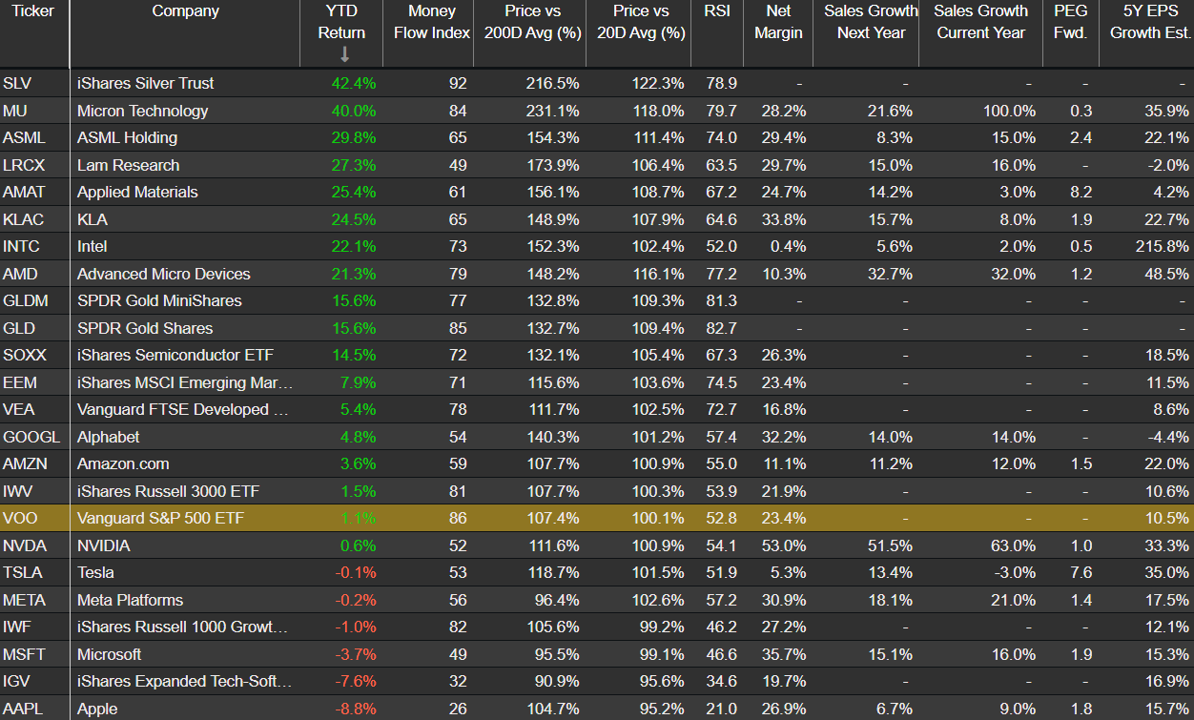

The 3 Biggest Megatrend Trades in the World are reflected in this table:

(1) The Debasement Trade:

People don’t trust fiat currencies because of excessive monetary policy. Gold and Silver are overbought on traditional technical metrics.

(2) The AI Megatrend:

AI Chips are taking over the world as people are addicted to Apps powered by semiconductors.

(3) US Uncertainty:

For the first time in over a decade, non-US stocks are gaining ground on US stocks (2025 and 2026 ytd) as US debt grows and the US president “renegotiates” trade policies.

Some “contrarians” salivate at the pullback in Mag 7 stocks (relatively weak this year) and “old guard” software stocks (lagging the market hard (in 2025 and 2026ytd—e.g. ServiceNow (NOW), Adobe (ADBE) and Salesforce (CRM)).

Others still see gold & silver as having strong momentum.

Technically speaking…

MONEY FLOW INDEX: A technical measure of price and volume, or money flow over the past 14 trading days with a range from 0 to 100. An MFI value of 80 is generally considered overbought, or a value of 20 oversold.

RELATIVE STRENGTH INDEX: Relative Strength Index (RSI) is a technical indicator that compares the magnitude of recent gains to recent losses over the past 14 trading days. A value of 70 is generally considered overbought, or a value of 30 oversold.