This report shares the latest update on the BH Disciplined Growth Portfolio (38 current positions, not at all equally weighted), including several small new trades as well as a continued focus on powerful long-term growth opportunities. After this week’s stellar Nvidia earnings, a lot of investors are left wondering “what unexpected, good news can possibly remain for this already unprecedented AI growth story?” And the answer, of course, is building a prudently concentrated long-term growth portfolio that will benefit from AI (including AI hyper-scalers and “picks-and-shovels” companies”) but also healthy growth businesses benefiting from opportunities beyond just AI. Enjoy!

Moderate Yet Aggressive

Before getting into the details, it’s worth reminding readers the objective of The BH Disciplined Growth Portfolio is to outperform the market over a long-term horizon, but that does NOT mean beating the S&P 500 by 30% or 50% every year. To do that, an investor would have to take on extreme concentrated positions, and that would also mean extremely unnecessary risks.

If you are just starting out (i.e. not a lot of money), or if you are just playing with a small subset of your wealth, then there are plenty of “Fast-Paced” growth stock ideas in the portfolio, but if you are trying to build and protect long-term weath—a more disciplined approach—such as the BH Disciplined Growth Portfolio—likely makes a lot more sense for almost everyone reading this.

The Disciplined Growth Portfolio

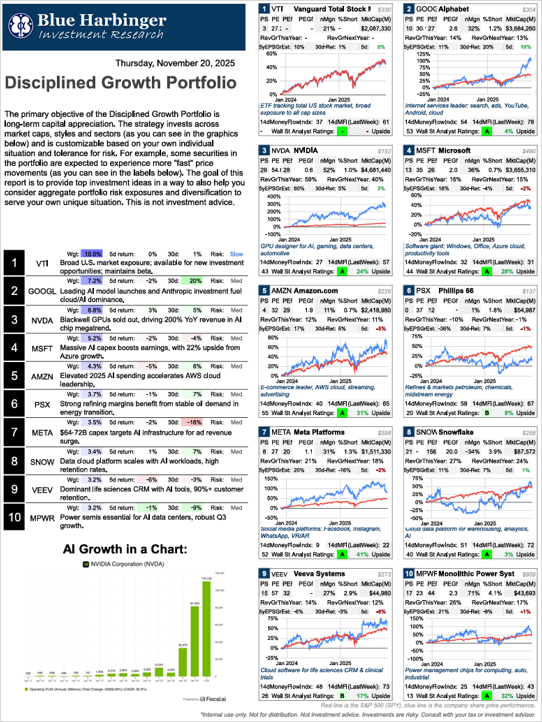

So with that backdrop in mind, here is a look at the latest BH Disciplined Growth Portfolio. Click the image below for a “zoom-in-able” PDF version of the complete portfolio, as well as important “risk management” metrics (such as top 10 concentration versus the S&P 500, sector diversification and growth-versus value plus small-versus-large cap style boxes.

You’ll notice on page 1 of 4 (above) the top 10 includes a healthy dose of the Magnificent 7 (which are absolutely dominant global businesses), but you’ll also see their weights are not the same as their weights in the S&P 500 (on page 3 of the report).

Nvidia

You’ll also note Nvidia is now the 2nd largest single-stock position (behind only Google—which has performed extremely well, of late—and VTI—a Vanguard Total US Market fund, which provides important market beta exposure).

You’ll also see the Nvidia Operating Income chart at the bottom left of page one—and this incredible growth demonstrates just how amazing the AI megatrend has been (Nvidia chips are at the center of virtually everything utilizing top-of-the-line AI).

Nvidia’s valuation also remains fairly reasonable, trading at a 0.6x forward PEG ratio (price-earnings to growth)—anything below one is often a very good sign.

So as the second largest single-stock holding, and considering the powerful ongoing megatrend and compelling valuation, having a large position in Nvidia still makes a lot of sense—especially considering it is such a large part of the S&P 500 and significant part of the total global economy.

New Trades

I also added small position in Taiwan Semiconductor (the foundry that manufactures Nvidia’s chips) and Micron (supplies Nvidia with advanced memory solutions). And I sold positions in highly aggressive AI “picks-and-shovels” companies, which I believe are still great businesses but overheating from a valuation standpoint (including Constellation Energy (CEG), Applied Digital (APLD) and Innodata (INOD)).

Overall, the portfolio remains positioned aggressively for long-term growth, but slightly less aggressive than before as certain top AI growth stocks appear to have high valuations that could pullback (and drag share prices dramatically lower in a hurry) at any time.

The Bottom Line

If you are a long-term growth investor, it can be scary to “stay the course” considering the non-stop rumblings of an AI bubble (and considering performance has been so great over the last year). However, it’s having the resolve to stay invested when the market gets scary that pays off the most in the long term. Overall, I am maintaining a prudently aggressive long-term growth positioning in the BH Disciplined Growth Portfolio (just slightly less aggressive than before).

And at the end of the day, you need to do what is right for you, based on your own individual, personal situation.