Top 10 Big Yields Ranked: BDCs, CEFs and Dividend Stocks

Fear Creates Opportunity

(updated: for December 2025)

In the market battle of bulls versus bears, fear-and-greed continues to create attractive high-income opportunities (yields of 7-10%+) in specific corners of the market, including business development companies (BDCs), stock-and-bond closed-end funds (CEFs), dividend stocks and more. This report reviews the critical costs and benefits of investing in each of these groups and then counts down (ranks) my top 10 specific big-yield investment opportunities right now (selected from across the groups) as fear is currently creating some very attractive opportunities. Enjoy!

About Big-Yield Investing:

Big-yield investing is absolutely NOT for everyone. In fact, it’s a unique breed of investors who have reached a point in life where “volatile long-term growth” matters less and “steady current income” matters more. If you are a young 23-year-old investor—you should probably be thinking in terms of many decades—not current investment income; consider buying an S&P 500 ETF (and getting into the habit of contributing to it regularly—through tax advantaged accounts—such as a Roth IRA). But if you are an income-focused investor, this report may help you appreciate the high-level (and very specific) risks and opportunities available to you right now.

Costs and Benefits: By Income-Focused Investment Group

All big yield is NOT created equally. In fact, they come with widely different costs and benefits in the form of risks, tax treatment, market sensitivity and price-and-dividend dynamics, to name a few. I dig into the specifics of each group in the sections below.

Business Development Companies (BDC): Costs and Benefits

A business development company (or BDC) is a specialized investment company (created by an act of Congress in 1980) designed to support small and mid-sized businesses (by providing capital and management support). BDCs are special because they don’t have to pay taxes on profits at the corporate level as long as they pay out at least 90% of their profits as dividends to investors. This is why many income-focused investors love BDCs (i.e. the big dividend yields), but investors should also be aware that BDC dividends are generally not “qualified” meaning they’re generally taxed at your ordinary income tax rate (instead of the often-lower “qualified” rate that many other publicly-traded-company dividends are taxed at).

Investors should also be aware that BDCs are subject to certain rules. For example, they must invest at least 70% of their assets in U.S. firms with market values under $250 million. And they are subject to certain regulatory borrowing (leverage) limits (for example, the BDC debt-to-equity ratio limit was raised from one-to-one to two-to-one in 2018).

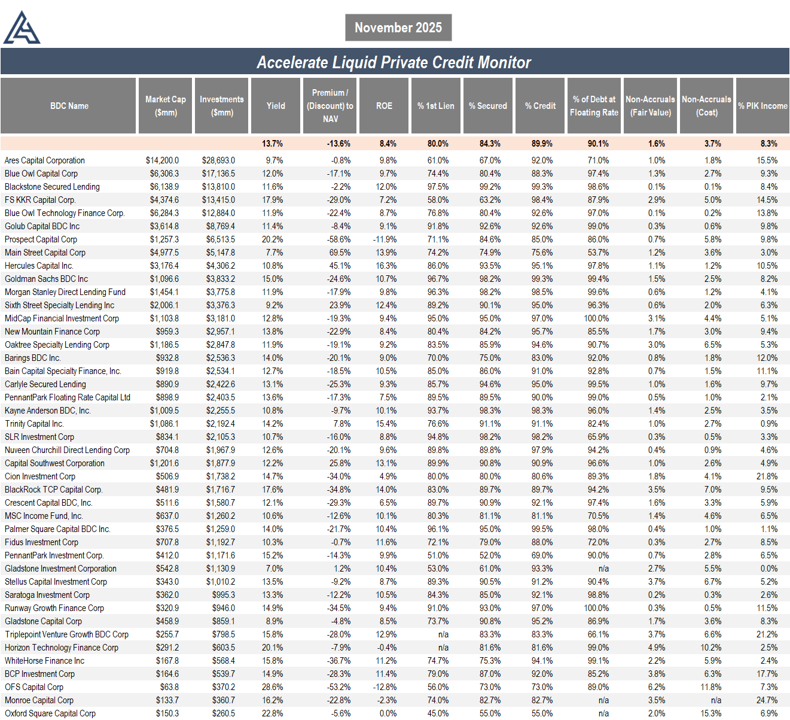

BDCs also come in a wide variety of flavors, ranging from venture-capital focused to distressed-debt focused, or first-lien to second-lien loans, various levels of equity and various fixed-versus-floating rate leverage dynamics (see table above for specific data points). Investors should also recognize they all generally fall in the “financials” sector of the economy (i.e. although they are different in many ways, they are also similar too). But overall, BDCs can be a critically important part of a prudently diversified high-income investment portfolio.

Closed-End Funds (CEFs): Costs and Benefits

CEFs can be another very important part of an income-focused investment portfolio (considering they often pay such very big distribution yields), but investors should be careful to understand the unique risks and opportunities of this group.

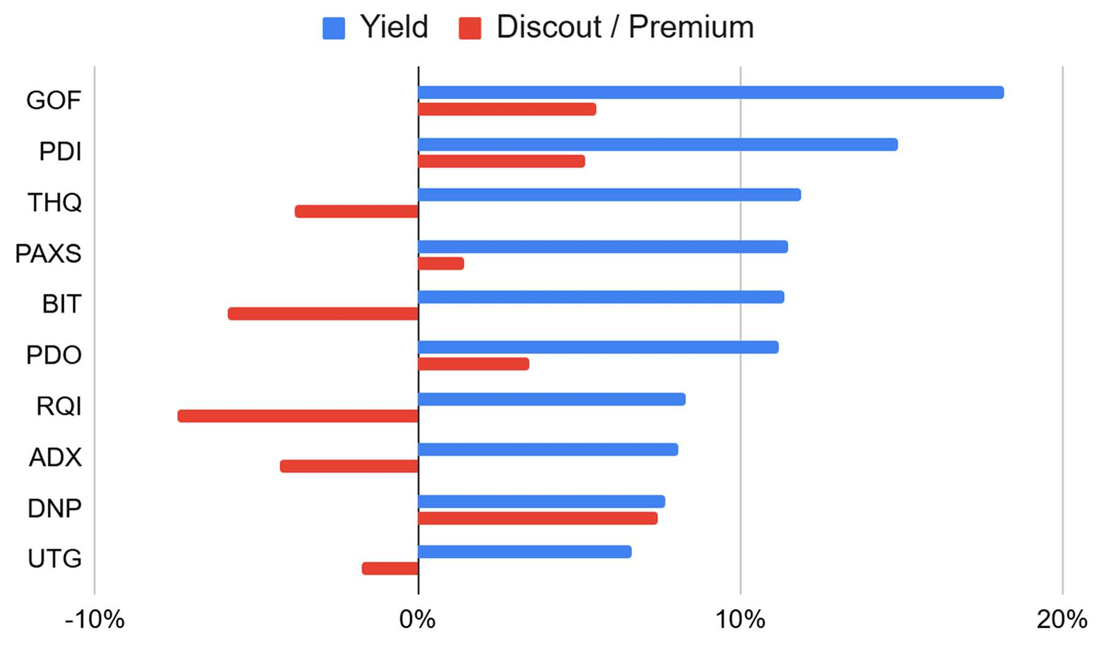

For starters, CEFs are basically exchange-traded vehicles with a fixed number of shares. And unlike a lot of other mutual funds or exchange-traded funds (which are open-ended), CEFs don’t continuously issue or redeem shares. This “closed” nature of CEFs allows them to trade in the market based on supply and demand whereby their market price can vary significantly from the net asset value (“NAV”) of their underlying holdings (i.e. they can trade at big premiums and discounts to NAV—which creates significant risks and opportunities). This is different than open-end funds where there are mechanisms in place to keep the market price very close to the NAV. You can see examples of recent yields and premiums-and-discounts versus NAV for a few popular CEFs in the graphic below.

Large CEFs (data as of 24-Nov-2025).

Additionally, CEFs come in a wide variety of shapes and sizes, including debt (e.g. bonds) and equity (e.g. stocks) as well as specific sectors, geographies, management types (and expense ratios), leverage levels and distribution (yield) sources (such as interest income, dividend income, capital gains and return of capital—which can all trigger different tax treatments). For some perspective, here are seven high-level questions I always ask myself before investing in any CEF.

Overall, CEFs can be another extremely important part of a prudently-diversified goal-focused high-income portfolio, but they vary widely and they come with unique risks and benefits (as I will cover with specific examples later in this report).

Dividend Stocks: Costs and Benefits

Whereas BDCs generally make loans to many companies, and CEFs invest in a basket of securities issued by many different organizations, “Dividend Stocks” represent an ownership position in one single company that pays out a portion of its assets as a dividend—and sometimes even a big one.

Dividend investing is an increasingly lost art for many as the extremely loose monetary policies of the last decades have led to the rise of pure growth stocks (that typically pay zero dividends and often have zero—or very little—profits too).

But there are still attractive publicly-traded businesses (stocks) out there, that have high profit margins, high free cash flows, defensible moats, and pay big steady dividends to investors. And when you find one that is trading at a low price (relative to its valuation) that can make an extremely attractive dividend stock to add to your income-focused investment portfolio. You can see examples of the 20 biggest dividend yields in the S&P 500 right now in the table below.

Also special, dividend stocks don’t add an additional level of management fees like BDCs and CEFs do (just the underlying expenses of the actual business). Further, dividend stock dividends are typically “qualified” meaning they are taxed at the qualified tax rate—which is often lower than BDC or CEF distributions for many investors (depending of course on your personal tax situation and the type of account in which you own your dividend stocks).

So while individual dividend stocks can be a bit risky on a standalone basis, they can also be extraordinarily attractive as a piece in a prudently diversified income-focused portfolio. I will review specific examples throughout this report.

Additional High-Income Investment Categories

I also own investments across other big-yield categories, and I share additional details and examples in my other reports. However, for reference, here is some high-level information for you to consider.

Property REITs (Real Estate Investment Trusts) are another big-yield category that can provide steady dividends, but real-estate market cycles can be long and risky. Plus the dividends are often NOT qualified (tax).

Mortgage REITs can offer very big yields, but they also typically involve high leverage—which is very risky. They also often have high-interest rate sensitivity (risky). Further, long-term prices often shrink. In my view, this is generally an unattractive big-yield category for long-term investors.

Preferred Stocks can offer decent yields too, however price gains can be volatile with interest rates, yet flat over the long-term. There is also a risk of getting called (retired), and occasionally defaults.

Municipal Bonds can offer attractive "tax equivalent" yields that are relatively safe for investors in high tax brackets. Usually federally tax exempt, sometimes state.

MLPs: Attractive steady distributions, but income is generally not tax qualified and K1-tax reporting can create challenges in Individual Retirement Accounts.

US Growth Stocks: Short- and mid-term price volatility makes generating income from selling shares nerve-wracking for many investors. Long-term growth can be very high, but dividend yields are generally very low (with some notable exceptions).

Individual Bonds can generate slightly higher yields than dividend stocks (and with less price volatility), but the yields are still lower than other opportunities (albeit safety can be very high among individual bonds, depending on which category you choose).

So with that backdrop in mind, let’s get into the rankings.

Top 10 Big Yields, Ranked:

Considering current market dynamics (such as recent fed interest rate moves, and what some investors believe to be an “AI Bubble”), income opportunities are constantly changing but increasingly attractive in some areas of the market, such as the ones I cover below. So without further ado, let’s get into the top 10 rankings, starting with #10 and counting down to my very top current big-yield investment opportunities.

10. Blue Owl Capital (OBDC), Yield: 12.3%

Coming in at number ten, Blue Owl is an extremely-dynamic, externally-managed, big-yield BDC focused on lending to the upper middle market. It’s been involved in a string of mergers which have added uncertainty and price volatility to the shares, ranging from its 2021 merger with Dyal Capital Partners, to its January 2025 merger with OBDE (i.e. Blue Owl Capital Corp III, which brought down the aggregate yield on loans when combined) and most recently its cancelled merger with Blue Owl Capital II in November 2025 (following an uproar from investors about paper losses, trapped capital and a loss of redemption rights). As such, the shares now trade at an attractively-discounted price (~17% below book value) as you can see in the BDC table below.

The fear surrounding the canceled merger has created an attractive big-yield investment opportunity considering the BDC still has relatively low non-accruals, reasonable leverage and a healthy amount of secured loans, despite lower exposure to first-lien loans and a high amount of floating rate debt. If you like big income, Blue Owl is absolutely worth considering for a spot in your income-focused portfolio. Be sure to check out the table earlier in this report to compare Blue Owl to other BDCs on a variety of critical metrics (e.g. fixed-versus-floating, non-accruals, secured and first-lien debt, to name a few). It’s attractive.

9. Altria Group (MO), Yield: 7.3%

Switching gears to an individual stock, and if you can get passed the fact that its product can kill you (what can’t these days), tobacco company Altria has one of the most compelling net profit margins outside of the technology industry, and it produces incredible steady free cash flow to support the huge “qualified” dividend payments that many investors absolutely love.

Top S&P 500 Dividend Yields

What’s more, Altria currently trades at an exceptionally attractive valuation multiple (10.4x forward price-to-earnings ratio) because other peoples’ disapproval (and selling pressure) for tobacco stocks is your big-yield opportunity.

8. PIMCO Dynamic Income Opportunities Fund (PDO), Yield: 11.1% (paid monthly)

Next on the list, a closed-end fund from premier industry leader, PIMCO. According to the company’s website, this income-focused CEF utilizes (emphasis mine):

“an opportunistic approach to pursue high conviction income-generating ideas across credit markets to seek current income as a primary objective and capital appreciation as a secondary objective.”

The fund uses a healthy dose of leverage (recently ~34%) to help magnify the interest rates on the underlying bonds it holds. And it has been doing a better job covering its big monthly distributions with Net Investment Income as compared to other popular PIMCO CEFs, as you can see in the follow table.

PDO also trades at a relatively small premium to NAV (recently ~4.5%), especially considering it’s managed by industry-leader, PIMCO. If you are an income-focused investor, PDO is absolutely worth considering for a position in your portfolio. I own it in mine.

7.b. Trinity Capital (TRIN), Yield: 13.7%

There are lots of ways to earn big yield in this market, and the BDC space is ripe with opportunities. And while BDCs come in a wide variety of shapes and sizes, one that stands out is Trinity Capital (TRIN) because of its growth-sector niche (arguably better aligned with the “new” US economy), internal management team (less conflicts of interest) and outstanding 13.7% dividend yield.

This report (link below) reviews all of that, plus the big risks Trintiy currently faces, and then concludes with a strong opinion on how to invest.

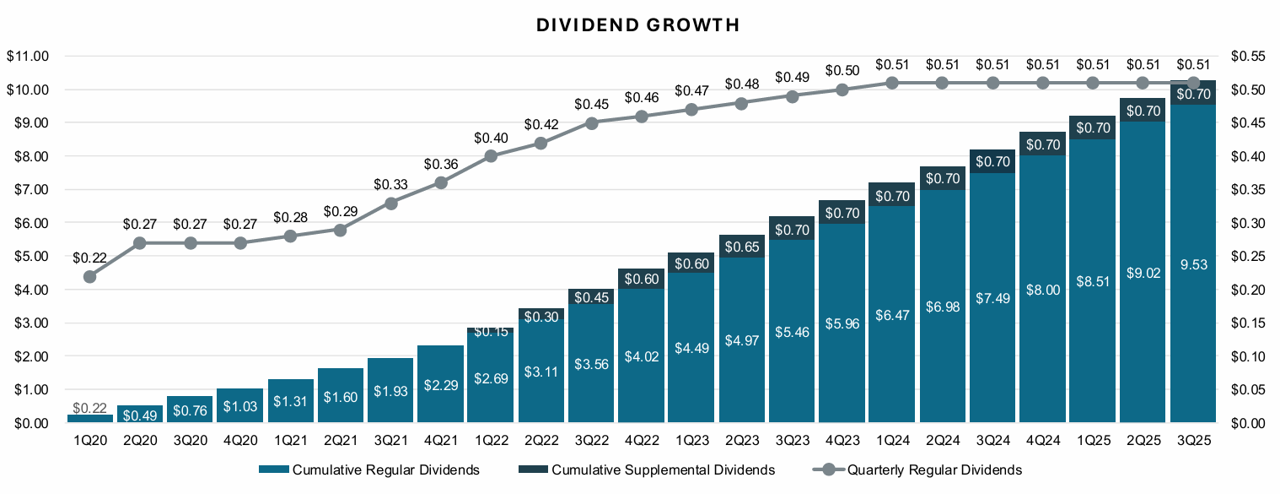

7.a. Main Street Capital (MAIN), Yield: 6.1%

Investors love to look at Main Street Capital’s relatively high price-to-book value and immediately declare it an overvalued bubble of a BDC. But what many investors don’t realize is it’s a fundamentally different type of BDC with its steady net asset value (“NAV”) gains (while peers stay relatively flat—or worse).

So while some thumb their nose at Main Street’s relatively small dividend yield (compared to other BDCs), they fail to recognize the steady dividend growth, plus the powerful supplemental dividends, as well as the many other attractive qualities that set it apart (i.e. low debt, strong liquidity, above-average pipeline, healthy portfolio, efficient operations and macro resilience). I recently wrote about MAIN in detail, and you can read that full report here.

The Top 6 Big Yields

The remaining top 6 big yields are available to members-only, and they can be accessed here. The top 6 includes a diversified mix of top income ideas, and I currently own all of them in my high-income portfolio.

The Bottom Line:

Income-focused investing is absolutely NOT for everyone, but if it is suitable for your personal situation—there are a lot of attractive big-yield opportunities in the current market environment across BDCs, CEFs, dividend stocks and more (such as the ones highlighted in this report). However, at the end of the day you need to do what is right for you based on your own personal situation. Disciplined, long-term, goal-focused investing continues to be a winning strategy.

Hi. I am Mark Hines. I founded Blue Harbinger to help you manage your own investments.

Here are three ways I can help you.

I typically send one complimentary top-growth-stock report, weekly. Sign up to get it here:

I periodically share complimentary income-security reports. Sign up to get them free, here:

I share more top ideas and portfolio strategies with full members: