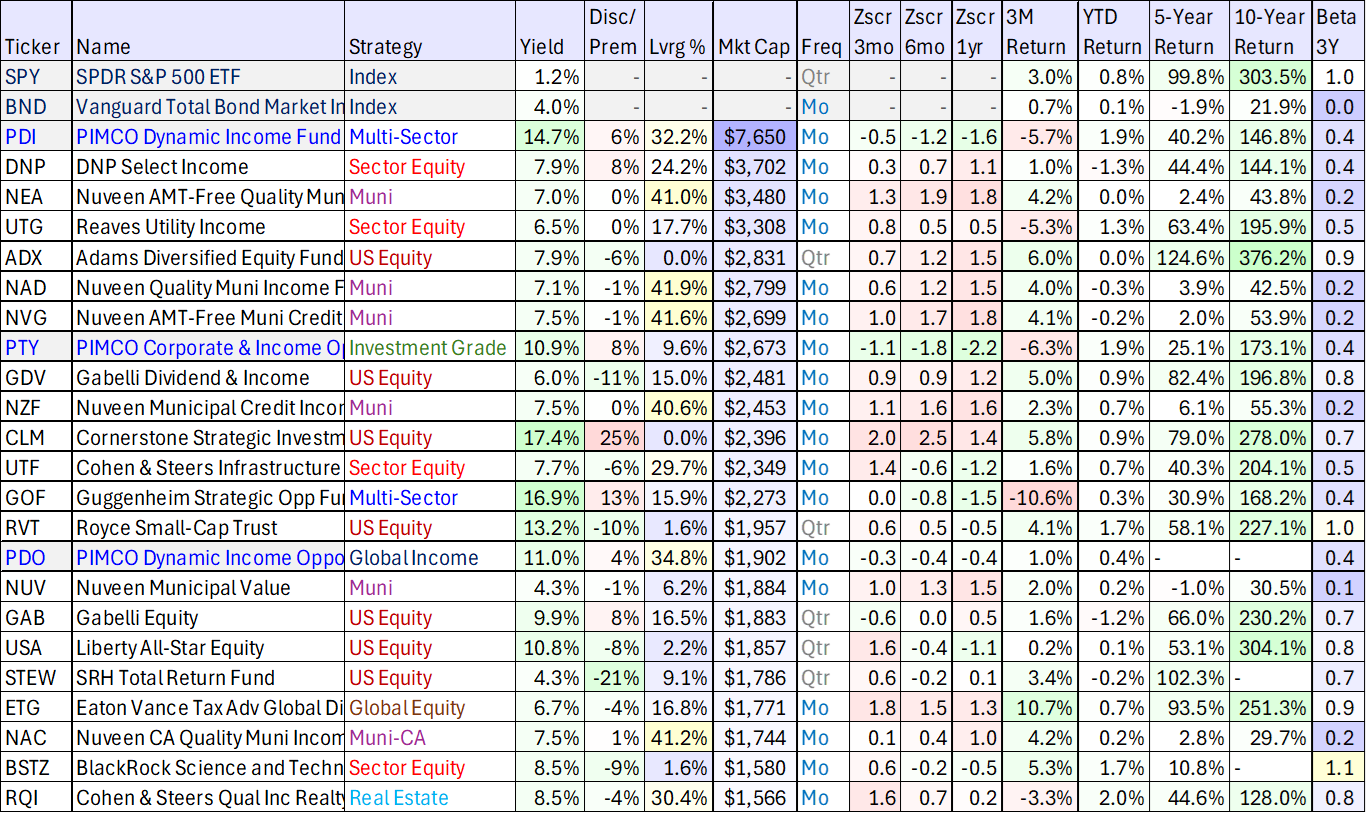

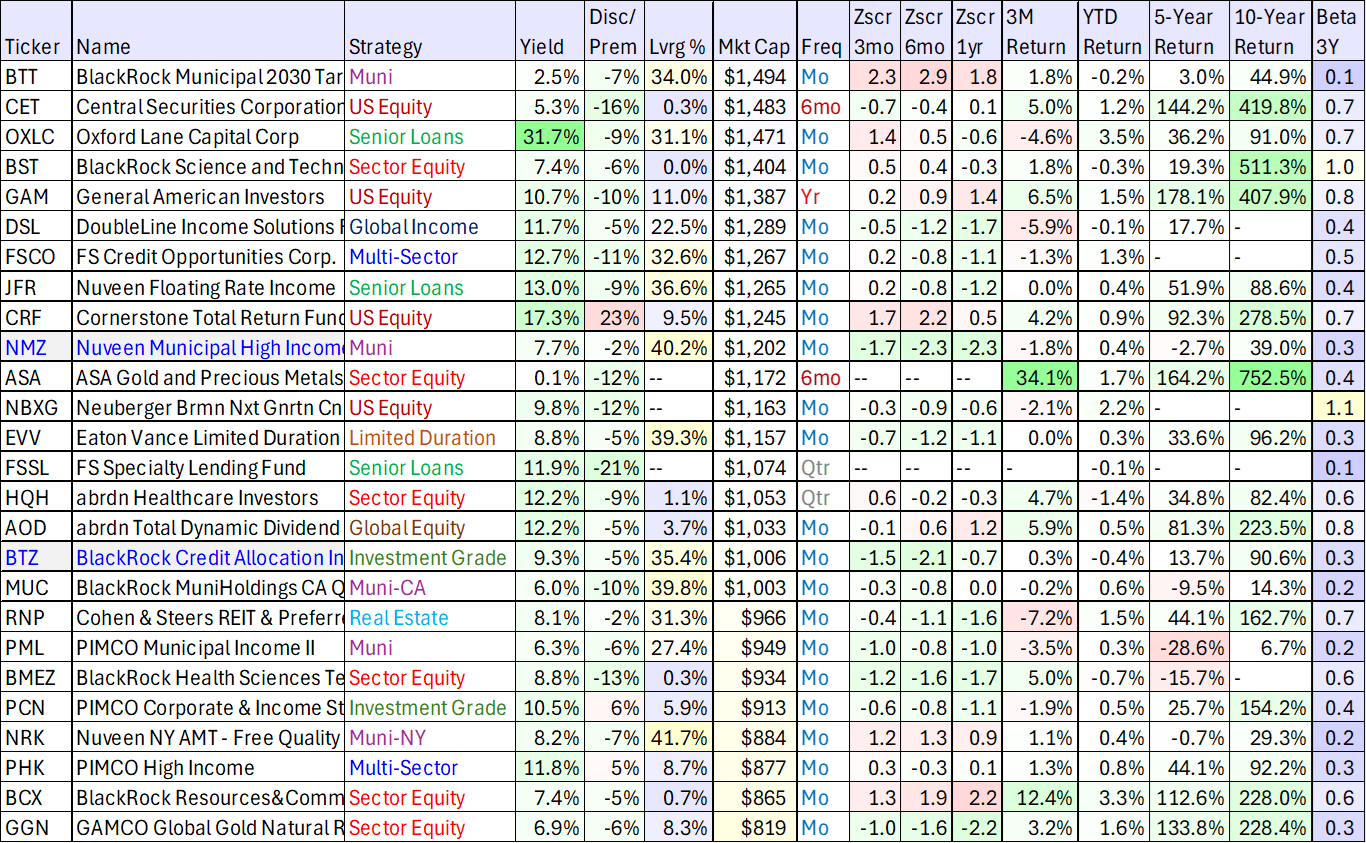

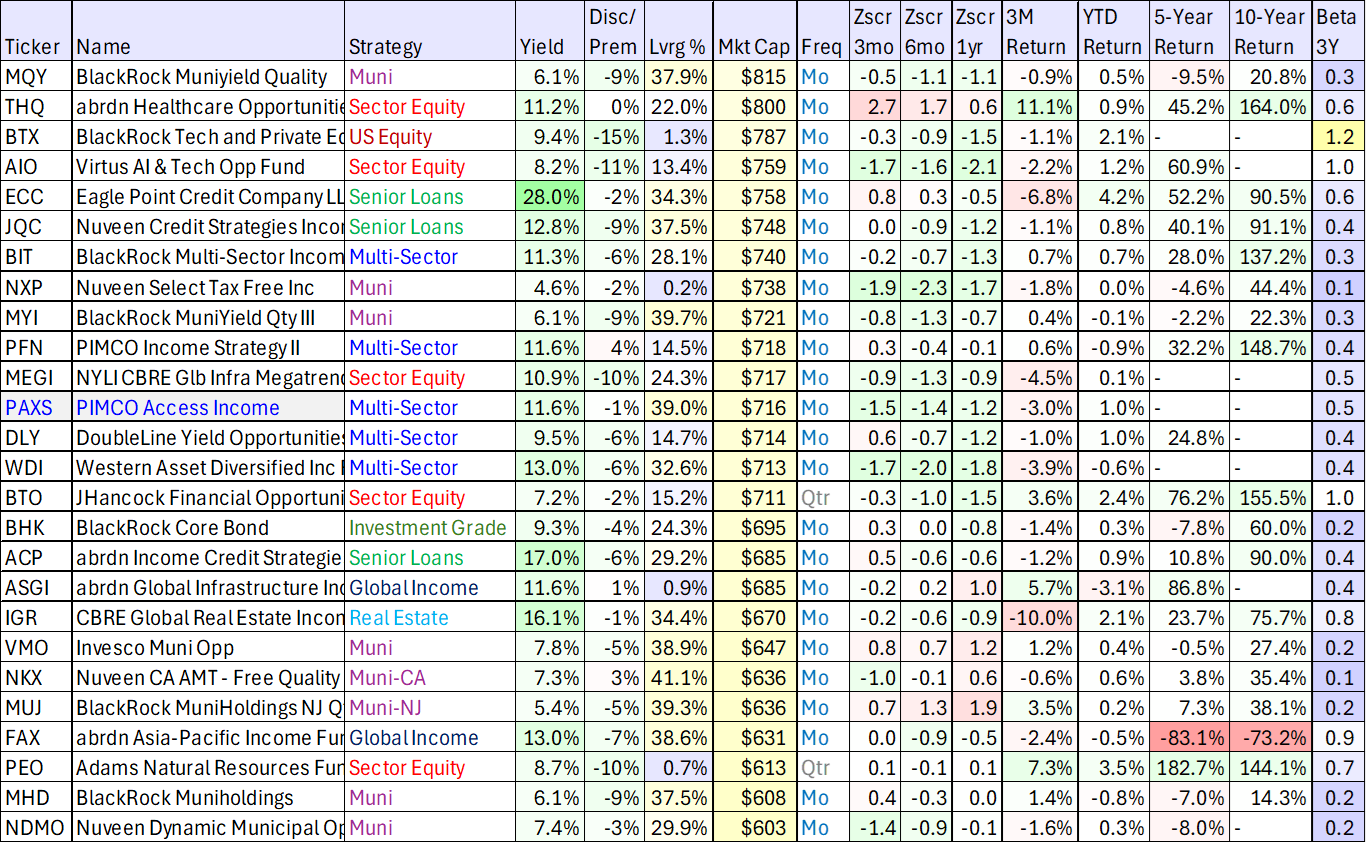

This report shares updated data on 50+ of the biggest big-yield Closed-End Funds (CEFs, by market cap), including current yield, discounts and premiums, leverage, beta, long-term performance and more! Interestingly, a few very popular PIMCO CEFs have recently come down in price (relative to NAV) which makes for some unusually attractive entry points on some premier double-digit yields (paid monthly). Muni bonds look good too (if you are in a high bracket and invest via your taxable account). Enjoy!

50+ Big-Yield CEFs:

For starters, let’s get right into the data (sorted by market cap). You likely recognize a few of your favorites (as well as multiple Blue Harbinger current holdings). The data is as of Monday’s close (05-Jan-25).

PIMCO Funds

For starters, you’ll notice several top PIMCO funds, which normally trade at large premiums to NAV, currently trade at much smaller premiums (which is attractive for PIMCO—the premier big-yield bond CEF manager). In particular, you’ll not the negative z-scores (a good thing) which compare the current premium to NAV versus the premium over the last 3-, 6- and 12-months (again—negative numbers are good here).

Muni Bond Funds

You’ll also notice a similar phenomenon for many top municipal bond CEFs (only they actually trade at bigger discounts to NAV than normal—again, negative z-scores are a good thing here). Just remember that muni bonds are generally exempt from federal taxes—so if you own them in a taxable account (owning them in a tax-preferred IRA is usually a very bad idea), but if you own them in a taxable account—a smaller yield can actually be a bigger yield after you factor in all the tax savings (especially if you are in a high tax bracket!)—google “tax equivalent yield.”

Also, if you live in a state with a high state income tax rate (e.g. New York, California) there are often state-specific munis which can save you even more on taxes (see examples in the tables above).

Market Conditions

The Fed recently reduced the discount rate (and the fed funds target rate), which is a good thing for most of these bond funds because they have positive durations (a measure of interest rate risk) and continuing cuts (versus expectations) will also be a good thing (as rates go down, bond prices go up—all else equal). And remember, these CEFs source their yields (which are actually distributions) from a combination of interest payments on the underlying bonds as well as capital gains (so rising bond prices is usually a good sign for distribution strength.

The Bottom Line

The bottom line is that if you are an income-focused investor, lots of attractive opportunities are currently available in the market, and you can see all of my current big-yield holdings (including several of the names in the tables above) within my prudently diversified BH High Income Portfolio. I hope you enjoy that portfolio (for idea generation) as well as the data in this report.