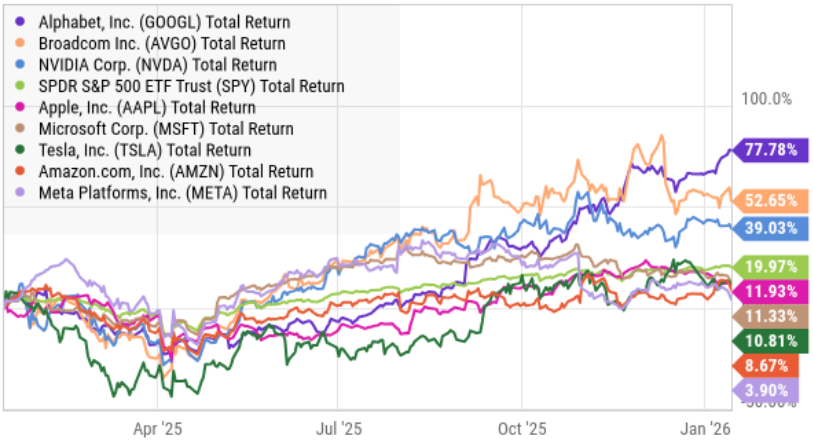

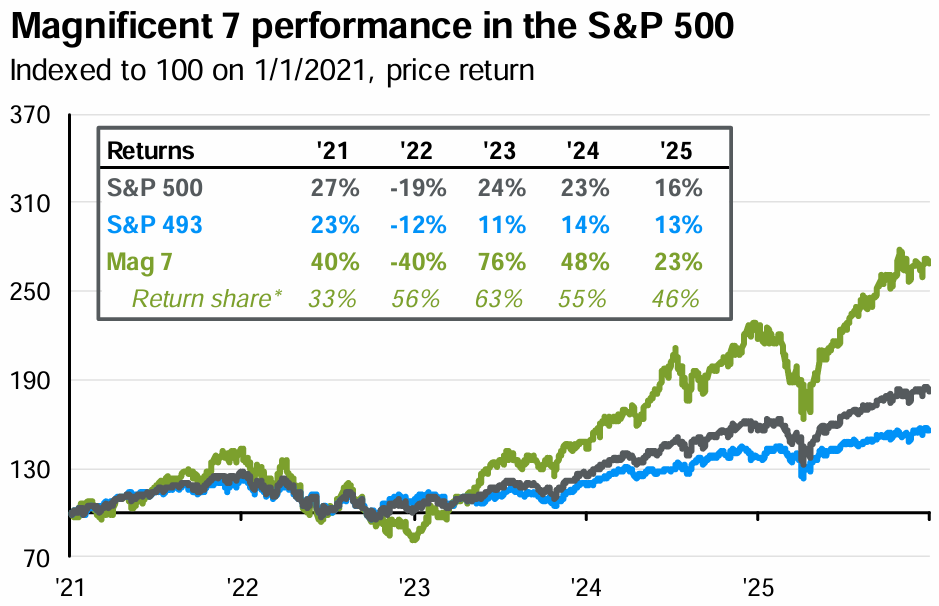

Alphabet stock (GOOGL) is up 76% over the last year, and the gains are driven by several of the same market themes (e.g. the cloud, AI and ecosystem) fueling the “Magnificent 7’s” dominance versus the rest of the S&P500. Alphabet has been a stalwart position in my portfolios (especially since the overblown narrative that ChatGPT would overthrow Google’s search dominance), and I’m sharing this report to help readers formulate their own forward-looking opinions. Specifically, this report ranks the Mag 7, including a special focus on Alphabet, and then concludes with my strong opinion on portfolio positioning going forward.

Google’s Big Rally: The Mag-7 Megatrend Themes Making It Possible

For starters, Google shares have soared more than 76% over the last year (see table below), and the gains have been driven by many of the same overarching themes benefiting the Mag 7, such as:

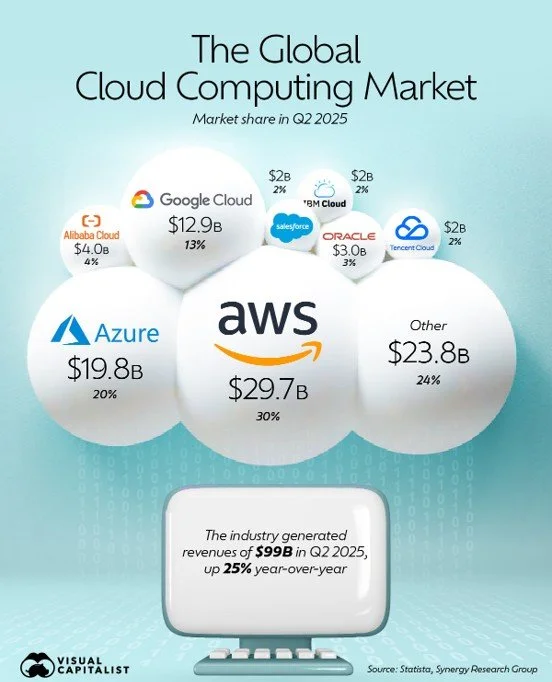

The Cloud: Over the last two decades, the incredible migration of data (from personal hard drives and company servers into the cloud—basically datacenters) has been spectacular. Companies that missed this trend (e.g. IBM) were left behind and companies that got ahead of it (first Amazon, then Microsoft and Google) have capitalized incredibly.

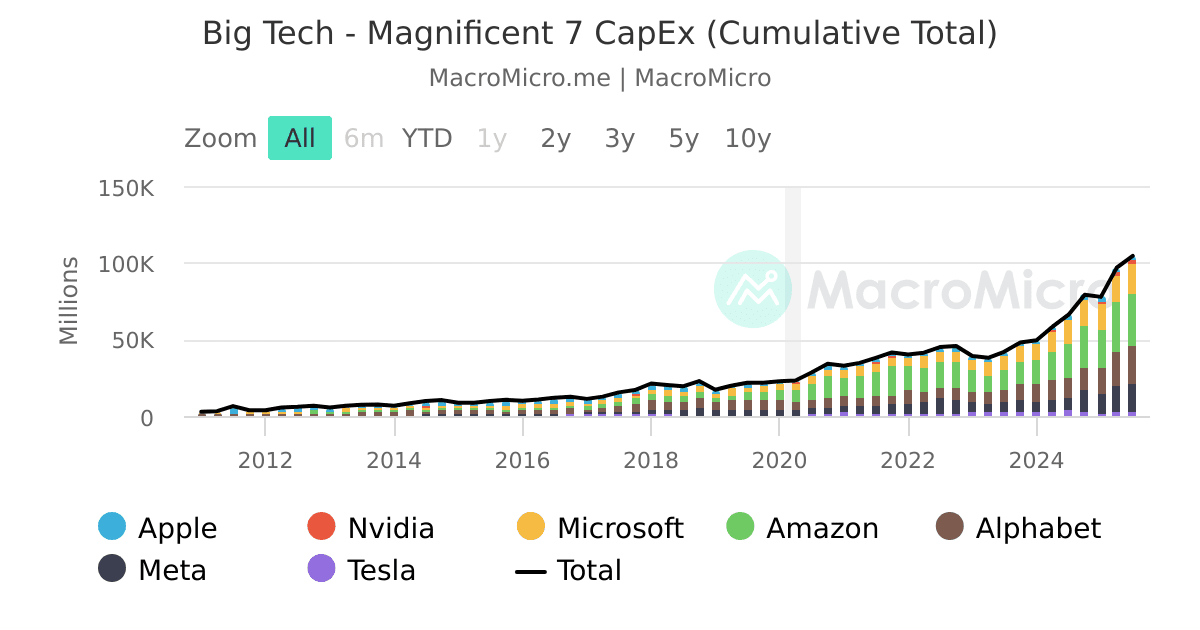

Artificial Intelligence: This recent theme (in the last few years) has benefited cloud companies even further because the massive amount of data and compute power required by AI means massive ongoing business and revenue growth for cloud companies. It is also only just beginning to open new opportunities for Apple (partnering with Google Gemini), Microsoft (partnering with OpenAI), and other Mag 7 companies spending massively on Nvidia’s leading chips powering almost everything AI at this point.

Digital Advertising: Alphabet’s Google and YouTube services (which are hosted in the cloud and being accelerated by AI) generate truly spectacular advertising revenue, much like other Mag 7 companies who have been able to accelerate advertising in a major way (e.g. Meta, Microsoft and Amazon)

Powerful Ecosystem Moats: Google, much like the rest of the Mag 7, has been able to build massive competitive advantages through walled garden ecosystems whereby they keep users captive within their own ecosystems (so as to ward off competition by preventing it from ever gaining any traction).

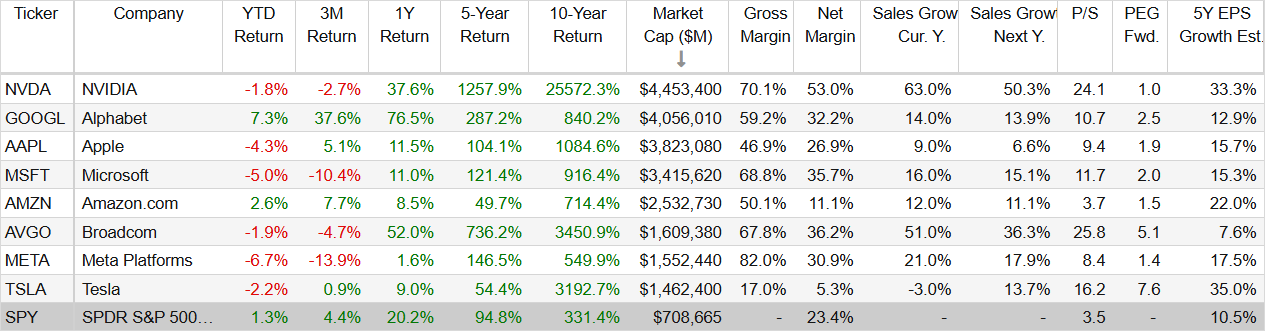

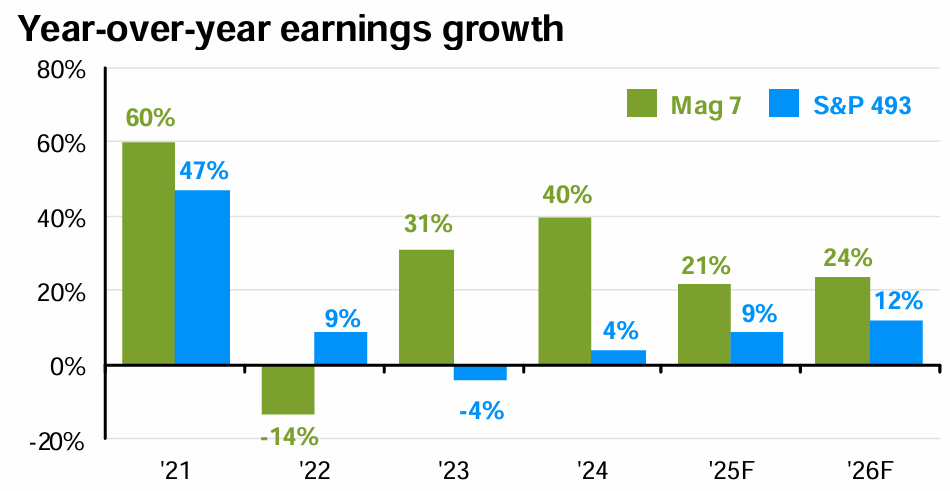

And based on these trends and competitive advantages, I fully expect the Mag 7 to keep outperforming the rest of the S&P 500 over the next 12-18 months (and beyond) for a few basic reasons:

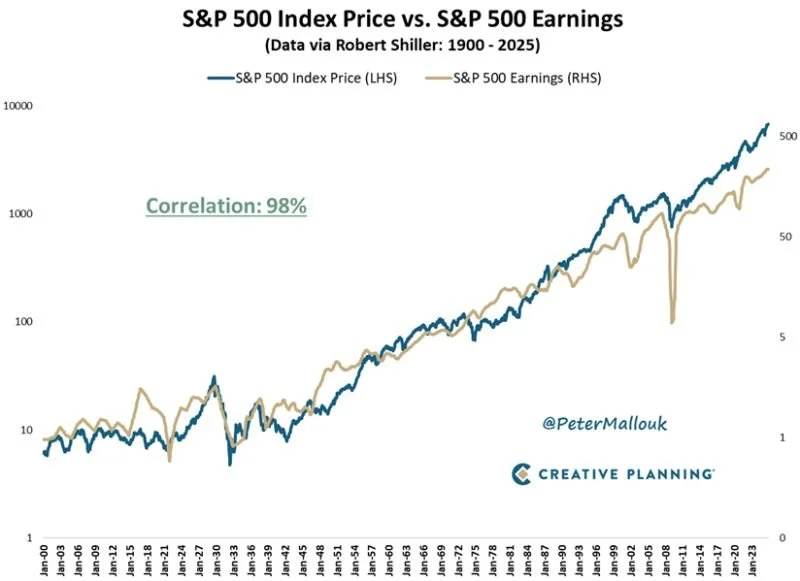

Stronger earnings growth is projected for the Mag 7 (18-23% in 2026) versus ~13% for the other ~493 stocks. In the long-term, share prices tend to follow earnings growth fairly closely, as you can see in the chart below.

Ongoing AI momentum, backlog monetization, and capex payoffs will likely continue to drive outsized Mag 7 returns, as recent heavy capex spending (by essentially all of them) is an indication of healthy expected growth ahead.

Slower non-AI growth will likely continue to hamper the S&P493 as their “older economy” business models will likely continue to grow, on average, just at a slower pace due to their lack of market disruption opportunities (compared to the Mag 7).

About Google:

For a little perspective, Google generates the majority of its revenue (~80%) from search and YouTube advertisements (with ~35% margin), and then from its growing cloud business (~10% of revenue, and with 24% margins), as well as ~10% of revenue from other bets (e.g. Waymo self-driving vehicles and Verily healthcare services).

Google’s Competitive Advantages:

Alphabet’s competitive advantages stem from its dominant position in search (with roughly 90% global market share), vast data moat (from billions of daily user interactions), and massive economies of scale in infrastructure. Further, Alphabet’s integrated ecosystem (spanning Android, YouTube, Google Cloud, and AI advancements like Gemini) creates powerful network effects and high switching costs (for users and advertisers).

Google’s Growth:

Alphabet is positioned for continuing growth going forward, driven mainly by accelerating monetization of AI (through Gemini integrations across search, YouTube, and Google Workspace) as well as significant expansion in Google Cloud, especially considering ongoing massive backlog conversion and growing AI demand. Plus, Waymo's accelerating commercialization adds some diversification away from core advertising.

Further, Alphabet’s major partnership with Apple (adopting Gemini for Siri) and heavy recent capital expenditures signal healthy ongoing growth.

Google’s Risks (including Valuation):

From a risk standpoint, Alphabet faces continuing antitrust and regulatory scrutiny (which could force divestitures in some of its ad-tech monopolies), as well as recent heavy capex (they could have overspent, depending on how growth plays out). Not to mention, the shares have recently rebound hard (see earlier chart)—which could be a turnoff to some contrarian investors—although trading at 29x forward earnings is not unreasonable, considering the ongoing high revenue growth and significant competitive advantage (as described earlier).

Google Takeaways:

Despite the very strong rally over the last year, Alphabet is still priced reasonably considering its leadership in cloud, dominance in advertising, AI growth trajectory and powerful competitive advantages. This is a company that is positioned to grow faster than the rest of the economy, and the shares will likely remain a leader among Mag 7 stocks for years to come.

Ranking the “Mag 7” versus the S&P 493

With that Alphabet overview in mind, let’s consider how it compares to the other Magnificent 7 stocks and the rest of the S&P 500 (the “S&P 493”). For starters, I fully expect all of the Mag 7 stocks to outperform the S&P493 (on average) in the years ahead, simply because Mag 7 stocks are growing their earnings faster.

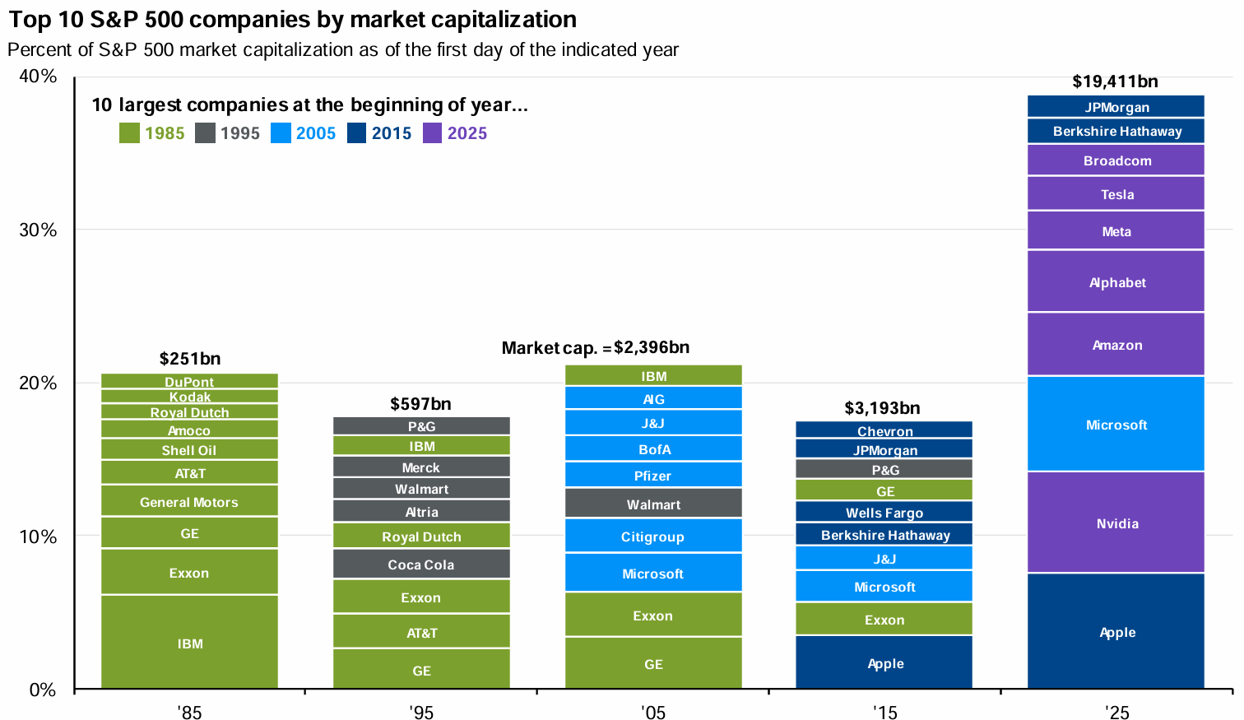

Understandably, a lot of “contrarians” love to highlight that the biggest companies in the world don’t always stay the biggest (due to competition, see chart below).

However, considering the current market megatrend themes, the stocks’ ecosystem moats, and the higher earnings growth trajectory, I expect the S&P 493 to continue underperforming the Mag 7 for years into the future. That’s not to say no stock in the S&P493 will outperform any stock in the Mag 7 (that would be false, there will be select big winners in the S&P 493), however, on average, I’d still prefer to own the Mag 7 over the S&P 493.

Next let’s consider how the Mag 7 stocks rank compared to each other. This is my personal ranking and yours may be very different

*note: I am including 8 stocks in the ranking (including Broadcom (AVGO) which is now larger, by market cap, than several of the other traditional Mag 7 stocks).

8. Apple (AAPL)

Coming in at number eight in my ranking, Apple is one of the bluest of the blue-chip companies, with solid margins, healthy growth and an incredible moat (iPhones are loved, customers are loyal and locked into the ecosystem, and the company’s R&D is efficient).

For a little overview, “Products” is Apple’s main business segment with the iPhone/Mac accounting for ~75% revenues and with ~40% of margins. Next is “Services (e.g App Store/iCloud) accounting for ~25% of revenues, but with an impressive ~70% margin.

From a growth standpoint, Apple is healthy (thanks to ramping AI integration into devices and emerging markets), but Apple’s growth is significantly lower than other Mag 7 stocks (see our earlier table for comparison).

For example, Apple's integration of Apple Intelligence (featuring on-device AI capabilities, enhanced Siri—with major upgrades like Gemini-powered features rolling out in 2026), and privacy-focused tools (across iPhone, iPad, Mac, and other devices) is expected to drive hardware upgrade cycles, boost services adoption, and accelerate revenue growth by encouraging users to replace older models for full AI functionality.

Further, this AI push, combined with strong expansion in emerging markets like India (e.g. record revenue highs and double-digit growth from local manufacturing and demand for premium iPhones), Southeast Asia, Latin America, and the Middle East, is fueling Apple's overall momentum (offsetting softer performance in areas like Greater China) and positioning the company for sustained double-digit growth in key regions.

However, to put that all in perspective, Apple’s expected growth is still lower than other Mag 7 stocks. And Apple has been paying a dividend (with an incredible long-term growth rate) which is a sign of financial health, but also an indication of relatively lower growth (if they had higher growth then reinvesting in their own business would become a higher priority than paying a growing dividend).

Further risks include iPhone revenue dependency, ongoing regulatory scrutiny, and the potential for supply chain disruptions.

Overall, Apple is an impressive blue-chip dividend growth stock, but not as impressive as the other Mag 7 opportunities.

7. Broadcom (AVGO)

Broadcom (basically a semiconductor company) generates ~58% of its revenue from AI/chips (and does so with impressive ~70% margins). It also generates ~42% of its revenue from Software (which is basically VMware) with incredible ~90% margins.

Broadcom competes with Nvidia (ground zero for AI) in the AI infrastructure space but in a complementary way rather than a direct head-to-head manner. Specifically, while Nvidia dominates general-purpose GPUs for AI training and inference (with its unmatched CUDA ecosystem), Broadcom focuses on custom ASICs (e.g., designing TPUs for Google, accelerators for OpenAI and others) and high-performance networking (e.g., switches like Tomahawk/Thor Ultra) that enable large-scale AI clusters, often as a cost-effective alternative for hyperscalers seeking to reduce dependency on Nvidia's GPUs.

This basically positions Broadcom as a key challenger in inference and custom silicon, with growing deals (e.g. multi-billion OpenAI rollout in 2026-2029), but Nvidia retains a strong moat in programmable, high-performance compute (again, making the rivalry more about market share shifts than outright replacement).

And from a growth perspective, Broadcom has an impressive AI backlog, especially considering its VMware integrations and hyperscaler deals. Further, Broadcom has the advantages of: (1) custom AI silicon, (2) high-margin software, and (3) customer lock-ins.

Specifically, Broadcom's high-margin software primarily comes from its Infrastructure Software segment (about 40-43% of total revenue in FY2025), dominated by VMware products (especially the bundled VMware Cloud Foundation (VCF) subscription platform for virtualization, networking, storage, and private/hybrid cloud management).

Further, VMware's growth potential remains healthy with low double-digit revenue increases expected in FY2026 from VMware Cloud Foundation adoption and private cloud/AI workloads, though its Total Addressable Market (“TAM”) in enterprise virtualization/cloud management is mature (~$50-100B+ broader hybrid cloud market), with upside from AI-integrated private clouds amid enterprise on-premesis demand.

And from a risk standpoint, Broadcom has significant client concentration, tariff exposure and margin pressures.

For example, its top five end customers (primarily hyperscalers for AI/custom chips) accounted for ~40% of net revenue in FY2025 (per 10-K), and heavy reliance on just five major AI clients, increasing vulnerability to demand shifts or spending cuts.

Tariff exposure also poses a risk considering ~20% of its revenue is tied to China (a key market/supply chain hub), exposing the company to U.S.-China trade tensions and potential retaliatory tariffs (though diversification efforts, such as partnerships in other regions, mitigate some impact).

Margin pressure is also a risk and arises from a growing mix of lower-margin AI system-level sales (including third-party components), with Q1 FY2026 gross margins expected to dip 100 basis points and trends potentially continuing throughout 2026 as AI revenue scales, despite high software margins (93%) providing an offset.

Overall, Broadcom is a massive juggernaut in the right place at the right time (cloud and AI megatrend beneficiary), but its TAM is limited, margins face pressures, and its overall earnings growth rate is expected to be lower than other Mag 7 stocks.

6. Amazon (AMZN)

Amazon is known for its online products marketplace (which generates 60% of the company’s total revenue from North America and another 25% from International), however this is low margin business, and the real profits come from Amazon Web Services (i.e. its cloud business) which generates only ~15% of total revenues, but does so with an impressive ~35% margin.

Amazon’s big competitive advantages are its enormous e-commerce scale and its AWS cloud moat, as well as its logistics network.

Amazon growth will come from several areas. For example, AWS AI workloads give the company a massive backlog (monetization ahead). Also, high-margin advertising revenue is expected to ramp (projected to exceed $70-80B annually with 20%+ growth from AI targeting and retail media). Further, Amazon has retail efficiency opportunities from automation/robotics and emerging AI agents. All of these position Amazon for earnings leverage, valuation re-rating, and potential outperformance in 2026 (particularly as AI investments begin yielding returns).

For some color, Amazon's robotics and automation efforts in fulfillment centers (e.g. deploying over 1 million robots coordinated by AI models like DeepFleet) are projected to drive significant cost savings (e.g. potentially $7.5 billion annually by 2026 through reduced manual labor and efficiency gains like 25% faster processing), and thereby contributing to retail margin expansion and operating leverage (that analysts cite as a key factor in the stock's 24%+ upside potential for 2026).

However, Amazon's shares have underperformed other Magnificent 7 stocks over the last year (2025) primarily due to heavy AI infrastructure capital expenditures (contributing to a plunge in free cash flow), slower-than-expected AWS growth (relative to rivals like Microsoft Azure and Google Cloud), tariff uncertainties (impacting retail operations), and an overall lack of fresh narratives for investors to get excited about (after prior themes like cost cuts and AWS recovery played out), and resulting in single-digit gains for Amazon (while peers like Alphabet and Nvidia soared in 2025).

Worth mentioning, from a risk standpoint, Amazon does face retail competition (Walmart, Target, Mercado Libre, to name a few). Also, antitrust probes and tariff impacts could weigh down the company.

Overall, Amazon has plenty of growth and catalysts, and the shares could be due for a re-rating higher, especially as they have lagged other Mag 7 AI leaders.

5. Alphabet (GOOGL)

As described earlier, and despite the very strong rally for the shares over the last year, Alphabet is still priced reasonably considering its leadership in cloud, dominance in advertising, AI growth trajectory and powerful competitive advantages.

4. Tesla (TSLA)

Perhaps most controversial of the Mag 7 (and not just because of the political forays of its leader (Elon Musk) into government efficiency and taking over social media platform Twitter/X), is Tesla. The volatility is huge as bulls and bears battle over valuing the current business (for example, as a car company it is extraordinarily overvalued) and a future business (the TAM of robotaxis and robots is enormous and excites many growth investors).

For some perspective, Tesla’s Automotive segment (electric vehicles) drives 80% of revenues (and with ~17% margins), while Energy/Storage drives 10% of revenue (and with 26% margins), and Services drives 10% of revenues (withg ~6% margins).

However, it is Tesla's Full Self-Driving (FSD) autonomy software, which relies on extensive real-world data training and over-the-air updates, positions the company as a leader in unsupervised self-driving technology, with plans for robotaxi deployments and broader AI integration in 2026. This is what is getting growth investors excited, and could lead to more big gains for the shares.

Tesla is currently trading at premium valuations (for example 13.8x forward sales) as investors bet heavily that FSD could add potentially $1 trillion in market value (through recurring subscriptions, robotaxi services, and autonomous market dominance) despite the execution risks.

Further, Tesla's Optimus humanoid robots (designed for tasks in factories, homes, and beyond) represent another pivotal shift in the company's strategy toward AI-driven robotics, with production ramping up in 2026 (for example, aiming for millions of units annually at a targeted price of $20,000).

This robotics initiative is significantly driving Tesla's current elevated valuation (potentially pushing market cap toward $2-3 trillion by end-2026) as investors bet on Elon Musk's vision that Optimus could comprise 80% of the company's future value through massive revenue from automation (although execution risks in this "prove-it" year could lead to more volatility).

Tesla’s advantages basically stem from its electric vehicle tech lead, its supercharger network and arguably its “brand charisma.”

Risks for Tesla include EV competition and margin erosion, production delays (execution risk), regulatory risks and key man risk (the CEO, Elon Musk can be a bit of a loose cannon at times).

3. Microsoft (MSFT)

If you are trying to optimize risk-versus-reward, a portfolio of stocks is always better than betting big on a single name, but if you had to bet on a single name, the pure combination of growth, profits and stability of Microsoft’s business (it’s one of only two companies with a triple-A credit rating—higher than the US government) makes Microsoft the opposite of Tesla in terms of speculative risk (i.e. Microsoft is a brilliant combination of steady, profitable, innovative, high growth).

For perspective, Microsoft generates ~40% of its revenue from its Productivity segment (Office products) and with extremely high margins. Next ~38% of revenue comes from its Cloud (Azure) business, also with strong (and improving) margins. Finally, Personal Computing (Windows/Xbox) contribute ~22% of revenue, albeit with a bit lower margins).

Microsoft’s competitive advantages stem from its expanding AI/cloud leadership position, its integrated ecosystem, and its very high recurring revenue model.

Growth will come from initiatives like accelerating Azure AI adoption (with 40% revenue growth and a $155B+ backlog), rapid Copilot enterprise scaling to over 150M users, Microsoft 365 price hikes (of ~16% in mid-2026), and truly massive AI infrastructure investments (including a $250B OpenAI deal through 2030 that could fuel a rebound by driving $25B+ in additional revenue and proving monetization potential).

Despite the company’s powerful growth trajectory, Microsoft's shares underperformed other Mag 7 stocks in recent months (late 2025 to early 2026) primarily due to investor concerns over escalating AI capital expenditures (i.e. reaching a record $35 billion in Q1 FY2026) which have eroded free cash flow and raised questions about near-term returns on AI investments. And this is compounded by Alphabet's Gemini/AI advancements (pressuring Microsoft's OpenAI partnership and broader Mag 7 valuation scrutiny), especially amid Microsoft’s slowing profit growth projections of 18% for 2026 (still quite high though!).

Specific risks include intense cloud competition (although there is room for multiple winners), antitrust regulations and cybersecurity threats (both real and reputational).

For example, Microsoft faces persistent cybersecurity threats including actively exploited zero-day vulnerabilities in its Windows and Office products (such as recent critical remote code execution flaws and a DWM zero-day in early 2026 Patch Tuesday), sophisticated nation-state and cybercriminal attacks leveraging AI for phishing, ransomware, and identity compromises, and risks from supply chain weaknesses, infostealers, and cloud misconfigurations amplified by its massive Azure and enterprise ecosystem footprint. These threats heighten operational and reputational risks for the company as a leading provider of critical infrastructure software and services.

Nonetheless, all things considered, Microsoft is a dramatically more attractive business than most S&P 500 stocks, and that includes many of the Mag 7.

2. Meta (META)

Meta spent big on AI capex, and the market has punished the shares as a result. However, this is likely a short-term phenomenon (as Meta has experienced many times in the past) as CEO Mark Zuckerberg focuses on long-term growth rather than appeasing short-term Wall Street preferences.

For perspective, Meta’s main business segment (advertising from its Family of Apps) contributes ~98% of total revenues and with an incredible ~30%+ net margin). Reality Labs (Virtual Reality) contributes ~2% of revenues (and generates profit losses).

Meta’s main competitive advantage is its astounding 3.5B+ users, enabling highly-targeted ads and powerful network effects.

Looking forward, Meta growth will come from AI advertising tools, monetization of messaging and impressive user engagement.

In particular, growth initiatives (that could fuel a rebound relative to Mag 7 peers) include accelerating AI-powered advertising tools (like Advantage+ driving $60B+ annualized run-rate and 26%+ ad revenue growth), successful monetization of WhatsApp/Threads (through AI integrations and new channels), continued strong core ad momentum (with projected 18-21% revenue growth in 2026), and potential cost discipline (e.g. Reality Labs cuts and opex under $155B), and especially demonstrating profitable AI execution (thereby positioning Meta's valuation (~21x forward earnings) as attractive (and for upside as sentiment shifts toward proven monetization).

Risks for Meta continue to include privacy regulations, advertising volatility (that ebbs ad flows with the economy) and metaverse losses.

As alluded to, Meta shares have underperformed other Mag 7 stocks in recent months (late 2025 into early 2026) primarily due to investor concerns over sharply rising capital expenditures (raised to $70-72 billion for 2025 with even larger projections for 2026) tied to aggressive AI infrastructure and data center builds (which have pressured free cash flow, sparked fears of delayed returns on investment, and triggered a post-earnings sell-off (shares are still down ~17% from August 2025 highs) amid broader scrutiny of AI spending payoffs across Big Tech.

Overall however, these selloffs are par for the course for Meta, as CEO Mark Zuckerberg continues to focus on long-term growth rather than short-term market expectations.

1. Nvidia (NVDA)

Nvidia is ground zero for the great datacenter cloud migration and now the AI revolution as surging demand for training and inference in generative AI clears a continuing path for massive high growth. And what makes this opportunity particularly spectacular (besides its already massively impressive scale) is the shares remain relatively inexpensive (particularly after the share price has been sideways in recent months).

For starter, Nvidia’s Data Center Segment has grown to 90% of total revenues with insane 75% margins. It’s once dominant gaming segment generates 8% of revenues (small only relative to Data Center) and with lower margins.

From a competitive advantage standpoint, Nvidia’s CUDA software creates an extremely powerful moat (as the industry had been trained over nearly two decades to use it, and switching costs for users are high (steep/long learning curve). And the network effects (as AI grows) makes it even harder for competitors (such as AMD) to overcome (even as hardware alternatives emerge).

From a growth standpoint, Nvidia's TAM in AI-driven data center semiconductors (and related infrastructure) is truly massive and rapidly expanding. Estimates for the broader AI chip and data center market are in the hundreds of billions annually, and with projections for $400B+ by 2027 for data center AI chips. Nvidia basically has a $3-4 trillion multi-year AI infrastructure opportunity (fueled by surging demand for training and inference in generative AI, while its core data center segment alone drives explosive growth amid the ongoing AI megatrend supercycle).

The main risks for Nvidia are basically: (1) the AI megatrend/supercycle is overblown (which seems unlikely based on hyperscaler capex), (2) the company’s main customers have already overspent, and (3) supply shortages (which can disrupt and delay deliveries).

From a customer concentration standpoint, Nvidia does disclose that two anonymous clients drive ~39% of total revenue:

“Customer A” accounts for 23% of total revenue, and is likely Foxconn/Hon Hai Precision, due to its dominant scale (projected as the world's top server vendor in 2025 by Omdia), close Nvidia partnerships (e.g., Blackwell GPU manufacturing), and explosive AI server growth (up 17% profit in Q3 2025 from Nvidia-related demand). Foxconn basically assembles ~24% of Nvidia GPU servers historically and leads in Asia's data centers.

“Customer B” accounts for 16% of revenue, and is likely Quanta Computer (or its QCT arm), as a key ODM with ~15-22% historical share of Nvidia servers, 100%+ revenue growth in AI-optimized systems in 2025, and deep integration for GB200/Blackwell racks. Alternatives like Dell (OEM) or Wiwynn (Wistron subsidiary) are frequently mentioned but lack the matching volume spike.

From a valuation standpoint, Nvidia still trades at only ~24x forward earnings, which is quite inexpensive considering revenue is growing at over 50% per year, earnings are expected to grow at a rate of over 30% for the next five years, and the company’s forward PEG ratio (price/earnings to growth) is only 1.0x (more attractive than other Mag 7 stocks).

Overall, despite Nvidia’s impressive rally over the last decade, it continues to have massive room to run and the shares trade at a very reasonable price. Considering it is now such a large part of the entire US stock market (more than 6%), it would be risky to not own any Nvidia, and it would be prudent to own a significant amount of it in your portfolio—depending, of course, on your own personal situation and goals).

The Bottom Line

US stocks have been on a multi-year rally of strong returns, and there is certainly no guarantee that 2026 will be the same. However, over the long-term, earnings is expected to continue to grow for the Magnificent 7 (and at a faster pace than the S&P493) and that bodes well for stock prices (particularly those trading at reasonable share prices).

Some Mag 7 stocks have recently performed better than others (such as Alphabet), but that doesn’t mean you need to sell them (that would be like benching Michael Jordan because he just won the MVP), especially considering valuations remain quite reasonable relative to growth.

Other Mag 7 stocks (Nvidia, Meta and Microsoft) have not performed as well (in terms of share price gains) in recent months, but their business have performed well (despite short term concerns over heavy capex and noise in general). The reality is these stocks continue to benefit from massive long-term megatrends and market supercycles (as described in this report).

I am not saying every Mag 7 stock will outperform every S&P493 stock (there will be some extraordinarily impressive returns from some S&P 493 stocks). But on average, I do expect the Mag 7 to keep outperforming the S&P493, and some Mag 7 stocks will likely perform better than others (as described in this report). I have positioned my own personal investment portfolio (i.e. The BH Disciplined Growth Portfolio) accordingly (and may make some small-ish tweaks in the coming days.

Overall, disciplined, goal-focused, long-term investing continues to be a winning strategy. And you need to be smart people—do what is right for you.