The drumbeat of “AI/Growth Stock Bubble” marches on, yet high-income investors continue to sleep well at night. If you are a member of this distinguished income-focused group (or even just a casual small-time allocator), BDCs, stock & bond CEFs and dividend stocks continue to offer attractive opportunities. This report shares the latest update on the BH High Income Portfolio (25 positions, 9.5% aggregate yield) and one 13.7% yield BDC in the portfolio that I am watching closely. Enjoy!

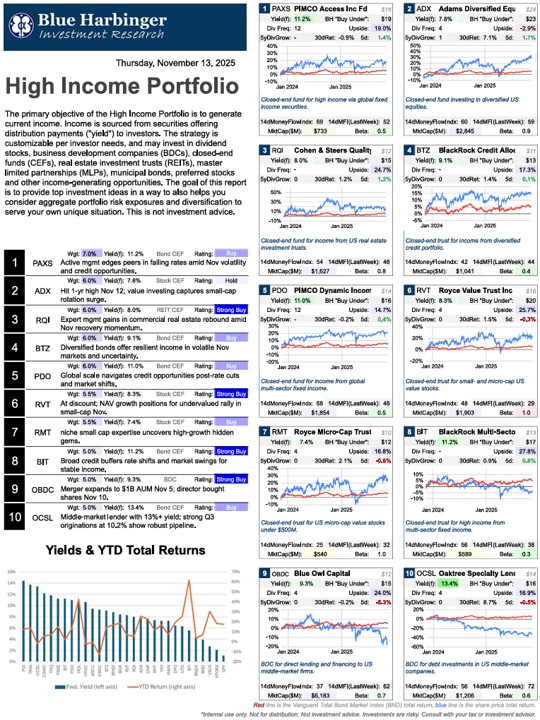

For starters, here is a look at the portfolio (click the image for a “zoom-in-able” PDF version of the complete portfolio).

Trinity Capital (TRIN), Yield 13.7%

I currently own a small position in Trinity Capital—an internally-managed business development company (“BDC”) that provides financing solutions to growth-stage, venture-backed companies. Founded in 2008 and public since 2021, Trinity specializes in senior secured loans, equipment financing, and equity co-investments, primarily targeting innovative firms in technology, life sciences, and software sectors.

As a BDC, it must distribute at least 90% of taxable income as dividends, making it compelling for yield seekers. But what really sets Trinity apart is its venture debt niche (unlike traditional banks, it offers non-dilutive capital to late-stage private companies, often with warrants for upside potential, blending debt stability with equity-like returns in a high-growth ecosystem).

Trinity's appeal stands out in today's volatile markets, where income investors continue to crave steady payouts (amid “AI Bubbles” and rate uncertainties).

Attractive TRIN Qualities

Here a few standout qualities making Trinity hard to ignore:

Increasing Dividend Yield (amid a sector dip): With shares down 11% from recent peaks, TRIN's forward yield has mathematically climbed to 13.7%, and is fully covered by net investment income (NII). This comes as BDCs have pulled back on modestly rising defaults and tariff fears (creating a lower entry point for yields far above the S&P 500's 1.3%).

Robust 2025 Originations Defying Headwinds: Despite BDC portfolio pressures from easing rates and economic slowdowns, Trinity originated a record $773 million in Q3 commitments, pushing year-to-date totals over $1.3 billion. Total investment income climbed 22.3% year-over-year to $75.6 million, with NII up 29% to $37 million ($0.52/share).

Prudent Credit Quality in a Risky Landscape: Trinity's weighted-average risk rating (its own internal metric) held steady at 2.9 (on a 1-5 scale) through Q3 (reflecting continued discipline in underwriting standards—amid modest sector-wide non-accrual increases). This resilience counters 2025's credit crunch, where other leveraged borrowers have been strained under persistent high rates).

Diversified, High-Growth Exposure: With $5.1 billion funded across 20+ industries, Trinity's portfolio emphasizes healthy tech and life sciences, offering inflation-hedged income less correlated to broader equities.

Trinity Risks:

However, Trinity also faces risks investors should consider. For example, primary concerns include:

Interest rate sensitivity: anticipated Fed cuts could pressure lending spreads, eroding NII as BDCs refinance at lower yields.

Credit defaults pose another threat; while Trinity's non-accruals are low, broader private credit turmoil—from bankruptcies to tariff-impacted sectors—could hit its venture-backed holdings, especially with Trinity’s high payout ratio (i.e. limited buffer).

Concentrated Growth Sector Exposure: With its concetration in growth and technology sectors, Trinity has been benefiting from the same “Growth/AI Bubble” that has many investors concerned. Even though Trinity is largely a debt investor, the BDC will still face pressures if/when the market cycle turns against growth and technology. For example, when the “Covid Bubble” burst in late 2021/2022, Trinity sold of hard as you can see in the following chart.

Arguably, if the fed plays its monetary policy cards right (with rate cuts), Trinity may not suffer the same fate (lower rates are good all sectors of the economy, especially growth and technology).

Valuation is another risk. While trading at only 1.1x book value (a small premium), Trinity’s valuation is a bit higher than peers and still relatively neutral relative to its own short history as a publicly-traded BDC (since 2021, as mentioned) as you can see in the table below (9th BDC up from the bottom).

So even though Trinity shares have sold off a bit in recent weeks (in sympathy with other BDCs) it’s still up year-to-date (unlike many BDCs) and it’s still not cheap on price-to-book valuation basis.

Trinity Takeaways

Trinity is an attractive differentiated BDCs (with its niche growth/technology sector focus) and it continues to benefit from strength in these sectors. The shares have sold off a bit recently (in sympathy with other BDCs—which have pulled back as the market faces uncertainty with tariffs, debt ceilings and moderate non-accrual increases), but the shares are still not “cheap” and face increased risk if/when the “growth/AI bubble” bursts.

As such, I view Trinity as attractive here (especially for that big dividend yield). And I own a small position in the BH High Income Portfolio. However, it’s still only a small position, and I will consider adding a lot more if when the “growth/AI bubble” bursts—which it may not.

Overall, disciplined income-focused investing remains a winning strategy. Be smart—keep on doing what is right for you.