As the largest publicly-traded Business Development Company (“BDC”), Ares Capital (ARCC) is not only well-positioned to defend its big dividend (current yield is 9.3%) with spillover capital, but it’s also well-positioned with multiple levers for growth (e.g. conservative balance sheet leverage, fees and plenty of deal flow). And despite the big risks (such as falling rates, spread compression and “hidden” liabilities), the latest earnings announcement suggests it continues to present an attractive valuation for long-term income focused investors. This report shares data on 10 top big-yield BDCs, then reviews the details on Ares and concludes with a strong opinion on investing.

10 Big-Yield BDCs

For starters, here is some high-level data on 10 top big-yield BDCs (click here for a “zoom-in-able” PDF) for comparison purposes.

Overview

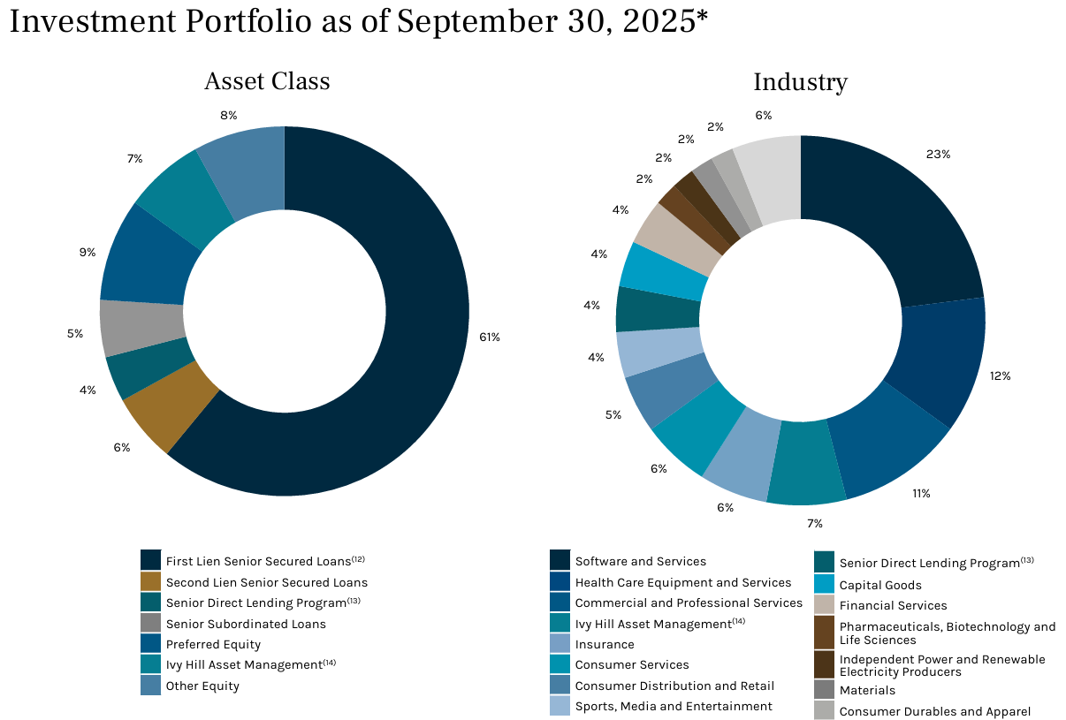

ARCC provides financing to small (middle-market) companies mainly through direct lending. It has a $28.7 billion fair-value portfolio across 587 companies and 25 industries.

ARCC was created by Ares Management in 2004, and is externally managed by Ares Capital Management LLC (a subsidiary of Ares Management Corporation (ARES)).

For some background, BDCs were set up by an act of Congress in the 1980’s to help “small” (middle market) businesses obtain financing, and as such BDCs avoid corporate taxation if they adhere to certain regulatory rules (notably paying out 90%+ of their income as dividends to investors). This is why they pay the big dividend yields that so many income-focused investors love.

Positive Quarterly Earnings:

Ares announced its latest quarterly earnings on October 28th, and the results were positive. For example, the it reported a loan origination surge, closing $3.9 billion in new commitments (+50% QoQ), including a record $5.5 billion Dun & Bradstreet “take-private” deal.

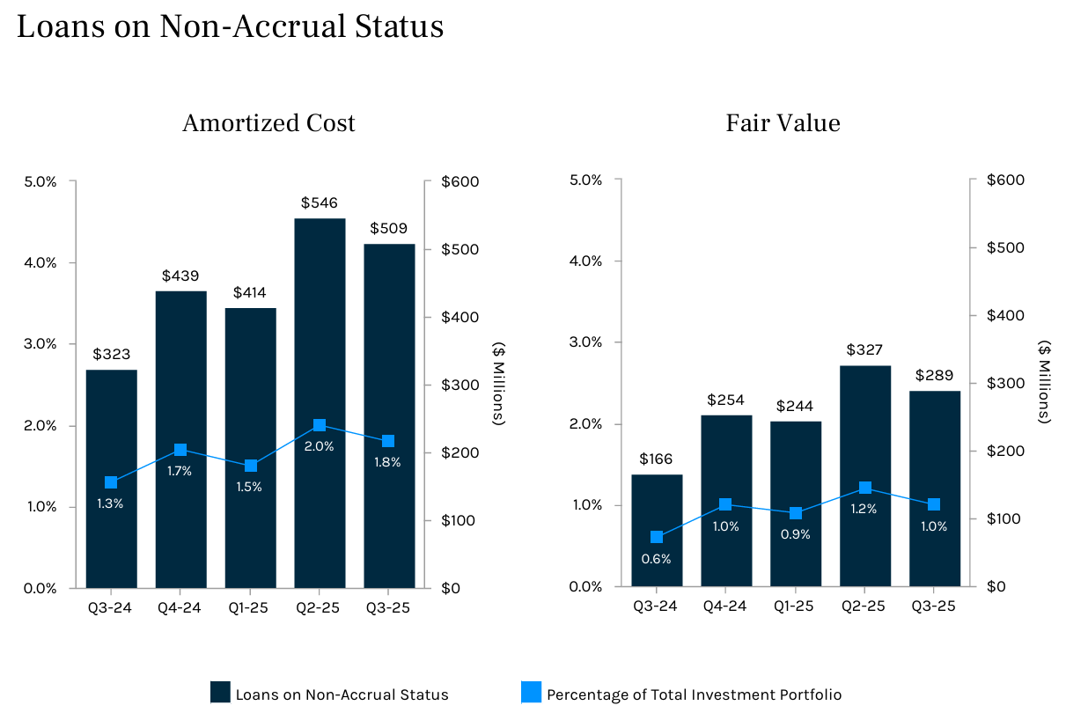

Also encouraging, ARCC reported improving credit (nonaccruals fell 20 bps to 1.8% (at cost) and 1.0% (at fair value)) and realized gains (Q3 delivered $175 million), led by a $262 million exit from restructured Potomac Energy with a 15% Internal Rate of Return (“IRR”)). Also positive, net deployments doubled to $1.3 billion.

Healthy Opportunities Ahead

ARCC is also well positioned on a go-forward basis, for several important reasons, for example:

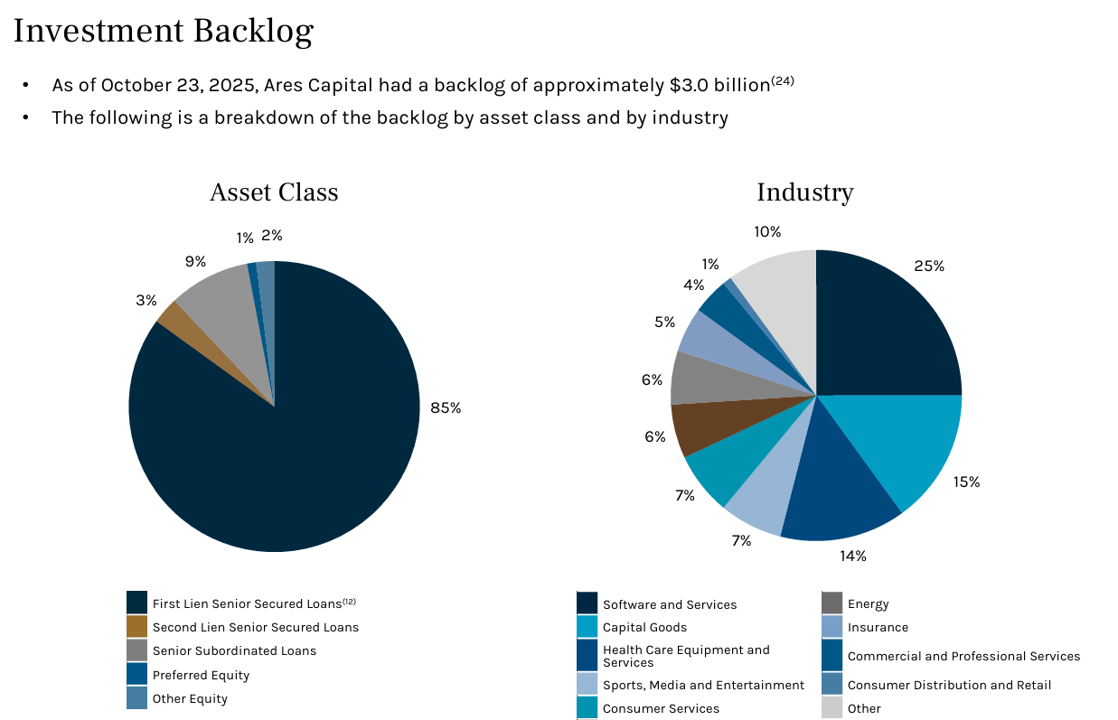

Activity Increasing: 60% of Q3 originations were new borrowers (over half were change-of-control deals—a good thing). And the opportunities are vast considering they reviewed $875 billion in deals over the last 12 months (a record), and they have an approximately $3 billion backlog (signaling early-cycle momentum).

Fee Income is a significantly important opportunity. For example, ARCC generates meaningful fee income from structuring, origination, and exit fees on its loans, which typically range from 1% to 3% per transaction (and provide a stable, high-margin revenue stream that supplements interest income). In recent quarters, these fees (along with prepayment penalties and advisory income) have contributed 5% to 10% of total investment income, and they remain particularly important as deal activity increases, as described earlier.

Balance-Sheet Leverage: with a debt/equity ratio at only 1.0x (see table below), Ares is left with plenty of room to push toward its 1.25x target, and thereby lifting ROE without issuing new equity (a good thing).

Valuation:

Ares currently trades at 1.0x book value (neither a premium or a discount). However, as compared to its own historical price-to-book range (see table below), this is arguably quite attractive considering the curren environment).

And as mentioned earlier, Ares debt-to-equity ratio of only 1.0x (see table above) positions it conservatively compared to peers and compared to its target of 1.25x (i.e. plenty of room to deal with risks and opportunities).

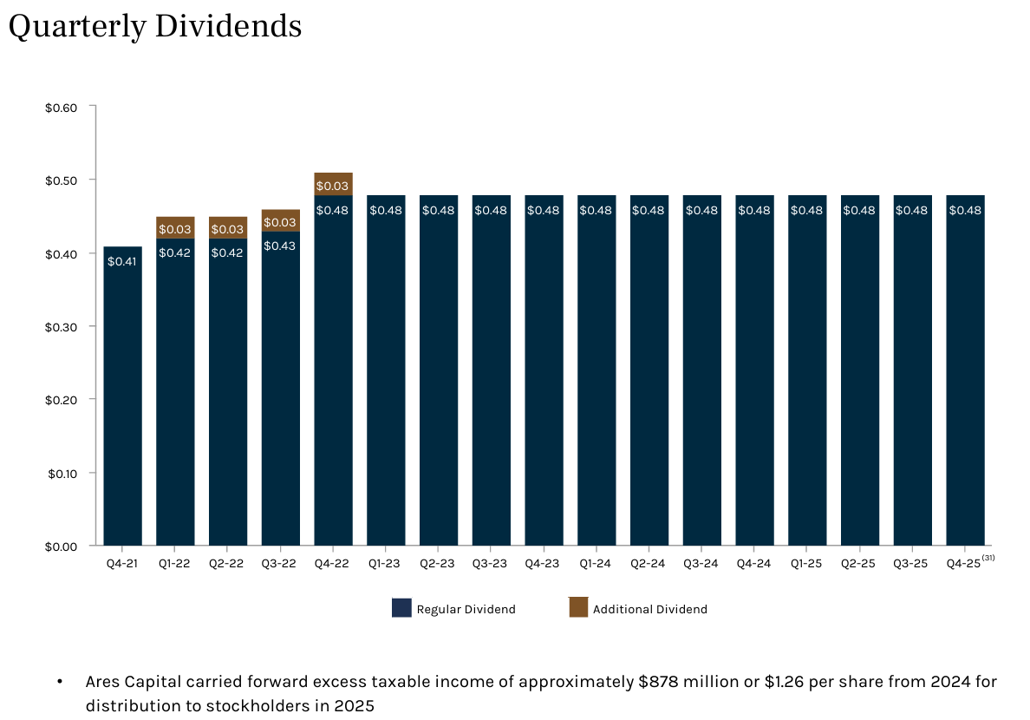

Dividend Safety

The big steady dividend is the main reason many investors choose Ares. And a look under the hood shows the dividend is healthy. For example, the $0.48 quarterly dividend has been covered for 20 consecutive quarters. And ARCC has $1.26/share in spillover (extra income not paid out and used as a safety net) which equates to over 2 quarters of dividend protection. Not to mention NAV has risen nine times in the last ten quarters (attractive).

Risks

However, investors should also consider the risks before investing.

Loan Non-Accruals: while low (and slightly down), loans unable to pay are the most basic risk for Ares. And if the economy weakens, non-accruals could go up fast. Fortunately, nonaccruals just fell 20 bps to 1.8% (at cost) and 1.0% (at fair value), as mentioned. And Q3 delivered $173 million in net realized gains, led by a $262 million exit from restructured Potomac Energy (with a nice 15% Internal Rate of Return).

Falling Interest Rates are another risk as declines pressure Ares’ floating-rate income. This means core earnings must also focus on volume, fees, and leverage to hold the $0.48 quarterly dividend. And fortunately for Ares, fee income (as mentioned) is significant and diversified.

Competitive Spread Compression: First-lien spreads held at SOFR +560 in the most recently reported quarter, but the competitive deal environment (from other BDCs) risks a “race-to-the-bottom” in profitability. Fortunately, as the largest BDC, Ares has other competitive advantages (scale and resources) to help them differentiate and standout in an increasingly competitive lending environment.

Hidden Liabilities pose another risk. For example, contingent credit risks embedded within ARCC’s loan portfolio (where defaults or restructurings could materialize rapidly during an economic downturn without immediate visibility on the balance sheet) are one such risk. Specifically, these off-balance-sheet exposures, often tied to subordinated or mezzanine debt positions, amplify vulnerability to borrower insolvency (e.g. non-accruals) and potentially leading to significant write-downs that would erode net asset value (and put pressure on the dividend). However, as mentioned, ARCC has both spillover income and lower leverage thereby providing an important buffer against these risks.

Takeaways for Income Investors

At the end of the day, Ares faces risks, but remains a solid business and an attractive investment opportunity. It’s not just paying a big dividend—it’s earning it with discipline. Scale drives selectivity (management passes on 99% of deals), its defensive industry focus keeps credit strong, and multiple earnings levers (leverage, fees, spillover, increasing deals) protect the payout even as rates fall. And with a 10% annualized ROE target sustained across 20 years and cycles, ARCC remains a top opportunity worth considering for your prudently-diversified high-income portfolio. I own it in mine.