Investors love to look at Main Street Capital’s relatively high price-to-book value and immediately declare it an overvalued bubble of a Business Development Company (“BDC”). But what many investors don’t realize is it’s a fundamentally different type of BDC with its steady net asset value (“NAV”) gains (while peers stay relatively flat—or worse). So while some thumb their nose at Main Street’s mere 5.3% dividend yield (puny in the BDC space), they fail to recognize the steady dividend growth, plus the powerful supplemental dividends, as well as the many other attractive qualities that set it apart (i.e. low debt, strong liquidity, above-average pipeline, healthy portfolio, efficient operations and macro resilience). This report reviews all of that (and the big risks) and then concludes with my strong opinion on investing.

Main Street Capital (MAIN)

Main Street Capital Corporation (MAIN) is a BDC providing long-term debt and equity capital to lower middle-market (“LMM”) companies (those with annual revenues between $10 million and $150 million) as well as debt to private equity-backed firms. It invests across diverse industries and its internal management structure (which allows for more efficient operations) make it special.

Additionally, as a regulated investment company (“RIC”), it distributes at least 90% its income as dividends to avoid corporate taxes and also thereby enabling those big steady monthly dividends many investors love.

Importantly, Main Street’s focus on the lower middle market provides a differentiated competitive advantage by addressing an underserved, fragmented segment where larger BDCs and institutions often overlook opportunities (and thereby allowing MAIN to secure attractive risk-adjusted returns through its specialized niche expertise).

Main Street Versus Other BDCs

A lot of investors avoid Main Street because its current dividend yield is relatively low in the BDC space and its price-to-book value (a basic BDC valuation metric) is relatively high (see table below).

However, a lot of investors fail to recognize many of the unique and attractive qualities that make these Main Street metrics not only acceptable, but actually quite attractive, as will be reviewed in the paragraphs below.

Growing NAV

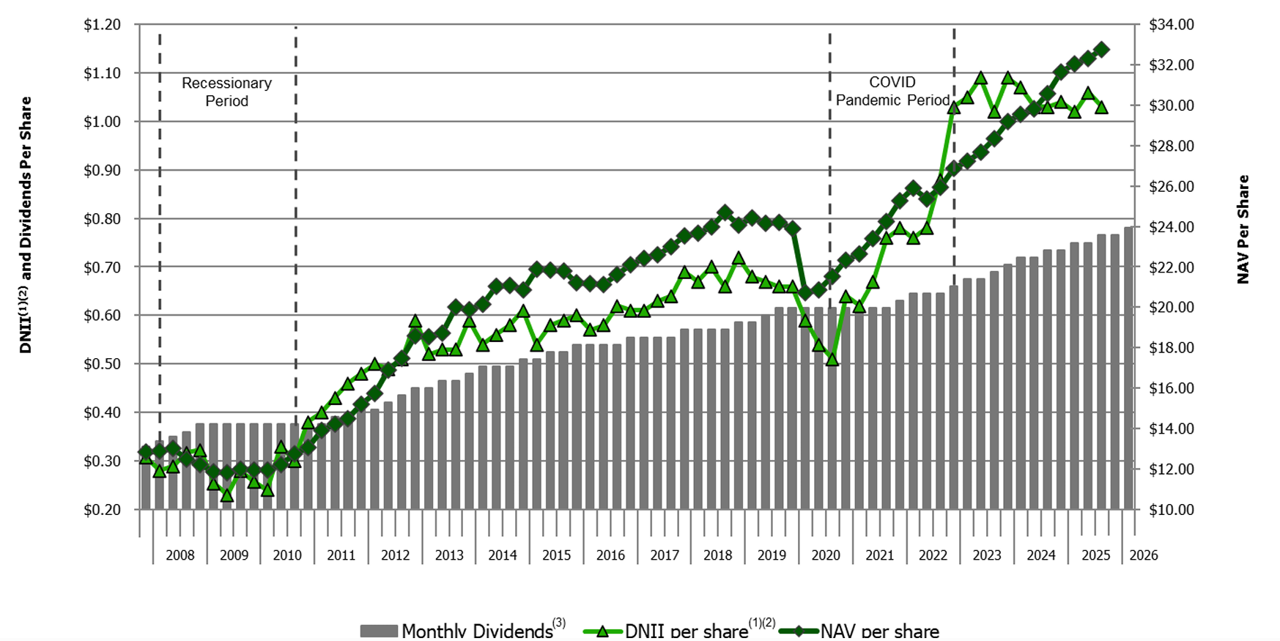

Unlike a lot of its peers, Main Street’s business approach has allowed it to steadily grow its net asset value over time (as you can see in the chart below).

And a growing NAV (or “book value”) also allows it to increase the dividend (e.g. a higher asset base upon which to earn income). And encouragingly, the most recent third quarter was the 13th consecutive quarter of record NAV per share (see table chart above). It also has an impressive 17% annualized ROE (return on equity) which underscores its long-term value creation for investors.

Dividend Health

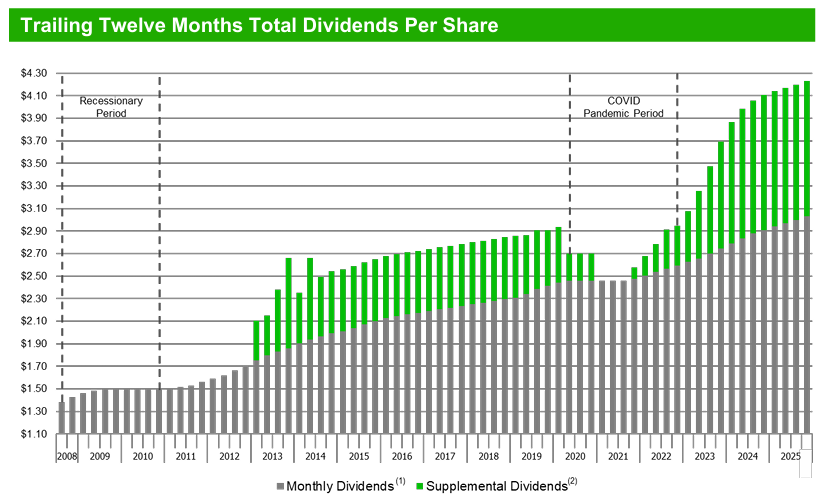

With both regular dividends (paid monthly) and supplemental dividends, Main Street is a dividend powerhouse. In fact, the board just declared a $0.30 supplemental dividend (payable Dec 2025—it’s 17th consecutive quarter) and raised the Q1 2026 monthly dividend 4% YoY to $0.26/share. And notably, trailing 12-month supplement dividends total $1.20/share (40% above regular), with expectation for another significant March 2026 supplemental tied to excess DNII (distributable net investment income) and realized gains.

Also, Q3 DNII before taxes was $1.07 per share (guidance ≥$1.05 Q4), which supports dividend coverage even if nonrecurring income (recently $4.3M in Q3) moderates.

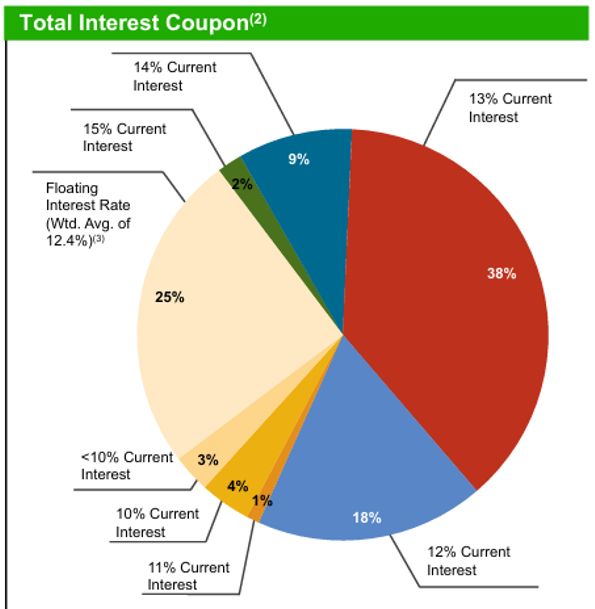

For a little more perspective, you can see the weighted average interest coupons on Main Street’s existing LMM debt investments in the table below (it’s basically well above the actual dividend yield, which demonstrates how they generate the income, but also that they have plenty of cushion built into the business).

Efficient Operations and Cost Structure

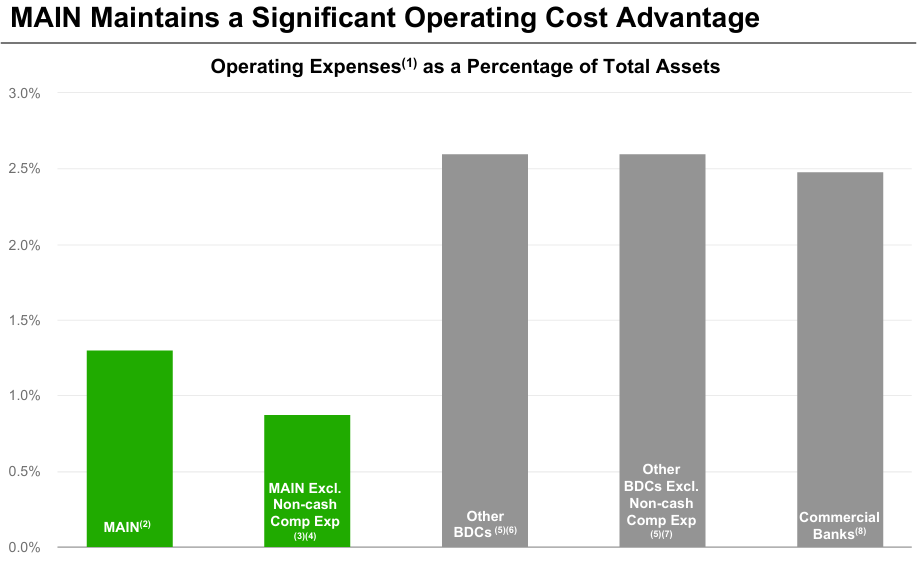

As an internally-manage BDC, Main Street has a significant operating cost advantage (see chart below) plus lower perceived conflicts of interest versus externally managed BDCs.

For example, “non-interest operating expenditures” versus average assets is only 1.4% on an annualized basis—among the industry lowest.

Conservative Leverage and Strong Liquidity

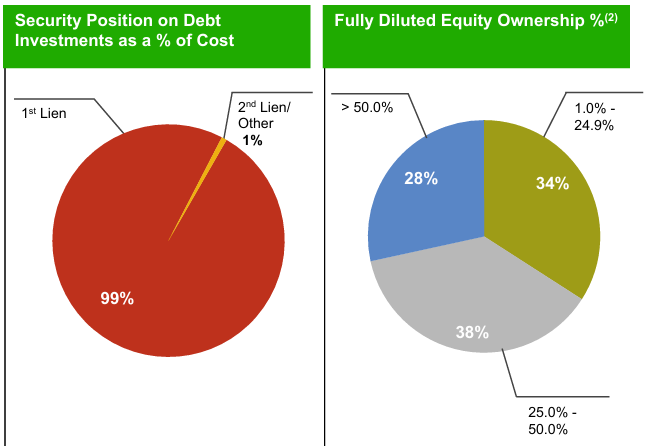

As you can see in the earlier BDC comparison table, Main Street has lower debt-to-equity than peers (which basically gives it more cushion if the market gets ugly, or more dry powder for when compelling opportunities arise). Further, “regulatory debt-to-equity” was 0.62x (below 0.8–0.9x target) with $1.5B+ liquidity (post the recent $350M 5.4% notes issuance and $150M early repayment). This puts Main Street in a position of strength (and able to take advantage of pipeline opportunities), especially considering most of its debt is first lien (safer) anyway (as you can see in the chart below).

Above-Average Investment Pipeline

According to Main Street CEO, Dwayne Hyzak, on the most recent quarterly call, the BDC’s pipeline is above average:

“Now turning to our current investment pipeline. As of today, I would characterize our lower middle market investment pipeline as above average. Consistent with our experience in prior periods of broad economic uncertainty, we believe that our ability to provide unique and flexible financing solutions to lower middle market companies and their owners and management teams and our differentiated long-term to permanent holding periods represent an even more attractive solution to the needs of many lower middle market companies given the current economic environment, and we are confident in our expectations for strong lower middle market investment activity in the fourth quarter.”

This encouraging environment (supported by Main Street healthy liquidity and low credit) is also supported by recent LMM portfolio outperformance and exit potential. For example, according to Hyzak (on the most recently quarterly call):

“We also continue to see significant interest from potential buyers in several of our lower middle market portfolio companies, which we expect will lead to favorable realizations over the next few quarters and which we believe further highlights the strength and quality of our portfolio companies and their exceptional leadership teams.”

These are investments with strong dividend income and fair value appreciation from positive performance. Main Street’s pipeline is healthy.

Asset Management Business Momentum

Important to mention, Main Street also has a healthy asset management business. Specifically, Main Street is the investment adviser and administrator to two private funds, each of which is solely focused on MAIN’s Private Loan investment strategy. This has a significantly positive impact on Main Street’s financial results, including $8.8 million contribution to net investment income in the third quarter of 2025 ($25.4 million contribution to net investment income in the nine months ended September 30, 2025, and $34.3 million contribution to net investment income in the year ended December 31, 2024). This is a diversified income stream adding a differentiated degree of steadiness to the business.

The Big Risks

Of course, Main Street faces risks that investors should consider.

Non-accruals and default: For starters, Main Street is providing capital to riskier private companies in the lower middle market. The high coupon interest on the loans it provides (as we saw in an earlier graphic) demonstrates the higher risks and is elevated in attempt to compensate for taking on the risk. Nonetheless, default remains a risk, particularly if macroeconomic conditions worsen and multiple companies all default on their loans at the same time. Fortunately, nonaccruals improved to 1.2% of fair value (3.6% cost) in the most recent quarter, relatively low and somewhat expected.

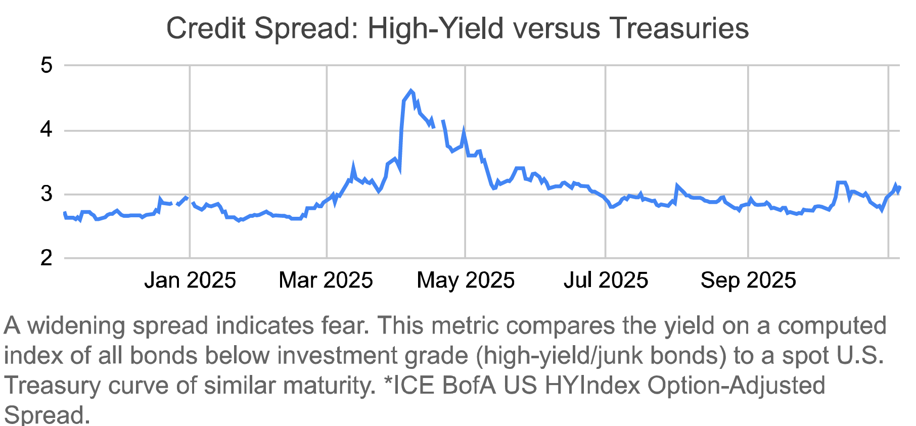

Credit Spreads are another way (a proxy) to more-broadly measure risk and potential default among riskier loans, such as those made by Main Street. However, as you can see in the chart below, credit spreads remain relatively low.

And according to Main Street CFO, Ryan Nelson, (during the most recent quarterly call) the company remains relatively well-positioned in this regard:

“Our total investment income for the third quarter was $139.8 million, increasing by $3 million or 2.2% over the third quarter of 2024 and decreasing by $4.1 million or 2.9% from the second quarter of 2025. Interest income decreased by $7.3 million from a year ago and increased by $2.4 million from the second quarter of 2025. The decrease from prior year was principally attributable to a decrease in interest rates, primarily resulting from decreases in benchmark index rates on our floating rate debt investments and decreases in interest rate spreads on existing debt investments and an increase in investments on nonaccrual status, partially offset by the impact of increased net investment activity.”

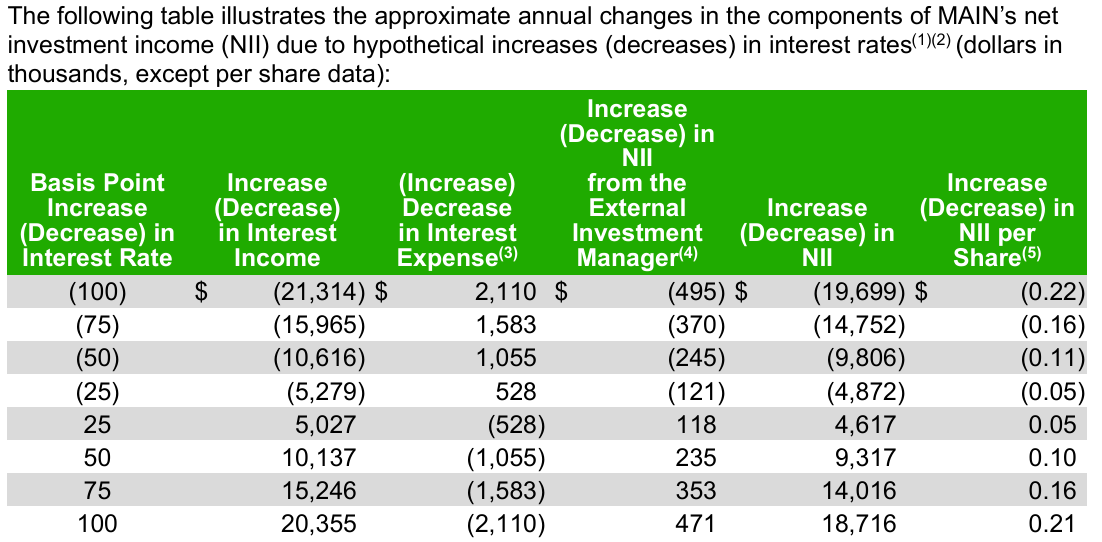

Interest Rates: Interest rate dynamics also pose a risk, as you can see in the table below. However, Main Street’s strong liquidity and lower leverage add a margin of safety against changing rates.

The Bottom Line

Despite the relatively lower yield (as compared to other BDCs) and the relatively higher price-to-book value (as compared to other BDCs), Main Street Capital is not an overvalued bubble. Quite the contrary, it’s a top-notch, differentiated BDC, offering a powerful growth trajectory in dividend and net asset value. Not only have Main Street’s investors easily outperformed other BDCs over the last nearly 20 years since its IPO (see earlier chart), but I expect Main Street to continue outperforming in the years ahead. If you are an income-focused investor, it’s absolutely worth considering for a spot in your prudently diversified, long-term portfolio. I own it in mine.

In fact, I have ranked Main Street Capital at #7a in my latest report: Top 10 Big Yields: BDCs, CEFs and Dividend Stocks.