The latest iteration of the BH20 Top Growth Stocks Ranking shows that AI megatrend themes and rare earths (precious metals) are back! Technically, they never went away. But the latest data proves (again) these themes are very real and very powerful! Take a look at these top 20 ranked growth stocks to corroborate your top ideas and manage your risk exposures (there are quite a few opportunities here worth considering here). Enjoy!

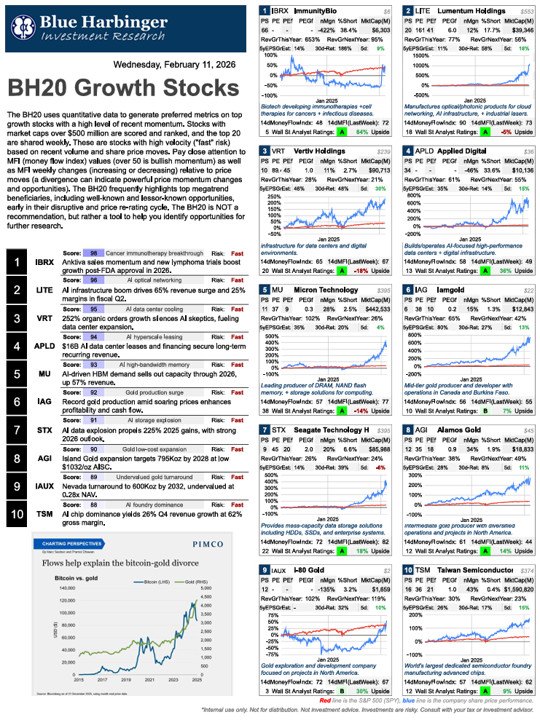

The BH 20 Top Growth Stocks:

For starters, here is a look at the ranking (below), and as you can see—the same themes are back to leading the market in a big way (gold/silver and AI).

*(click the image to launch the full zoom-in-able PDF document).

As a reminder…

The BH20 uses quantitative data to generate preferred metrics on top growth stocks with a high level of recent momentum. Stocks with market caps over $500 million are scored and ranked, and the top 20 are shared weekly. These are stocks with high velocity ("fast" risk) based on recent volume and share price moves. Pay close attention to MFI (money flow index) values (over 50 is bullish momentum) as well as MFI weekly changes (increasing or decreasing) relative to price moves (a divergence can indicate powerful price momentum changes and opportunities). The BH20 frequently highlights top megatrend beneficiaries, including well-known and lessor-known opportunities, early in their disruptive and price re-rating cycle. The BH20 is NOT a recommendation, but rather a tool to help you identify opportunities for further research.

And here are a few standout highlights from this latest iteration:

Immunity Bio (IBRX): You’ll see this immunotherapy biotech sits atop the ranking this week after incredible momentum (following its latest Anktiva sales momentum and new lymphoma trials boost growth post-FDA approval). Biotechs are a tricky group to invest in, in general (because they frequently lose money steadily until one day, a breakthrough occurs).

*No position.

AI Megatrend

You’ll note #’s 2-5 are all AI-related leaders with serious momentum. You can read more about them in the PDF (above). However, I am currently long Vertiv (VRT) and Micron (MU) in the BH Disciplined Growth Portfolio (with no intention of selling anytime soon), and I owned Applied Digital (very profitably) in 2025.

Gold & Silver

Coming in at #’s 6, 8, 9, 11 and 13 are gold stocks, with a Silver opportunity at #15.

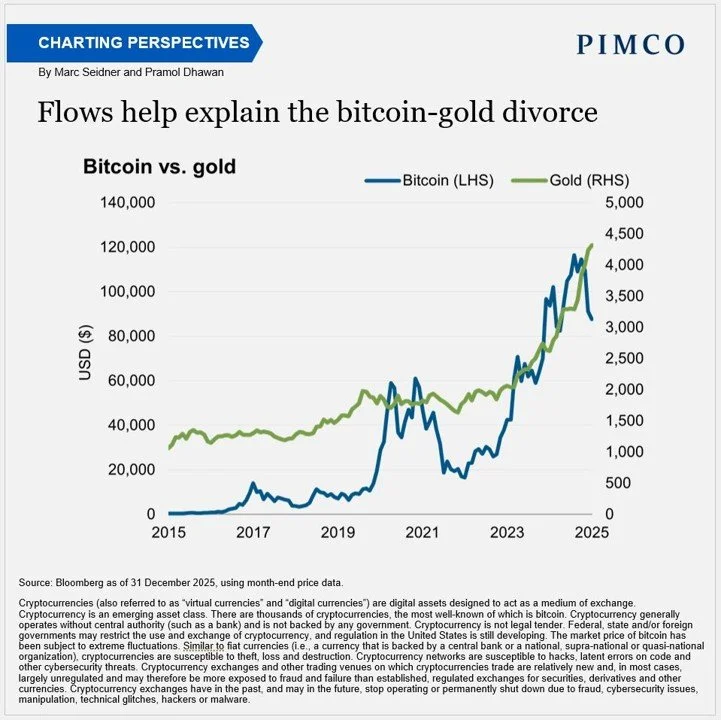

The Debasement Trade: Gold & Silver (Commodities) + Crypto

It’s no secret that the US government credit rating has declined and national debt and deficits rise over time (combined with a US Congress that seems to spend more time fighting than anything else). These factors, combined with heightened global politics and inflation (Congress keeps spending and central banks regularly manipulate the value of currencies) leave a lot of investors looking for alternatives.

The classic “debasement trade” is owning gold. After all, the US dollar used to be backed by gold, and people have used it as a currency for many centuries. Additionally, many national governments have increasingly been stock piling gold (e.g. Russia, China, India). All of this adds to its recent epic rally (which has also recently extended to silver too—although silver is also impacted by industrial demand).

Another alternative currency is cryptocurrency (such as Bitcoin). A ton of investors view crypto as an alternative to the US dollar—although it isn’t backed by any world superpower (such as the US). Rather, crypto is backed by limited supply and strong demand (which can shift). There is increasingly talk of stable coins as an alternative to volatile Bitcoin and such, but any stable coin backed by a national government automatically loses a lot of the allure that makes crypto currencies attractive in the first place.

The Bottom Line:

Fast-paced high-growth stocks (such as the opportunities in the BH20) bring great opportunities (for profit) and risks. I use these opportunities as part of my own long-term growth (and compounding) focused portfolio (the BH Disciplined Growth Portfolio). I currently own MU, VRT and TSM, for example), but you may consider turning up the concentration and owning more of these opportunities (depending on how much risk you are comfortable with).

Others may avoid them all together (they may already be comfortable with their total wealth and thereby prefer to stay away from any fast-paced growth stocks whatsoever).

As always, at the end of the day, you need to do what is right for you, based on your own personal situation and goals. Be smart people.