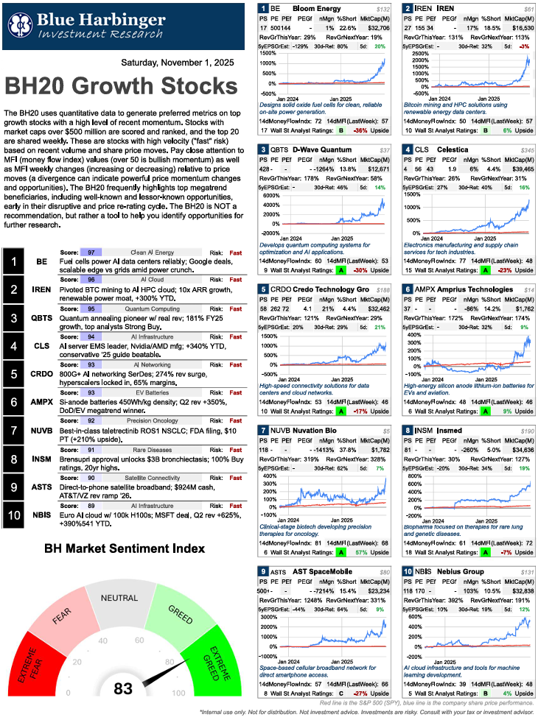

There is a new #1 in town, as Bitcoin-turned-AI-HPC-cloud company, Iren (IREN), has been dethroned by this accelerating fuel cell provider for AI datacenters. Massive runway for fast-paced growth, especially if this market stays healthy—which it may with stong AI momentum signs from megacap hyperscalers this past week. So much concentrated data and compelling opportunities in this market if you know where to look (such as this report).

You can view a zoom-in-able PDF of this week’s BH20 Fast-Paced Growth Stocks here. Enjoy!

You can also view the data behind the “BH Market Sentiment Index” (above) in this report. Notably…

Markets regained momentum, confidence and "greed" over the last week as stocks remained near flat but regained their footing as money flowed in (MFI over 50 again for SPY), the VIX (market fear index) calmed down, credit spreads came down/ remain low, and treasury yields remained mostly neutral. Nvidia surged ~5% on US-China trade truce optimism and Qualcomm's AI chip wins amplified tech fervor. But the Fed's quarter-point cut included hawkish tones with Powell claiming Dec easing is "not a foregone conclusion." Meta's AI-spend shock + Microsoft's costs weighed on megacaps, but Amazon & Apple's earnings beats offered some optimism. Next week's election jitters loom large. Yet overall greed/momentum dominates sentiment.