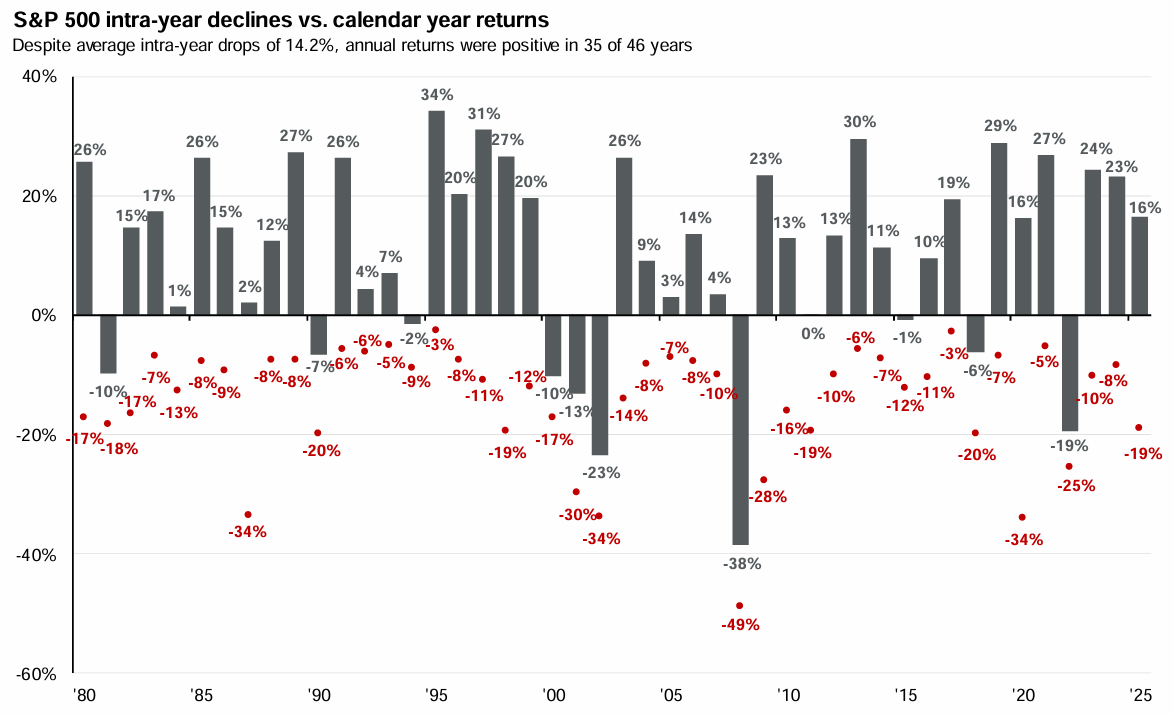

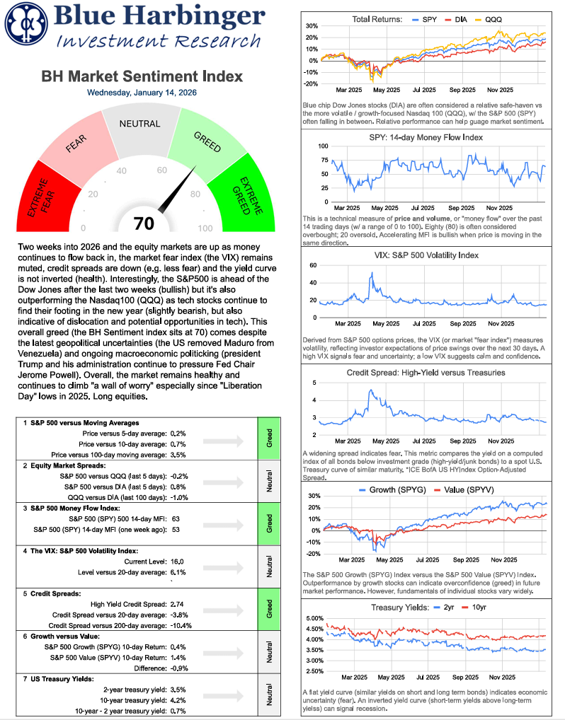

After 3 consecutive strongly-positive years for US stocks (see graph), 2026 is off to a healthy start, despite geopolitical risks (Maduro removed from Venezuela) macroeconomic political risks (the Trump administration continues to pressure Fed Chair Jerome Powell), as the BH Market Sentiment Index sits at 70 (Greed).

We are now 2-weeks into 2026 (3.8% of the year is over) and the equity markets are up as money continues to flow back in, the market fear index (the VIX) remains muted, credit spreads are down (e.g. less fear) and the yield curve is not inverted (health).

*(click the image for a zoom-in-able PDF version).

Interestingly, the S&P500 is ahead of the Dow Jones after the last two weeks (bullish) but it's also outperforming the Nasdaq100 (QQQ) as tech stocks continue to find their footing in the new year (slightly bearish, but also indicative of dislocation and potential opportunities in tech).

This overall greed (the BH Sentiment index sits at 70) comes despite the latest geopolitical uncertainties (the US removed Maduro from Venezuela) and ongoing macroeconomic politicking (president Trump and his administration continue to pressure Fed Chair Jerome Powell).

Overall, the market remains healthy and continues to climb "a wall of worry" especially since "Liberation Day" lows in 2025. Long equities.