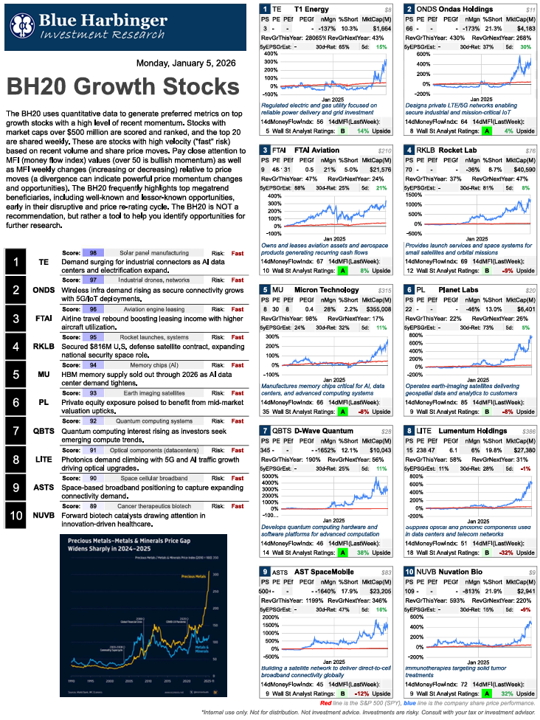

Many of the same megatrends we saw pullback near the end of 2025 are now reaccelerating in 2026. This report shares the latest iteration of the BH20 Top Fast-Paced Growth Stocks and highlights a few exceptional standout names worth considering.

For starters, here is the latest ranking (click the image to open a zoom-in-able PDF of the full report).

AI Chip Stocks

So far, in early 2026, the AI chip sector continues to surge, building on explosive growth from the previous year, with semiconductor sales projected to exceed 2025's $400 billion mark driven by custom processors and edge computing advancements. Companies like Micron (MU), Taiwan Semiconductor (TSM), and AMD are at the forefront, benefiting from a 44% increase in custom AI chip shipments and innovations in GPU technology amid a global memory shortage.

AI Data Center Facilities

This ties into broader data center expansion, where hyperscale facilities are prioritizing energy-efficient designs, liquid cooling, and AI-optimized infrastructure to handle escalating power demands, projected to reach 219 GW globally over the next five years. Firms such as Lumentum (LITE), Sunnova (SEI), and Vertiv (VRT) are capitalizing on this, with trends emphasizing sustainable, high-density builds to support AI workloads.

AI Data Center Energy Demand

Energy demand remains a critical megatrend, fueled by data centers and electrification, with global electricity needs expected to grow 3.7% this year, prompting accelerated deployment of renewables like solar and battery storage. Players including Trina Solar (TE), Bloom Energy (BE), and Eos Energy (EOSE) are seeing gains from falling battery prices and solar-plus-storage projects aimed at hyperscalers, amid a push for AI-driven smart grids and long-duration storage solutions.

Gold & Silver

Precious metals markets are kicking off the year positively, with gold and silver rising on rate cut expectations and safe-haven buying after silver's 147% surge in 2025, though index rebalancing poses headwinds. Miners like AngloGold Ashanti (AU), Alamos Gold (AGI), Coeur Mining (CDE), Equinox Gold (EQX), and royalty firm Royal Gold (RGLD) stand to benefit if silver hits forecasted highs in the $70s or beyond.

Other Notable Trends

Emerging trends in space, biotech, and fintech are also shaping the landscape, with space tech advancing through AI integration and sovereign initiatives, boosting companies like Rocket Lab (RKLB), Planet Labs (PL), and AST SpaceMobile (ASTS).

Biotech firms such as Nuvation Bio (NUVB), BridgeBio (BBIO), Travere (TVTX), Precision BioSciences (PGEN), and Eli Lilly (LLY) are leveraging digital tools and patient-centric designs for faster innovation in areas like rare diseases and weight loss drugs.

Meanwhile, fintech is undergoing structural shifts with AI agents, embedded finance, and stablecoins, favoring digital banks like Nu Holdings (NU), while data platforms MongoDB (MDB) and Confluent (CFLT) ride the wave of cloud and streaming demands.