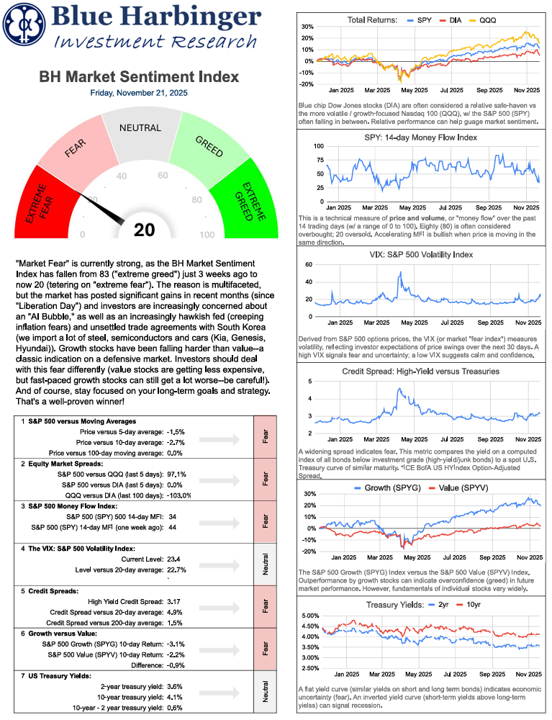

"Market Fear" is currently strong, as the BH Market Sentiment Index has fallen from 83 ("extreme greed") just 3 weeks ago to now 20 (teetering on "extreme fear"). The reason is multifaceted, but the market has posted significant gains in recent months (since "Liberation Day") and investors are increasingly concerned about an "AI Bubble," as well as an increasingly hawkish fed (creeping inflation fears) and unsettled trade agreements with South Korea (we import a lot of steel, semiconductors and cars (Kia, Genesis, Hyundai)).

Growth stocks have been falling harder than value--a classic indication of a defensive market. Investors should deal with this fear differently (value stocks are getting less expensive, but fast-paced growth stocks can still get a lot worse--be careful!). And of course, stay focused on your long-term goals and strategy. That's a continues to be a winning strategy!