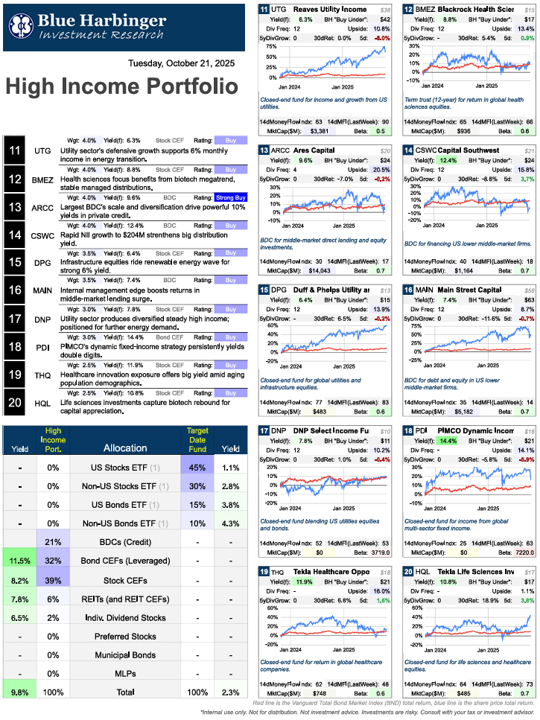

This report shares recent data on all 25 positions in the 9.8% aggregate yield “High Income Portfolio,” and highlights notable risks and investment opportunities as you manage your own income-focused portfolio. Notably, we’ve seen some share price movements (as the market continues to digest tariffs, interest rate dynamics and the ebbs and flows between value and growth, particularly AI) that are worth considering as you manage your own investments.

High Income Portfolio, Yield: 9.8%

For starters, here is the complete High Income Portfolio:

You can review the portfolio for recent position performance and opportunities, and I’ll refer back to the link above throughout this report.

Business Development Companies (BDCs)

BDCs have been interesting as much of the group continues to sell off (see 1-month return column) and now trades at lower price-to-book ratios than normal (some of them now trading below 1.0x).

The sell off is due to (a) risks as investors fear increasing trouble on the horizon (BDCs are a proxy for high-yield bonds because they are essentially “high yield credit” which is usually the first line of losses in the capital structure as the economy gets challenging. Obviously, not all BDCs are the same—some are a lot less risky than others), and (b)investors have been shirking the “financials” industry (where BDCs reside) in favor of flashier tech and AI stocks.

1. Ares Capital (ARCC), Yield: 9.6%

Industry leader, Ares Capital has sold off hard (its Money Flow Index, MFI, is still in oversold territory) and the shares trade at a compelling 1.0x book value (lower than normal as investors are fearful). If you are a high-income investor, Ares is a staple of many portfolio, and the shares are compelling at the current level.

Bond Closed-End Funds (CEFs)

Bond CEFs are another compelling group, especially when you can buy top names at a discount.

2. PIMCO Bond CEFs (PAXS, PDO and PDI), Yields: 11%+

PIMCO is the premier industry leader in the levered bond fund space, and although not trading at a discount to NAV, PAXS, PDO and PDI are all trading at smaller premiums than usual (attractive) and PAXS (the largest holdings in the BH High Income Portfolio is now basically trading at NAV—attractive for this fund!).

Utility-Stock CEFs

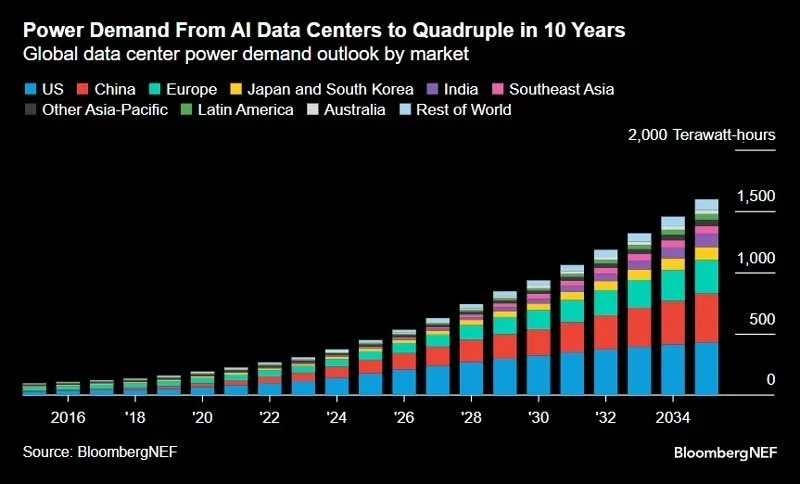

A handful of utility stocks (usually a boring sector) have been caught up in the AI megatrend as they produce energy to supply power for high-demand dataceters running AI. As such, one name in paricular has just pulled back a bit despite a powerful upward trend this year…

3. Reaves Utility Income (UTG), Yield: 6.3%

UTG is up more than 18% this year (more than the S&P 500 at ~+13.9%), yet has pulled back 8% over the last week as AI stocks (including several high-profile utility stocks powering datacenter AI) are down big. This provides a more attractive entry-point for UTG an attractive long-term dividend payer that is a large postion in the BH High Income Portfolio.

The Bottom Line

Markets have gotten a little more volatile than usual over the last couple weeks, and this is putting pressure on some top high-income opportunities (such as the ones discussed above).

In the income space, “buying low” (or at least on a pullback) can be a lot more important than in the growth stock space (where buying “mometum” can pay off). As such, the opportunities highlighted in this report are particularly interesting and worth consdering if you are adding new money (or rebalancing) your prudently-diversified high-income-focused investment portfolio.