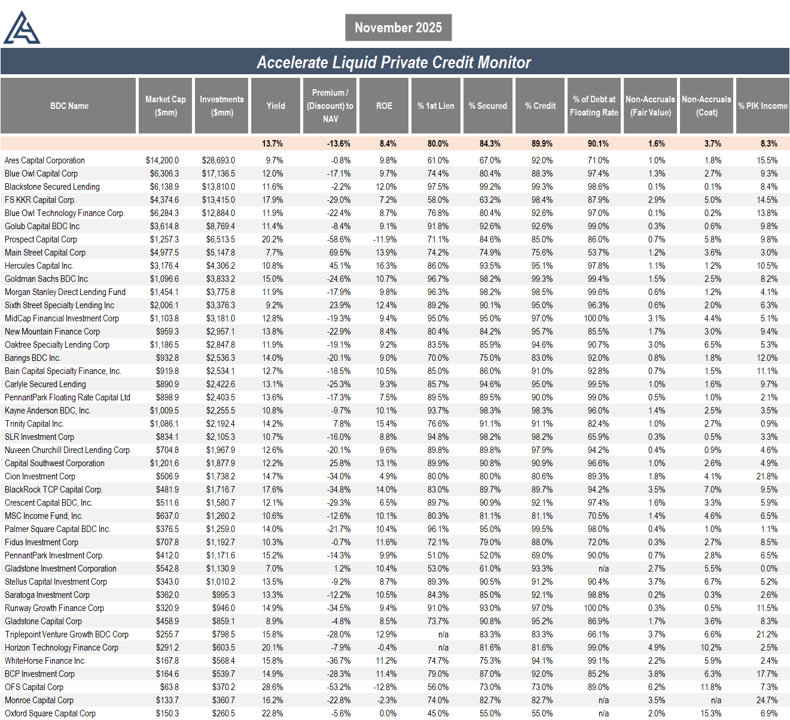

A lot of BDCs currently trade at lower price-to-book values than their historical range, as you can see in the BDC comparison table. For example, Ares trades at roughly par (price-to-book value equals 1x) whereas risky names like Blue Owl are trading at discounts to book value (recently 0.8x).

It’s important to recognize, not all BDCs are created equally. In fact, they vary widely in terms of types of loans (for example, safer first-lien loans, and the level of non-accrual or non-paying loans), as you can see in the following table.

Additionally, larger BDCs (such as Ares) or niche BDCs (such as Main Street) may have stronger and more extensive relationships with borrowers, thereby giving them a significant advantage versus the competition.

The Bottom Line

The BDC industry continues to evolve, especially as competition has grown since the GFC and now as big banks may increasingly re-enter the space due to loosening regulation. And just because a BDC is “cheap” that doesn’t mean it is an attractive investment. Sticking with BDCs with a significant competitive advantage (such as Ares impressive scale and extensive borrower relationships) makes a lot of sense (especially when the valuation, such as Ares’ current 1.0x p/b) is compelling.

I continue to own Ares and Main Street (as I have written about in the recent past), and I will continue to stay away from the smaller BDCs (unless they have some unique niche or competitive advantage).

BDCs can still be a critical component of a prudently diversified high-income portfolio. But you need to be cognizant of market dynamics and do what is right for you.