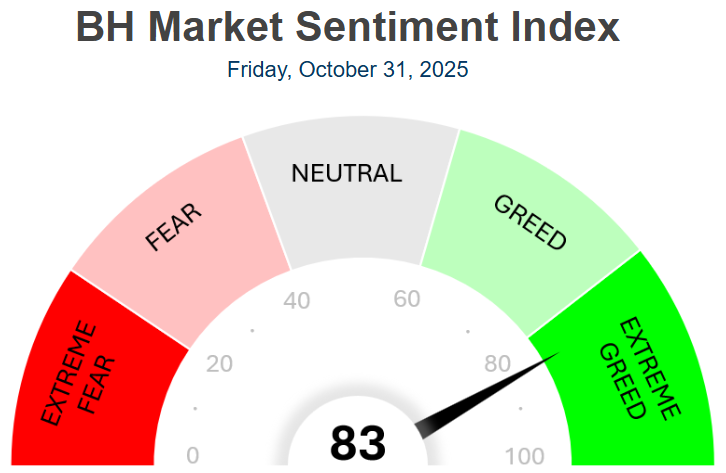

Markets regained momentum, confidence and "greed" over the last week as stocks remained near flat but regained their footing as money flowed in (MFI over 50 again for SPY), the VIX (market fear index) calmed down, credit spreads came down/ remain low, and treasury yields remained mostly neutral. Nvidia surged ~5% on US-China trade truce optimism and Qualcomm's AI chip wins amplified tech fervor. But the Fed's quarter-point cut included hawkish tones with Powell claiming Dec easing is "not a foregone conclusion." Meta's AI-spend shock + Microsoft's costs weighed on megacaps, but Amazon & Apple's earnings beats offered some optimism. Next week's election jitters loom large. Yet overall greed/momentum dominates sentiment.

You can access more data on this week’s reading here.