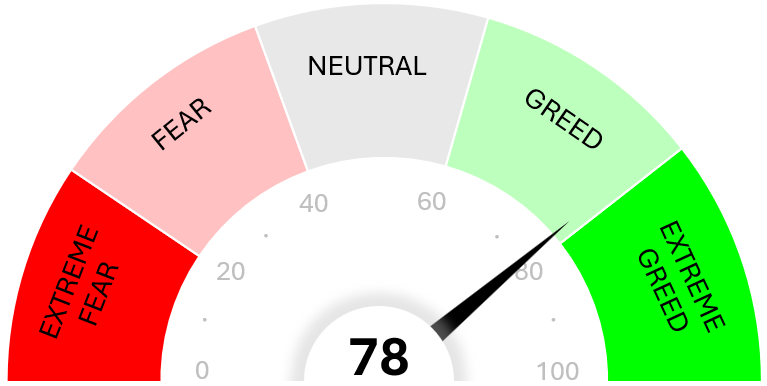

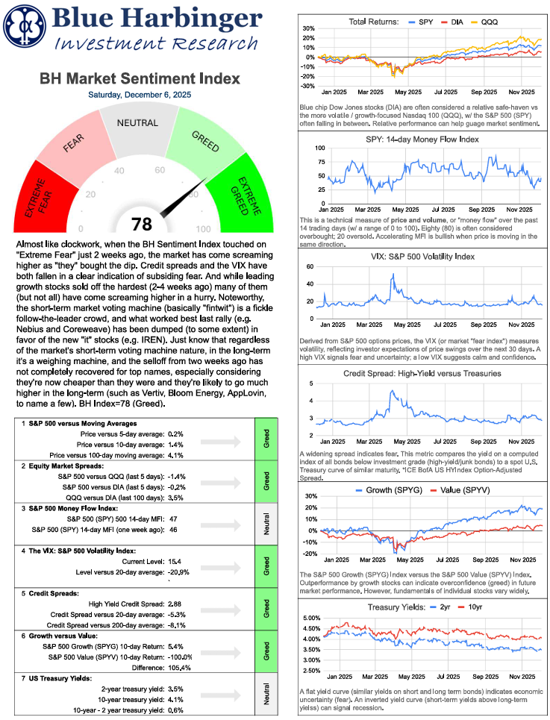

Almost like clockwork, when the BH Sentiment Index touched on "Extreme Fear" just 2 weeks ago, the market has come screaming higher as "they" bought the dip. Credit spreads and the VIX have both fallen in a clear indication of subsiding fear. And while leading growth stocks sold off the hardest (2-4 weeks ago) many of them (but not all) have come screaming higher in a hurry. Noteworthy, the short-term market voting machine (basically "fintwit") is a fickle follow-the-leader crowd, and what worked best last rally (e.g. Nebius and Coreweave) has been dumped (to some extent) in favor of the new "it" stocks (e.g. IREN). Just know that regardless of the market's short-term voting machine nature, in the long-term it's a weighing machine, and the selloff from two weeks ago has not completely recovered for top names, especially considering they're now cheaper than they were and they're likely to go much higher in the long-term (such as Vertiv, Bloom Energy, AppLovin, to name a few). BH Index=78 (Greed).

Click the image below to open a zoom-in-able PDF version of the report.