Far more money has been lost waiting for the market to correct than in the actual corrections themselves. That is a paraphrase of Peter Lynch, and it’s likely a wise warning for investors in the current “cloud-AI bubble” led by a small handful of US mega-caps stocks. The warning cuts hard both ways, as many investors will likely face huge financial pain in days ahead. This report reviews the current state of the cloud-AI bubble, considers a secular market paradigm shift, discusses the huge financial pain many investors are about to inevitably face, considers a handful of S&P 500 risk metrics and then concludes with my strong opinion on how to defend yourself against the growing cloud-AI bubble.

The Cloud-AI Bubble

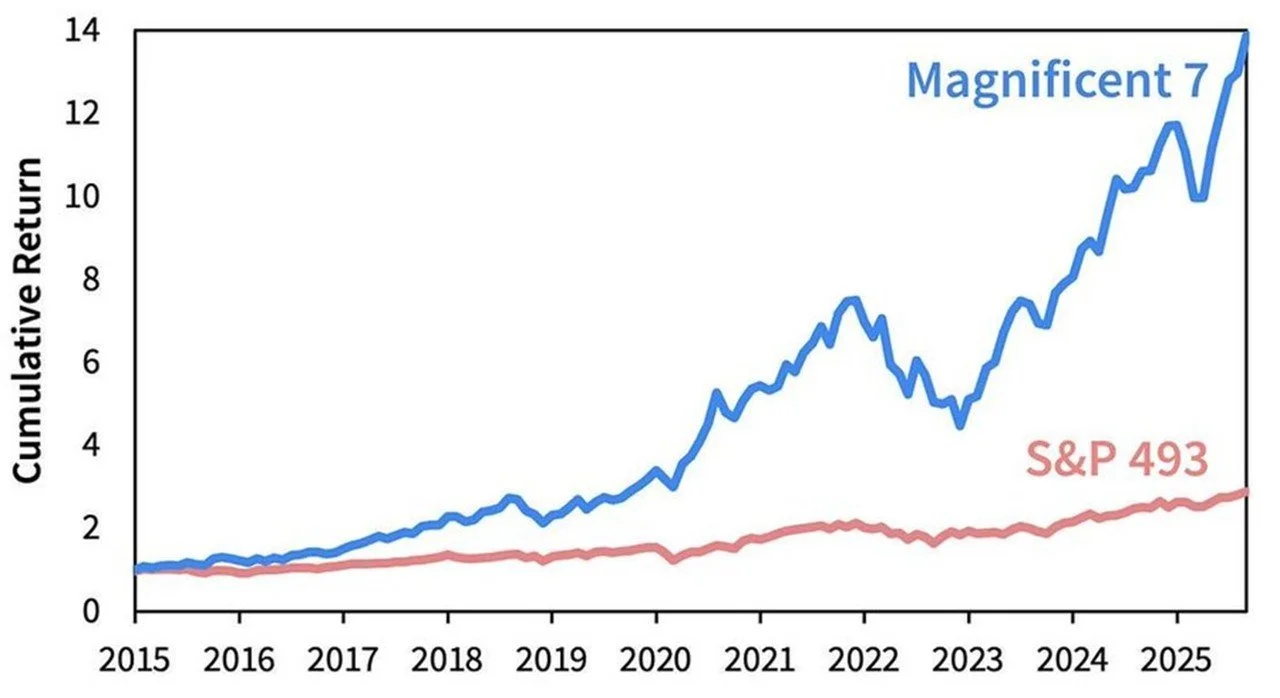

We’ve heard the incredible rally for cloud-AI stocks described as a potential bubble by leading CEOs, including Sundar Pichai at Alphabet (GOOGL), Jensen Huang at Nvidia (NVDA) and Sam Altman at OpenAI, and you can see just how split market performance has been by said cloud-AI leaders (loosely the Mag 7) as described in the chart below (an image is often worth a thousand words).

This chart sparks fear for many investors for a variety of reasons, ranging from those remembering what happened to the tech bubble at the turn of the century (it burst badly), academic value investors (who once strongly believed value stocks always outperform growth in the long run) and to simple contrarians (who believe in “buy low, and “sell high!”).

A Market Bubble or a Paradigm Shift?

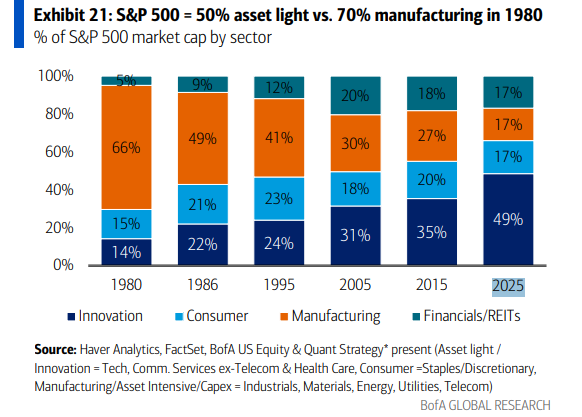

But is the so-called “Cloud-AI Bubble” really a bubble or more of a secular market shift whereby we’re never going back to the days of old? We’ve all heard the media cries of anguish surrounding President Trump’s “un-academically-wise” protectionist tariffs, but the chart below suggests the market shift towards US technology leadership has been going on for decades and manufacturing may not ever be coming back in any significant way.

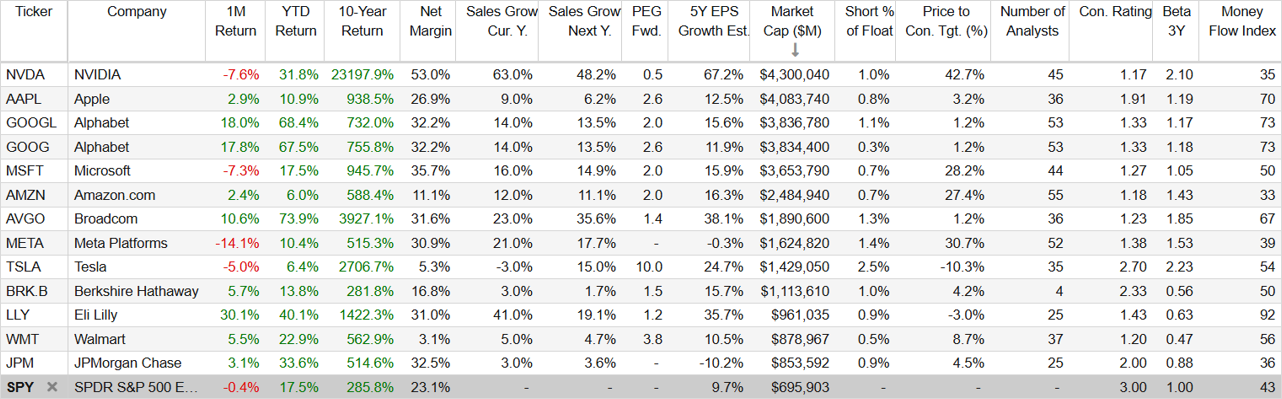

More specifically, the US economy has shifted heavily toward its technology strength (and away from manufacturing), so in this regard, it makes perfect sense that leading US technology companies (i.e. the hyper-scalers leading the so called “AI-cloud bubble”) have grown so large (the top 10 stocks now comprise over 40% of the total S&P 500) and they are so very profitable (check out the impressive profit margins and revenue growth rates in the table below).

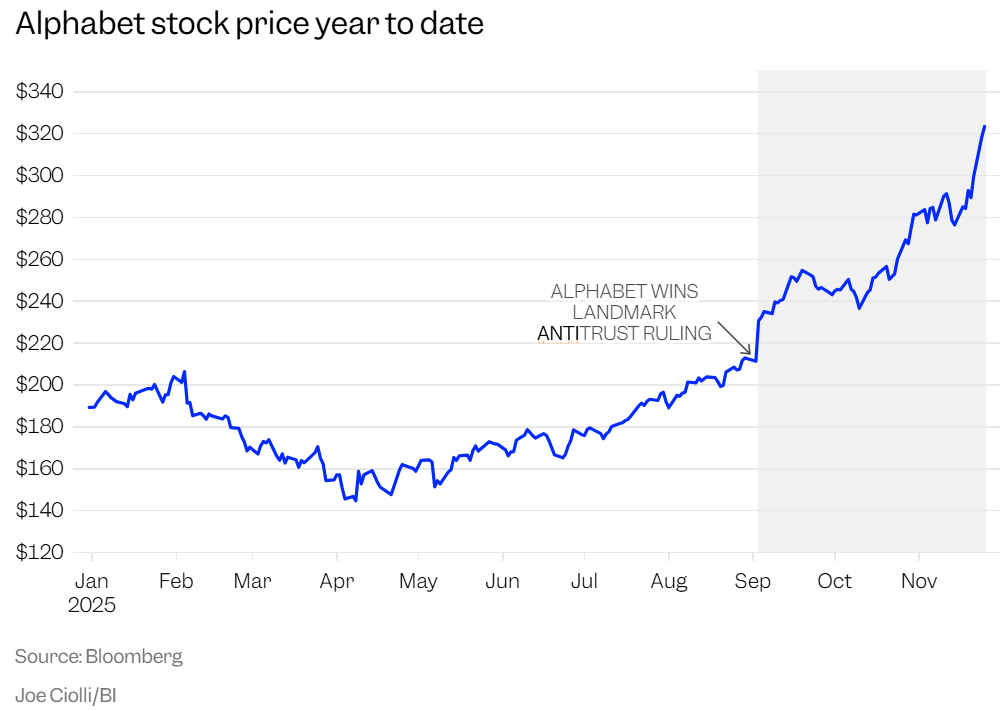

So while some pundits decry these impressive Mag 7 metrics as an obvious bubble, others suggest it’s simply a reflection of a permanent paradigm shift in the market and nothing (not even US government tariffs) is going to stop it. For example, Alphabet just recently defeated a US antitrust case against it and thereby clearing the path for its dominance to continue unmolested by anyone (e.g. not the government, not smaller companies with less resources, and not even other mega caps considering Google’s powerful ecosystem moat).

The Huge Pain Ahead

Whether or not there is a cloud-AI bubble, it will cause enormous financial pain for investors on both sides of the argument. Let me explain the bubble-fearmonger side of the argument first, with Peter Lynch’s full quote:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

In a nutshell, many investors fearing the cloud-AI bubble have sold all their stocks (or refuse to own any of the technology mega caps), and as a result they will miss out on massive long-term returns (after all, the cloud and AI are such a huge part of the US economy—many investors are dangerously undiversified by NOT owning any of the Mag 7).

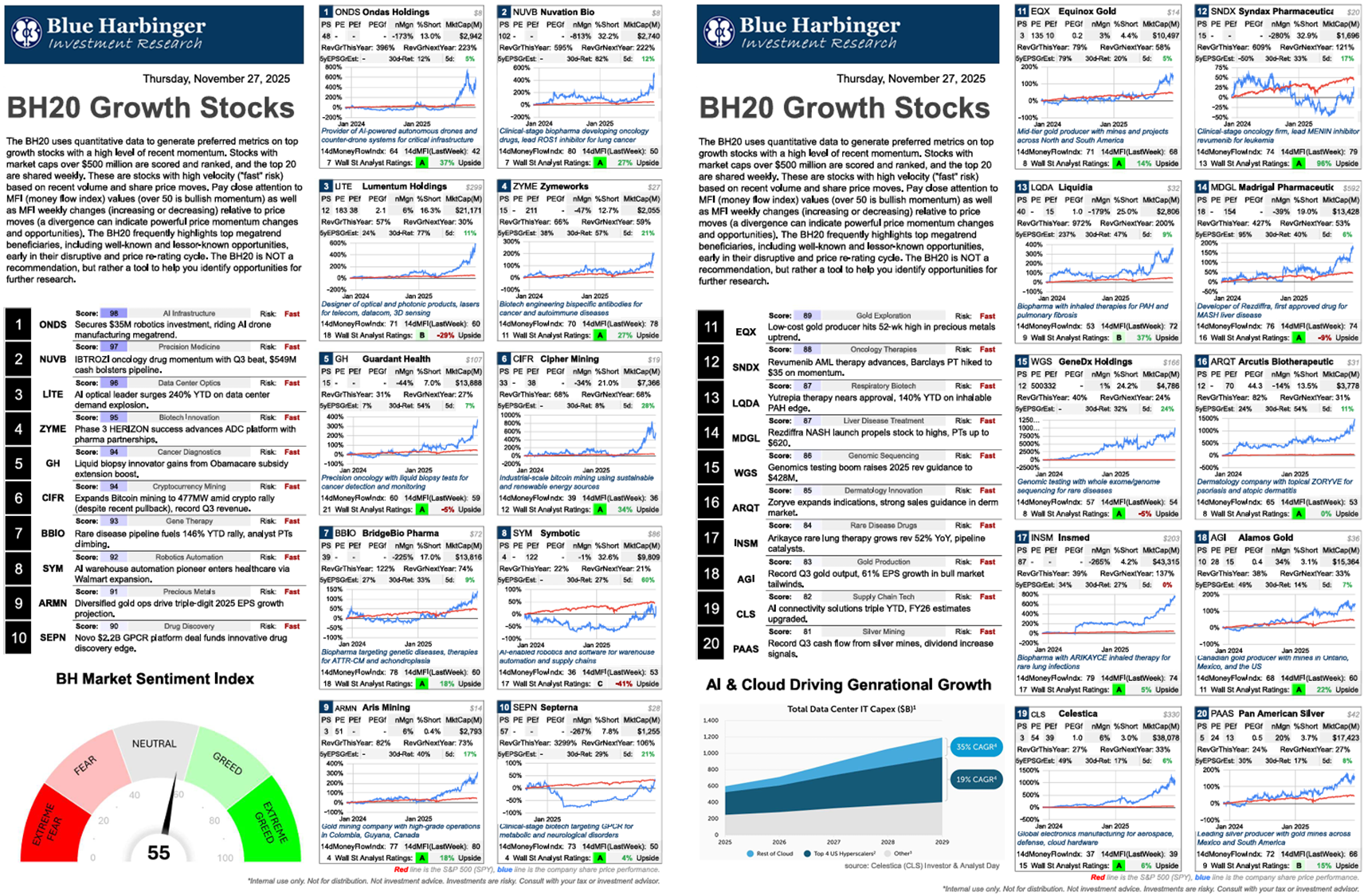

On the other end of the argument, there are investors who strongly believe there is no cloud-AI bubble, and they have elected to go all in on the Mag 7 and any fast-paced high-growth technology stock they can find, such as the ones in the graphic below.

The problem with this aggressive all-in strategy is the huge volatility (for example, check out the extreme price-volatility of the aggressive growth stocks versus the S&P 500 in the charts above).

One of two very-financially-painful things is going to happen to many in the “no-bubble” group. One, they’re either going to get scared by the extreme short-term price volatility that they will panic-sell their stocks at exactly the wrong time (i.e. when they are down big) and then they will miss out on the subsequent rebound. Or two, for liquidity reasons (e.g. they need cash for a big, unexpected expense) they’re going to be forced to sell their stocks at exactly the wrong time and again be forced to miss the rebound and lock in their losses permanently—yuck!

A Few More S&P 500 Risk-Factor Considerations

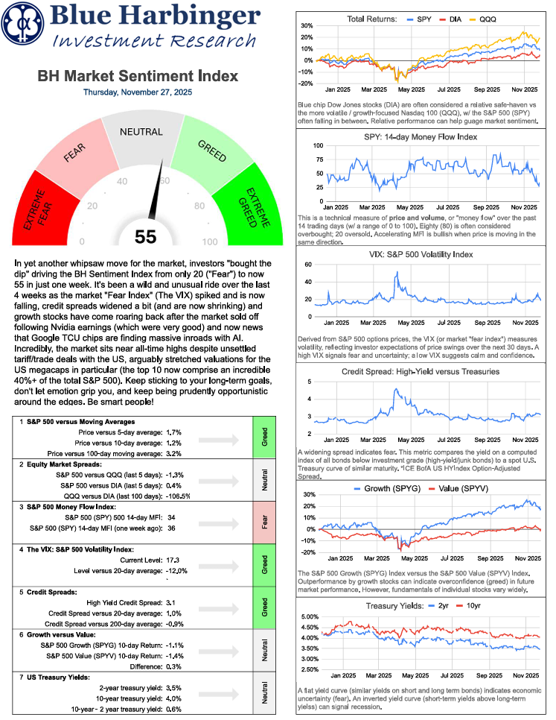

As a long-term investor, I like to monitor a variety of market risk factors (such as credit spreads, growth-versus-value performance, interest rates and the S&P 500 “Fear Index” known as the VIX), as you can see in the graphic below.

And as you can see, the market (i.e. the S&P 500) has been extremely volatile in recent weeks and months (due to government shutdown uncertainty, AI bubble fear, big tech earnings announcements, and unsettled tariff deals) with this index oscillating from heavy greed to deep fear (and now sits in the neutral range).

It can make a lot of sense to buy when the market is fearful (that has proven to be the case once again in recent weeks and months), but more importantly it makes sense to stick to your personal long-term goal and an investment strategy that works for you. For example, if you are an aggressive growth investor you may be able to find some interesting ideas in the BH20 report above, and if you are a high-income investor—I recently wrote up a ranking of my Top 10 Big Yields here.

The Bottom Line:

With constant cries and debates about a massive “cloud-AI bubble,” investors need to be careful. There will likely be huge financial pain for those who miss out on long-term market gains (because they are trying to time the bursting of a debatable AI bubble, as Peter Lynch explained with his quote). And there will likely be huge financial pain for those who get overly aggressive with AI-cloud stocks only to learn they truly cannot handle the high volatility (for emotional and/or liquidity reasons).

At the end of the day, you need to do what is right for you. Don’t let constant bubble fearmongering drive your investment decisions. And remember, disciplined, goal-focused, long-term investing continues to be a winning strategy.