No one has a working crystal ball, but it’s not hard to see where the market is going (e.g. the “cloud AI megatrend,” for example). Where uncertainty starts to creep in is the likely winners (e.g. mega-cap hyper-scalers) versus the less-certain long-term winners with more volatile upside (e.g. the nuts-and-bolts hyper-scaler suppliers and datacenter component makers). This week’s BH20 fast-paced growth stocks shares a handful of top ideas from the latter group (e.g. huge upside “potential” but volatile and less-certain).

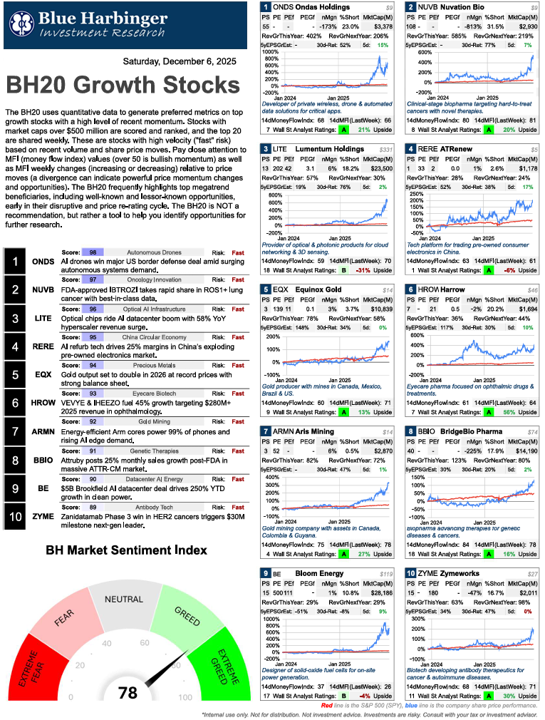

For starters, here is the report (click the image for the full 3-page zoom-in-able PDF).

Ondas Holdings (ONDS)

This autonomous AI drone maker again takes the top spot as it keeps winning contracts and has serious momentum again (although it still sits below its previous peak just a few weeks ago).

Ondas is basically a developer of private wireless, drone & automated data solutions for critical apps. And it recently won a major US border defense deal amid surging autonomous systems demand.

From a technical standpoint, this one has room to run, especially considering its price and “Money Flow Index” are both moving in the same direction (higher) and even Wall St. analysts believe it has over 20% upside (and potentially a lot more as buyers pile in).

Fear & Greed

You’ll also notice the BH Market Sentiment Index sits at 78 (Greed). Almost like clockwork, when this index touched on "Extreme Fear" just 2 weeks ago, the market has come screaming higher as "they" bought the dip.

Credit spreads and the VIX have both fallen in a clear indication of subsiding fear. And while leading growth stocks sold off the hardest (2-4 weeks ago) many of them (but not all) have come screaming higher in a hurry.

Noteworthy, the short-term market voting machine (basically "fintwit") is a fickle follow-the-leader crowd, and what worked best last rally (e.g. Nebius and Coreweave) has been dumped (to some extent) in favor of the new "it" stocks.

Just know that regardless of the market's short-term voting machine nature, in the long-term it's a weighing machine, and the selloff from two weeks ago has not completely recovered for top names, especially considering they're now cheaper than they were and they're likely to go much higher in the long-term (such as Vertiv, Bloom Energy and AppLovin, to name a few).

The Bottom Line

The stocks in this report are NOT for the faint of heart. These are fast-paced growth stocks with building momentum and potentially a lot of near-term upside. These are NOT recommendations, just data points for you to consider. I like to add a few of these types of names, opportunistically, to my long-term growth portfolio. Use the names in this report with caution. There will be a lot of volatility.