If you like big steady income (to offset the short-term uncertainty of long-term stock-market investments), closed-end funds (“CEFs”) currently offer a widely-diverse set (ranging from varied stock and bond strategies) of big-yield opportunities (9%+ yields, often paid monthly) to choose from (ranging from those benefiting from market over-reactions to Fed interest rate signaling as well as otherwise-steady utility sector opportunities being whipsawed by AI’s startling demand for energy). This report shares 10 top big-yield opportunities (including a variety of relevant quantitative data and important qualitative commentary) and dives a bit deeper into one contrarian PIMCO bond CEF that is particularly compelling right now. Enjoy!

PIMCO Dynamic Income Fund (PDI): 14.8% Yield (Paid Monthly)

If you like big steady income from leveraged bond funds, PIMCO is the premier industry leader, and one fund in particular is currently trading at an attractive price (i.e. PDI).

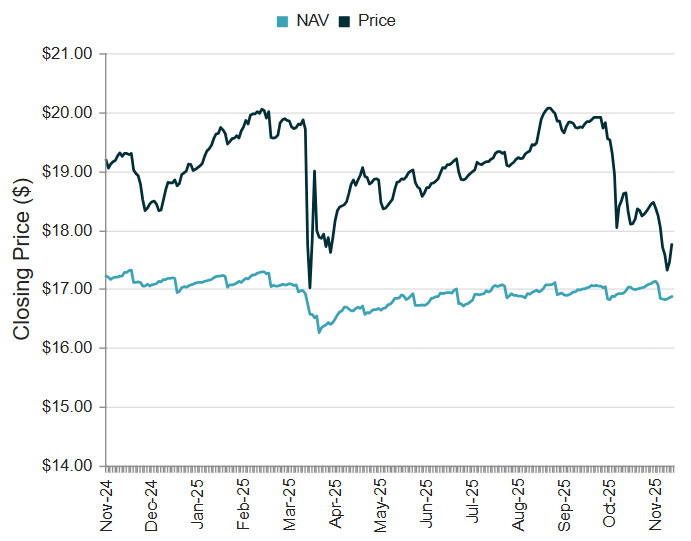

As you can see in the chart below, PDI often trades at a large premium to its net asset value (“NAV”) (because investors appreciate the leading manager (PIMCO) and its ability to invest in bonds that are typically only accessible to institutional investors), however that premium has recently come down dramatically thereby creating a more attractive entry point in my view.

The reason for the sharp decline is two-fold:

The Fed has become more hawkish in its tone on interest rates (less likely to cut considering inflation data remains a bit high) and this hurts PDI because of its ~3.8 year duration (interest rate risk). All else equal, as rates fall, bond prices mathematically rise (as the price recalibrates to make the yield “market rate”).

Section 19 Notice: There is an increasing likelihood that PDI will report its distribution is being generating largely by the “ROC,” or return of capital (rather than interest earned on its underlying holdings). This is a complex issue, but basically ROC can destroy earnings power by reducing net asset value (and it can also cause unexpected tax consequences when you sell your shares because ROC can reduce your cost basis thereby increasing your potential capital gains tax when you sell—depending on what type of investment account you hold PDI in. Here is a look at how well (or not well) PDI has been covering its distribution with investment income as compared to other PIMCO funds—and it’s not great.

And for reference, here is a link to the fund’s latest Section 19 notice (which was released right around the time the share price began to fall).

Without going to deep here, the fund is able to delay the immediate recognition of ROC by reclassifying it with interest rate swaps (which it has been doing heavily since the extreme unexpected interest rate volatility related to Covid stimulus and then inflation-reduction efforts). But the good news is, we know it’s been coming and it’s already baked into NAV.

The latest Section 19 Notice is a negative in the minds of many investors because they think it is a bad signal of what is to come, but in reality it’s good to get the ROC out of the way because the damage is already baked into the shares (it has been for a while).

Long story-short: investors over-reacted, PDI’s premium to NAV is really small for a top-notch PIMCO fund, and this price sell-off (while NAV remains fairly consistent—see earlier graph) has created a more compelling buying opportunity for income-focused investors.

More CEF Characteristics to Consider

Of course there are many additional important considerations before investing in any CEF. For example, here are 7 big ones for me:

And you can access much of this data, and much more, in the earlier top 10 CEF graphic above.

The Bottom Line:

If you are an income-focused investor, there are increasingly attractive market opportunities to consider (such as PDI and the nine additional attractive CEFs highlighted in the earlier table in this report.

And if you are an income-focused investor, CEFs can be an important part of your investment strategy, depending on your personal goals and situation. Most importantly, be smart people—do what is right for you.