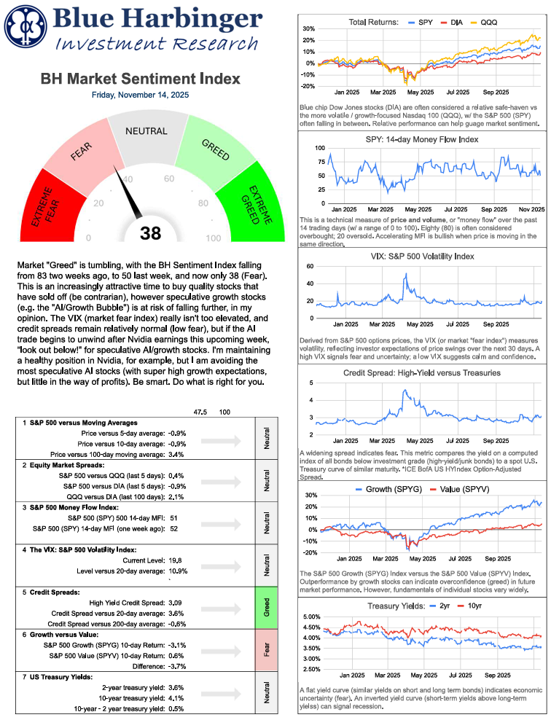

Market "Greed" is tumbling, with the BH Sentiment Index falling from 83 two weeks ago, to 50 last week, and now only 38 (Fear). This is an increasingly attractive time to buy quality stocks that have sold off (be contrarian), however speculative growth stocks (e.g. the "AI/Growth Bubble") is at risk of falling further, in my opinion.

The VIX (market fear index) really isn't too elevated, and credit spreads remain relatively normal (low fear), but if the AI trade begins to unwind after Nvidia earnings this upcoming week, "look out below!" for speculative AI/growth stocks. I'm maintaining a healthy position in Nvidia, for example, but I am avoiding the most speculative AI stocks (with super high growth expectations, but little in the way of profits).

Be smart. Do what is right for you.