When it comes to income-focused investing, not all big yields are created equally. And from four distinct big-yield categories (including (1) declining businesses, (2) manufactured distributions, (3) selling shares, and (4) well-covered qualified dividend yields), Altria’s category is arguably the best (it’s in the fourth group) and the shares are currently down big and worth considering. This report shares data on 40 big yields (with share prices currently down big), reviews four attractive investment opportunities (from across the four groups), dives deeper into Altria (including a review of the business, sin-stock valuation discount, dividend safety and risks), and then concludes with my strong opinion on investing.

40 Big Yields Down Big

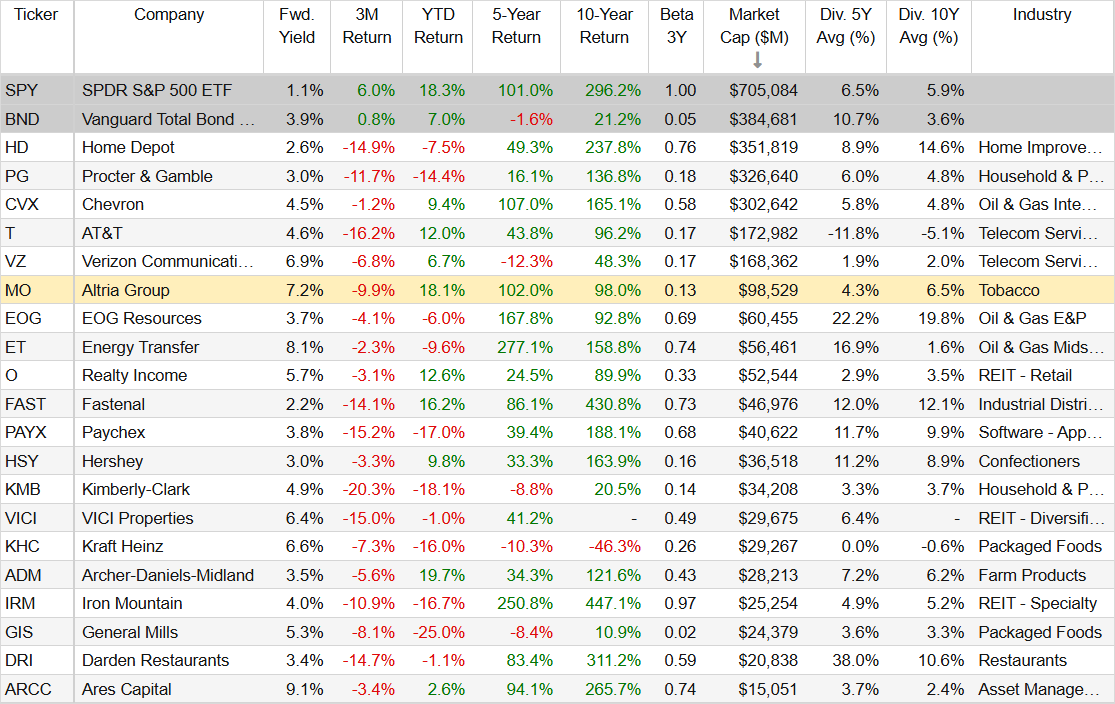

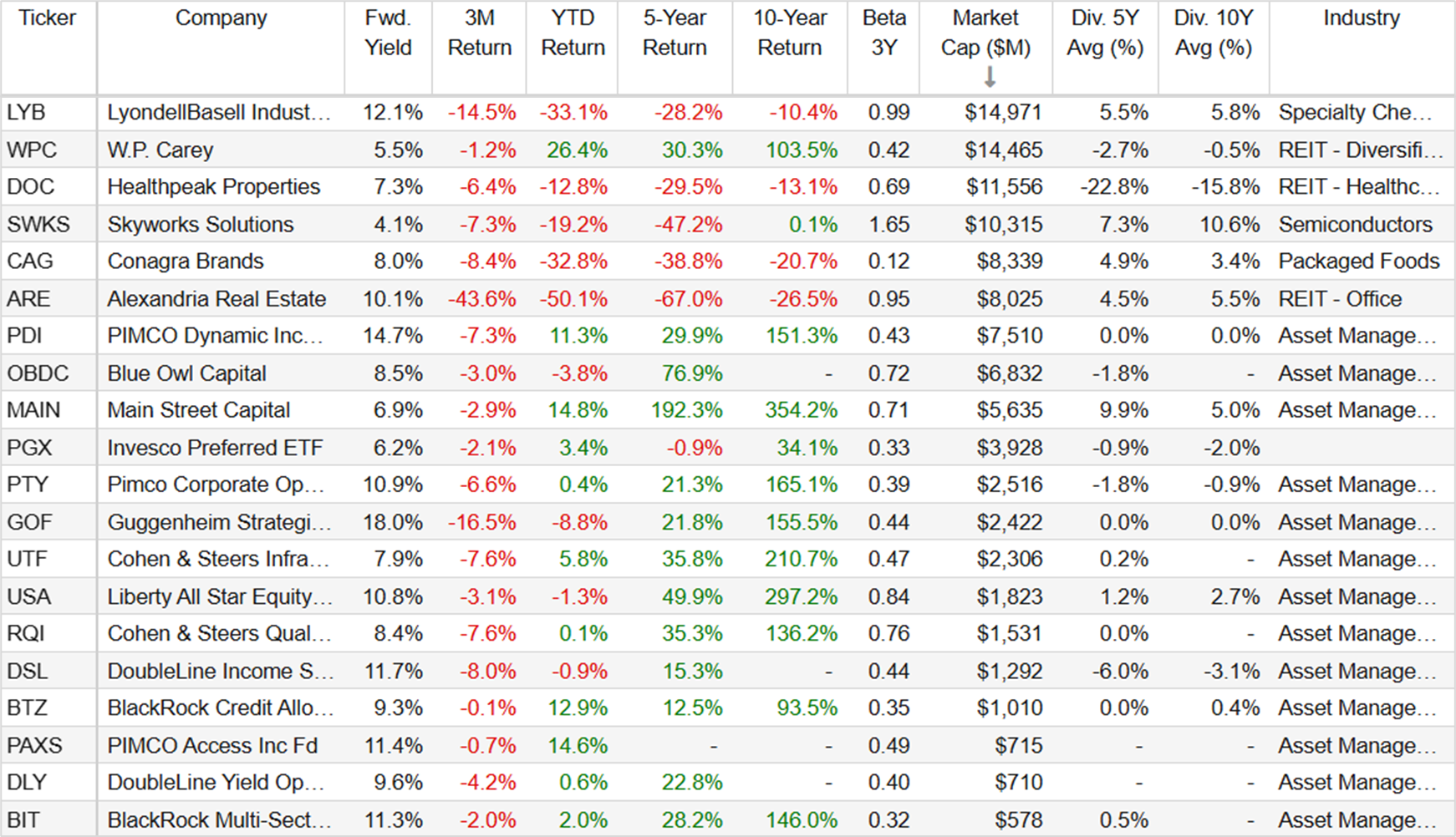

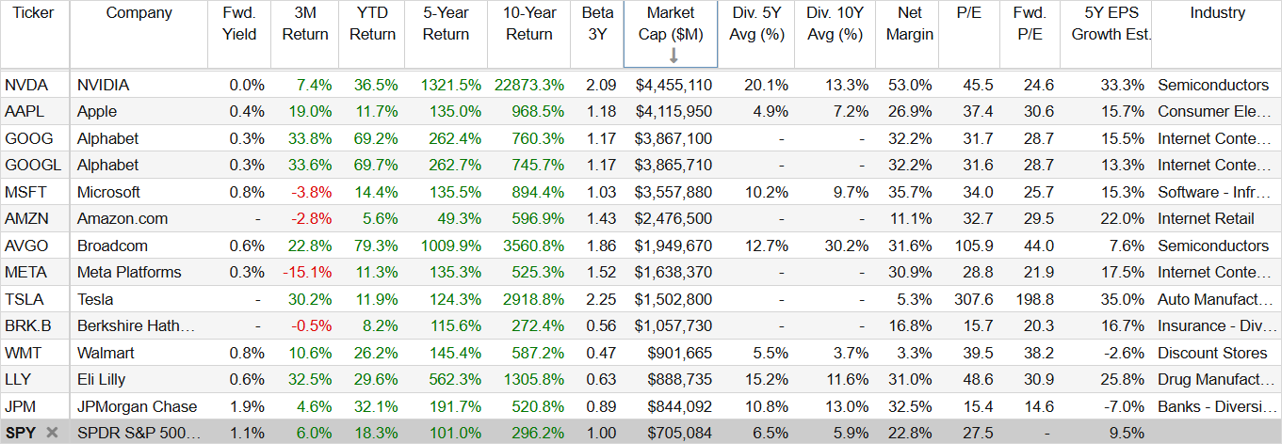

For starters, here is a look at 40 popular big-yield investment opportunities, all of them recently down significantly (as compared to the S&P 500 (SPY)).

But before you go blindly buying any of these names, just because they are trading lower, let’s briefly review some important characteristics of each of the four big-dividend types (mentioned earlier), to help you make more informed investment decisions.

Declining Businesses

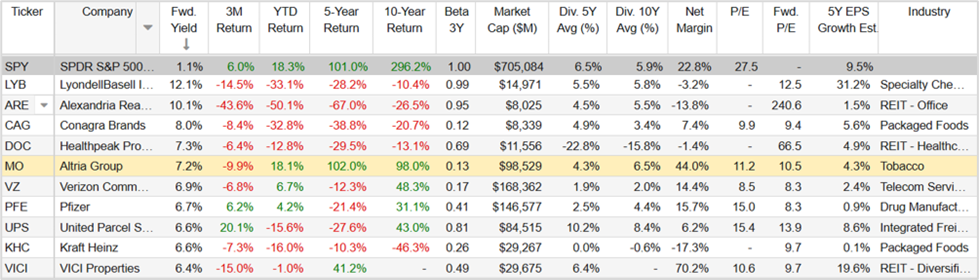

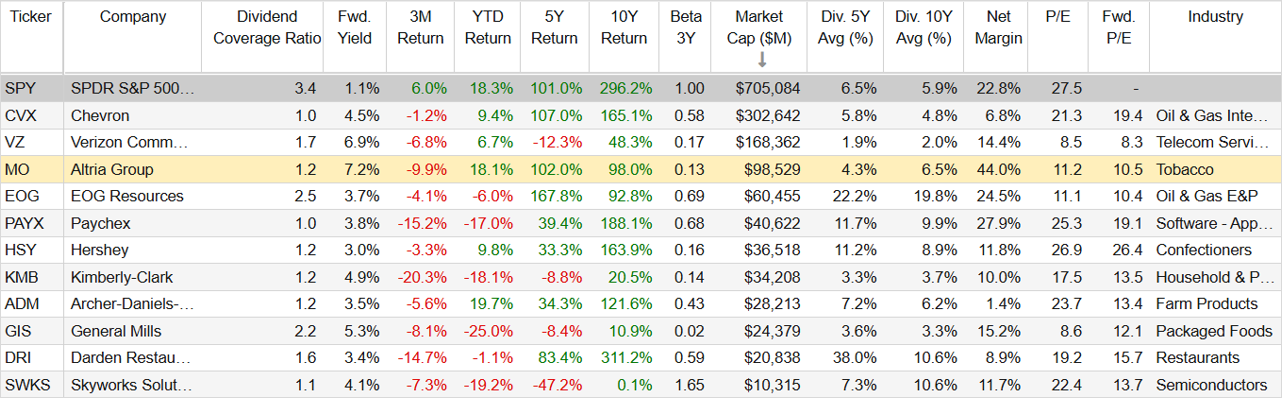

All else equal, when a share price falls, the dividend yield mathematically increases. And just because the share price is down, that doesn’t necessarily mean it’s a good investment. Rather, a lot of times it just means it’s a business in decline. For some perspective, let’s consider the 10 biggest dividend yields in the S&P 500 (see below). Pay close attention to the 5- and 10-year total returns of these stocks versus the benchmark S&P (they are dramatically underperforming).

If you had bought this entire group of 10 top dividend yields, just because the yields were big, you might be sorely disappointed with your longer-term performance.

Manufactured Distributions

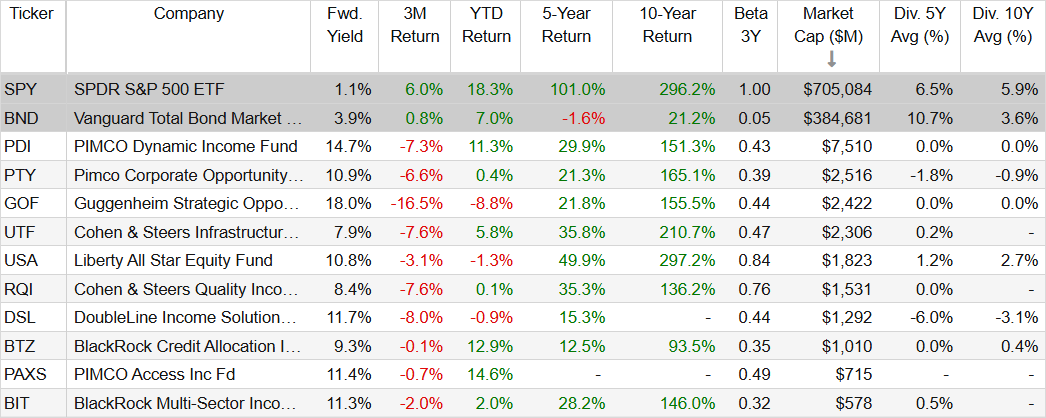

Next on our list, “manufactured distributions” include companies or investment funds (such as popular big-yield closed-end funds, or “CEFs”) that often support their big distribution yields with capital gains, heavy borrowing, derivative instruments and/or a return of your own investment dollars (which all add a layer of risk to your investment, not to mention potential tax consequences (more on this later)). Here are ten examples in the table below.

This is not to suggest temporary actions to support the dividend, or CEFs entirely, are bad. They are not. But manufactured distributions can be a bit artificial and do introduce new risks investors need to consider, such as the specific CEF questions I propose in the graphic below.

Selling Shares (to Generate Income):

A commons source of consternation for many income-focused investors is when some young hotshot with little to lose suggests all income investors would be better off if they just bought great growth stocks and then sold a few shares every month or quarter to generate whatever spending cash you need to support your lifestyle.

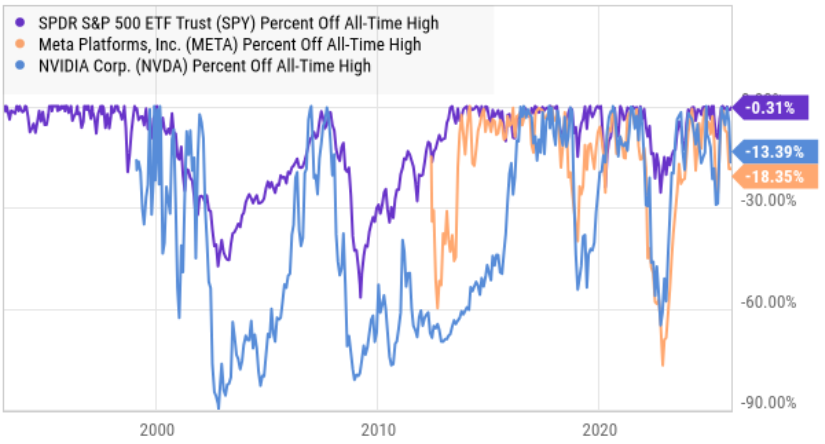

And while this can be a good strategy, in some situations, to generate some of your income needs, it’s also often reckless and ignorant advice that can quickly send you to the poor house if the market crashes (like it did in the tech bubble, the great financial crisis, the initial covid crash and the subsequent post covid stimulus growth stock bubble that burst hard) and you’re forced to sell shares at the bottom to raise cash and thereby permanently locking in your losses—yuck!

For example, you can see examples (in the chart above) of just how far top growth stocks and the overall market can actually fall during periods of distress. Not to mention the unnecessary stress and lost sleep fretting and worrying about dramatically inconsistent levels of market volatility—yuck again!

Well-Covered Qualified Big Dividends

Arguably the best big-yield category is the special group of well-covered qualified big dividend payers supported by financially strong businesses that are likely to keep performing well, regardless of whatever crisis the market faces next (Altria is an example of one such attractive dividend, as will be covered in subsequent sections of this report).

For instance, you can see examples of ten top dividend stocks currently down big included within the popular (~100-stocks) Schwab US Dividend Equity ETF (SCHD) in the table below (this fund is known for dividend safety and quality).

Not only do these individual companies avoid risks commonly associated with declining businesses (the fund screens against many such risks), as well as avoiding manufactured distributions and living-and-dying by market volatility (e.g. selling shares for income as discussed earlier), but they are also “qualified” dividends, which means they may be taxed at a lower rate, depending on your own tax bracket and whether you own them in a taxable account or a tax-advantaged retirement account.

This can be a huge advantage over other popular big-yield categories, such as CEFs, BDCs and REITs, for example (their dividends are often actually “distributions” that can be taxed at a higher rate and/or lead to surprise capital gains tax bills when you sell in the future if they are relying on a significant return of your own capital to support the regular income payouts).

Qualified dividends can also provide tax advantages over master limited partnerships, or MLPs (another popular big-yield category), which can actually cause surprise tax consequences in otherwise tax-advantaged individual retirement accounts (IRAs) via unrelated business taxable income and painful K-1 tax statements delaying your individual tax return—yuck!

And qualified dividends can also be more attractive than municipal bond (and municipal bond CEF) investments (which are often almost entirely tax exempt) after factoring in “tax-equivalent” total returns and the potential for ongoing long-term compound growth. Overall, big, qualified dividends can be a very special thing—depending on your own personal situation.

Altria Overview

One particularly interesting “qualified” big dividend (current yield is 7.2%) is Altria Group, especially considering the shares have recently sold off and the valuation is increasingly attractive.

About Altria:

Altria is a US-based holding company focused on mainly tobacco and related products. Specifically, Altria provides nicotine choices (to adult consumers 21+) through subsidiaries such as Philip Morris USA (cigarettes), U.S. Smokeless Tobacco Company (smokeless tobacco), John Middleton Co. (cigars), and NJOY LLC (e-vapor). Altria manufactures and sells premium brands such as Marlboro cigarettes, Copenhagen dip, on! pouches, and Black & Mild cigars. It also has a strategic investment in Anheuser-Busch InBev (~10% stake) and Cronos Group (cannabis).

For some color, Altria generated $17.4 billion in revenue through the first 9 months of 2025, through the following three business segments:

Smokeable Products (88% of revenue): This is the core legacy business and includes combustible cigarettes (e.g. Marlboro) and machine-made large cigars (e.g. Black & Mild).

Oral Tobacco Products (12% of revenue): This encompasses moist smokeless tobacco (e.g. Copenhagen, Skoal) and oral nicotine pouches (e.g. on!).

All Other (0% of revenue): This includes e-vapor products (NJOY), heated tobacco sticks (via Horizon Innovations joint venture), oral nicotine innovation (Helix), and R&D for emerging platforms.

Altria’s Moat:

As a business, Altria has a wide moat versus the competition, stemming mainly from the addictive nature of its products and regulatory barriers to entry.

For example, Altria’s core product, nicotine, is highly addictive and commands strong brand loyalty. For instance, Altria's flagship Marlboro brand commands approximately 41-42% of the US cigarette market thanks to decades of brand equity that drives strong pricing power (well above inflation and any volume declines—more on this risk later).

And from a regulatory standpoint, things like strict FDA approvals for new or modified tobacco products and advertising bans (since the 1970s) make it nearly impossible for new competitors to enter the market successfully.

Altria’s “Sin-Stock” Valuation Discount

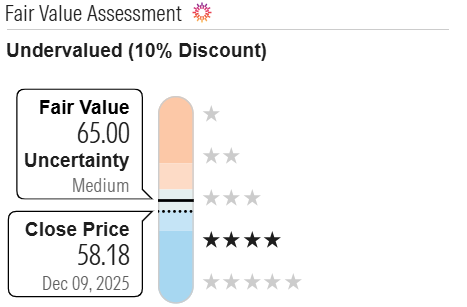

From a valuation standpoint, Altria is a financial powerhouse that is being significantly undervalue by the market (arguably due to “sin-stock” selling pressure from large “socially conscious” institutions) and thereby creating one of the most compelling dividend stock opportunities in the market.

Currently trading at just 10.5x forward earnings (see earlier table) and easily returning a mountain free cash flow to investors (via qualified dividends and share repurchases), Altria is extremely compelling if you can get passed the “sin-stock” nature of the product (nicotine is addictive, known to cause cancer, and tobacco can discolor your teeth).

For some color, social screens within ESG mandates that prohibit large institutional investors (such as pension funds and endowments) from owning tobacco stocks are putting significant pressure on the shares (i.e. this significantly reduces the buyer pool). Studies show (for example here and here) sin stocks like Altria exhibit 5-10% lower institutional holdings compared to similar non-sin peers, creating a persistent "sin discount" that suppresses valuations despite robust free cash flow generation ($9B+ annually).

Dividend Safety:

This structural bias creates an outstanding opportunity for unconstrained income investors to purchase shares at a discounted price and thereby mathematically boosting your yield on cost. Discounted cash flow analysis from Morningstar suggests the shares are currently 10% undervalued—which is a lot compared to that big dividend yield (and a 55-year dividend growth streak).

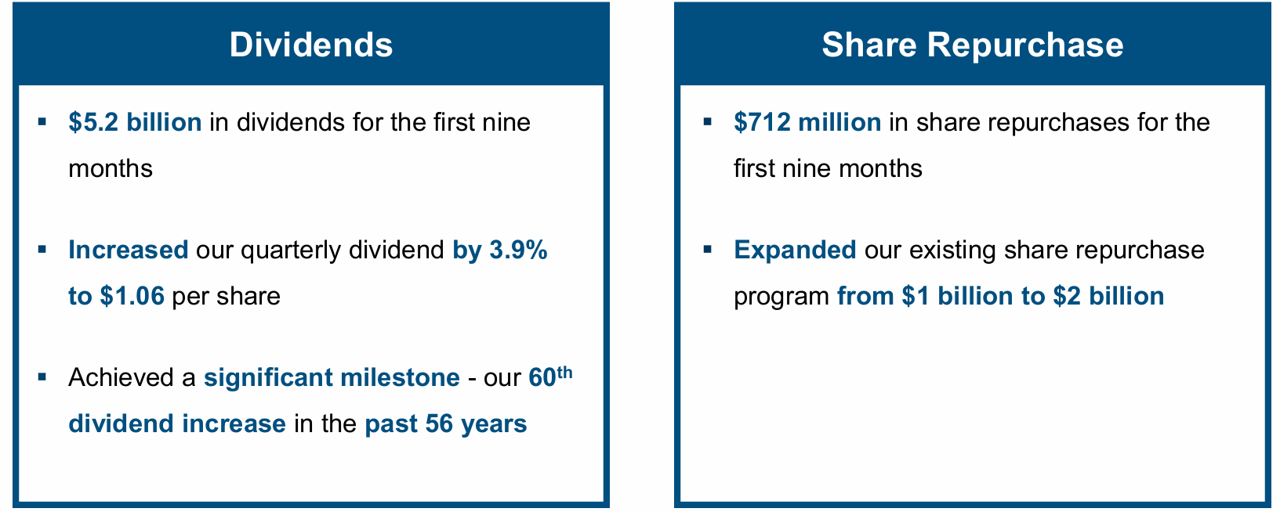

In fact, Altria is doing exactly what a financially healthy company in its position should do—return massive cash to shareholders (in the form of big dividends and share repurchases).

Altria Risks:

Investors should also be aware of the risks associated with investing in Altria.

Declining Cigarette Volumes: Altria’s core smokeable segment (88% of revenue) faces ongoing US shipment declines (~8–10% annually) from health awareness and illicit trade. Nonetheless, Altria continues to offset this with price increases (loyal and addicted customers continue to show little elasticity to prices rising faster than inflation, as described earlier).

Regulatory and Litigation Pressures: FDA actions, potential bans (e.g. menthol cigarettes), and lawsuits could impose fines, marketing restrictions, and/or import bans on products like NJOY ACE (which has been prohibited since March 2025).

Economic and Consumer Shifts: Inflation, tariffs, and reduced disposable income may drive downtrading to cheaper/illicit options. For example, a pack of Marlboro Red cigarettes now costs $15-$19 in the city of New York, whereas it only cost around $1.00-$1.50 40 years ago.

Supply Chain Disruptions: According to Altria, geopolitical tensions, climate change, and tobacco sourcing volatility also pose significant risks to the business.

Altria Takeaways

For a company with a wide moat and that generates impressive free cash flows, Altria’s shares are significantly inexpensive, likely in significant part due to its “sin-stock” discount (i.e. a lot of institutions won’t buy tobacco products and thereby drive down buying pressure and the price). And Altria is doing the exact right thing in this situation by returning huge cash to shareholders in the form of massive, qualified dividends and share repurchases. The shares have also just recently pulled back in recent months thereby sweetening the deal. If you are an unconstrained income-focused investor, Altria shares are absolutely worth considering.

3 More Big Yields Worth Considering

In addition to Altria, it would be remiss to not at least consider a few more big-yield opportunities from the list of 40, so let’s briefly get into that.

PIMCO’s Access Income Fund (PAXS), 11.4% Yield

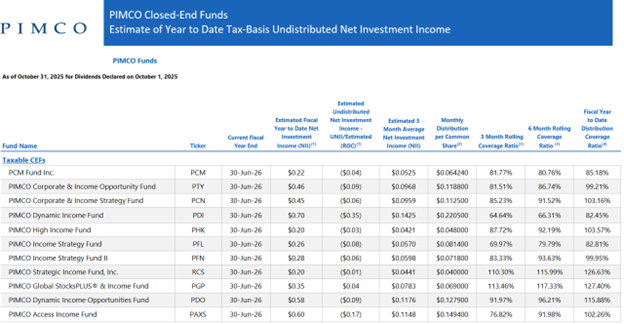

PIMCO is the premier big-yield bond fund manager, and PAXS is an attractive CEF that stands out. Not only does it offer a big yield (paid monthly), but it also trades at reasonably small 1.6% premium to net asset value (attractive for a top PIMCO fund). It uses a healthy dose of leverage, or borrowed money (currently ~38%), to help magnify the income produced by its largely bond holdings (and PIMCO gets lowering institutional borrowing rates and is much more operationally efficient at borrowing than most individuals). It also purchases bonds that are virtually impossible for a little guy (non-institutional) investor to purchase. Further still, PAXS is a relatively newer PIMCO fund, it has never reduced its distribution and it has avoided a lot of the legacy derivatives (e.g. interest rates swaps) that older funds used (and to some extent still have on their books) to survive the post-covid interest rate volatility. It’s also doing just fine covering the distribution with investment income as compared to other PIMCO funds (as you can see in the graphic below).

If you are an income-focused investor, PAXS shares are down (see early table) and worth considering.

Trinity Capital (TRIN), 13.9% Yield

Trinity is a big-dividend Business Development Company (“BDC”) and the shares have recently sold-off thereby making for a more attractive entry point. And whereas a lot of other BDCs focus on “old” economic sectors, Trinity’s niche focus on growthier and technology sectors gives its investors differentiated big-yield exposure. Not only is the outsized dividend yield attractive, but it’s generated from “newer” parts of the economy—arguably providing significantly more long-term growth potential. It does come with risks, including potential pain when the current growth-sector rally sells off (potentially significantly harder than more-value-focused BDCs). However overall, it’s as an attractive big-yield BDC that is absolutely worth considering. I own it in my prudently diversified, long-term, income-focused portfolio, and I wrote more about Trinity here.

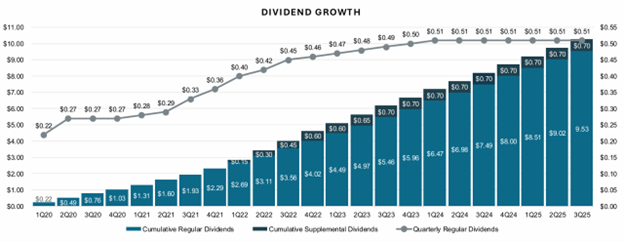

Main Street Capital (MAIN), Yield: 5.3%

Another BDC, investors love to look at Main Street Capital’s relatively high price-to-book value and immediately declare it an overvalued bubble. But what many investors don’t realize is it’s a fundamentally different type of BDC with its steady net asset value (“NAV”) gains (while peers stay relatively flat—or worse). So while some thumb their nose at Main Street’s mere 5.3% dividend yield (puny in the BDC space), they fail to recognize the steady dividend growth, plus the powerful supplemental dividends, as well as the many other attractive qualities that set it apart (i.e. low debt, strong liquidity, above-average pipeline, healthy portfolio, efficient operations and macro resilience). I review all of that (and the big risks) and then concludes with my strong opinion on investing in this report.

S&P 500 Index Fund (SPY)

As mentioned earlier, a lot of investors believe the simplest and best income strategy is to buy a low-cost S&P 500 ETF and then just sell a few shares every month or quarter to create income (i.e. build your own dividend from price appreciation). Of course this comes with the volatility problem. Specifically, the market gets extremely volatile at times, and if you are forced to sell shares at “the bottom” of a selloff you will effectively sell low and lock in losses (whereas many dividend investors sleep better at night knowing their big dividends keep rolling in even when market prices get volatile). Nonetheless, this can be a compelling strategy to consider for some of your investment dollars (diversification can be an extremely good thing), but of course it depends on your personal situation. And you can read more about my opinion here:

The Bottom Line:

Don’t ever rate an investment opportunity by its big yield alone. Rather, consider also the fundamental qualities and risks of the business or fund, and consider also the tax consequences based on your own individual situation (all of these factors can have dramatic impacts on your results).

Altria stands out for its big, well-covered, qualified dividend—a type of income source that has advantages versus other categories, as discussed (not to mention its shares are down and the valuation is attractive). However, that’s not to say attractive opportunities don’t exist in the other big yield categories too—they do!

And although not my biggest positions, I do currently own all four of the specific big-yield examples shared in this report (within my prudently diversified, 25-position, 9.6% aggregate yield, high-income portfolio). However, at the end of the day, you need to do what is right for you. Be smart people and invest according to your own personal situation.