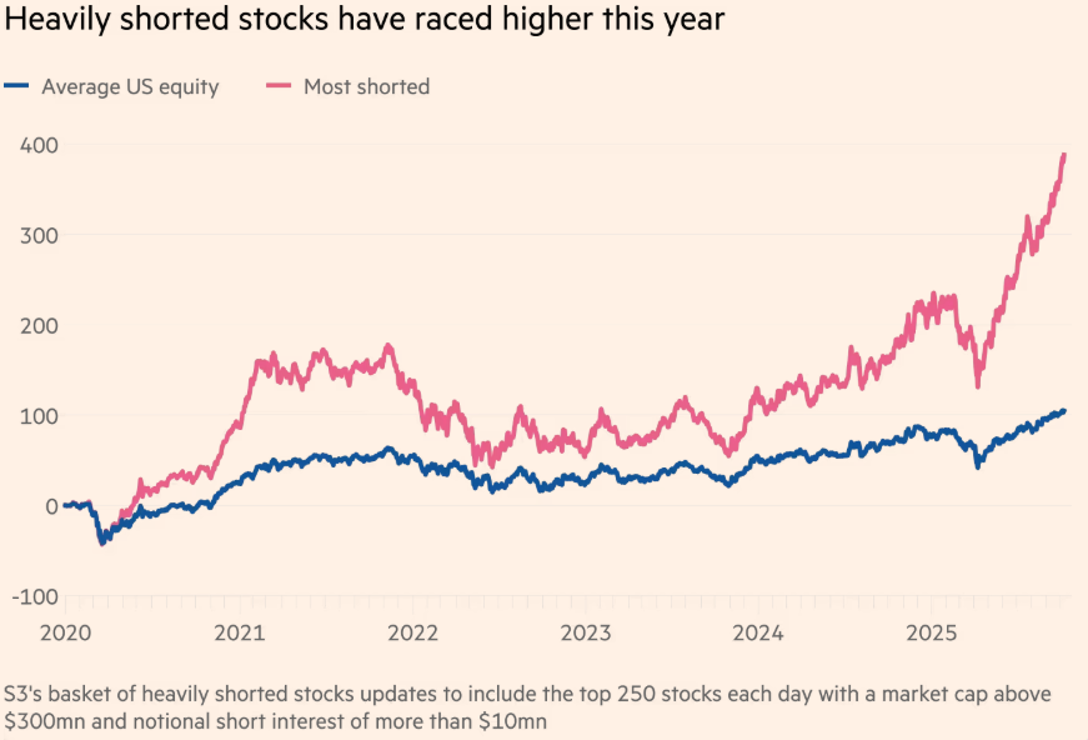

Market jitters continue as China-tariff risks, plus the AI “bubble,” keep investors up at night. Nonetheless, “high-performance-computing” datacenter stocks and trade war beneficiaries (such as MP Materials) continue to soar higher (despite very high short interest) and with no end in sight for this powerful megatrend rally. This report shares the latest “BH20 Top Growth Stocks” with a special discussion of MP Materials.

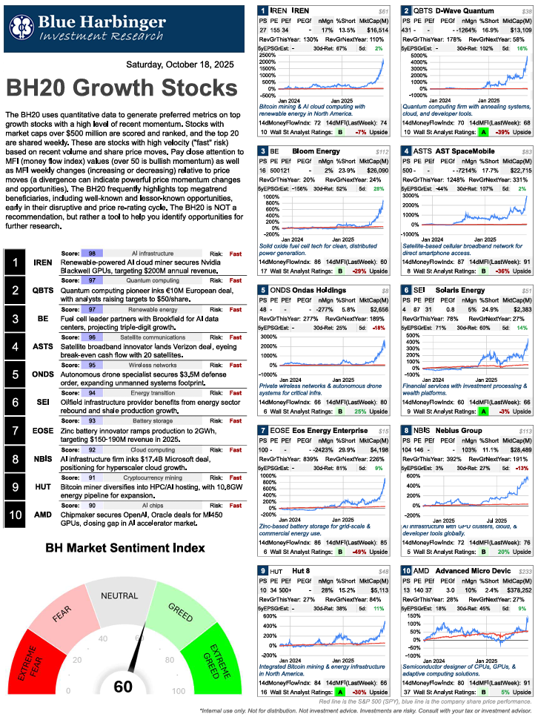

For starters, here is the latest iteration of the BH20 Growth Stocks (click the image to open the PDF).

And as you can see, AI stocks (such as HPC datacenter stocks, including Nebius and CleanSpark) continue to dominate the leader board.

However, another name on the list that stands out is MP Materials. Not only is it posting powerful returns, but its 14-day “money flow index” has gone even higher over the last week—an indication of investor enthusiasm and more potential upside ahead.

MP Materials (MP)

MP Materials stands out (as an attractive investment worth considering) amid escalating US-China tensions over rare earth elements, critical for electronics, EVs, and defense.

As America's sole integrated rare earth producer, MP benefits from efforts to diversify away from China's 80-90% market dominance.

Recent news highlights China's new export restrictions on seven rare earth metals in retaliation to US tariffs, including Trump's threat of 100% duties on Chinese imports starting November 1, 2025.

This tariff risk highlights MP's strategic value, with the shares up nearly 400% this year. Attractively, revenue is expected to grow 41% this year and a whopping 148% next year (as per Wall Street estimates)—wow! And reaching $1.42 billion by 2029 (as such, the shares currently trade at 10x that 2029 figure).

Importantly, MP has secured partnerships with Apple (i.e. a $500 million investment) and multiple Saudi collaborations too. Analysts rate the shares a “Buy,” and it is well positioned for long-term gains in a geopolitically charged sector.

The Bottom Line

Despite high valuations for AI stocks and trade-war beneficiaries, they are backed up by powerful revenues, cash flows and earnings; this makes the so-called “bubble” very different than the dot-com bubble at the turn of the century (those stocks had little revenue and no path to positive earnings).

Nonetheless, depending on your personal situation, it probably is a very bad idea to put all your money in AI beneficiaries and other “hot” stocks. The BH20 is intended to provide top ideas for you to consider—as only one part of your broader portfolio—and MP materials (as well as many others on the list) stand out as attactive.