In the face of naysayers, the meteoric rise of Palantir stock has been nothing short of spectacular. To be certain, this is a very real, very fast-growing, very high profit margin business benefiting from the intersection of big-data software and accelerating Artificial Intelligence (“AI”). This report reviews 5 big risks of “backward-looking financial analysis” that caused most Wall Street analysts to miss this generational wealth-building opportunity over the last few years (while many retail investors got rich), as well as what these 5 big risks say about the business and the share price opportunity going forward.

About Palantir

Palantir is a software company that builds AI-powered platforms to help organizations analyze massive amounts of data for real-time decision-making. Its main products are Gotham (intelligence and defense applications used by governments), Foundry (commercial data management and operations) Apollo (software deployment across environments) and its Artificial Intelligence Platform (AIP) (for deploying large language models and agentic AI in secure settings). Palantir serves government clients and commercial sectors. And in recent years, it has been emphasizing "decision intelligence," ontology-driven AI, and high-stakes operational leverage.

Growth in The Face of Naysayers

As you can see in this next chart, over the last three years Palantir’s share price (blue line) has risen from around $7 to over $200 (spectacular growth) while Wall Street analyst price targets (orange line) have consistently lagged the share price gains (generally increased only after price gains have already occurred—suggesting they have little to no forecasting ability whatsoever).

So what was Wall Steet doing wrong that caused them to miss the price gains ahead of time? In a nutshell, they were applying traditional financial analysis techniques to a non-traditional company (as will be described in the next section).

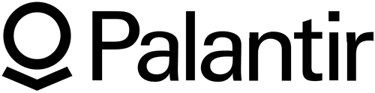

And just for a little more color (and as a point of reference) Wall Street still doesn’t love Palantir (lots of lukewarm “hold” ratings, but not too many “buys” or “strong buys”) as you can see in the graphics below.

5 Big Risks of Backward-Looking Financial Analysis as Applied to Palantir

So with that backdrop in mind, let’s consider 5 big risks of traditional backward-looking financial analysis when applied to the disruptive growth story of Palantir.

1. Software and AI: Not Your Granddad’s Market Disruptors

The type of market disruption being caused by Palantir is easy to underestimate when comparing it to history. For starters, software stocks (such as Palantir) are very different than the traditional manufacturing companies that dominated US markets when valuation metrics like “price-to-earnings ratio” made a lot more sense. Specifically, software companies like Palantir have much higher margins and much simpler scalability potential than technology companies of decades ago (where scaling often meant hiring more people and building more factories). Palantir CEO Alex Karp alludes to this differentiation in his most recent shareholder letter, when he writes:

“We have grown quite significantly in recent years.

And yet, counterintuitively to many, including ourselves at times, our reluctance to abandon constraints has been a principal and driving force of our continued rise.

Our headcount is one manifestation of this disciplined approach. The casual expansion of our ranks would have diminished the need to lean even more heavily on the strength of our software and the Ontology and to ensure their continued maturation. The alternative would have been to rely on an army of bright minds to do work that would have obscured the platform’s weaknesses and ultimately hindered its development.”

And now factoring in the power of AI on top of an already powerfully disruptive software industry (whereby AI allows new software to be created dramatically faster and with less people) software is truly taking over the world (or “software is eating the world” as Marc Anderseen famously predicted in 2011).

Overall, the rate of disruption caused by AI software is easy to underestimate when comparing it to the disruption of the past. This is one big reason why Wall Street underestimated Palantir, and it remains a big risk going forward.

2. Defying Traditional Valuation Metrics (For Good Reason)

Here is a look at how Palantir (the 18th largest stock in the S&P 500, by market cap), compares to other top names (see table below). Specifically, Palantir looks extraordinarily expensive by traditional valuation metric (such as P/E ratio and P/S ratio).

However, these traditional valuation metrics are better suited for companies of decades past, and don’t give enough credit to the rapid disruptive growth potential (Palantir is expected to grow revenues by 54% this year and 42% next year) and large market opportunity (the AI megatrend is huge—unlike the type of high growth the market has experienced in the past).

So while many Wall Street underestimated Palantir’s growth potential in the past, this remains a risk today (the market may still be underestimating how good this business is). And Palantir’s incredible growth trajectory sits a top wide gross and net margins (see table above)—a truly extraordinary combination!

3. Karp’s Short-Term Voting Machine Prints Money

Alex Karp (“CEO”) is the jedi mind trick of Palantir cheerleading, and his ability to strike a positive emotional chord with investors is both impressive and value creating for shareholders. For example, a common complaint from institutional investors (the ones that largely missed out on Palantir’s epic rally) is that the share price gains have been driven by low-information retail investors and fueled further by an extremely fired up and defiantly optimistic CEO, Alex Karp.

For example, in the latest shareholder letter, Karp unapologetically boasts of Palantir’s:

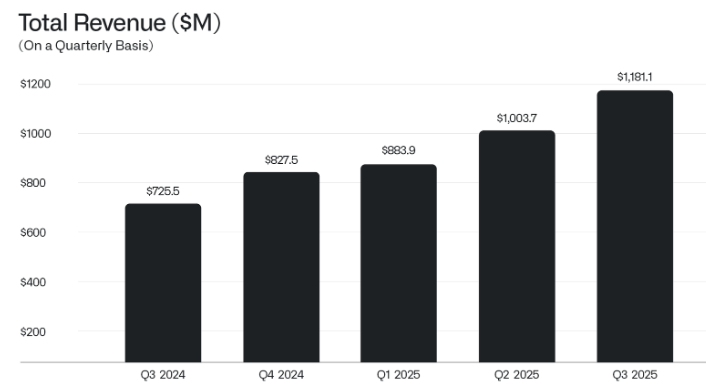

“$1.2 billion in revenue for the third quarter of the year, a new record in our more than twenty-year history, representing an accelerating and otherworldly growth rate of 63% over the same period the year before.”

And while this sounds impressive, the reality is Palantir’s revenue over the last 12 months puts it firmly in the bottom 10% of the S&P 500 (not so impressive when you look at it that way—especially considering it is the 18th largest S&P 500 stock by market cap).

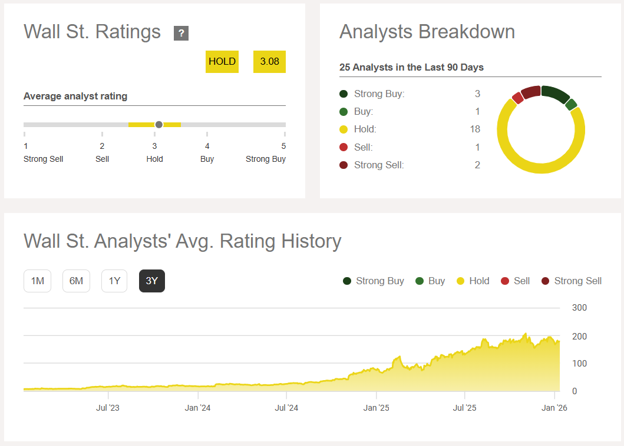

Nonetheless, Palantir’s extreme valuation (it trades at over 400 times earnings) has allowed the company to richly compensate and retain employees—which is an important part of its success. For example, you can see just how much Palantir’s shares outstanding have increased (largely through restricted share units and the exercise of stock options) in the following chart.

So while old school investors may suggest Palantir’s share price has risen as the result of short-term retail voting (an allusion to the famous Ben Graham quote: “in the short run, the market is a voting machine, but in the long run, it is a weighing machine”), Karp has used the rapid price gains to create very real value for the company’s shareholders.

And again, the risk here is that investors are not recognizing the powerful market leadership position Palantir has already built in a very short period of time since going public in 2000 (which by the way was also spectacular timing in raising cash while market prices were high).

4. Business Lifecycles Have Changed

In decades past, valuing companies was much easier because the rate of innovation was lower and business models didn’t change as rapidly. This is important because the valuation methodologies of past decades do not capture the business lifecycles of today.

For example, business lifecycles today are much faster and much slower, and investors are more patient and more rapidly rewarded. Specifically, the rate of innovation in software (especially those fueled by AI) is much rapider, yet investors are also willing to incubate new businesses much longer without worrying about maximizing short-term profits as Wall Street would prefer. This amalgamated conundrum confounds investors trying to apply traditional financial analysis (such as the old-school Wall Street Analysts who missed the epic Palantir rally) and rewards younger investors and companies who are able to learn and understand (such as Palantir and its shareholders).

In fundamental and financial terms, Palantir was a negative-profit government contractor for years, while forward-looking patient investors allowed the commercial business to incubate and while the durable long-term big-data-and-AI profits only recently began to emerge.

Not realizing how business lifecycles have changed remains a risk today, especially as Palantir remains at the forefront of rapid innovation and change.

As a specific example, the battle front in modern-day war has moved to real-time big-data and AI intelligence, such as the type likely used by President Trump and The US Department of War in recently removing Nicholas Maduro in Venezuela, as described here, here and here.

5. Extrapolating the Past into the Future

To play “devil’s advocate,” extrapolating past valuation norms onto Palantir is what caused many traditional analysts to miss the spectacular share price gains in recent years, and similar extrapolation presents a similar but contrary risk going forward today.

For example, investors are growing increasingly accustomed to Palantir’s spectacular growth, despite the fact that it may already be slowing (the rate of expected revenue growth this year (54%) is lower than the third quarter number cited earlier (63%), and higher than next year’s expected revenue growth rate (42%, see table)).

Without question, Palantir is an exceptionally strong business that will be around for many years to come (the type of software applications it builds are mission critical and thereby create fantastically sticky revenue—a great thing). However, if revenue growth slows and/or doesn’t meet investor expectations, the stock’s valuation multiples have a lot of room for compression—and thereby potentially driving the share price lower in the short and intermediate term.

For perspective, currently trading at 421 times earnings, it would take 421 years for the company to earn back the cost of one single share, assuming zero growth. And even with its continuing high growth trajectory, the share price has already priced in many years of spectacular growth. That’s not to say the valuation and shares cannot still go dramatically higher—they can. But extrapolating continued extreme growth of the past into the future is a risk factor that investors need to consider.

The Bottom Line

Palantir is an absolutely fantastic high-growth business at the forefront of software and AI, and I firmly believe it will be a dramatically larger business (in terms of revenues and profits) 10 years from now. My ONLY problem with this company is the nosebleed valuation (and the military/war stock status—depending on your personal views on that type of thing).

I owned these shares from around $14 per share to over $100 per share before exiting (and I have missed out on a lot more gains since then as the price has risen to now ~$180 per share).

I have been wrong many times in the past (that’s why I invest via a prudently concentrated/diversified portfolio—which continues to serve me very well in terms of compounding growth and gains).

Despite the temptation to hop back into Palantir here (especially considering the possible big unexpected revenue bump forecast from Trump’s latest “Department of War” activities when Palantir announces earnings on Feb 2nd), I am not buying shares because I believe there are better risk/reward opportunities from a valuation standpoint, particularly within the AI megatrend (such as the names in my Disciplined Growth Portfolio and some of the opportunities in the table below—check out these growth-versus-valuation combos as compared to Palantir).

At the end of the day, you need to do what is right for you. Disciplined, goal-focused, long-term investing continues to be a winning strategy.